Xpeng's first-quarter revenue beat Wall Street estimates, gross margin rebounded further to a new high since the third-quarter of 2022, despite conservative guidance for second-quarter deliveries.

Xpeng (NYSE: XPEV) posted first-quarter earnings that beat expectations, with gross margin rebounding further, though guidance for the second quarter appeared conservative.

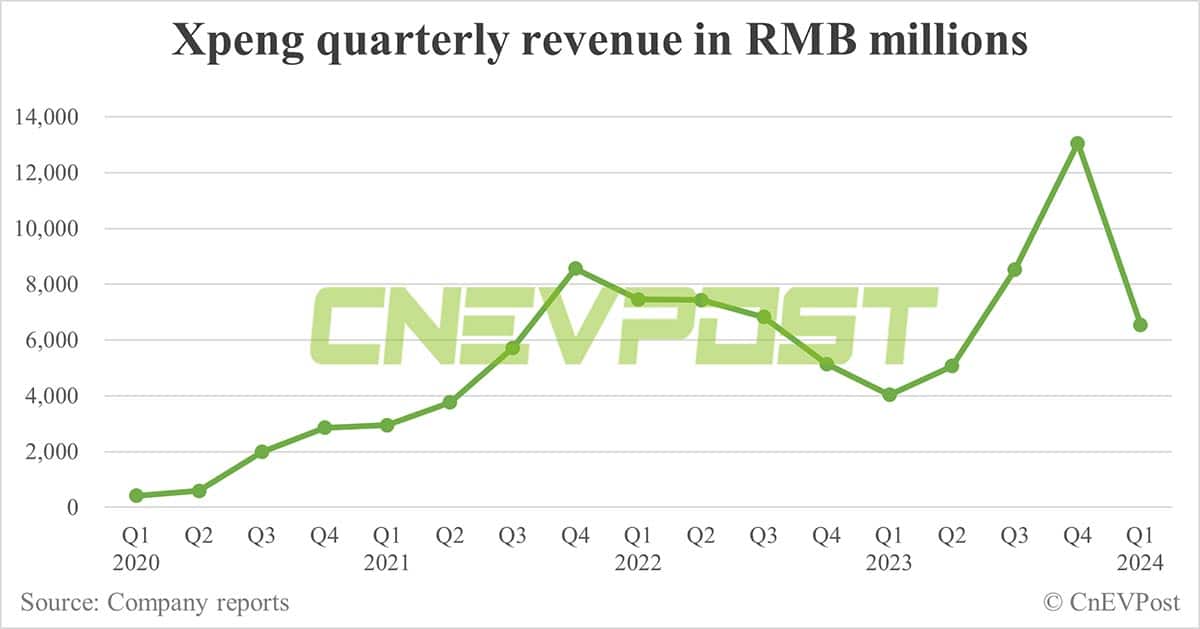

The company reported revenue of RMB 6.55 billion ($910 million) in the first quarter, beating analysts' estimates of RMB 6.11 billion in a Bloomberg survey, according to its unaudited earnings report released today.

That exceeded the upper end of its previous guidance range of between RMB 5.8 billion and RMB 6.2 billion, and was up 62.3 percent from the same period in 2023, though down 49.8 percent from the fourth quarter as vehicle deliveries fell.

Xpeng's revenue from vehicle sales in the first quarter was RMB 5.54 billion, up 57.8 percent from the same period in 2023 while down 54.7 percent from the fourth quarter.

The year-on-year increase was mainly attributable to higher deliveries, especially of the X9 in the first quarter, Xpeng said.

The year-on-year decline was mainly due to lower deliveries of the G6 and 2024 G9, combined with seasonal effects, which were partially offset by the contribution of the X9, it added.

