Xpeng guided for first-quarter deliveries between 21,000 and 22,500 units, meaning it expects to deliver 8,205-9,705 units in March.

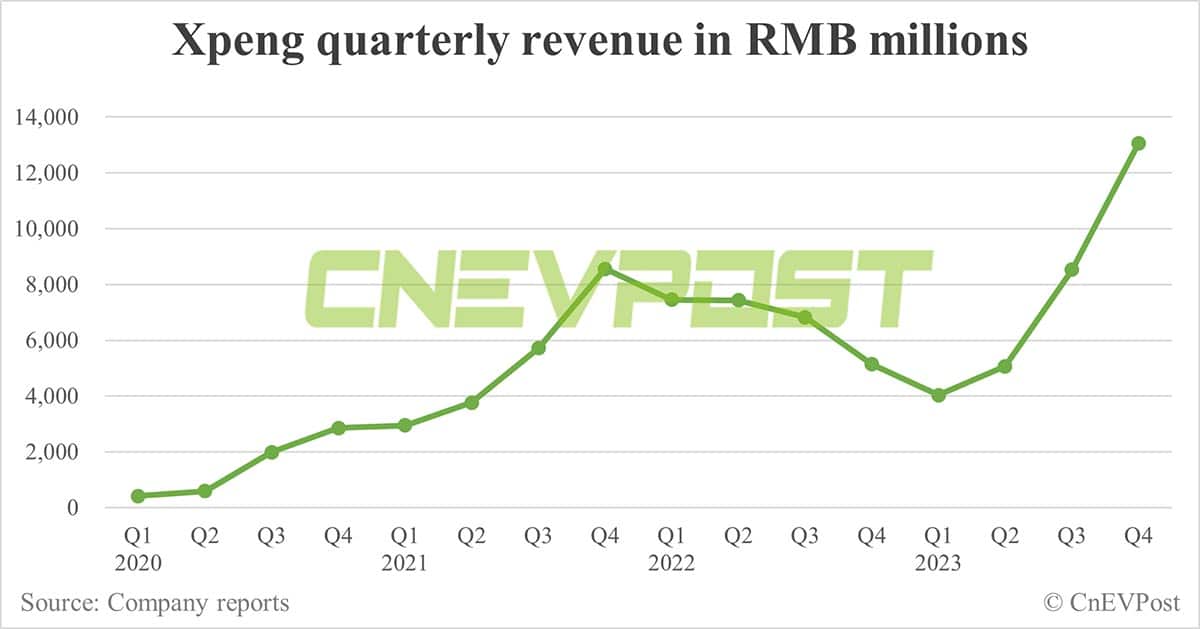

Xpeng (NYSE: XPEV) saw record revenue in the fourth quarter, net loss narrowed significantly and gross margin turned positive.

The company reported revenue of RMB 13.05 billion ($1.84 billion) in the fourth quarter of 2023, up 153.9 percent from the same period in 2022 and up 53.0 percent from the third quarter of 2023, according to its unaudited financial results announced today.

That was within the company's previously announced guidance range of between RMB 12.7 billion and RMB 13.6 billion, but below the RMB 13.28 billion expected by Wall Street analysts in a Bloomberg survey.

