The offshore fund will help CATL finance the corporate ecosystem needed to expand production in Europe and other foreign markets, according to the Financial Times.

Chinese power battery giant CATL has held talks with overseas sovereign wealth funds and private wealth management offices of the super-rich about raising a $1.5 billion fund to build its global supply chain, according to a report in the Financial Times today.

The offshore fund would help CATL finance the corporate ecosystem needed to expand production in Europe and other foreign markets, the report said, citing two people familiar with the matter.

Although CATL had RMB 289 billion yuan ($40 billion) in cash as of March 31, China's overseas direct investment rules make it difficult for it to make large international investments, a person with knowledge of the fund said.

CATL plans to contribute about 15 percent of the fund alongside global investors, which will primarily target companies that can supply CATL in Europe, according to the Financial Times.

Sources close to the fund said that CATL has a "a big gap in supply…and it’s a good investment return" and described the fund as "a market solution to [the] problem" of not having sufficient suppliers in Europe and the difficulty of directly funding new suppliers.

The $1.5 billion fund will be managed by Hong Kong-based Lochpine Capital, which was founded as CATL Capital in August 2023 and renamed in May, the report said.

The Chinese battery maker has approached Mercedes-Benz and the families behind other automakers about investing in the fund, according to the report.

The company is in talks with sovereign wealth funds, family wealth management offices, oil and gas companies and European manufacturers about potential investments, one of the people familiar with the matter said.

"The purpose of the fund is to facilitate the global energy transition with support from like-minded partners from all over the world," CATL said, adding that it "is intended to raise capital mainly from overseas investors," according to the Financial Times.

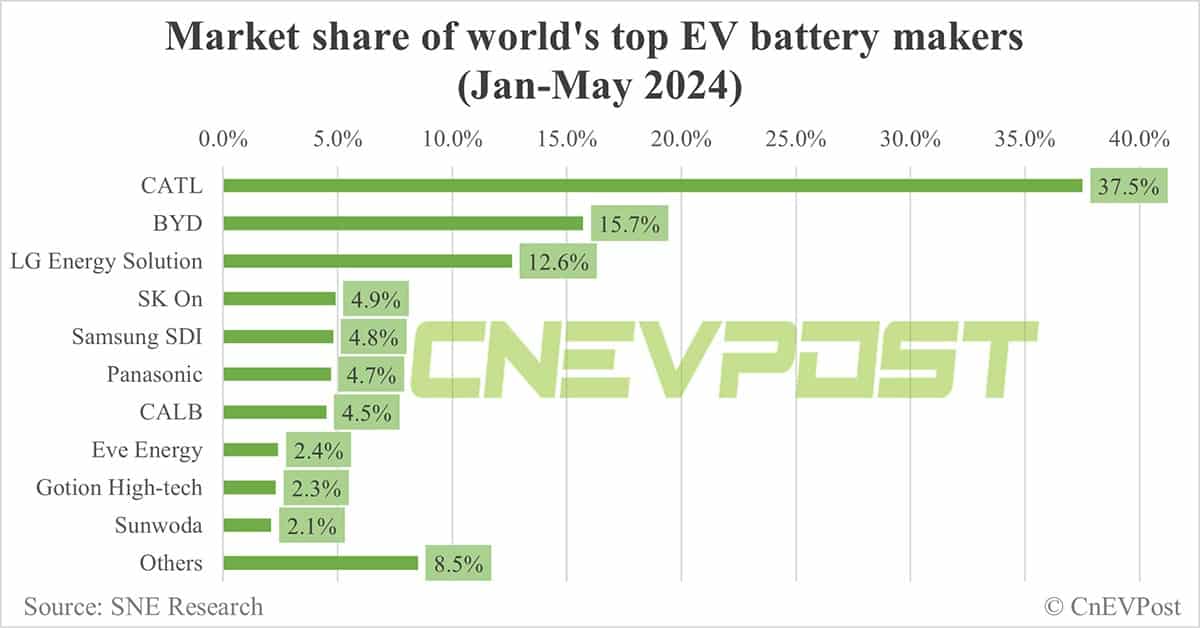

CATL is the world's largest battery maker, with a 37.5 percent share of the global EV battery market in the January-May period, making it the only battery supplier in the world with a market share of more than 30 percent, according to South Korean market researcher SNE Research.

In overseas markets, CATL has a plant in Thuringia, Germany, which realized mass production of lithium-ion battery cells in December 2022. It is also building a new battery plant in Hungary.