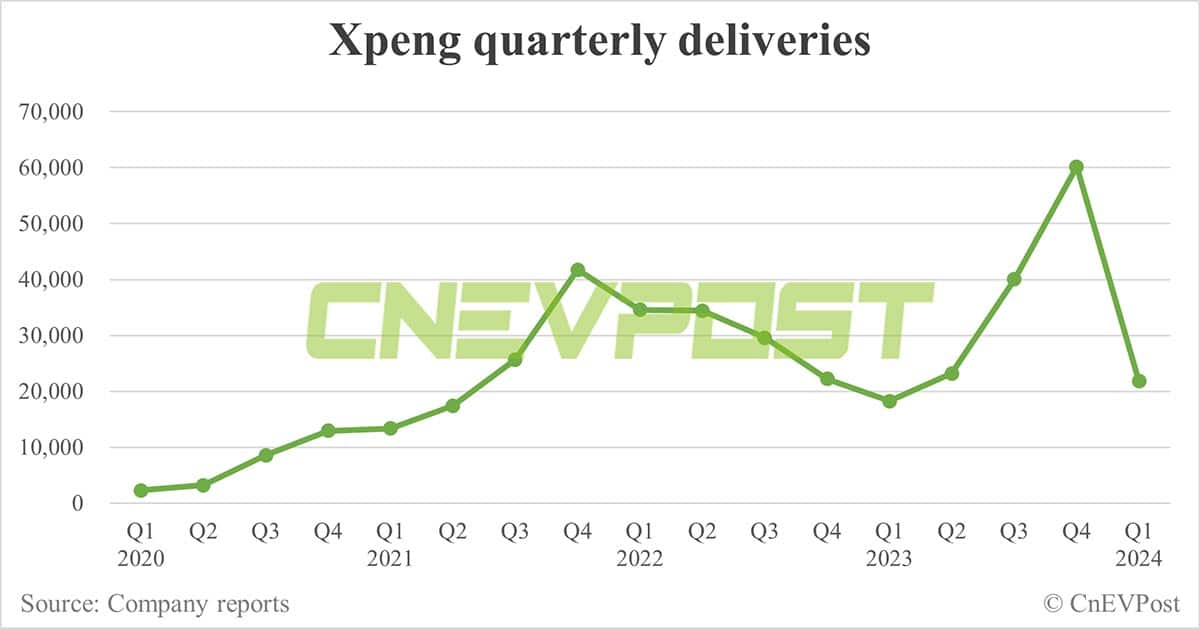

Xpeng delivered 21,821 vehicles in the first quarter, up 19.7 percent year-on-year, but down 63.73 percent from the fourth quarter of 2023, previously announced data showed. Deliveries in the quarter were slightly above the lower end of the guidance range of 21,000-22,500 vehicles.

The X9 MPV (multi-purpose vehicle), which went on sale January 1, delivered 7,872 vehicles in the first quarter, according to data compiled by CnEVPost. The G6 delivered 4,437 vehicles in the first quarter, and the G9 3,991 vehicles.

Xpeng's first-quarter revenues from services and others were RMB 1 billion, up 93.1 percent from RMB 520 million in the same period in 2023 and up 22.1 percent from RMB820 million in the fourth quarter.

The increases were mainly attributable to the revenue from technical research and development service recorded in the first quarter, which is related to the platform and software strategic technical collaboration with Volkswagen, the company said.

