Stellantis will form a joint venture with Leapmotor, Leapmotor International, which will begin export operations in the second half of 2024.

(Image credit: Leapmotor)

Chinese electric vehicle (EV) maker Leapmotor has announced a tie-up with Stellantis NV, Europe's second-largest carmaker by sales, making it the latest landmark after Volkswagen's deal with Xpeng (NYSE: XPEV).

Stellantis will invest 1.5 billion euros ($1.58 billion) in Leapmotor for a roughly 20 percent stake and will get two seats on the company's board of directors, an announcement from the Chinese EV firm said today.

The two companies plan to form a joint venture called Leapmotor International to accelerate and expand global sales of Leapmotor's products by leveraging Stellantis' global resources, the announcement said.

Stellantis will have a 51 percent stake in the joint venture, with Leapmotor holding the other 49 percent.

The arrangement is interesting because before China fully opened its auto market to foreign investment, foreign carmakers entering the country were required to set up joint ventures with local carmakers to hold no more than 50 percent of the equity.

The joint venture has exclusive rights to conduct export and sales operations to all other markets in the world except Greater China, as well as exclusive rights to manufacture Leapmotor products locally.

"The establishment of a global partnership between the two companies will be an industry first, whereby a world-leading automaker and a new force in electric vehicles from China collaborate on a global electric vehicle program," Leapmotor said.

(Image credit: CnEVPost)

In addition to further increasing Leapmotor's sales in China, the partnership will also help Stellantis increase sales of the Leapmotor brand in global markets, starting with Europe, the announcement said.

Stellantis plans to leverage Leapmotor's cost-effective EV ecosystem to achieve the electrification goals of its "Dare Forward 2030" strategic plan.

The two companies may also further explore mutually beneficial synergies, with Leapmotor International expected to begin export operations in the second half of 2024, according to the announcement.

Stellantis will have two seats on Leapmotor's board of directors, and the European automaker will appoint Leapmotor International's chief executive officer.

As consolidation occurs among the stronger EV startups in the Chinese market, a small number of efficient and agile EV startups like Leapmotor will dominate the mainstream segments of the Chinese EV market, said Carlos Tavares, CEO of Stellantis.

With this strategic investment, an area of potential in Stellantis' business model will be developed and the group will profit from Leapmotor's competitiveness in China and other markets, Tavares said.

Leapmotor founder and CEO Zhu Jiangming said the company brings best-in-class EVs to the market in the most cost-competitive way, and he looks forward to working with Stellantis to sell Leapmotor's products around the world.

Leapmotor was founded in 2015, a year after Nio (NYSE: NIO), and is one of the earliest new car-making forces in China.

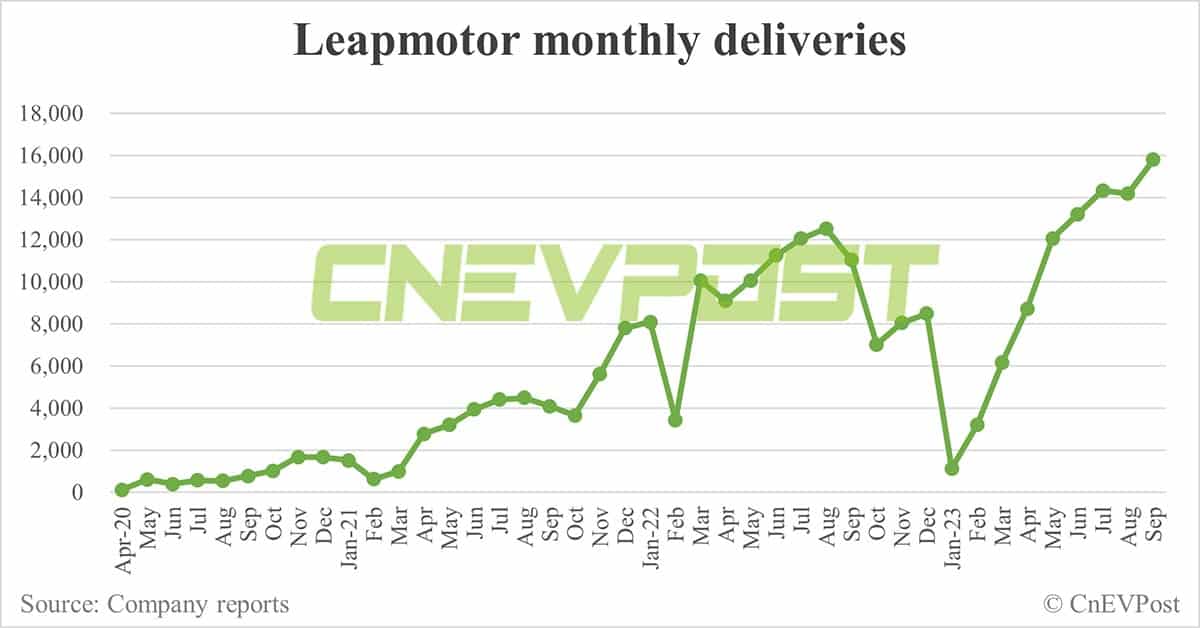

The company had annual vehicle deliveries of 7,380 units, 43,121 units, and 111,168 units from 2020 to 2022, data monitored by CnEVPost show.

