Xpeng reported revenues largely in line with expectations in the second quarter, with gross margin increasing sequentially for the fourth consecutive quarter and net loss narrowing slightly from the first quarter.

Xpeng (NYSE: XPEV) reported second-quarter results that were largely in line with expectations, with some key metrics seeing improvement.

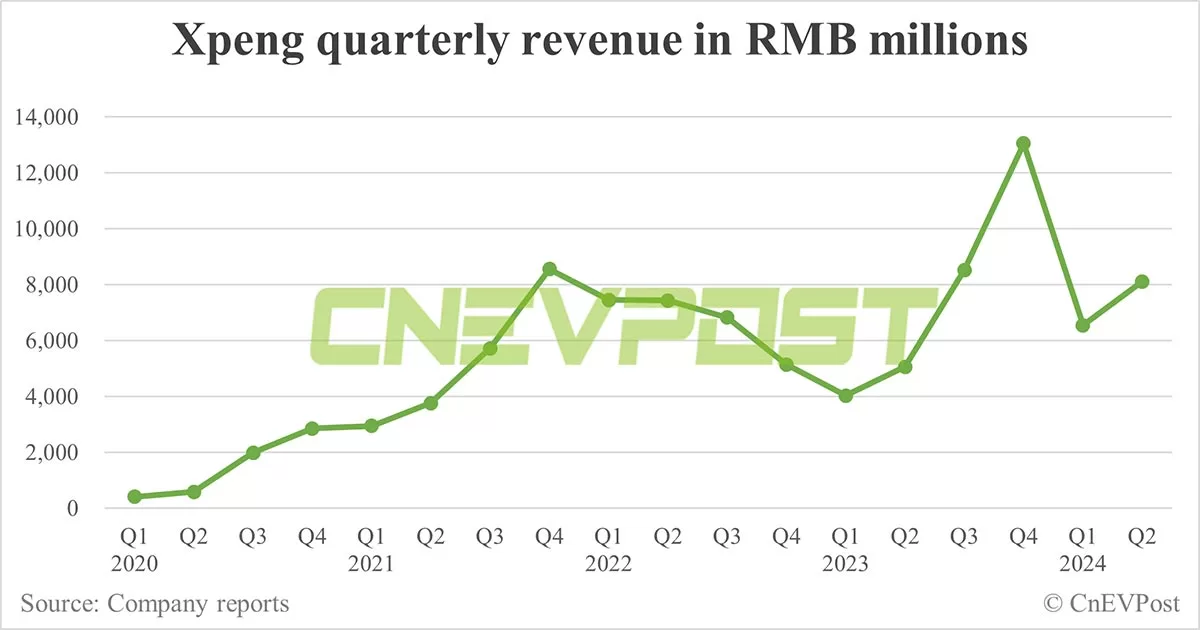

The Chinese electric vehicle (EV) maker reported revenue of RMB 8.11 billion ($1.12 billion) in the second quarter, largely in line with the median analyst estimate of RMB 8.12 billion in a Bloomberg survey, according to its unaudited results released today.

That sits within its previous guidance range of RMB 7.5 billion to RMB 8.3 billion, up 60.2 percent from RMB 5.06 billion in the same period in 2023 and up 23.9 percent from RMB 6.55 billion in the first quarter of 2024.

Xpeng's revenue from vehicle sales in the second quarter was RMB 6.82 billion, an increase of 54.1 percent from RMB 4.42 billion in the same period in 2023 and an increase of 23.0 percent from RMB 5.54 billion in the first quarter of 2024.

The year-on-year and sequential growth was mainly attributable to increased deliveries, Xpeng said.

Xpeng delivered 30,207 vehicles in the second quarter, an increase of 30.17 percent year-on-year and up 38.43 percent from the first quarter, as previously announced. Deliveries for the quarter were in its guidance range of between 29,000 and 32,000 vehicles.

The company reported service and other revenue of RMB 1.29 billion in the second quarter, up 102.5 percent year-on-year and up 28.8 percent from the first quarter.

