BYD will launch its fifth-generation DM hybrid technology in May, with a vehicle range expected to exceed 2,000 kilometers. Its 2024 sales are expected to grow by over 20 percent, with overseas sales targeted at 500,000 units.

(Image credit: CnEVPost)

BYD (HKG: 1211, OTCMKTS: BYDDY) held an investor meeting today to talk about a wide range of issues, including next-generation technology and sales targets.

The new energy vehicle (NEV) maker will launch its fifth-generation DM (Dual Mode) hybrid technology in May, which will see fuel consumption drop to 2.9 liters per 100 kilometers on a low charge and give the vehicles a range of up to 2,000 kilometers on a full tank of fuel and full charge, said Wang Chuanfu, the company's chairman and president.

Wang mentioned the plan at a meeting held today to communicate with investors about its 2023 financial results, local media Yicai said, citing minutes from the meeting. The meeting was not open to the general public.

BYD will gradually make the switch to the fifth-generation DM technology in May depending on market conditions as demand for the current models exceeds supply, Wang said, adding that the popularity of models equipped with the next-generation hybrid technology is expected to continue for one to two years.

In 2025, BYD will invest more in DM hybrid technology, smart driving, chips and algorithms, among which DM hybrid technology is expected to be a key driver of BYD's earnings growth, Wang said.

About half of BYD's current sales are of plug-in hybrid electric vehicles (PHEVs), and the other half are of battery electric vehicles (BEVs), based on the DM platform and e-Platform, respectively.

The company introduced the DM hybrid technology platform in 2008 and launched the fourth generation of the DM platform in 2021, dividing the technology into the more performance-oriented DM-p and the more energy-consumption-oriented DM-i.

BYD's current BEV platform is the e-Platform 3.0, released in September 2021.

On March 11, local media outlet 36kr reported that BYD will spend three years fighting a "liberation battle" to accelerate its effort to gain market share from traditional gasoline vehicles.

As part of the move, BYD will update its DM hybrid system, as well as its all-electric platform e-Platform, according to the report.

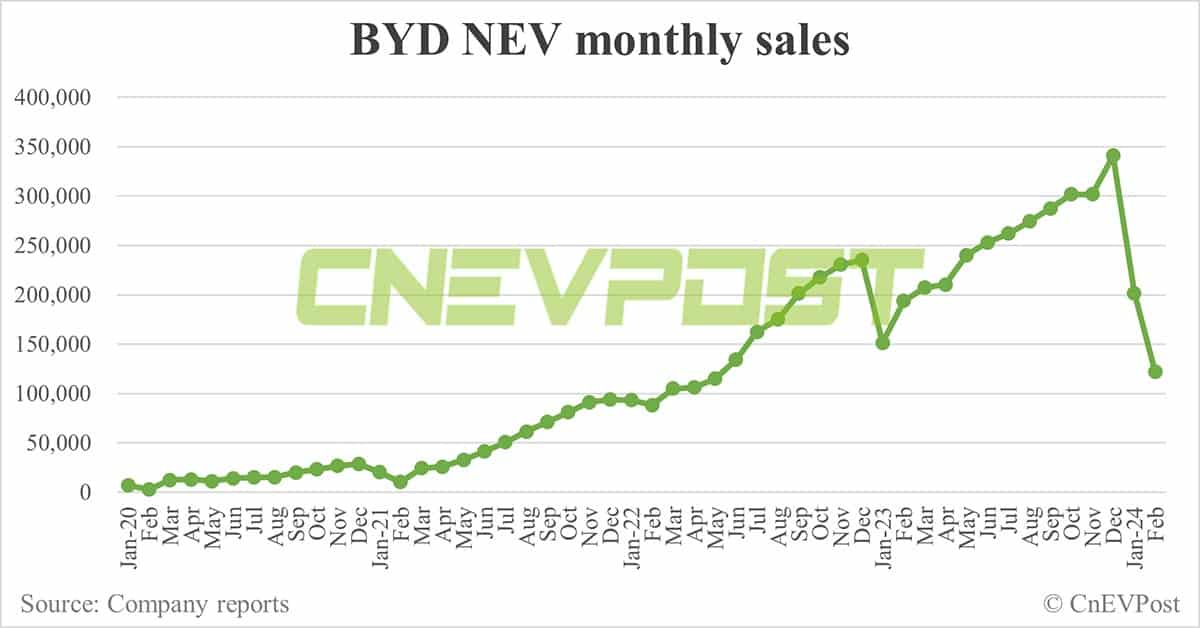

In 2024, BYD's full-year sales are expected to grow more than 20 percent from 2023, Wang said, according to Yicai.

