(CATL battery packs seen at Nio's Hefei manufacturing base. Source: CnEVPost)

As the world's largest power battery supplier, Nio and Tesla's battery supplier CATL is expected to further consolidate its leading position with the addition of more capacity.

On June 17, the first phase of CATL's power battery base project in Yibin, Sichuan Province, went into operation and will serve car companies in southwest China more efficiently.

Within a three-hour logistics time, CATL's power cells can be on the production lines of car companies in Chengdu or Chongqing, the company said.

CATL Chairman Robin Zeng said the base is an important part of CATL's global layout, becoming the company's strategic and most important power battery production base in southwest China.

According to the plan when the project started in late 2019, CATL will invest RMB 10 billion on a site of about 1,000 mu to build a power battery production line with an annual capacity of 30 GWh.

The project at that time was divided into two phases, with a total investment of RMB 4.5 billion in Phase I, aiming to build a power battery production line with an annual capacity of 15GWh.

The second phase of the project had a total investment of RMB 5.5 billion in order to build a 15GWh power battery production line.

The first phase of the project will take no more than 26 months from the start of construction, and the second phase of the project is planned to start within two years after the first phase goes into operation.

Subsequently, CATL deepened its cooperation with the local area. Since September 2019, CATL has signed one to six phases of power battery projects for the base with Yibin City, with an estimated total investment of over RMB 30 billion and an area of about 3,000 mu.

In addition to the first phase of the project, which is officially in operation, on January 5 this year, the third and fourth phases of the power battery project, with a total investment of RMB 10 billion and covering an area of about 800 mu, have started construction.

These two phases have a planned annual capacity of 30 GWh and are scheduled to be completed and put into operation in December 2022, with an expected annual output value of approximately RMB 30 billion upon production.

By the end of 2020, CATL's power battery production capacity will be 69.1 GWh, with 77.5 GWh of capacity currently under construction.

Since 2021, the company has announced several capacity expansion plans. According to Soochow Securities, CATL's seven lithium battery production bases have a total planned capacity of 600GW, with new capacity planned to reach 535GW.

According to data released last week by the China Automotive Power Battery Industry Innovation Alliance, China's power battery installed capacity was 9.8 GWh in May 2021, up 178.2% year-on-year and up 16.2% from April.

CATL's power battery installed base was 4.28GWh in May, with a 43.9% market share. From January to May, CATL power battery installed 20.32GWh, with a 49.1% market share.

Earlier this month, market research firm SNE Research said global electric vehicle battery sales were 65.9 GWh in January-April, up 146 percent from 26.8 GWh in the same period last year.

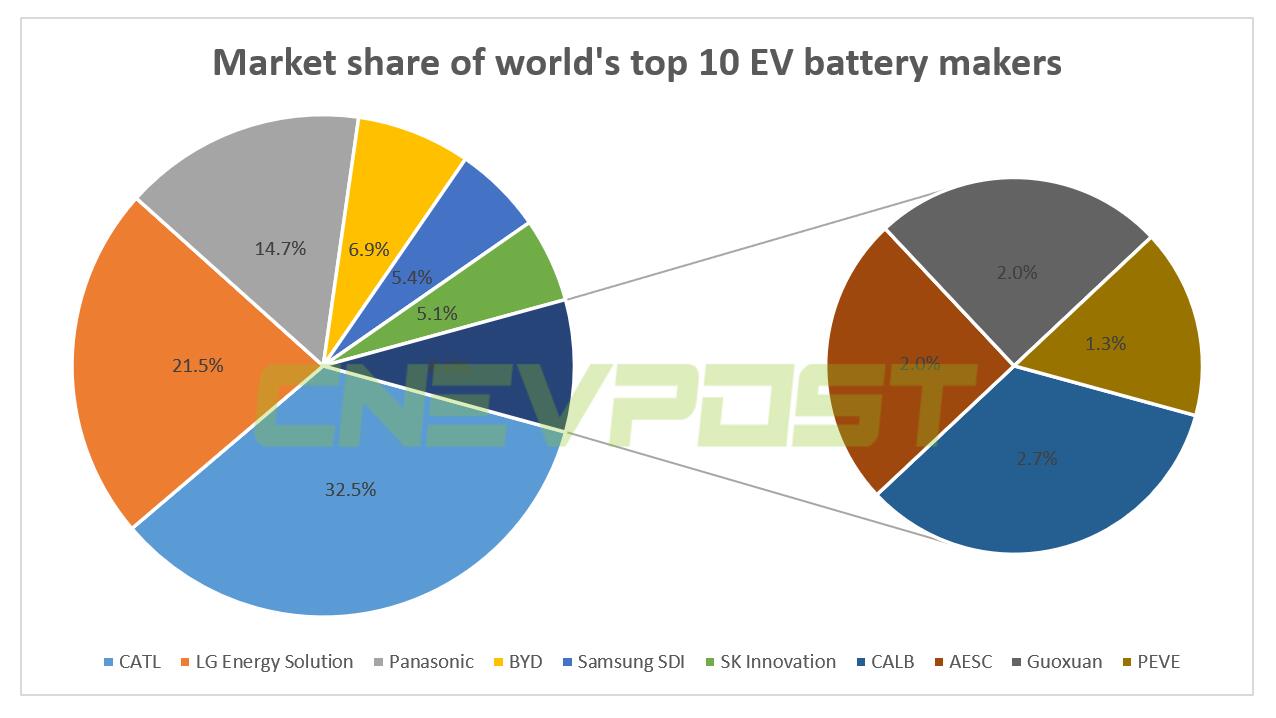

CATL's sales almost quadrupled to 21.4 GWh, further cementing the company's position as the world's largest EV battery maker, giving it a 32.5 percent market share, 10 percentage points higher than second-place LG Energy Solution's 21.5 percent.