Morgan Stanley said it sees multiple inflection points in CATL's fundamentals and upgraded the company to Overweight from Equal Weight.

Shares of Chinese power battery giant CATL (SHE: 300750), traded in Shenzhen, surged in early trading after Morgan Stanley upgraded its rating and price target.

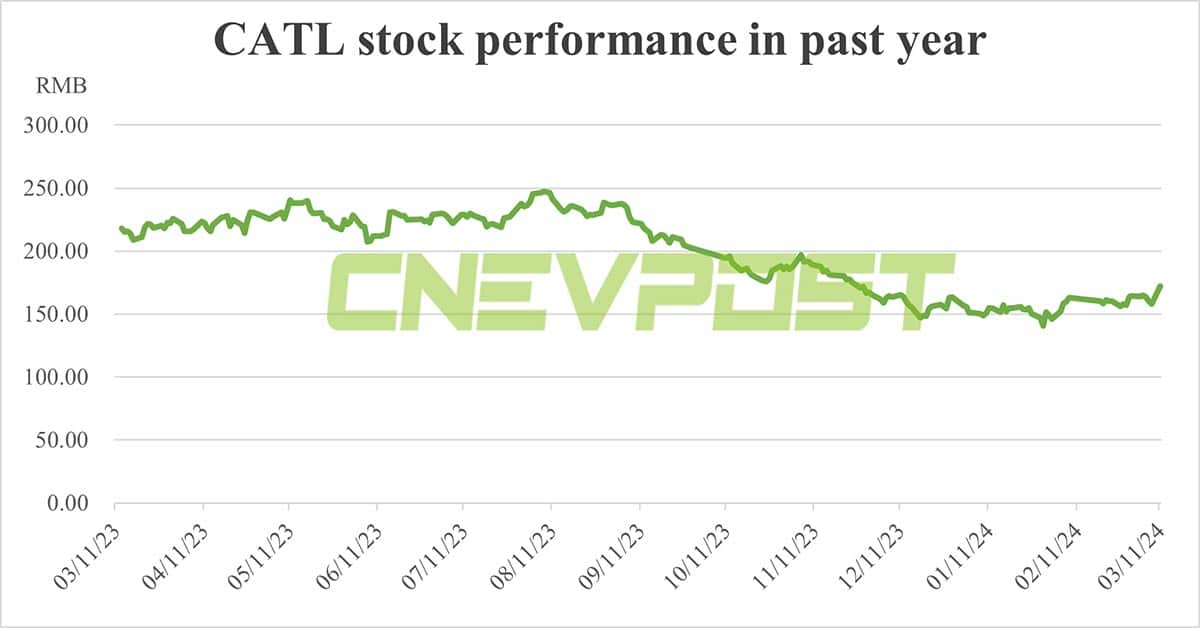

Morgan Stanley raised its target price on CATL by 14 percent to RMB 210, saying it sees an inflection point in its fundamentals.

As the price war draws to a close, CATL is poised to increase cost efficiency through a new generation of large-scale production lines, which is expected to widen its advantage in terms of return on net assets, Morgan Stanley analyst Jack Lu's team said in a recent research note.

The team said they see multiple inflection points in CATL's fundamentals and upgraded the company to Overweight from Equal Weight and picked it as a sector top pick.

CATL's stock looks to have reacted to the headwinds of the US Inflation Reduction Act (IRA), according to the team.

CATL's EBITDA (earnings before interest, taxes, depreciation, and amortization) growth is expected to return to year-on-year growth in the following quarters after slowing in the first quarter, Morgan Stanley said.

CATL's Shenzhen-traded shares were up 9 percent to RMB 172.36 at press time.