The year-on-year and sequential growth was mainly attributable to higher sales from maintenance services, which were in line with the increase in accumulated vehicle sales, and higher sales of technology development services related to the Volkswagen Group's strategic technology partnerships for platforms and software, Xpeng said.

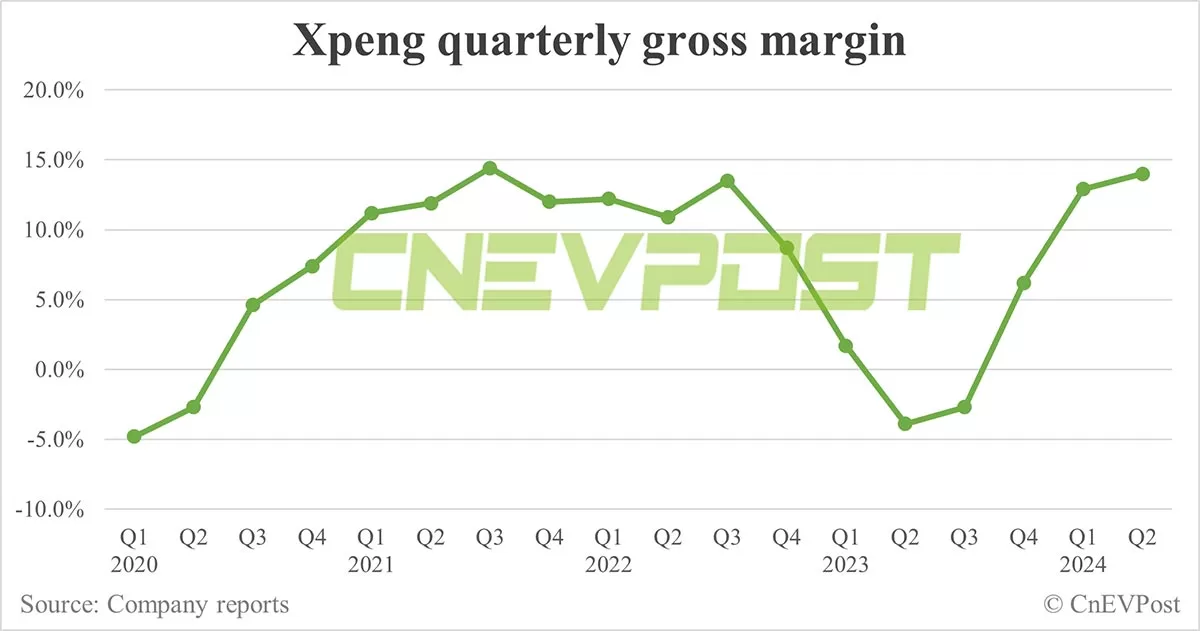

Xpeng's gross margin was 14.0 percent in the second quarter, marking the fourth consecutive quarter of sequential improvement. The figure was -3.9 percent in the same period in 2023 and 12.9 percent in the first quarter of 2024.

