Steps being taken by Nio should bear fruit in the coming quarters, but a material improvement in the sales trajectory may take more time, Edison Yu's team said.

Nio (NYSE: NIO) is set to report its third-quarter financial results on Tuesday, December 5, before the US markets open, and as usual, Deutsche Bank analyst Edison Yu's team shared their preview.

"Nio will report 3Q23 earnings next week Tuesday (Dec 5th) and we expect a mostly in-line print, accompanied by a soft 4Q volume outlook considering QTD trends," the team wrote in a research note sent to investors on November 30.

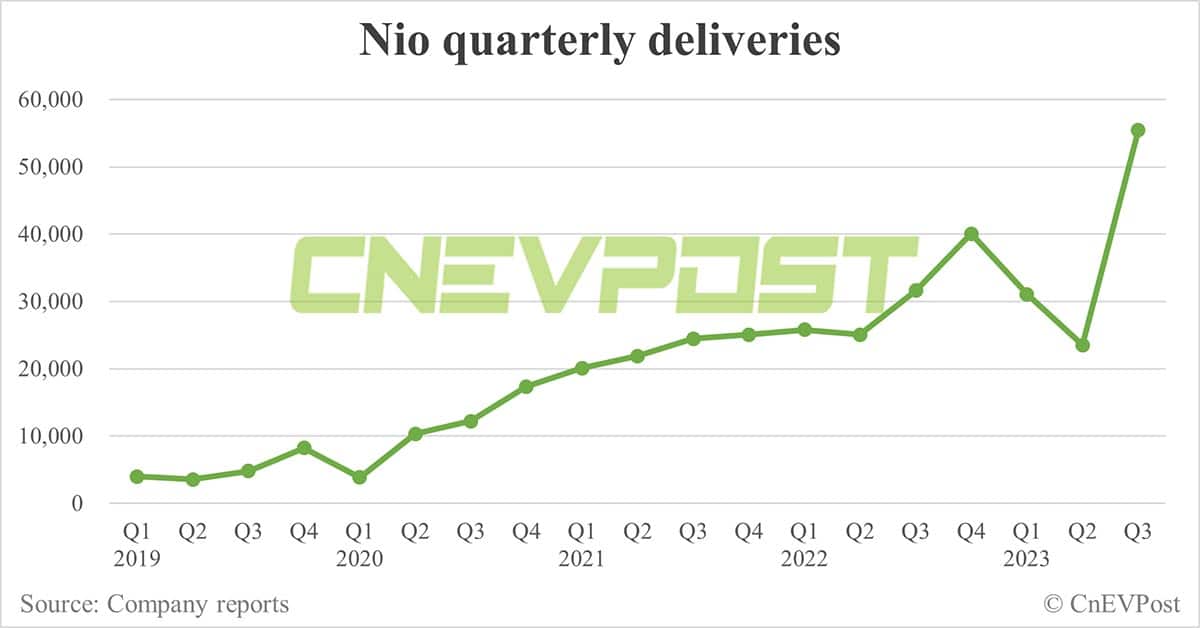

As a background, Nio delivered 55,432 vehicles in the third quarter, slightly above the lower end of its guidance range of 55,000 to 57,000 units. Deliveries for the quarter were up 75.38 percent year-on-year and up 135.68 percent from the second quarter.

Nio had previously guided for third-quarter revenue of RMB 18.9 billion ($2.65 billion) to RMB 19.52 billion, implying year-on-year growth of about 45.3 percent to 50.1 percent.

Yu's team expects Nio to report revenue of RMB 19 billion for the third quarter, which is in line with consensus.

Nio's gross margin in the third quarter is expected to show a large sequential improvement to about 7-8 percent due to increased sales volume, based on an expectation of vehicle margin of about 10 percent, according to the team.

SG&A should grow quarter-on-quarter as Nio aggressively promotes new models while R&D is stable, the team noted.

All of this translates into EPS of RMB -2.30, the team said, adding that Cash burn is expected to improve sequentially.

Nio's gross margin was 1.0 percent in the second quarter, down from 13.0 percent in the same period last year and from 1.5 percent in the first quarter. Its second-quarter vehicle margin was 6.2 percent, down from 16.7 percent a year ago and an improvement from 5.1 percent in the first quarter.

Nio hopes to achieve a double-digit gross margin in the third quarter and 15 percent in the fourth quarter, the company's management said in its second-quarter earnings call.

For the fourth quarter, Yu's team expects a soft volume outlook in the mid-high 40,000 range. That would represent a sequential decline, as order book seems to be facing more pressure than previously expected.

Nio delivered 16,074 vehicles in October, up 59.80 percent year-on-year and up 2.77 percent from 15,641 in September.

The company is expected to announce November deliveries later today. Insurance registrations of Nio vehicles in China from November 1 to November 26 were 12,700, according to figures shared by Li Auto (NASDAQ: LI) earlier this week. Deliveries and insurance registrations are tallied based on different methodologies.

Given the drop in sales, Nio's vehicle margin in the fourth quarter is expected to fall short of management's initial 15 percent target, and perhaps only up slightly from the previous quarter due to lower battery input costs, Yu's team said.

With a 10 percent reduction in headcount, operating expenses will naturally fall, but the full benefits won't be realized until next year, the team said.

Nio founder, chairman and CEO William Li unveiled plans for organizational optimization, including a 10 percent job cut, in an internal letter on November 3, set to be completed during November.

Competition in China's EV market is only going to get fiercer, and the Nio management team has yet to show the tenacity needed to consistently take market share from incumbents, Yu's team said.

Encouragingly, the company appears to be making significant changes, particularly in its sales structure and expense management/ROI, the team added.

This should bear fruit in the coming quarters, while material improvement in sales trajectory may take more time, the team said.

($1 = RMB 7.1319)