(Photo source: CnEVPost)

A team at Hong Kong-based financial services firm CMB International raised its price target on Nio on Monday ahead of the EV maker's July delivery data release, citing marginal improvement in chip supply and the prospect of continued growth in deliveries in the second half of the year.

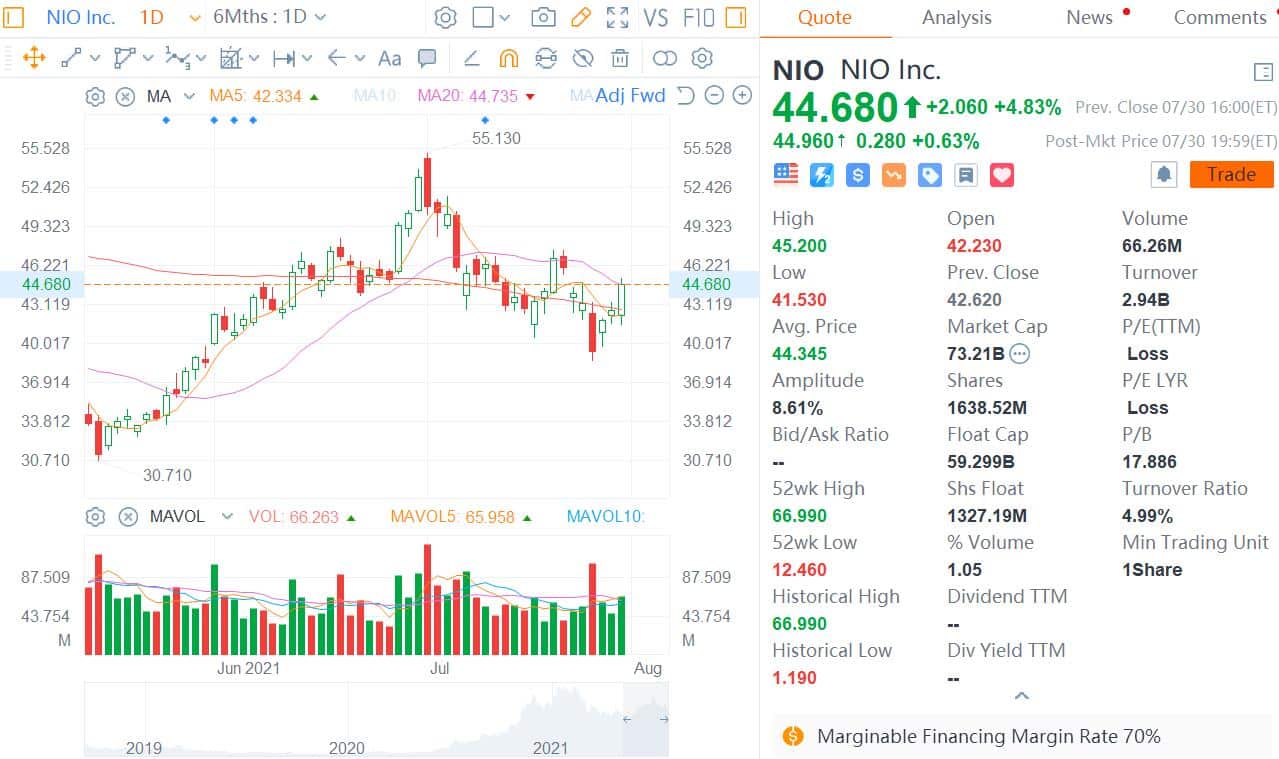

The team raised its price target for Nio by 13.6 percent to $52.6 per ADS, maintaining a buy rating. Nio closed up 4.83 percent to $44.68 on Friday and the price target implies an upside of about 18 percent.

Nio delivered 8,949 units of ES8, 18,023 units of ES6, and 14,984 units of EC6 in the first half of the year, with sales of ES8 and EC6 "significantly exceeding expectations," the team said.

Against the backdrop of a marginal easing of chip supply constraints, CMB expects Nio deliveries in the second half of the year to be better than in the first half, so it is raising its sales forecast for Nio by 10.9-13.4 percent to 99,000, 140,000 and 186,000 units in 2021-2023.

In addition, Nio was recently included in the shortlist of official vehicle purchases by Chinese central government departments and quasi-government agencies, underscoring its brand status, the team said.

They were referring to the strategic cooperation agreement Nio signed with Guoxing Auto Service Center in Beijing on July 26 to cooperate on car purchasing services for locally located Chinese central state agencies, central enterprises and other quasi-government agencies.

The team also said that Nio's overall gross margin reached 19.5 percent in the first quarter, supported by the 100-kWh battery pack and Nio Pilot. They expect the company to negotiate favorable purchase prices with suppliers in the second quarter and the second half of the year to cover the impact of higher commodity prices so far this year.

"We expect the company's overall gross margin to remain solid in the second quarter and the second half of the year," the team said.

Nio said in early July it raised its target for battery swap stations from 500 to 700 by the end of this year and plans to add 600 battery swap stations a year until it reaches 4,000 by 2025.

CMB believes that in the short term, Nio expects to drive sales growth through increased density of battery swap stations. In the long term, Nio's unique business model of separating the vehicle from the battery will contribute to vehicle sales as it focuses on providing quality service to its customers.

Based on the volume forecast adjustment, CMB raised its price target on Nio by 13.6 percent to $52.6 per share, which corresponds to 13.9 and 9.8 times of Nio's overall P/S forecast in 2021 and 2022, and 136.4 times of 2025 forecast P/E ratio.

Looking ahead to the second half of the year, the team expects Nio's order book to remain high, and its climbing delivery volume is expected to continue to drive valuation higher as chip constraints are gradually removed.

Nio is expected to announce its July deliveries on Monday, after its local peers Li Auto and Xpeng Motors both posted strong numbers earlier, with the former delivering 8,589 units in July and the latter 8,040 units.