Morgan Stanley raised its price target on Nio to $18.7, on Xpeng to $25.4, and on Li Auto to $53, all keeping their ratings at Overweight.

Morgan Stanley raised its price targets on China's electric vehicle (EV) trio -- Nio (NYSE: NIO), Xpeng (NYSE: XPEV), and Li Auto (NASDAQ: LI) -- as a lackluster first half passes and investor sentiment improves recently.

"The lackluster 1H23 is now behind us, and we are starting to see an inflection point of meaningful operational improvement and potential re-rating opportunities, backed by volume upturn, policy tailwinds, autonomous driving and technology monetization," Morgan Stanley analyst Tim Hsiao's team said in a research note sent to investors yesterday.

The team raised its price targets on the EV trio and maintained its Overweight ratings on them, saying that proven volume growth driven by the new model cycle will push up shares of the EV trio.

As background, Nio released several new models based on the new NT 2.0 platform in the first half of the year and has completed the switchover to almost all models based on the older NT 1.0 platform, except for the only remaining EC6 coupe SUV.

Xpeng launched the P7i, a facelifted version of its flagship sedan P7, on March 10, with deliveries starting on March 26. It launched the new SUV G6 on June 29, with deliveries starting on July 10. The company will also launch an MPV called X9 during the year.

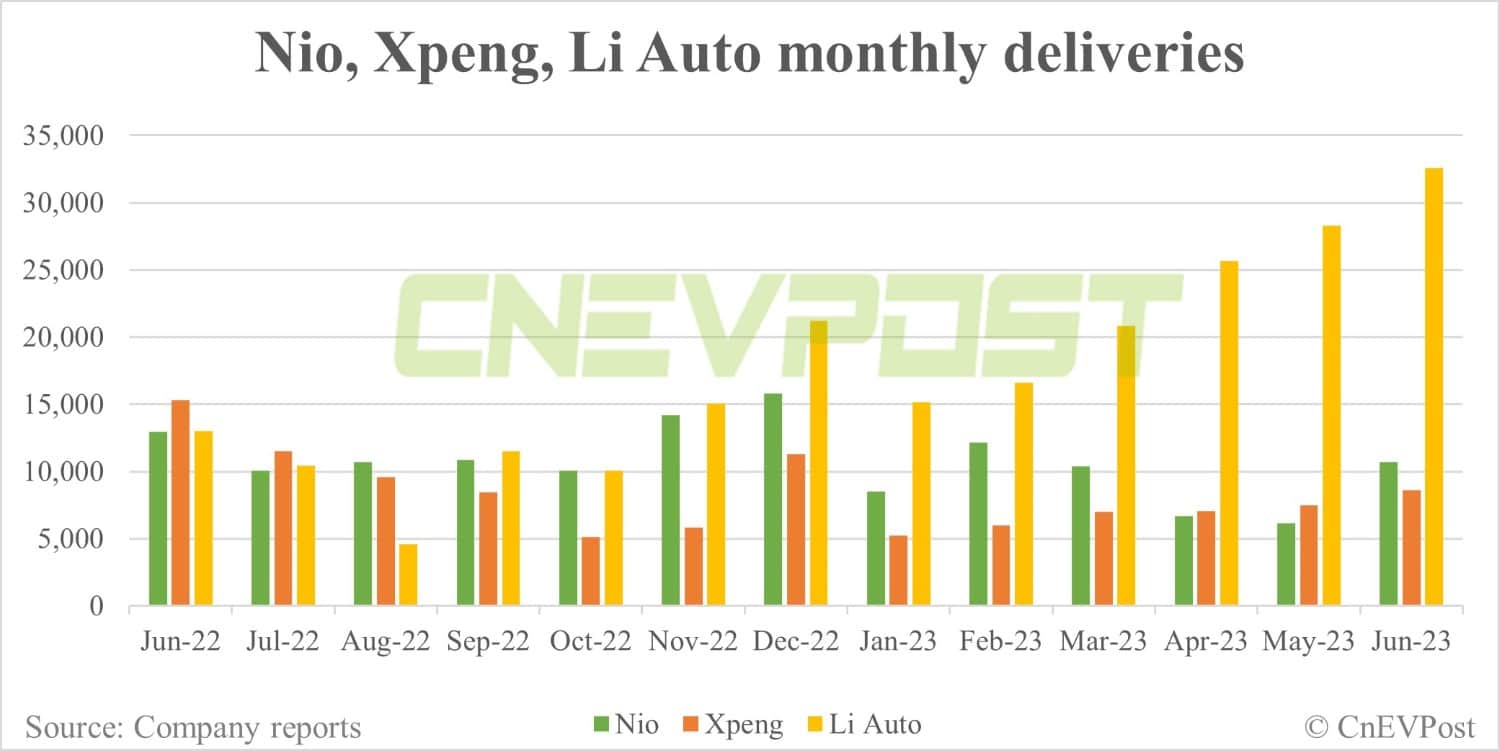

Model switching has been one of the major factors behind the weak sales of both Nio and Xpeng over the past year, and with that work largely complete, both companies have shown signs of improvement in deliveries.

Li Auto has not been plagued by model switching this year and has continued to see strong delivery growth since the start of the year, delivering 32,575 vehicles in June, the first time it has passed the 30,000 mark.

"1H23 is now in the rear-view mirror, and we are seeing green shoots of operational resurgence with steady production ramp-ups starting from July," Hsiao's team wrote in their research note.

Despite believing that sales are expected to improve sequentially, the team lowered their 2023 sales expectations for Nio and Xpeng to reflect tepid sell-through during the model transition in the second half of the year. At the same time, the team raised their Li Auto delivery forecast due to stronger-than-expected model growth.

Specifically, the team lowered their 2023 sales forecast for the Nio to 175,000 units, down 24 percent from the previous 230,000 units.

Their volume forecast for Xpeng in 2023 was lowered by 15 percent to 132,000 units from 155,000 units previously, and their volume forecast for Li Auto was raised by 17 percent to 350,000 units from 300,000 units previously.