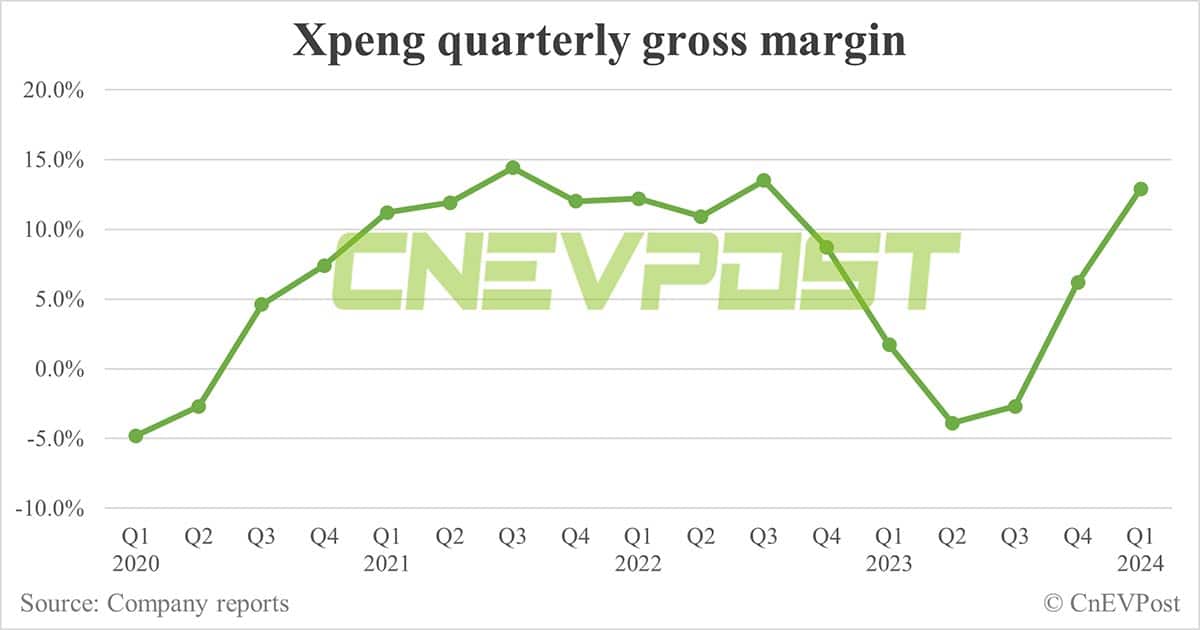

Xpeng's first-quarter gross margin came in at 12.9 percent, above analysts' expectations of 9.2 percent, a new high since the third quarter of 2022, and its third consecutive sequential rebound.

It had gross margins of 1.7 percent in the same period in 2023 and 6.2 percent in the fourth quarter of 2023.

