Offering new variants with LFP batteries is a means for some EV makers to cut prices, and Xpeng's LFP version of the P7i, launched last month, has lowered the starting price by RMB 26,000 yuan.

(Image credit: CnEVPost)

Nio (NYSE: NIO) is filing to add a lithium iron phosphate (LFP) battery option to its vehicles, in what could be one of its latest efforts to turn a profit and cut costs.

China's Ministry of Industry and Information Technology (MIIT) today released its latest catalog of models that will be allowed to be sold in China, as well as many filings from automakers for changes in vehicle specifications, for public comment. The public can submit feedback between December 9 and December 15.

Fourteen Nio models -- including eight currently on sale and six previously sold -- saw changes to vehicle specifications, according to documents reviewed by CnEVPost.

All of these models have added the LFP battery option, with the supplier of battery cells and assemblies being Chinese power cell giant CATL.

It's important to note that Nio's models differ from the vast majority of other car companies' electric vehicles (EVs) in that they support battery swap, so they can use the latest packs, even if they were launched a few years ago.

For EVs, the power cell options are usually ternary (NCM) cells and LFP cells.

Ternary cells offer higher energy density and better winter range performance but at a higher cost and higher risk of thermal runaway.

LFP batteries typically have lower energy density and worse winter range performance, but lower cost and better thermal stability.

Over the past few years, ternary batteries have been the choice for high-end models and in many cases higher trim levels due to their ability to provide higher range.

The packs circulating in Nio's battery swap network initially only had ternary batteries because of the high-end market the company was targeting from the start.

On September 23, 2021, Nio announced the launch of a 75-kWh standard range hybrid battery pack, using a mix of the common ternary and LFP cells.

Previously EV makers' battery packs had either ternary or LFP cells, Nio was the first EV maker to use both ternary as well as lithium iron phosphate materials in its packs.

The pack delivers longer winter range and accurate state of charge (SoC) estimates supported by Nio's proprietary technology, providing the same performance as Li-ion ternary batteries, the company said at the time.

Nio had designed complete thermal management software as well as a hardware system for the new pack, which allows the pack to reduce mileage loss in cold temperatures by 25 percent compared to its LFP counterpart, it previously said.

If Nio starts offering LFP batteries for its models, it is expected to significantly reduce the cost of the vehicles, which would allow for lower selling prices.

Nio reduced the prices of its entire model lineup by RMB 30,000 yuan ($4,200) on June 12 by cutting the previously free battery swap entitlement.

Since then, prices for its models have remained stable, although its local counterparts have tried to boost sales by cutting prices or offering incentives.

Offering new versions of existing models with LFP batteries is one way to help some EV makers lower prices.

For example, Nio's local counterpart Xpeng (NYSE: XPEV) launched new variants of its flagship sedan, the P7i, with LFP battery packs on November 6, lowering the starting price by RMB 26,000 yuan.

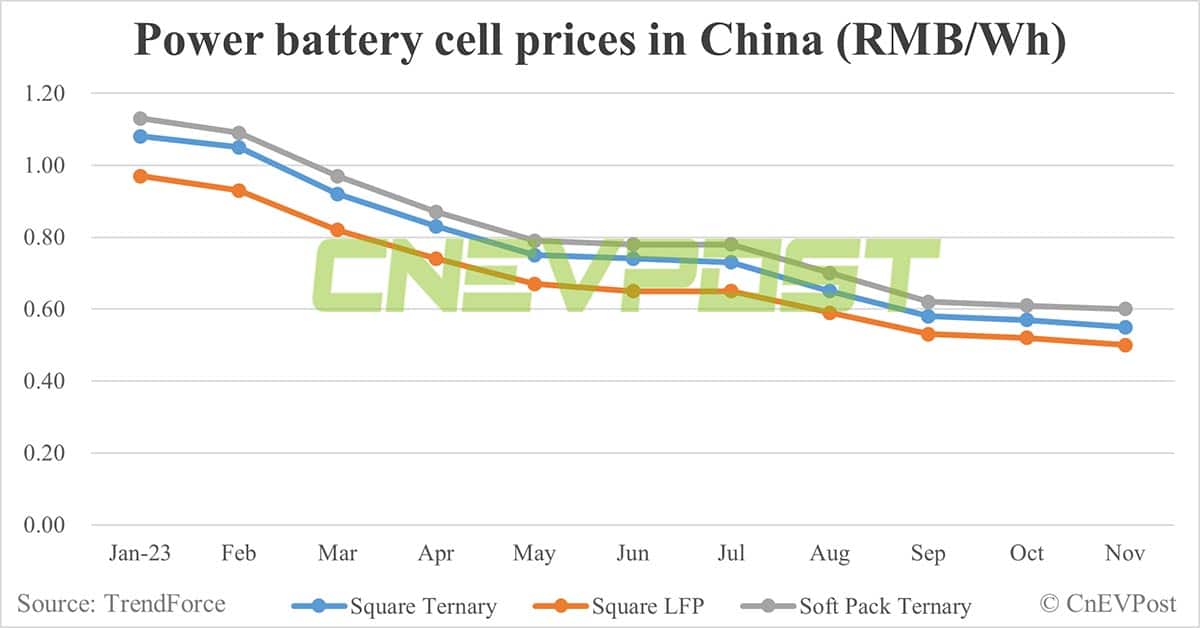

Prices of power batteries have been on a steady decline so far this year, along with the fall of lithium carbonate, a key raw material.

Amid falling battery prices, the price of LFP battery cells has been about 10 percent lower than the price of ternary battery cells, according to market research firm TrendForce.

In November, the price of square ternary batteries was RMB 0.55 per Wh, while LFP battery cells were RMB 0.5 per Wh, according to TrendForce.

($1 = RMB 7.1656)