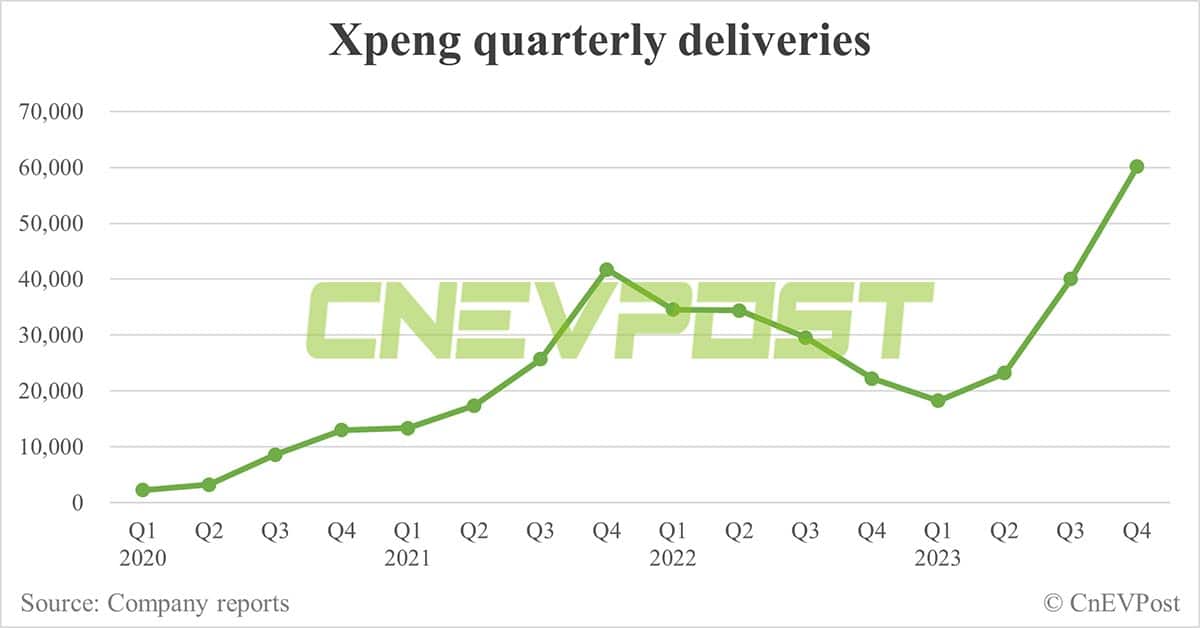

Xpeng delivered a record 60,158 vehicles in the fourth quarter, up 170.93 percent year-on-year and up 50.36 percent from the third quarter, and within its previous guidance range of 59,500 to 63,500 vehicles.

The company reported revenue from vehicle sales of RMB 12.23 billion in the fourth quarter, up 162.3 percent from the same period in 2022 and up 55.9 percent from the third quarter of 2023.

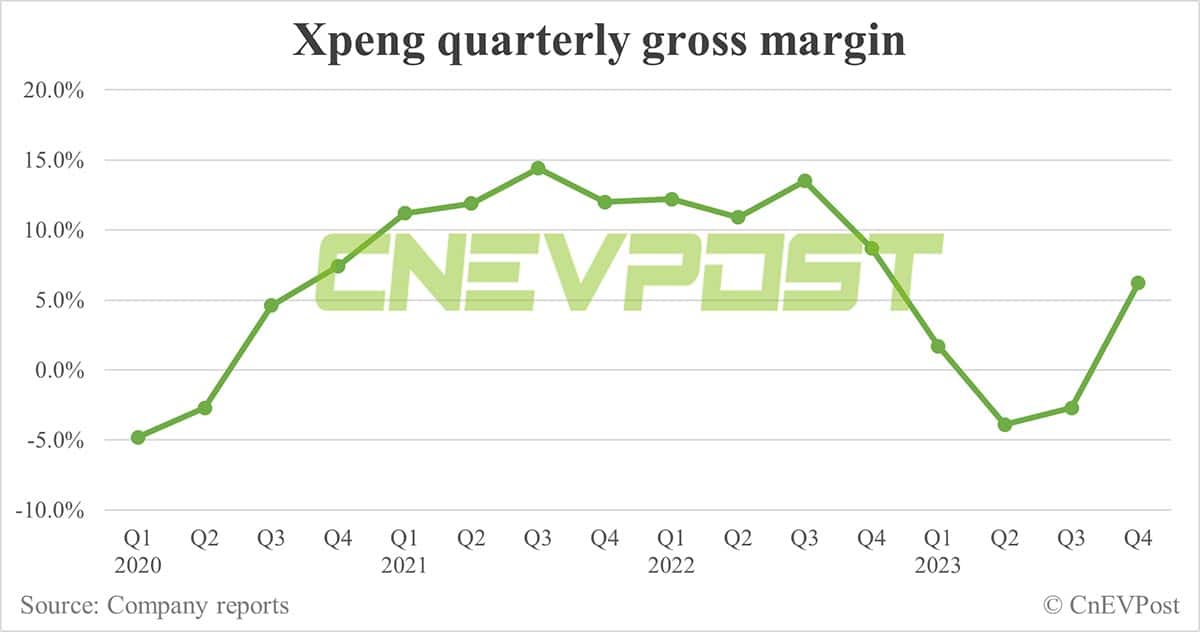

Xpeng's gross margin was 6.2 percent in the fourth quarter of 2023, reversing two consecutive negative quarters.

It had gross margins of -3.9 percent and -2.7 percent in the second and third quarters of 2023, respectively, and 8.7 percent in the third quarter of 2022.