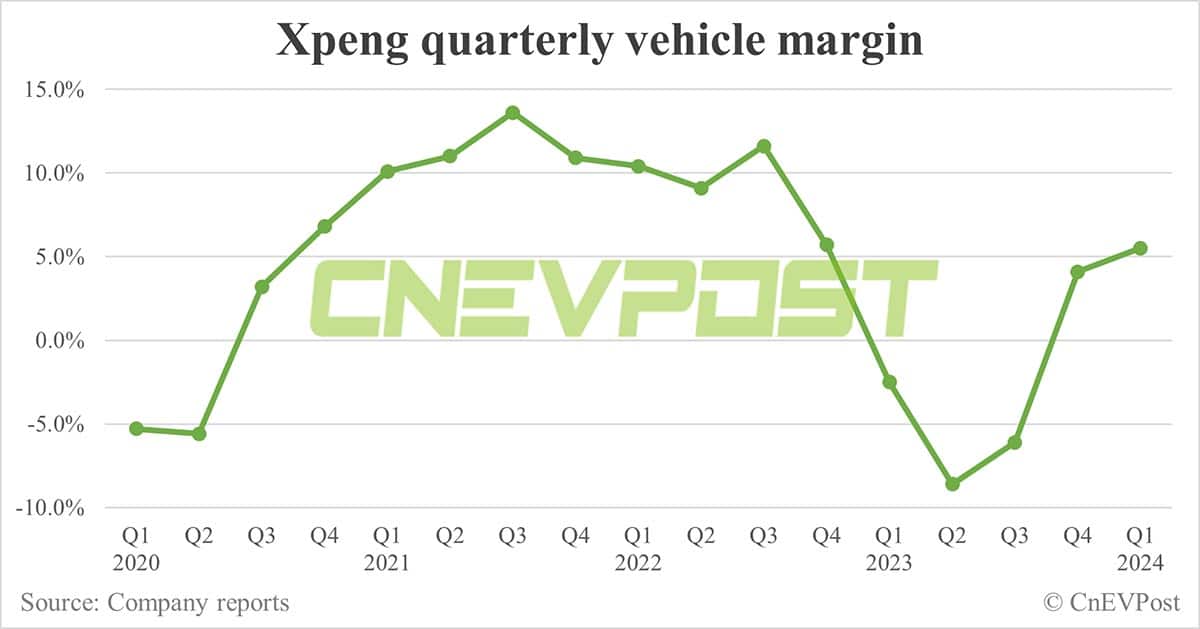

The company's vehicle margin was 5.5 percent in the first quarter, compared to -2.5 percent in the same period in 2023 and 4.1 percent in the fourth quarter.

The increase in vehicle margin was primarily due to cost reduction and improvement in model product mix, partially offset by the inventory provision and losses on purchase commitment related to the P5, with a negative impact of 3.2 percentage points on vehicle margin for this quarter, as management lowered the P5’s forecasted sales due to expected stronger market demands for upcoming new vehicle models, Xpeng said.

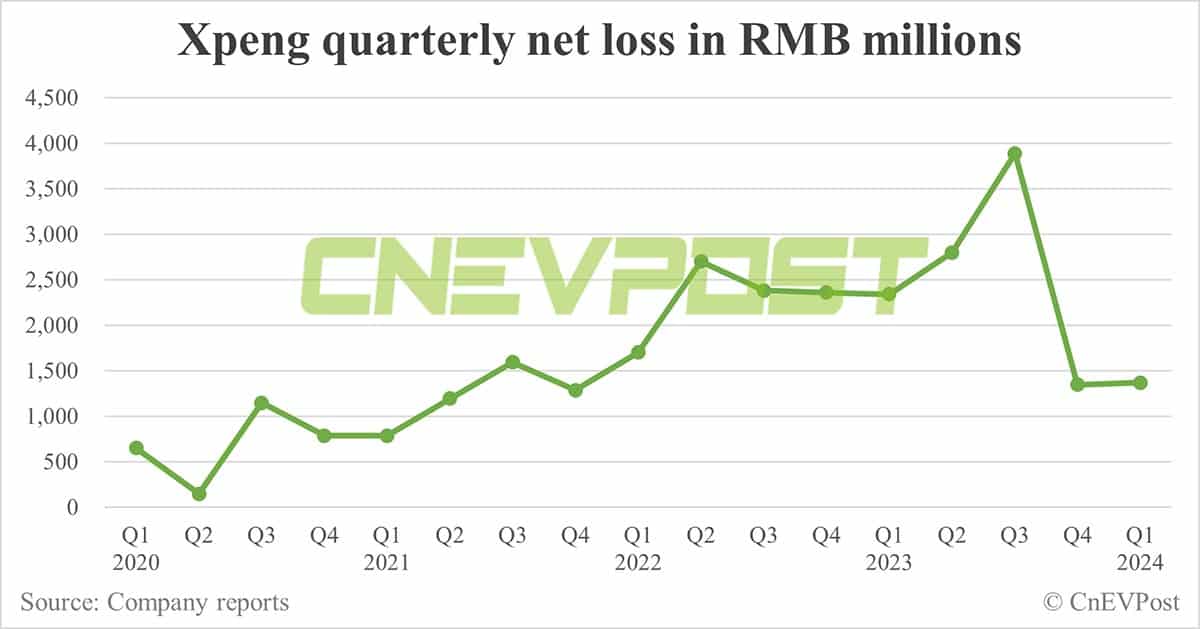

Xpeng reported a net loss of RMB 1.37 billion in the first quarter, lower than analysts' expectations of RMB 2.08 billion. It reported a net loss of RMB 2.34 billion for the same period in 2023 and a net loss of RMB 1.35 billion for the fourth quarter.

