Evergrande Auto surged in Hong Kong on Thursday as its parent company's debt problems eased and Faraday Future (FF), in which it has a stake, is set to go public in the US.

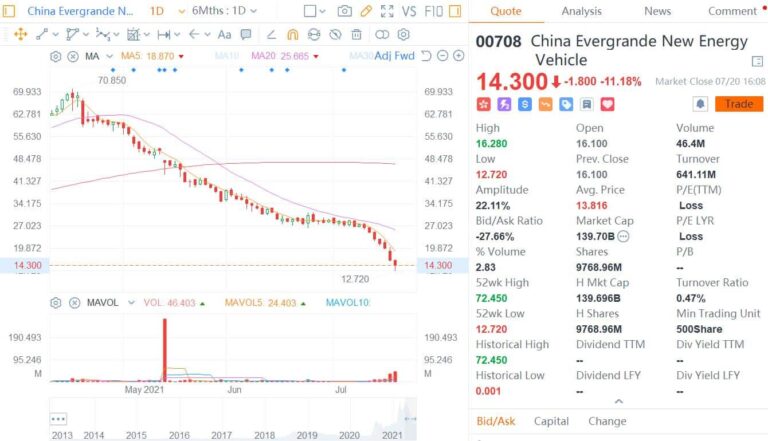

As of press time, Evergrande Auto was up about 30 percent to HK$17.1. However, the stock is still down about 76 percent since the Shanghai auto show on April 19.

California-based electric car company FF said Wednesday that Property Solutions Acquisition Corp's (PSAC) shareholder meeting approved a deal to merge with it, and it will start trading on Nasdaq on July 22.

The business combination of the two is expected to close around July 21, 2021, and FF expects to receive about $1 billion in funding, according to the announcement.

Upon completion of the business combination, PSAC will be renamed "Faraday Future Intelligent Electric Inc." and its common stock and warrants are expected to begin trading on the NASDAQ exchange on July 22, 2021 under the ticker symbols "FFIE" and "FFIE.WS", respectively, FF said.

In addition, Evergrande Group's financial situation has raised investor concerns, leading to recent sell-offs in the shares of all of its companies.

A branch of China Guangfa Bank in Yixing, Jiangsu province recently asked the court to freeze RMB 132 million in bank deposits of Evergrande Group and one of its companies, bringing Evergrande's financial situation into the spotlight.

Evergrande objected to the court's decision to freeze the assets and said it would sue.

On Thursday, Evergrande said it has maintained a good business relationship with Guangfa Bank and that the recent matter has been properly resolved after full communication between the two parties.