Xpeng guided for vehicle deliveries in the range of 39,000 to 41,000 units in the third quarter, meaning it expects to deliver a total of 27,992 to 29,992 vehicles in August and September.

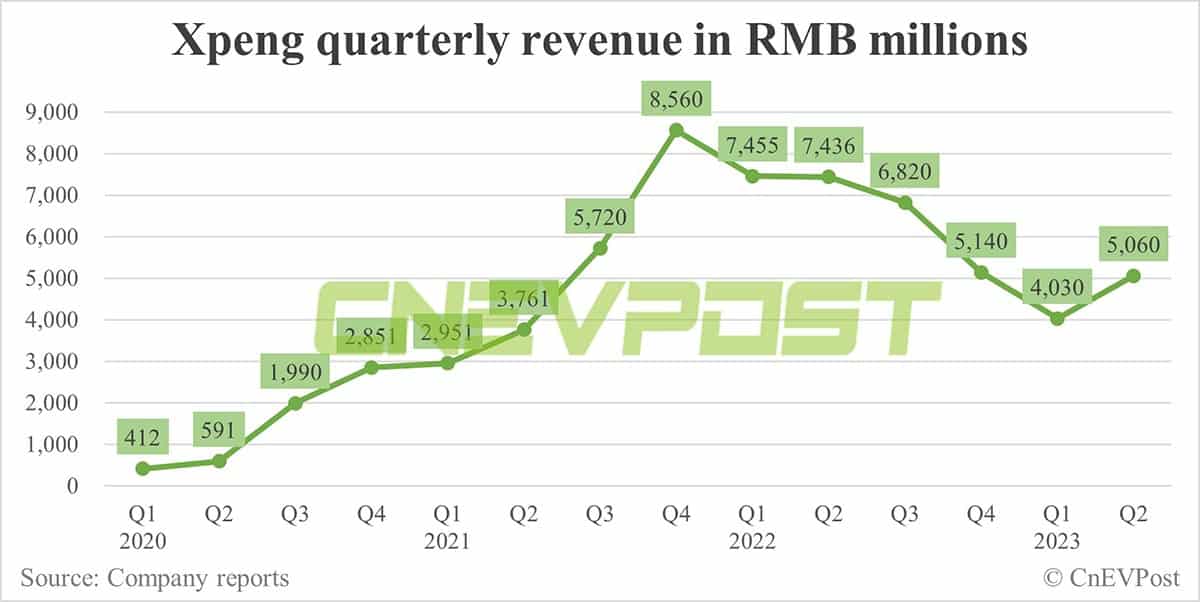

Xpeng (NYSE: XPEV) saw revenue rebound in the second quarter, but gross margins fell back into negative territory and net loss widened to a record high.

The company reported revenue of 5.06 billion yuan ($700 million) in the second quarter, down 31.95 percent from 7.44 billion yuan in the same period in 2022, but up 25.56 percent from 4.03 billion yuan in the first quarter, according to its unaudited financial results released today.

Revenue for the quarter exceeded the upper end of Xpeng's previously provided guidance range of RMB 4.5 billion to RMB 4.7 billion, and topped Wall Street analysts' expectations of RMB 4.91 billion.

Xpeng previously reported that it delivered 23,205 vehicles in the second quarter, exceeding the upper end of its guidance range of 21,000 to 22,000 vehicles.

It reported revenue from vehicle sales of RMB 4.42 billion in the second quarter, down 36.2 percent year-on-year but up 25.9 percent from the first quarter.

The year-on-year decline was mainly due to lower vehicle deliveries and the elimination of new energy vehicle (NEV) subsidies, while the year-on-year increase was mainly due to higher vehicle deliveries of the P7i, Xpeng said.

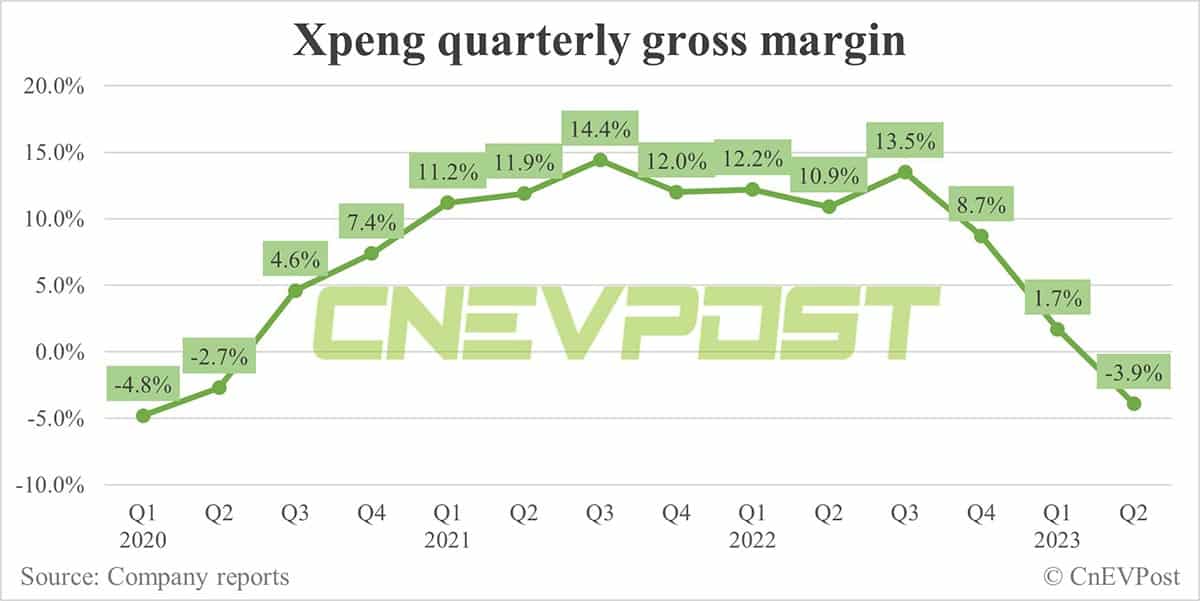

Xpeng's gross margin was -3.9 percent in the second quarter, missing analysts' expectations of 4.79 percent and a new low since the first quarter of 2020. As a comparison, its gross margin was 10.9 percent in the same period in 2022 and 1.7 percent in the first quarter.