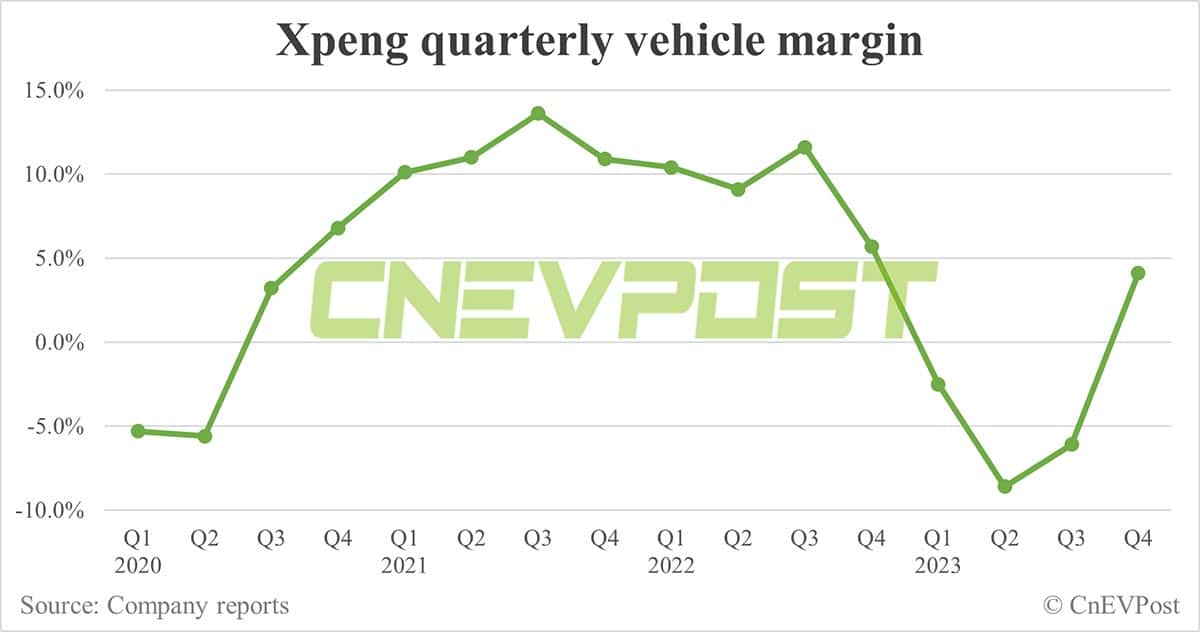

Xpeng's vehicle margin was 4.1 percent in the fourth quarter of 2023, compared to 5.7 percent in the same period of 2022 and -6.1 percent in the third quarter of 2023.

