With full control over all core processes of vehicle production, Nio will be able to improve its manufacturing efficiency and have more leverage in the fierce competition.

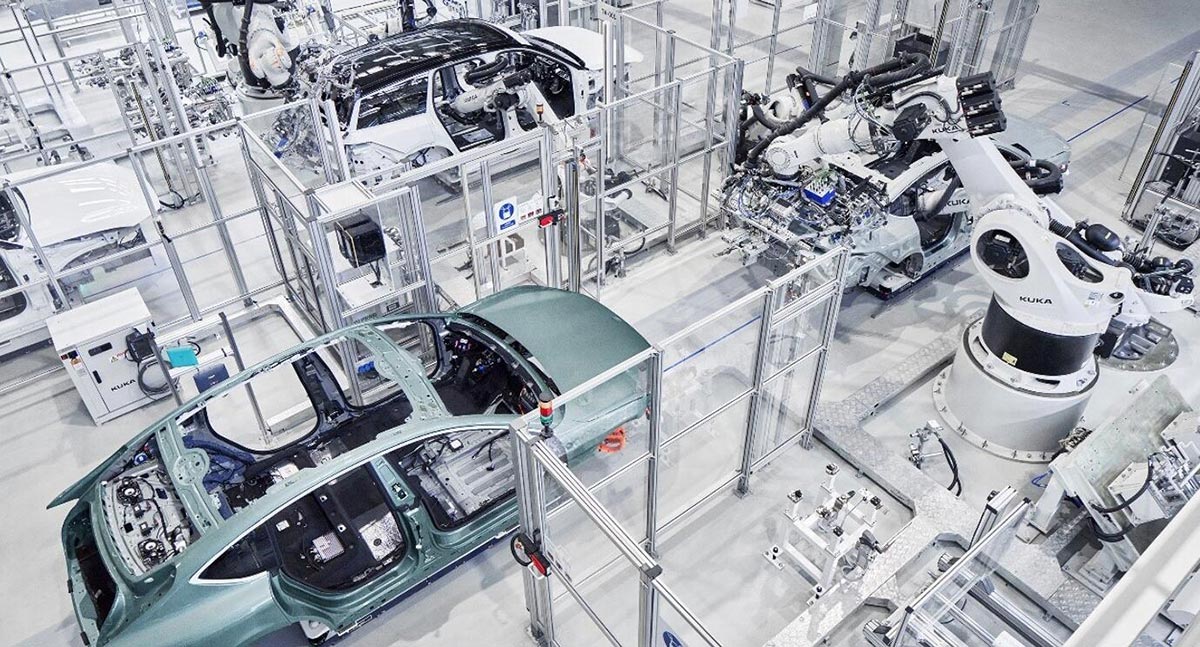

(Nio's production line at the NeoPark plant. Image credit: Nio)

Nio (NYSE: NIO) announced on December 5 that it will spend RMB 3.16 billion ($442 million) to acquire two factories held by its vehicle manufacturing partner, Anhui Jianghuai Vehicle Group (JAC).

This is the second key step in the company's move from contract manufacturing to fully managing its own factories and production. It entered the Chinese industry regulator's list of vehicle producers on December 4, meaning it will be able to produce vehicles under its own name without continuing to use the JAC name.

Production costs are expected to fall by about 10 percent after Nio acquires JAC's factory assets and takes full control of the manufacturing process, William Li, the electric vehicle (EV) maker's founder, chairman, and CEO, said during yesterday's third-quarter earnings call.

Neither Nio's nor JAC's announcements, nor Li's words, mention the decision-making process behind this. Now, a new report from local media outlet 36kr provides a lot of interesting details.

China has strict entry requirements for vehicle production to avoid disorderly expansion of production capacity. Nio had two previous opportunities to qualify for vehicle manufacturing, but missed them both, according to 36kr's report today.

In 2015, China's National Development and Reform Commission (NDRC) -- the country's economic planner – started to allow companies to qualify for the production of pure electric vehicles.

In a little over a year, starting in March 2016, a total of 15 companies received the qualification, which is commonly known as the "birth certificate" for EVs, according to the report.

That was the first opportunity for new car makers, including Nio, to get the qualification, but most of them missed the window due to factors such as the founding time and product schedule.

