Nio's vehicle deliveries in August and September are expected to be 20,000-21,000 units per month due to auto parts constraints, but parts supply will improve in the fourth quarter, BofA said.

Bank of America further raised its price target on Nio (NYSE: NIO) after doing so last week.

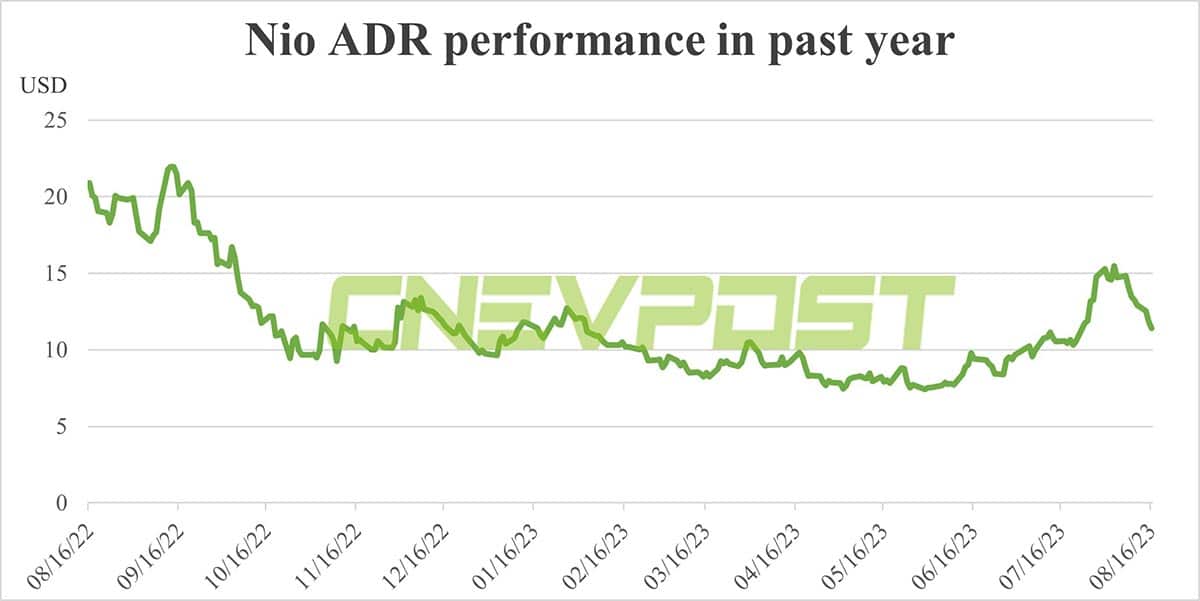

Analyst Ming Hsun Lee's team raised their price target on Nio by 5 percent to $16.20 from the previous $15.40 in an August 15 research note sent to investors.

"We reiterate our Buy rating on sequential improvement in product offerings and sales volume," the team wrote.

It's worth noting that the team just raised their price target on Nio to $15.40 from the original $13 in a research note sent to investors on August 10.

CnEVPost would like to continue to remind readers that Wall Street analysts' price target adjustments are the result of their tweaking of a handful of parameters in a complex valuation model.

BofA's latest adjustment to Nio's target price came as they raised their sales expectations for some of Nio's models going forward.

"We expect Nio’s vehicle delivery to be 20-21k per month in August and September due to auto component constraint, but we believe component supply will improve in 4Q23," the team wrote in the August 15 note.

BofA lifted the estimated sales volume by 0.4 percent, 1.6 percent, 16 percent for ET5, ES6 and Nio's mass-market brand Alps in 2023, 2024, 2025, respectively.

Nio delivered a record 20,462 vehicles in July, with the ES6 contributing 54.33 percent at 11,118 units.

The company continued to increase the number of stores and infrastructure in July, and BofA believes that the rapid expansion of Nio's infrastructure should help improve user experience and boost sales in the long run.

Lee's team said in the August 11 note that July deliveries exceeded their previous forecasts, as Nio had originally targeted monthly sales of 20,000 units by the fourth quarter of 2023.

In last week's note, the team said that Nio's strong sales momentum would continue into the fourth quarter and raised their sales forecasts for Nio in 2023-2025 by 15 percent, 11 percent, and 17 percent, respectively.

Nio closed down 3.63 percent to $11.40 in the US stock market on Wednesday, and BofA's latest price target implies a 42 percent upside.