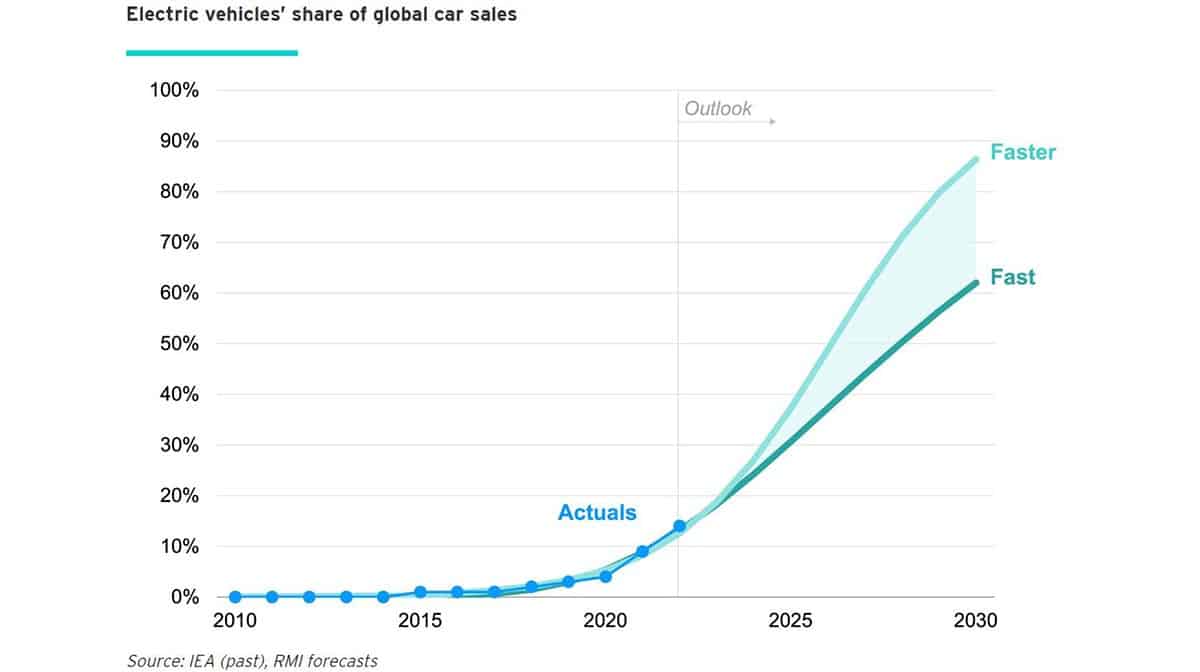

If sales continue up the S-curves, EVs will make up between 62 percent and 86 percent of global car sales by 2030, with China's EV market share reaching at least 90 percent.

(Image credit: Rocky Mountain Institute)

Electric vehicles (EVs) will see S-curve growth in the coming years and are expected to contribute the lion's share of global car sales by 2030, according to a new study.

Rapid growth in EVs means global oil demand for cars has peaked and will be in freefall by 2030, and the end of the internal combustion engine (ICE) era has begun, a report yesterday by the Rocky Mountain Institute (RMI), a US-based nonprofit organization, said.

There is a clear exponential growth pattern for EVs, as rising sales track along an S-curve, the report said.

"By 2030, EVs will dominate global car sales. If we continue to solve the challenges and sales continue up the S-curves, then EVs will make up between 62 percent and 86 percent of global car sales by 2030, with China enjoying an EV market share of at least 90 percent," the report reads.

Meanwhile, consensus sales forecasts are lagging and get upgraded every year, RMI added.

Led by Northern Europe and China and driven by policy, it took about six years for EVs to rise from 1 percent to 10 percent of new car sales.

The next stage is even faster, with another six years needed to reach 80 percent in the leading countries, the report said.

Because battery costs enjoy learning curves, total cost of ownership price parity has been reached, and sticker price parity will be reached in every major car market and segment by the end of the decade, RMI said, adding that this will allow the revolution to expand into the southern hemisphere and reach into other transportation sectors.