The company's vehicle margin was -8.6 percent in the second quarter, compared to 9.1 percent in the same period in 2022 and -2.5 percent in the first quarter.

The decline in gross margin was due to inventory write-downs and loss of inventory purchase commitments related to the G3i, which negatively impacted vehicle margin by 4.5 percentage points in the second quarter 2023, as well as increased promotions, expiration of NEV subsidies, according to its earnings release.

"With the G6 and other new products accelerating sales growth, we expect gross margin to gradually recover while operating efficiency continues to improve and free cash flow to substantially improve," said Brian Gu, vice chairman and co-president of Xpeng.

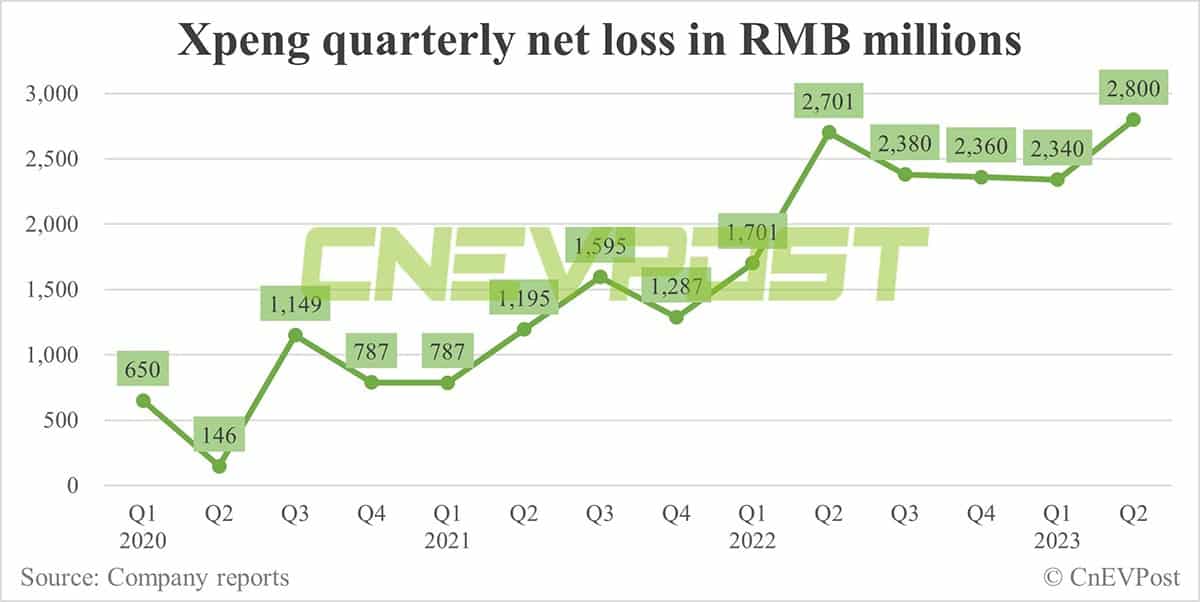

Xpeng reported a record net loss of RMB 2.8 billion in the second quarter, compared to a net loss of RMB 2.7 billion in the same period in 2022 and a net loss of RMB 2.34 billion in the first quarter.

It reported a non-GAAP net loss of RMB 2.67 billion in the second quarter, compared to RMB 2.46 billion in the same period in 2022 and RMB 2.21 billion in the first quarter.

It reported basic and diluted net loss per ADS of RMB 3.25 in the second quarter, compared to RMB 3.16 in the second quarter of 2022 and RMB 2.71 in the first quarter.

Non-GAAP basic and diluted net loss per ADS were both RMB 3.10 in the second quarter, compared to RMB 2.88 in the second quarter of 2022 and RMB 2.57 in the first quarter.

Xpeng's research and development expenses for the second quarter were RMB 1.37 billion, an increase of 8.1 percent from RMB 1.26 billion for the same period in 2022 and an increase of 5.5 percent from RMB 1.30 billion in the first quarter.

The increase was mainly due to higher expenses related to new model development as the company expands its product portfolio to support future growth, Xpeng said.

Xpeng's selling, general and administrative expenses for the second quarter decreased 7.3 percent year-on-year to RMB1.54 billion, up 11.3 percent from the first quarter.

The year-on-year decrease was mainly due to lower commissions paid to franchises and lower marketing and advertising expenses, while the year-on-year increase was mainly due to higher marketing and advertising expenses to support new product launches, Xpeng said.

As of June 30, Xpeng held cash and cash equivalents, restricted cash, short-term investments and time deposits of RMB 33.74 billion.

Xpeng expects vehicle deliveries in the third quarter to be in the range of 39,000 to 41,000 units, an increase of about 31.9 percent to 38.7 percent year-on-year.

The guidance means that Xpeng expects it to deliver a total of 27,992 to 29,992 vehicles in August and September, considering it delivered 11,008 vehicles in July.

Xpeng guided third-quarter revenue to be in the range of RMB 8.5 billion to RMB 9 billion, up about 24.6 percent to 31.9 percent year-on-year.