Nio had intended to use its first production vehicle, the ES8, to apply for the qualification, but by the time the model was ready, the NDRC's channel for awarding the qualification had closed, according to the report.

Nio didn't consider spending RMB 20 million to hire a third-party service provider to build a mockup for the qualification, so it missed the opportunity, the report said, citing a person familiar with the matter.

That opportunity led to the emergence of dozens of new car-making companies in China, with some of the fast-moving ones starting to build factories across the country at the time.

The NDRC suspended the issuance of EV making qualifications when it noticed signs of uncontrolled expansion in the sector, according to 36kr.

In June 2017, Volkswagen Anhui -- then known as JAC Volkswagen -- got the last newly-approved EV production qualification issued to a local company in China.

Since then, new entrants have had to produce cars in two ways: by acquiring qualifications from other car companies, or by partnering with a qualified company for production.

New car-making companies, including Li Auto (NASDAQ: LI) and Xpeng (NYSE: XPEV), targeted the first option. Li Auto acquired Chongqing Lifan for RMB 650 million in late 2018, while Xpeng and Leapmotor sought to acquire the qualification while relying on contract production in their early days.

Nio only opted for contract production, which Li argued at the time was more prudent and would reduce pressure on its assets, allowing the company to prioritize its resources on launching new models and operating its user community, according to 36kr.

The Nio ES8 was launched at the end of 2017, and the model began mass production at a newly built plant by JAC in 2018.

After suspending the issuance of EV production qualifications, the NDRC introduced new investment regulations for the automotive sector in late 2018, when new entrants were still being offered room.

The new regulations delegated the approval of automotive projects to provincial governments, provided that the car companies and local governments' jurisdictions meet requited conditions to control production capacity, the report noted.

Those conditions include that a car company's cumulative sales in the past two years reached 30,000 units or the cumulative sales amount exceeded RMB 3 billion. For specific provinces, the vehicle capacity utilization rate for the past two years needs to be higher than average, and all new pure EV factories need to reach production before new plants are approved.

Meeting these conditions is not easy, and while local governments have been given approval authority, the NDRC was still giving window guidance, making it difficult to get new capacity approved, the report said, citing a person familiar with the matter.

Looking at the results, Nio missed a second chance as it did not get the car-making qualification through acquisitions like Li Auto and Xpeng, the report noted.

In its partnership with JAC, the legacy automaker is responsible for building the factories and Nio procures the equipment and deploys a team to work with for co-production. In this model, Nio did not have to build its own factories and utilized JAC's production and management capabilities.

The pitfalls of this model are that quality is difficult to control and capacity expansion could be slowed down by the partner. But Nio circumvents many of these by participating in the whole production process, according to the report.

Nonetheless, Nio and JAC did not have a smooth start to their partnership. The JAC team initially had a strong voice in Nio's vehicle production, and the two had many disagreements over areas including the partnership model and resource allocation, 36kr cited a person familiar with the matter as saying.

Nio was thought to be paying JAC a production fee based on each vehicle, but in reality, it was more than that, the person said, adding that Nio was also required to pay other fees to JAC, resulting in a high average manufacturing cost per vehicle previously.

In addition to the production cost per vehicle, Nio has to pay JAC for depreciation and amortization of assets, production materials and related taxes, and compensation, among other things, the report said, citing Nio's annual report.

In 2020, 2021 and 2022, Nio paid JAC RMB 530 million, RMB 720 million, and RMB 1.13 billion, respectively.

In order to resolve differences that arose during the co-production, Nio established a joint venture company with JAC in May 2021 called Jianglai, which is responsible for the operation and management of the plants.

After Jianglai managed the factory, the collaboration between the two went much smoother, though it was only until the second half of last year that it got on track, said the person familiar with the matter, cited by 36kr.

Late last year, Nio announced that it was transferring production facilities to JAC. The move was made to comply with the tenure requirements for fixed assets under the contract manufacturing model, and these facilities needed to be transferred to JAC's name, the person said.

In the long run, gaining independent car-making status is the beginning of Nio's journey on the main course, said the report by 36kr.

After taking full control of all core processes of car production, Nio will be able to improve its manufacturing efficiency step by step and have more leverage in the fierce competition, the report said.

($1 = RMB 7.1579)