The rapid growth of EVs means that peak oil demand for cars has passed.

Global oil demand for cars peaked in 2019 and is now at a typical plateau, squeezed by efficiency gains and EV growth, the report said.

By 2030, oil demand for cars will be declining at a rate of more than 1 million barrels per day (bpd) every year, with endgame for one-quarter of global oil demand in sight, RMI said.

Rapid growth in automotive battery production is triggering lower costs and higher energy densities that are driving changes in other transportation sectors, from two-wheelers in the Southern Hemisphere to heavy trucks in China and the US, the report said.

The International Energy Agency (IEA) expects Chinese gasoline demand to peak at about 3.7 million bpd in 2024, bringing forward previous forecasts that demand would level off by 2025/2026, according to a Reuters report in July.

Peak production is expected to reach 3.7 million bpd, but as early as the first quarter of 2024, compared with previous forecasts of 2024-2025, said Mukesh Sahdev, senior vice president and head of downstream/oil trading at Rystad Energy, according to the report.

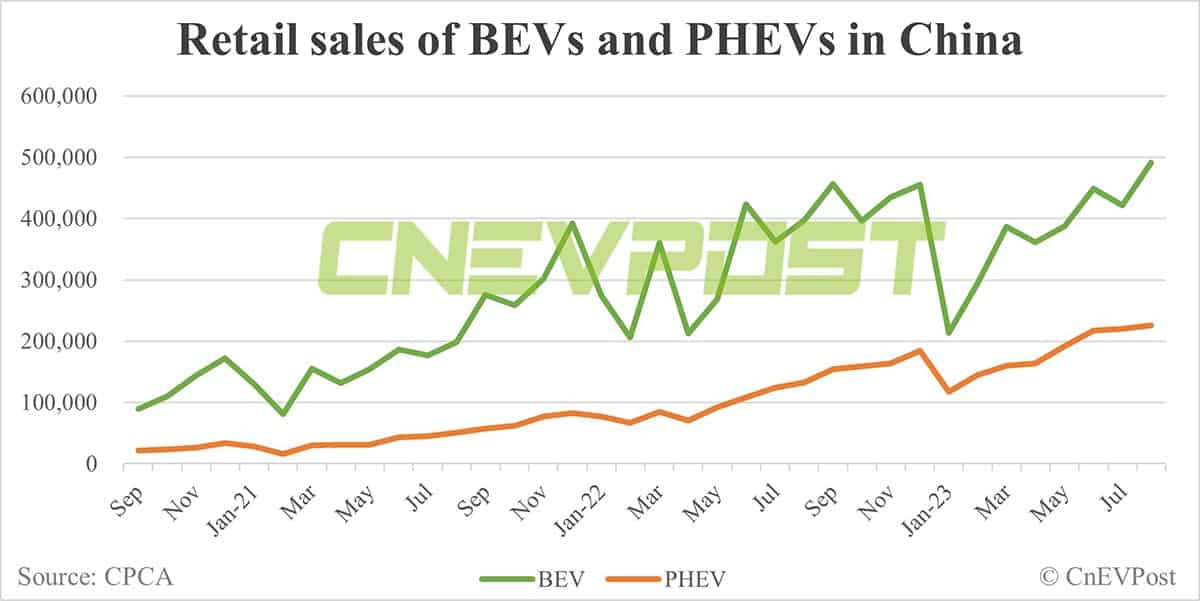

China is the world's largest EV market, seeing retail sales of 4.44 million new energy vehicles (NEVs) in January-August, up 36.0 percent year-on-year, according to the China Passenger Car Association (CPCA).

NEVs contributed 33.6 percent of China's 13.2 million retail sales of all passenger vehicles in January-August.

In January-August, China's retail sales of battery electric vehicles (BEVs) amounted to 3.0 million units and plug-in hybrids (PHEVs) to 1.44 million units, contributing 22.7 percent and 10.9 percent of all passenger vehicle retail sales, respectively.