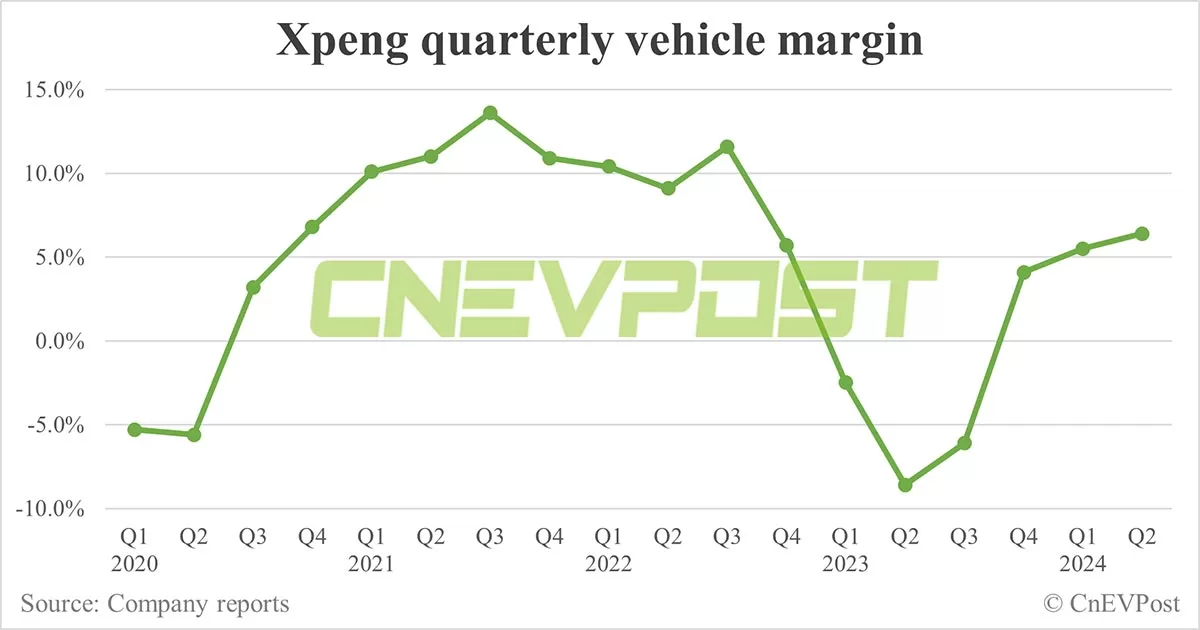

It had a vehicle margin of 6.4 percent in the second quarter, compared to -8.6 percent in the same period in 2023 and 5.5 percent in the first quarter of 2024.

The year-on-year increase was mainly attributable to cost reductions and improved model mix, and the sequential increase was mainly attributable to cost reductions, Xpeng said.

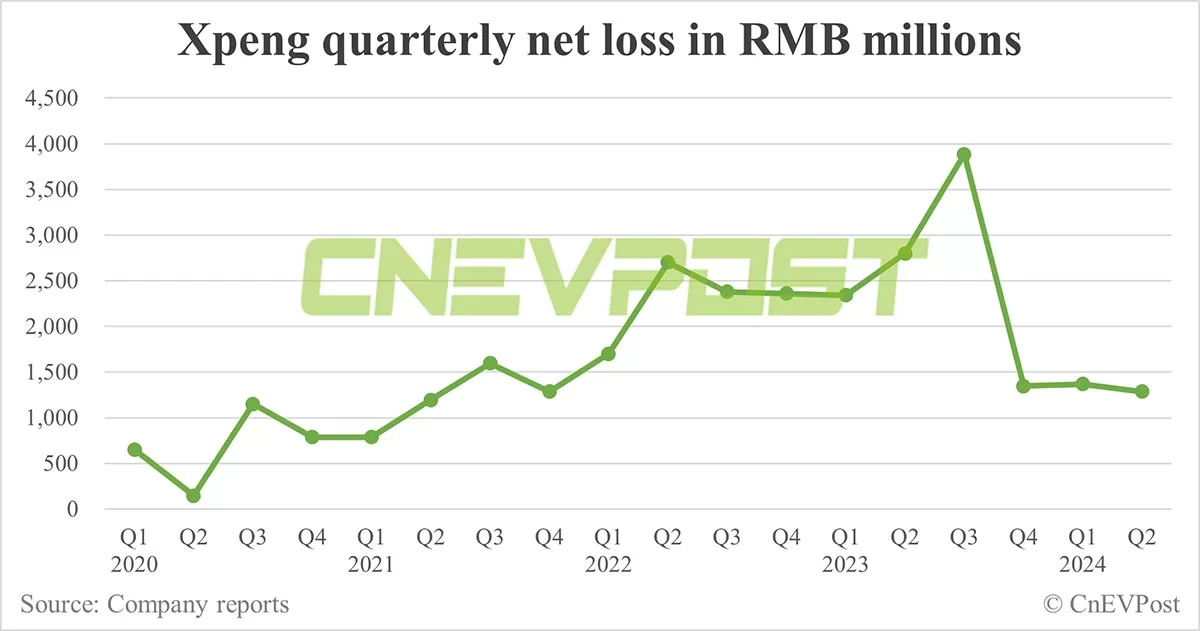

Xpeng reported a net loss of RMB 1.28 billion in the second quarter, a decrease of 54.12 percent year-on-year and down 6.08 percent from the first quarter.

