Xpeng delivered solid fourth-quarter earnings although the guidance came in soft, said Deutsche Bank.

Xpeng (NYSE: XPEV) reported its fourth-quarter 2023 earnings earlier today, and as usual, Deutsche Bank analyst Edison Yu's team shared their first look.

The following is from their research note.

Xpeng delivered solid 4Q earnings although the guidance came in soft.

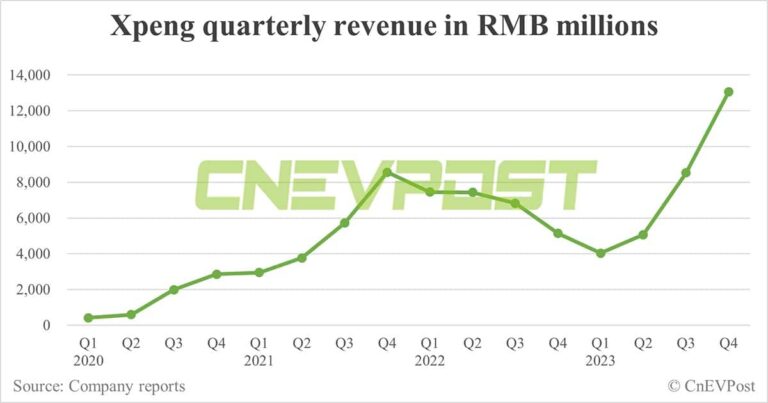

Deliveries for 4Q23 were already reported at 60,158 units, leading to revenue of 13.1bn RMB, compared to DBe/consensus 12.9/13.3bn.

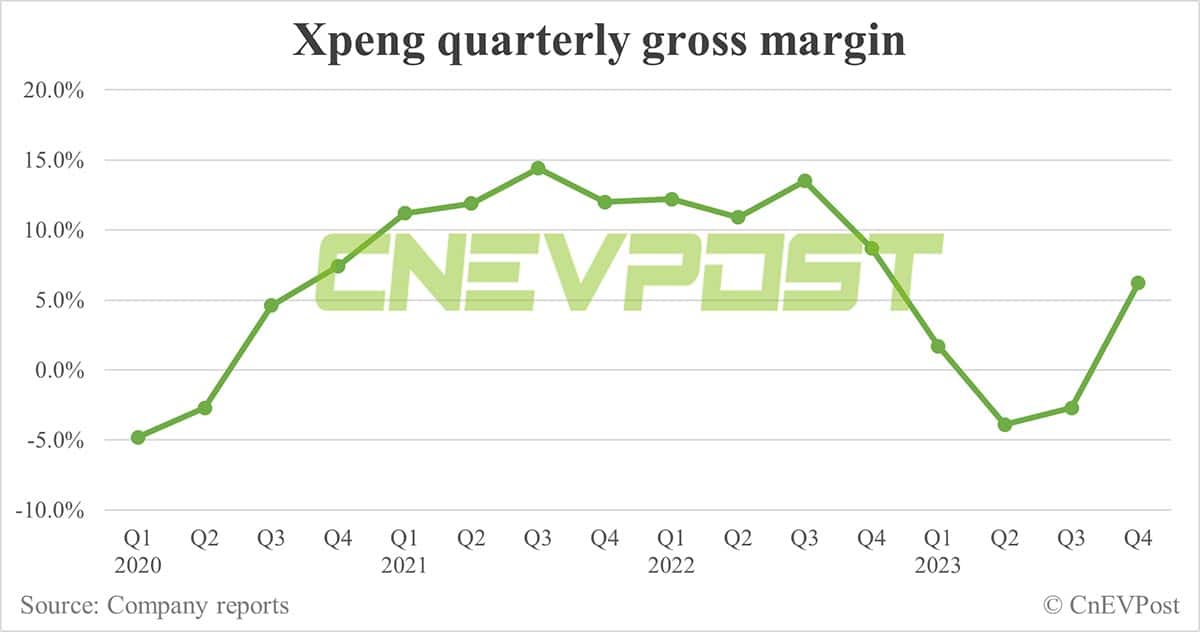

Gross margin increased 890bps QoQ to 6.2%, beating our estimate of 4.3%, driven by stronger vehicle margin of 4.1% vs. our 2.5% as cost reductions flowed through and mix improved.

Services & other margin also delivered upside by nearly 600bps. Opex of 3.2bn was largely consistent with our estimates with higher-than-expected SG&A offset by lower R&D.

All together, EPS of (1.98) came in better than our (2.43).

Management provided a soft 1Q24 outlook calling for only 21,000-22,500 deliveries, compared to our ~25,000, translating into 5.8-6.2bn RMB in revenue.

This implies March volume increasing at the midpoint to about 9,000 units (vs. 4,545 in Feb and 8,250 in Jan) but ASP actually up materially, benefitting from X9 launch/ramp.

X9 is Xpeng’s highest margin model and should mitigate some of the downside from the lower volume QoQ.

On the earnings call, we will look for incremental color on the volume trajectory for the rest of the year, vehicle margin/ cost progress, timing of VW technology service revenue, and details about the new lower-end brand.