Nio is confident it will see sales of more than 20,000 units per month in the second half of the year, but its goal of achieving profitability in the fourth quarter may have to be delayed, its management said.

Nio announced its first-quarter earnings today and held an analyst call afterward. Here are the key takeaways from the call as recorded by CnEVPost, with the latest being placed at the top.

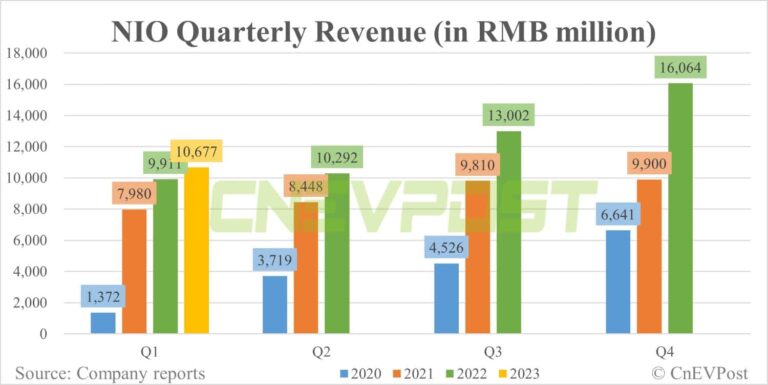

(Image credit: CnEVPost)

Nio will deploy about 100 battery swap stations in June, with a faster pace to follow, which will help boost sales.

Nio is confident that it will see sales of more than 20,000 units per month in the second half of the year.

NOP+ is already in use by 50,000 users, and Nio has begun testing the Urban Pilot assisted driving feature, which will be available to users at the right time this year.

In the future, Nio will launch NAD service when regulations allow.

If the lithium price returns to rational level, it is not difficult for Nio to achieve 20 percent gross margin. With the progress of in-house development and vertical integration, it is also possible to achieve 25 percent gross margin in the future.

Nio is confident about the future performance of the new ES6. The new ES8 will be delivered in the near future and the volume of pre-orders has exceeded expectations. The external distractions are much less than last year.

With the withdrawal of national subsidies, the prices of Nio models have actually increased. In addition, competition has become more intense, and Nio will adjust its channels, organizational structure, and marketing strategy in the near future.

The current factories can support the production of both Nio and ALPS brands and no major CapEx investment is needed in the factories. The current battery swap stations are also sufficient for both brands to share.

In a fast-moving market, the whole company is ready to be agile and responsive, but will be more careful with cash management.

Overall, cash will not be a big issue for Nio, but the company will manage it more carefully.

Nio will not make cuts to the configuration of current models, including dual motors and computing power. But Nio has some flexible measures to reconsider, such as for the needs of users who do not need battery swap service.

Based on the current situation, Nio may need to push back the point of achieving break-even, but within a year.

Nio will manage its cash prudently and will postpone some fixed asset investments this year.

Nio is confident that the gross margin will return to double digits in the third quarter and to 15 percent in the fourth quarter.

Nio ES6's locked-in orders have met expectations and the test drive conversion rate is the highest of any model.

Nio is targeting 10,000 units of the new ES6 for both production and delivery in July.

The other models besides ES6 still have a chance to achieve the target of 20,000 units delivered per month, except that the ET5 faces a greater challenge after the withdrawal of national subsidies.

Nio will launch the ET5 Touring on June 15 and will start its delivery this month.

The ET5 Touring can meet the diverse usage scenarios of individual and family users, greatly enhancing the company's competitiveness in the high-end family car market.

The sub-brand ALPS is still on track and will start delivering products in the second half of next year. Nio will be managed more carefully in terms of pace and efficiency.

The development of models for Nio's second-generation platform has been completed, and now we need to think about how the marketing team can better sell the cars.

Nio's goal is to obtain a fair share of the current eight vehicles in their segments.