Non-GAAP net loss was RMB 1.22 billion, compared to RMB 2.67 billion in the same period in 2023 and RMB 1.41 billion in the first quarter of 2024.

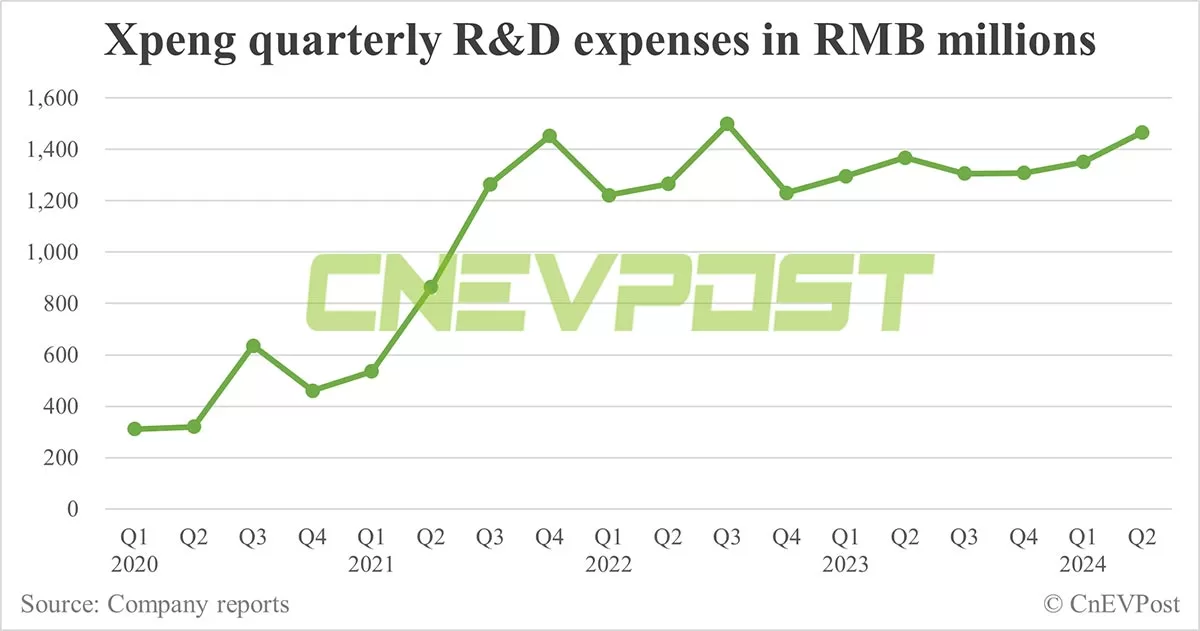

Xpeng's research and development expenses in the second quarter were RMB 1.47 billion, the second highest on record after RMB 1.5 billion in the third quarter of 2022, an increase of 7.3 percent year-on-year and an increase of 8.6 percent from the first quarter.

The year-on-year and quarter-on-quarter increases were mainly due to higher expenses related to new model development as the company expands its product portfolio to support future growth, Xpeng said.

As of June 30, 2024, Xpeng's cash and cash equivalents, restricted cash, short-term investments and time deposits amounted to RMB 37.33 billion, compared to RMB 41.4 billion as of March 31.

Xpeng guided third-quarter vehicle deliveries to be in the range of 41,000 to 45,000 units, representing year-on-year growth of about 2.5 percent to 12.5 percent.

It guided third-quarter revenue to be in the range of RMB 9.1 billion to RMB 9.8 billion, an increase of about 6.7 percent to 14.9 percent year-on-year.

Considering Xpeng delivered 11,145 vehicles in July, the guidance means it expects to deliver between 29,855 and 33,855 vehicles in August and September combined.