It had a non-GAAP adjusted net loss of RMB 1.41 billion in the first quarter, below analysts' expectations of RMB 1.71 billion. The figure was RMB 2.21 billion in the same period in 2023 and RMB 1.77 billion in the fourth quarter.

Xpeng's basic and diluted net loss per ADS for the first quarter was RMB 1.45, and basic and diluted net loss per ordinary share was RMB 0.73. Each ADS represents two class A ordinary shares.

It reported non-GAAP basic and diluted net loss per ADS of RMB 1.49 and basic and diluted net loss per ordinary share of RMB 0.75 for the first quarter.

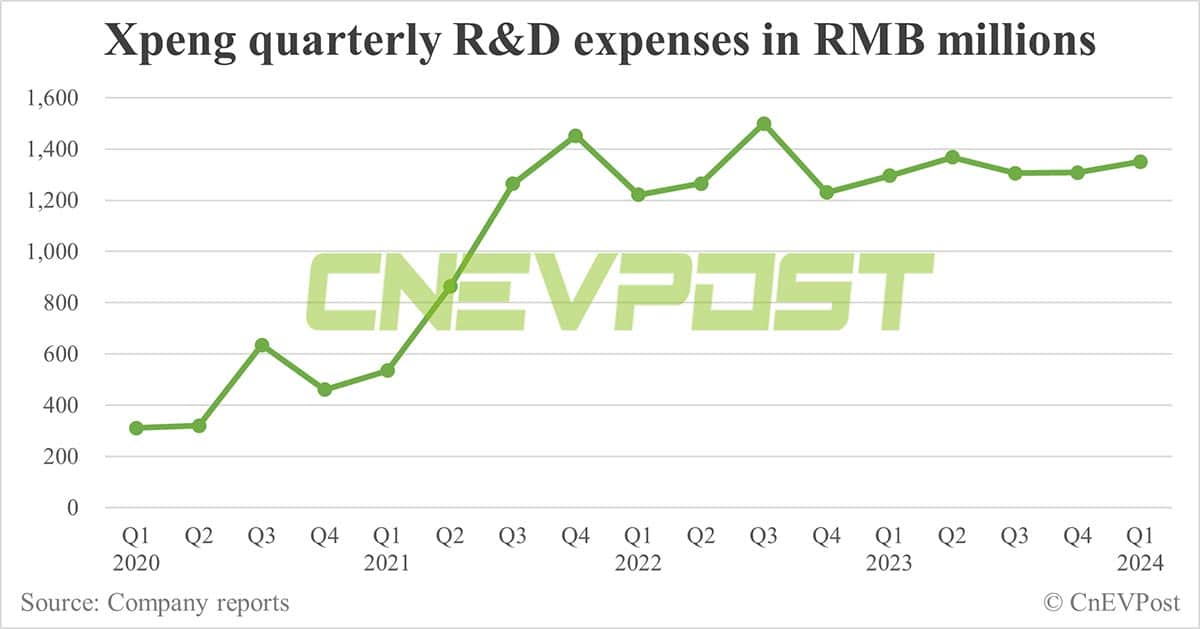

The company reported research and development expenses of RMB 1.35 billion in the first quarter, up 4.2 percent from RMB 1.3 billion in the same period in 2023 and up 3.3 percent from RMB 1.31 billion in the fourth quarter.

Xpeng's cash and cash equivalents, restricted cash, short-term investments and time deposits amounted to RMB 41.4 billion as of March 31, compared to RMB 45.7 billion as of December 31, 2023.

Xpeng guided second quarter vehicle deliveries to be in the range of 29,000 to 32,000 units, representing year-on-year growth of about 25.0 percent to 37.9 percent.

It guided second-quarter revenue to be in the range of RMB 7.5 billion to RMB 8.3 billion, representing year-on-year growth of about 48.1 percent to 63.9 percent.

The delivery guidance was below analysts' expectations of 38,147 units, meaning Xpeng expects it to deliver between 19,607 and 22,607 vehicles in May and June combined, considering it delivered 9,393 vehicles in April.