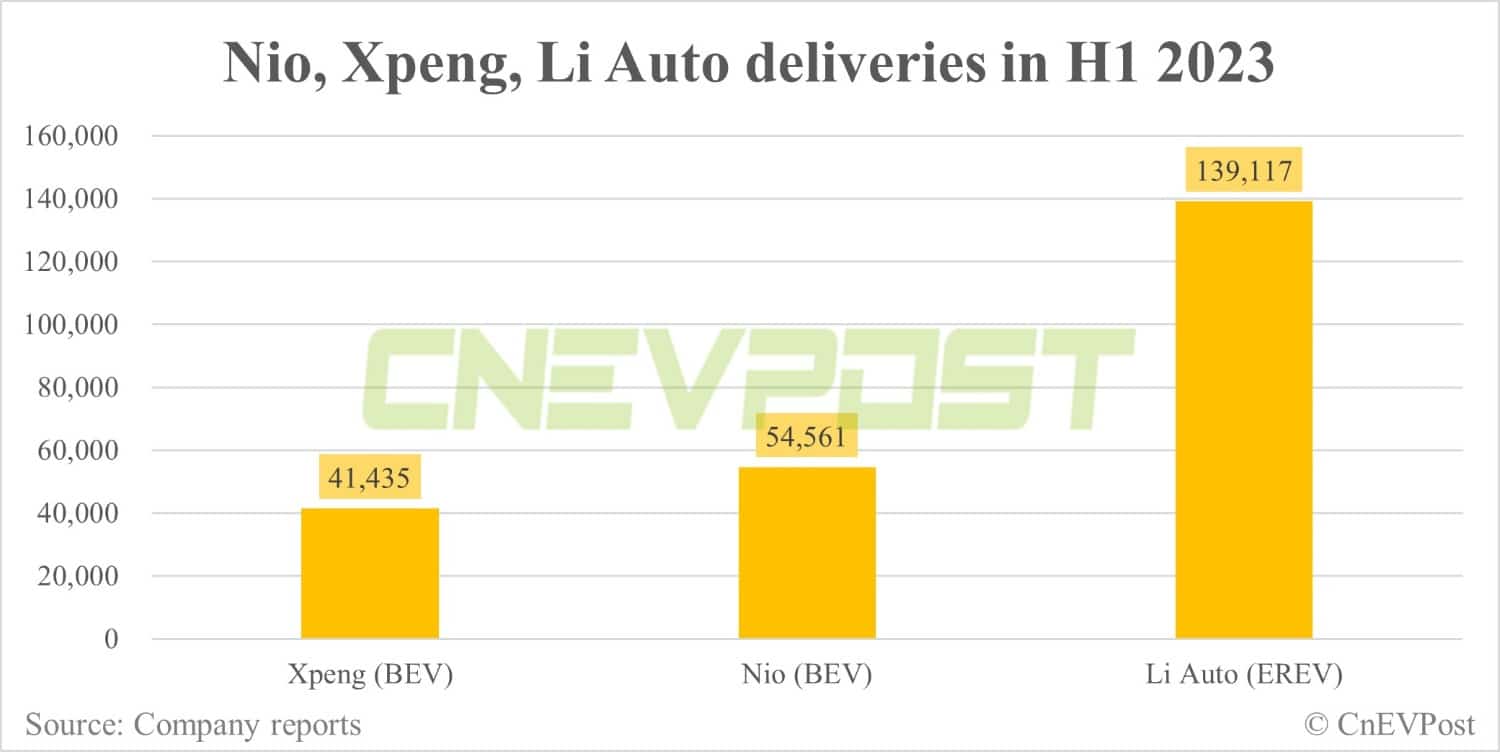

In the first half of the year, Nio, Xpeng, and Li Auto delivered 54,561, 41,435, and 139,117 vehicles, respectively, according to their previously announced figures monitored by CnEVPost.

Hsiao's team believes that the guidance issued by the National Development and Reform Commission (NDRC) on July 21 to promote auto consumption lays a favorable foundation for EV companies in the second half of the year, despite the weak macro environment.

At the same time, the team believes that the scalability of autonomous driving remains underrated.

Despite making solid progress in L2+ autonomous driving development, China's major EV startups do not yet appear to have enjoyed a valuation premium during the sector downturn.

As China commits to deploying L3 vehicle automation, startups should accelerate the rollout of city navigation-assisted driving features on a wider scale, the team said, adding that they expect consumer adoption of autonomous driving features to grow significantly over the next 12-18 months.

"With this change, we would encourage investors to reconsider the value of EV startups' software/algorithm, which looks set to effect a reshuffle of the auto industry and act as the next key catalyst that further drives a re-rating of the EV trio's shares," the team wrote.

Additionally, the team is bullish on the opportunity to cash in on new technology after Volkswagen's recent deal with Xpeng.

Following Xpeng's announcement of its strategic partnership with Volkswagen, investors began to ask whether there were additional monetization opportunities in China and overseas for the EV trio, given their industry-leading position in affordable EV platforms and technologies, compared to traditional OEMs around the world, the team said.

For automakers, this is a key step in moving beyond traditional business models and generating new revenue streams primarily from software, services, which are highly profitable and recurring, the team noted.