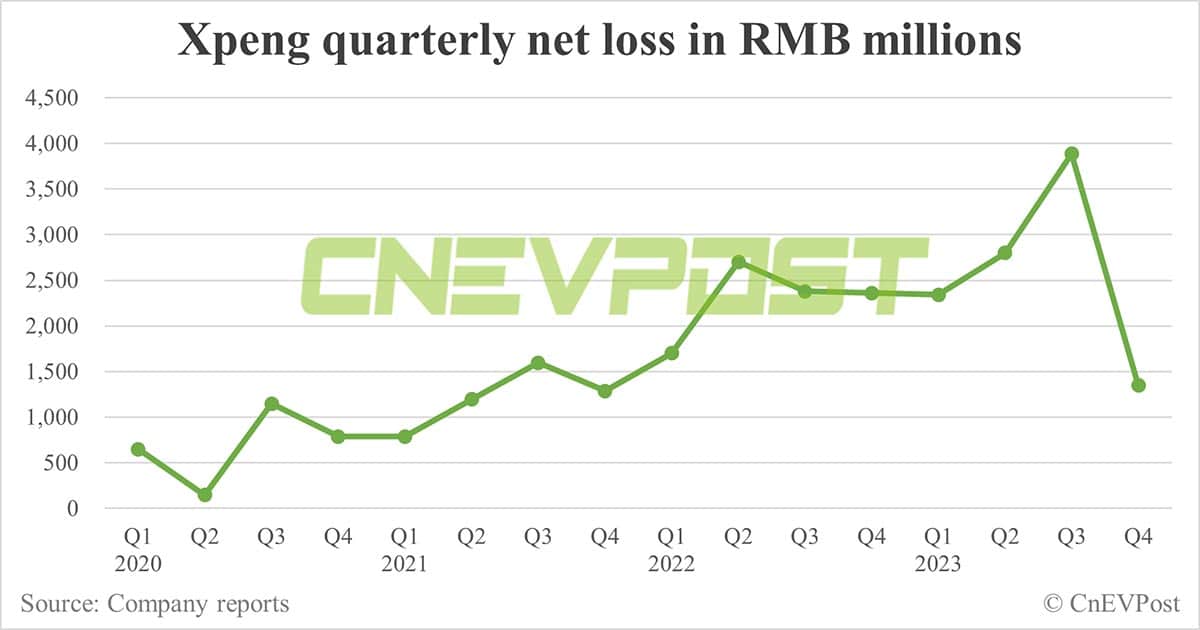

The company reported a fourth-quarter net loss of RMB 1.35 billion in the fourth quarter, a decrease of 42.90 percent year-on-year and a decrease of 65.33 percent from the third quarter.

Xpeng reported a non-GAAP net loss of RMB 1.77 billion in the fourth quarter of 2023, compared to RMB 2.21 billion in the same period of 2022 and RMB 2.79 billion in the third quarter of 2023.

It reported a basic and diluted net loss per American Depositary Share (ADS) of RMB 1.51 per share and a basic and diluted net loss per ordinary share of RMB 0.75 per share for the fourth quarter. Each ADS represents two class A ordinary shares.

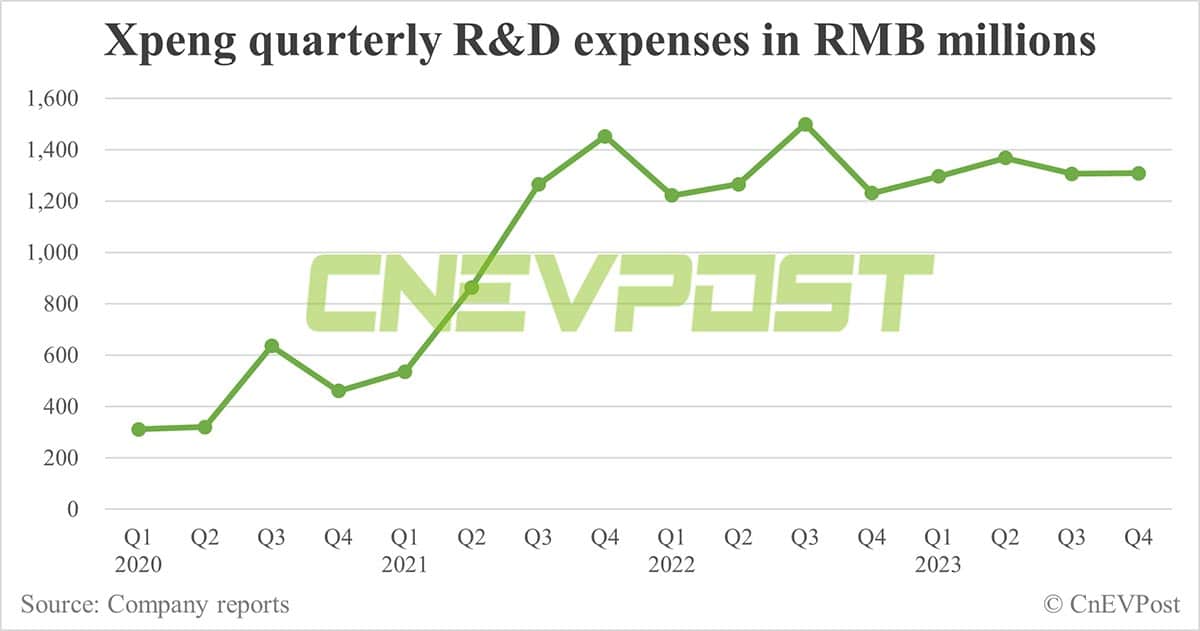

Xpeng's research and development expenses were RMB 1.31 billion in the fourth quarter of 2023, an increase of 6.3 percent from RMB 1.23 billion in the same period of 2022 and an increase of 0.1 percent from RMB 1.31 billion in the fourth quarter of 2022.

Xpeng's cash and cash equivalents, restricted cash, short-term investments and time deposits were RMB 45.7 billion as of December 31, 2023, compared to RMB 36.48 billion as of September 30, 2023.

Xpeng's delivery guidance for the first quarter is between 21,000 and 22,500 units. Considering it delivered 8,250 units in January and 4,545 units in February, this means it expects to deliver 8,205-9,705 units in March.

It guided first-quarter revenue to be in the range of RMB 5.8 billion to RMB 6.2 billion, up about 43.8 percent to 53.7 percent year-on-year.