That means BYD is expected to sell more than 3.63 million vehicles this year, considering it sold 3,024,417 NEVs in 2023.

On February 26, 36kr reported that BYD's initial plan for its 2024 sales target is 4 million units, giving a 4.2 million sales forecast to suppliers.

In overseas markets, BYD's sales target for 2024 is 500,000 units, and will reach 1 million units by 2025, according to the minutes.

BYD sold 242,765 vehicles overseas in 2023, up 493.51 percent year-on-year, according to data compiled by CnEVPost.

BYD is expected to sell more than 300,000 units in March, giving it a 16 percent share of the Chinese passenger car market and 35 percent of the NEV market, Wang said.

The current Qin Plus has already encountered a capacity bottleneck, and the model's capacity is expected to be further increased in April to May, he said.

Wang believes that China's NEV industry has now entered a phase of elimination, and 2024 to 2026 will be a showdown over scale, cost and technology.

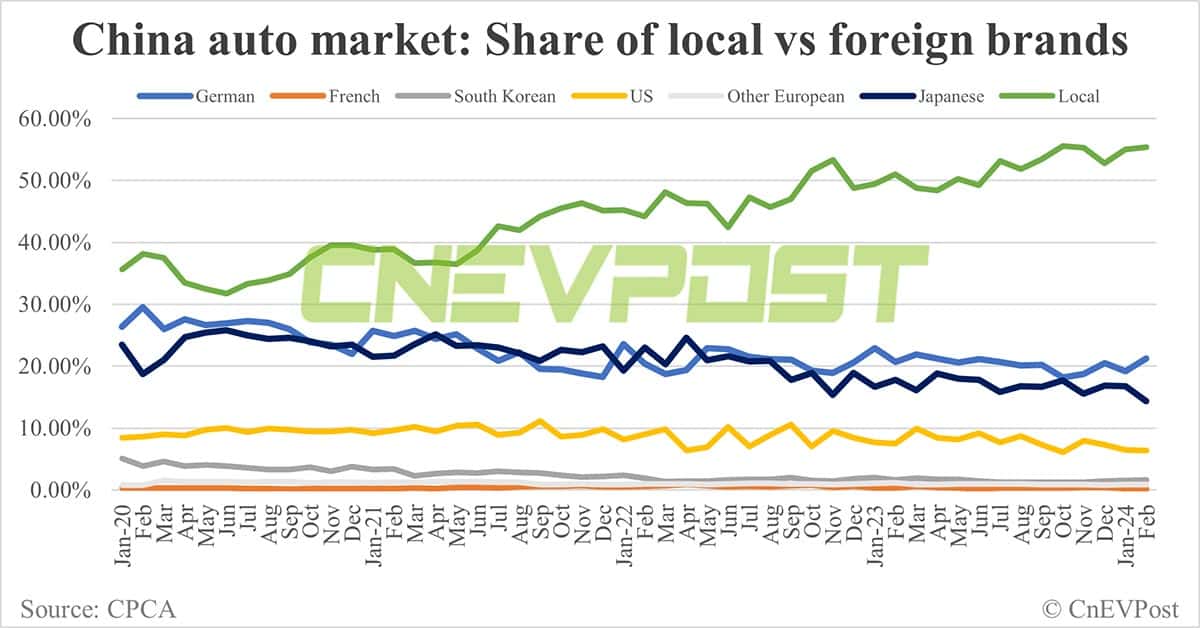

The accelerated launch of NEV models by Chinese carmakers will eat into the market of joint venture carmakers, and in the next 3 to 5 years, the share of joint venture brands in China will drop from 40 percent to 10 percent, of which the 30 percent will be growth space for Chinese brands, he said.

In February, local brands contributed 55.4 percent of China's passenger car sales, up from 50.99 percent a year earlier, according to the China Passenger Car Association (CPCA).

BYD will launch a number of models priced below 200,000 yuan ($27,670) later this year with city pilot-assisted driving features, some with suppliers' solutions and others with BYD's own, Wang said.

BYD's strength is scale, with the company able to get the best resources and prices from global suppliers, he said.

BYD has built a smart driving team of more than 4,000 people, and has invested heavily in chips, algorithms and perception, which will show its strengths over time, Wang said.

BYD also plans to launch solid-state batteries and high-energy-density products for high-end models, he said.

($1 = RMB 7.2272)