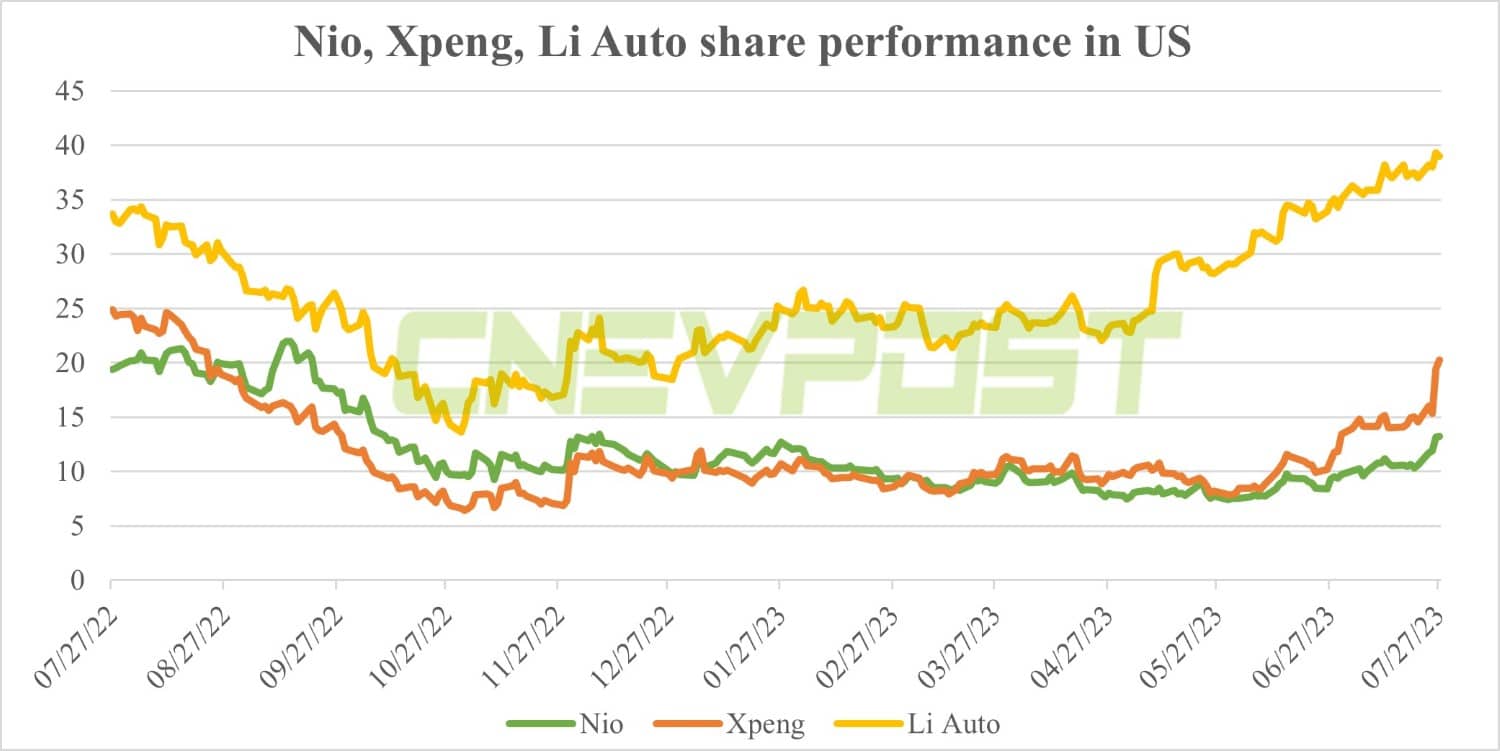

Despite year-to-date gains of 35 percent-96 percent, Nio and Xpeng are still 70 percent-80 below their late 2020-early 2021 peaks, the team said.

"We think the EV trio's valuations have yet to fully capture the idiosyncratic volume upturn from 2H23e, of which the 68-190% YoY growth we expect should outshine that of peers," the team wrote.

Morgan Stanley raised its price target on Nio by about 56 percent to $18.7 from $12 previously. Considering that the company closed at $13.24 yesterday, the price target implies a 41 percent upside.

The team raised its price target on Xpeng by 103 percent to $25.4 from $12.5. Xpeng closed at $20.22 yesterday on the US stock market, and the target implies an upside of 26 percent.

Morgan Stanley raised its price target on Li Auto by about 33 percent to $53 from $40. Li Auto closed yesterday at $38.99, and the target implies a 36 percent upside.