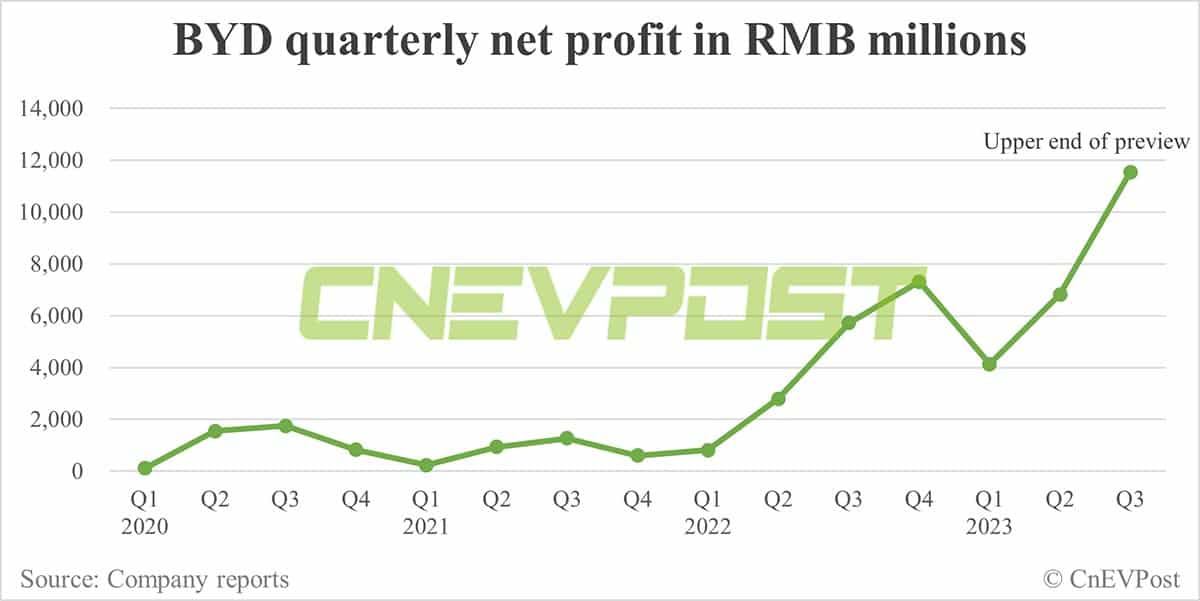

BYD expects its net profit for the first three quarters to be RMB 20.5 billion - RMB 22.5 billion, up 120.16 percent - 141.64 percent year-on-year.

BYD (OTCMKTS: BYDDY) expects it will continue to see strong profit growth in the third quarter, as its vehicle sales rise.

The Chinese new energy vehicle (NEV) giant expects it will post a net profit of between RMB 9.55 billion ($1.31 billion) and RMB 11.55 billion in the third quarter, according to its earnings preview released today.

That represents a year-on-year increase of 67 percent to 101.99 percent, and an increase of 39.89 percent to 69.2 percent from the second quarter.

The preview means that BYD's net profit in the third quarter is set to hit a new record high by surpassing last year's fourth-quarter net profit of RMB 7.31 billion.

In the first quarter, BYD's net profit was 43.5 percent lower than last year's fourth quarter due to a decline in NEV sales. In the second quarter, BYD's net profit increased 65.23 percent from the first quarter.

After non-recurring gains and losses, BYD expects third-quarter net profit to be RMB 8.61 billion to RMB 10.51 billion, representing year-on-year growth of 61.29 percent to 96.9 percent.

BYD expects third-quarter earnings per share of RMB 3.29 to RMB 3.97, up from RMB 1.97 in the year-ago period.

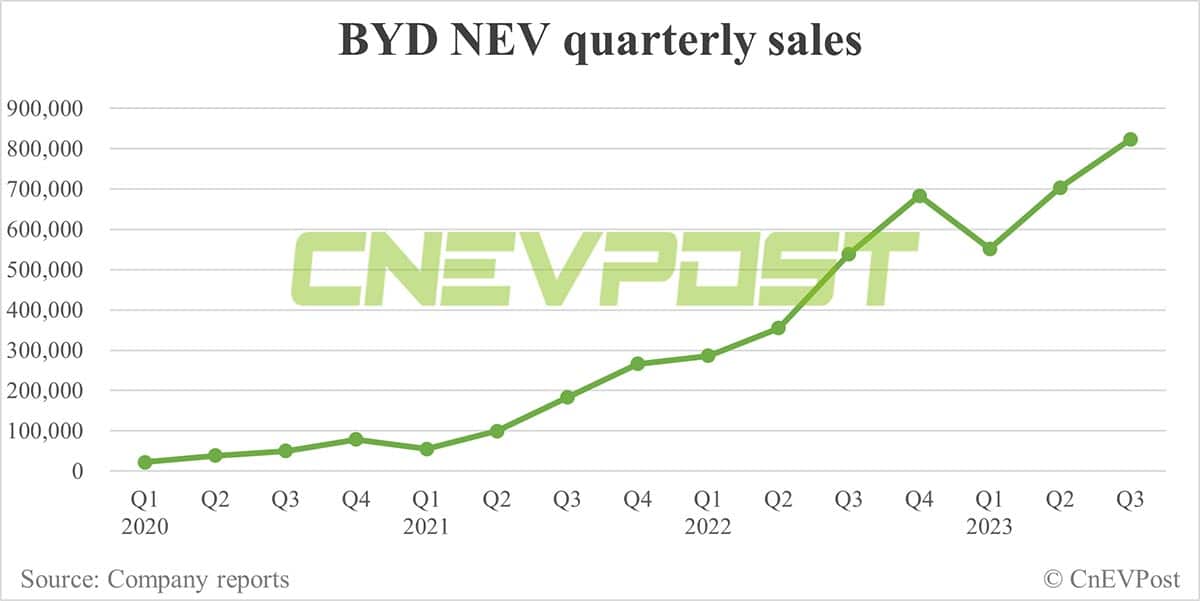

The company sold 824,001 NEVs in the third quarter, up 52.96 percent year-on-year and up 17.12 percent from the second quarter.

In the first three quarters, BYD sold 2,079,638 NEVs, up 76.23 percent year-on-year, data monitored by CnEVPost show.

BYD expects its net profit for the first three quarters to be RMB 20.5 billion - RMB 22.5 billion, up 120.16 percent - 141.64 percent year-on-year.

BYD's NEV sales hit a record high in the third quarter and held steady as the world's No. 1 seller of NEVs, the company said in its earnings preview.

Despite the continuation of intensified competition in the third quarter, BYD demonstrated strong resilience as the company's earnings continued to improve thanks to its rising brand power, continuously expanding scale advantage and strong industrial chain cost control, it said.

BYD's phone parts and assembly business benefited from an increase in the share of large overseas customers and a rebound in demand from Android customers, it said.

The company's businesses such as NEVs and new smart products continued to grow at a high rate, capacity utilization continued to improve, business structure was further optimized and profitability continued to improve, BYD said.

($1 = RMB 7.3128)