Leapmotor saw a big drop in deliveries earlier this year, with January deliveries falling to 1,139 vehicles, partly due to a product switch.

The company's monthly deliveries got back above 10,000 units in May and saw a record 15,800 deliveries in September. In the January-September period, Leapmotor delivered 88,827 vehicles, up 1.4 percent year-over-year.

Stellantis was founded in 2021 as a result of the merger of the former Peugeot Citroën Group and the former Fiat Chrysler Group, which were over 100 years old respectively.

The European automotive giant has 14 iconic vehicle brands and two mobility services units with customers in more than 130 countries and manufacturing operations in more than 30 countries.

In 2022, Stellantis sold more than 6 million vehicles worldwide, with net revenues of €179.6 billion and net profit of €16.8 billion.

In the first half of 2023, Stellantis generated net revenues of €98.4 billion and net profit of €10.9 billion and continued to have one of the highest profit margins in the global automotive industry with an adjusted operating margin of 14.4 percent.

Over the next ten years, Stellantis will invest more than €50 billion in electrification to achieve its electrification targets in its "Dare Forward 2030" strategic plan, Leapmotor's announcement said.

By 2030, Stellantis aims to have all passenger cars sold in Europe and 50 percent of passenger cars and light trucks sold in the US purely electric. It plans to be a net-zero carbon emission company by 2038.

To achieve the target, Stellantis will secure access to a battery capacity reserve of about 400 GWh, which includes battery capacity support from its six battery manufacturing facilities in Europe and North America.

In addition to the strategic partnership with Leapmotor, Stellantis will continue to work on the implementation of its asset-light business model for its brands in China.

The deal is another landmark event in China's auto industry since the announcement of the Volkswagen-Xpeng deal in late July.

On July 26, Volkswagen announced an agreement with Xpeng to invest about $700 million in the latter to acquire about 4.99 percent of its equity.

Volkswagen will co-develop two B-segment all-electric vehicles to be sold in China under the Volkswagen brand, based on the Xpeng G9 platform as well as Connectivity and ADAS software.

The deals come at a time when China's EV industry is growing rapidly and local startups are showing strong competitiveness.

About 40 percent of new cars sold each month in China are new energy vehicles (NEVs), including battery electric vehicles (BEVs) and plug-in hybrids (PHEVs).

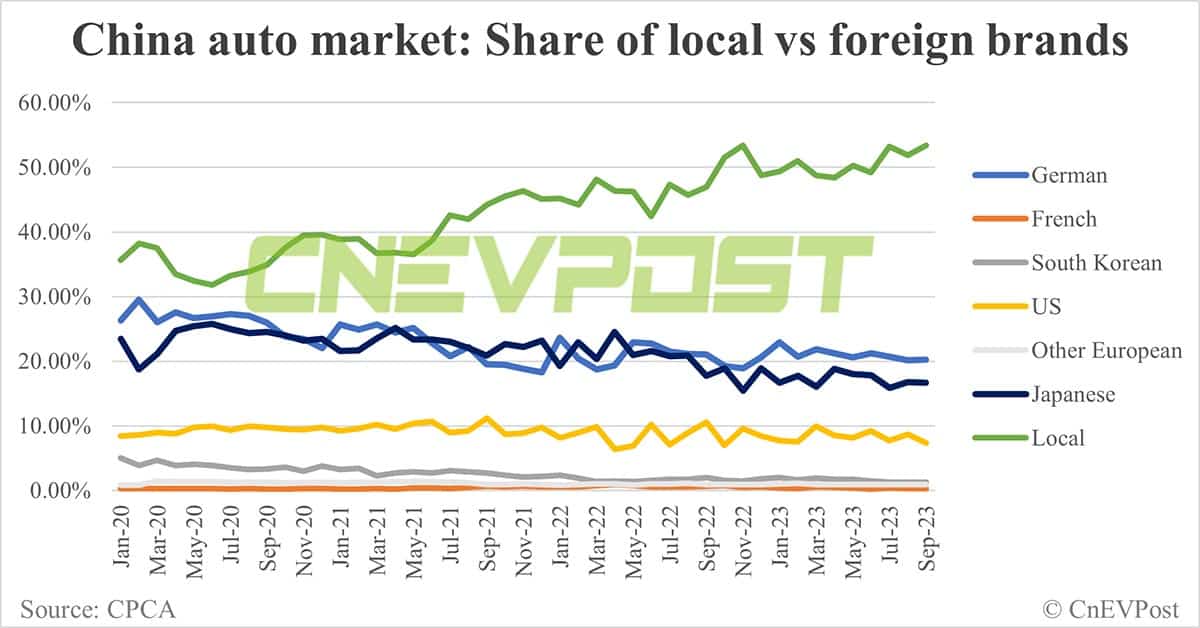

While international auto giants dominated China's auto market during the traditional fuel-vehicle era, they are clearly lagging behind in the EV era, resulting in a rapid erosion of their market share in China by local carmakers.

Currently, German and Japanese automakers are the main foreign players in China's auto market, with their shares standing at 20.2 percent and 16.67 percent respectively in September, according to the China Passenger Car Association (CPCA).

For comparison, their shares in January 2020 were 26.32 percent and 23.47 percent, respectively.

The share of local carmakers in China, on the other hand, has risen from 35.6 percent in January 2020 to 53.38 percent in September this year.

($1 = €0.9472)