BYD's average profit per vehicle fell by about RMB 1,400 in the fourth quarter from the third quarter, mainly due to promotions through discounts and incentives offered to dealers, a team of analysts said.

(Image credit: CnEVPost)

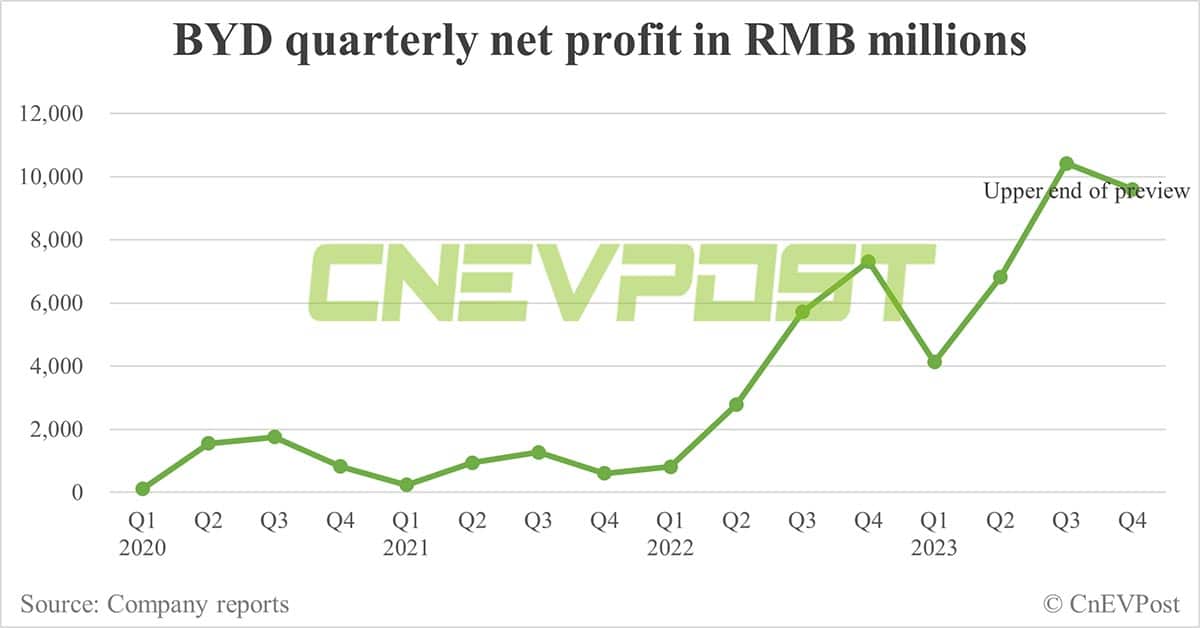

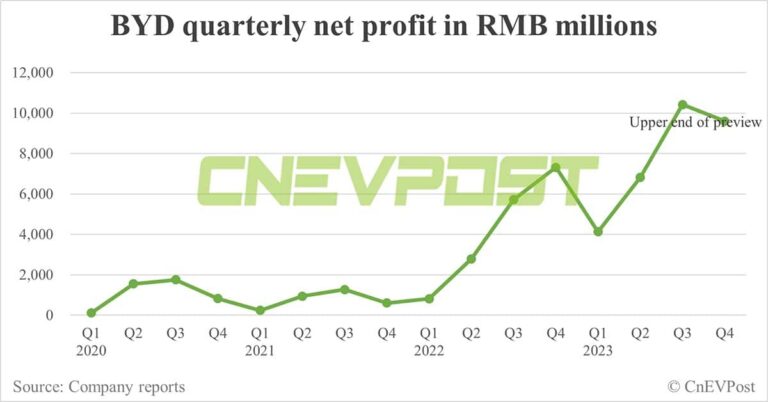

BYD (OTCMKTS: BYDDF) yesterday reported results that showed a strong 2023, but implied a decline in fourth-quarter net profit from the third quarter. A team of local analysts shared their thoughts after digging into the earnings preview.

Based on the median value of the preview and excluding the contribution from BYD Electronic, BYD had an average net profit per vehicle after non-recurring gains and losses of RMB 9,100 ($1,270) in the fourth quarter, SDIC Securities analyst Xu Huixiong's team said in a research note today.

SDIC Securities, previously known as Essence Securities, changed its name in December 2023 after using it for the previous 17 years.

The number slipped about RMB 1,400 from the third quarter of 2023, SDIC Securities said. The team blamed the decline on several reasons:

The vast majority of BYD's Ocean and Dynasty lineups offered official discounts in November and December ranging from RMB 5,000 to RMB 10,000, significantly impacting average per-vehicle profits.

The company invested higher marketing expenses in the fourth quarter in order to reach its annual sales target of 3 million units. It gave incentives to all stores that had accomplished their sales tasks, which amounted to RMB 666 per vehicle delivered, affecting profits to some extent.

The team noted that the drop in average net profit per vehicle was significantly smaller than the magnitude of the incentives offered, mainly because of these factors:

The incentives offered for BYD's Ocean and Dynasty series models in the fourth quarter covered only 2 months and 1 month respectively, which was diluted in the quarterly disclosed financials.

The average price of lithium carbonate in the fourth quarter was RMB 141,000 per ton, down 41.6 percent from the third quarter, bringing down battery costs.

BYD's two premium models, the Bao 5 under the Fang Cheng Bao brand, and the U8 under the Yangwang brand, sold 5,712 and 1,001 units respectively in the fourth quarter.

BYD exported 97,000 NEVs in the fourth quarter, up 26,000 units from the third quarter.

The premium and export models are expected to have brought in significant profits due to better profitability.

BYD's wholesale sales of 941,000 NEVs in the fourth quarter, up 14.5 percent from the third quarter, hit a new high and are expected to bring a more significant scale advantage.

BYD's net profit attributable to shareholders in 2023 is expected to be between RMB 29 billion and RMB 31 billion, a year-on-year increase of 74.46 percent to 86.49 percent, according to its earnings preview released yesterday.

After non-recurring gains and losses, BYD expects 2023 net profit to be RMB 27.4 billion to RMB 29.7 billion, up 75.22 percent to 89.92 percent year-on-year.

The preview implies fourth-quarter net profit of RMB 7.6 billion to RMB 9.6 billion, a year-on-year increase of 3.97 percent to 31.33 percent, but lower than the RMB 10.4 billion in the third quarter.

After non-recurring gains and losses, BYD's net profit is expected to be RMB 8.1 billion to RMB 10.4 billion.

Overall, BYD performed strongly in 2023, SDIC Securities said, adding that the company is expected to see continued high growth in 2024.

BYD continues to make progress at the premium end of the market, with the Denza brand already enjoying initial success and two flagship sedans expected to hit the market in the first half of 2024, the team noted.

Following the Bao 5, the Fang Cheng Bao brand will launch two new models, the Bao 3 and Bao 8, which are expected to make breakthroughs in the off-road NEV market, the team said.

In addition, the Yangwang U9 and U7 are expected to join the U8 in tapping into the luxury car market priced at the RMB 1 million level, the team noted.

"The company's earnings are expected to improve due to the generally better profitability of premium models," the team said.

The team believes the BYD brand is expected to continue to grow in sales and achieve high profitability through scale advantages, while overseas models with significantly higher selling prices and better profitability than domestic models are expected to contribute significantly to earnings.

($1 = RMB 7.1761)