The sequential increase in new orders for Nio in April was mainly due to lower prices for its BaaS battery rental service, according to Deutsche Bank.

(Image credit: CnEVPost)

Nio (NYSE: NIO) saw a significant increase in new orders in April, as lower prices for its battery rental service brought greater appeal, according to Deutsche Bank.

Deutsche Bank analyst Wang Bin's team obtained first-hand information on the order situation of major electric vehicle (EV) makers through auto dealer surveys and interviews.

The Chinese new energy vehicle (NEV) industry as a whole saw new orders rise 7 percent in April from a year earlier, driven by industry-wide retail price cuts, according to a research note the team sent to investors today.

In April, consumers waited ahead of upcoming government trade-in subsidies, new products at the Beijing auto show, and further price cuts by automakers, the team said.

In other words, customers placed orders mainly for newly-launched products, or for products with official price cuts, the team wrote.

Nio's new orders in April were up 19 percent sequentially and flat year-on-year, according to Deutsche Bank.

The team did not mention specific order figures, but instead measured them with an index they compiled.

Nio's sequential increase in new orders in April was mainly due to a BaaS (battery as a service) price cut from RMB 980 ($136) per month to RMB 728 per month for a standard range battery pack, the team said.

As a backdrop, Nio announced the BaaS service in August 2020, allowing the purchase threshold to be lowered by at least RMB 70,000, but customers would need to pay for rented batteries every month.

The company dramatically tweaked its BaaS battery rental plan on March 14 in an attempt to bolster the appeal of its cars amid fierce price competition.

The monthly rental cost for the standard range battery pack was reduced to RMB 728. The monthly rental fee for the long-range battery pack has been reduced to RMB 1,128 from RMB 1,680 previously.

In addition to the lower monthly fees, Nio is also allowing customers to recoup most of their previously paid monthly fees when they buy out the batteries in the future, unlike the previous practice of not allowing any recoupment of monthly fees.

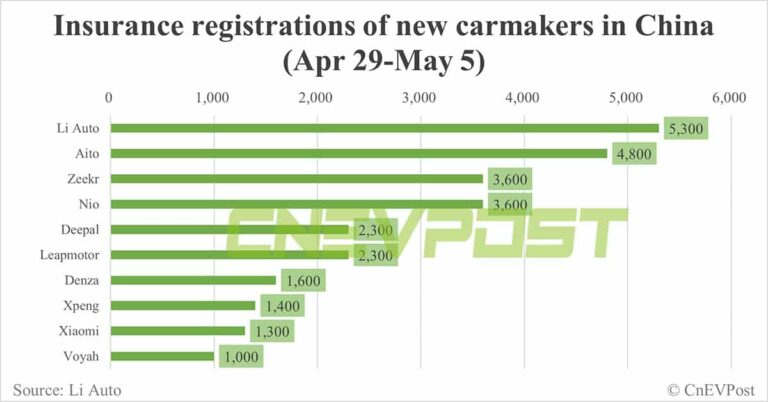

Li Auto's new orders in April were down 8 percent sequentially and up 2 percent year-on-year, according to the research note from Deutsche Bank.

Li Auto's sequential decline in new orders was mainly due to customers' "standing by" attitude towards the new Li L6 5-seater SUV, according to the team.

The company announced that Li L6 orders topped 20,000 units in April and another 20,000 in the first week of May, a very strong number, the team noted.

Xpeng (NYSE: XPEV) new orders in April were up 4 percent sequentially but down 29 percent year-on-year, according to Deutsche Bank.

The sequential increase was mainly due to an official price cut of RMB 20,000 for the Xpeng G6 SUV, as well as offsetting competitive pressure from peers like the newly launched Xiaomi SU7 and Tesla's official price cut, the team said.

BYD (HKG: 1211, OTCMKTS: BYDDY) new orders in April were up 9 percent sequentially and up 87 percent year-on-year, benefiting from the full-month contribution of significant price cuts across the board since March, with monthly new orders hitting a record high in April, according to the team.

Tesla (NASDAQ: TSLA) new orders in China were up 12 percent sequentially and up 71 percent year-on-year in April.

Monthly new orders recorded the highest level in April given official price cuts of RMB 14,000 across the board for the Model 3, Model Y, Model S, and Model X models since April 21, according to the team.

($1 = RMB 7.2179)