Wang believes that the NEV change is a technological revolution, and only companies with core technologies will survive.

BYD is confident of gaining a higher market share in the next 3-5 years, said Wang Chuanfu, chairman and president of the Chinese new energy vehicle (NEV) giant, at its 2022 annual shareholders meeting today.

Commenting on the price war in China's auto industry, Wang said BYD's scale, brand and technology advantages will help it outperform its peers in future competition.

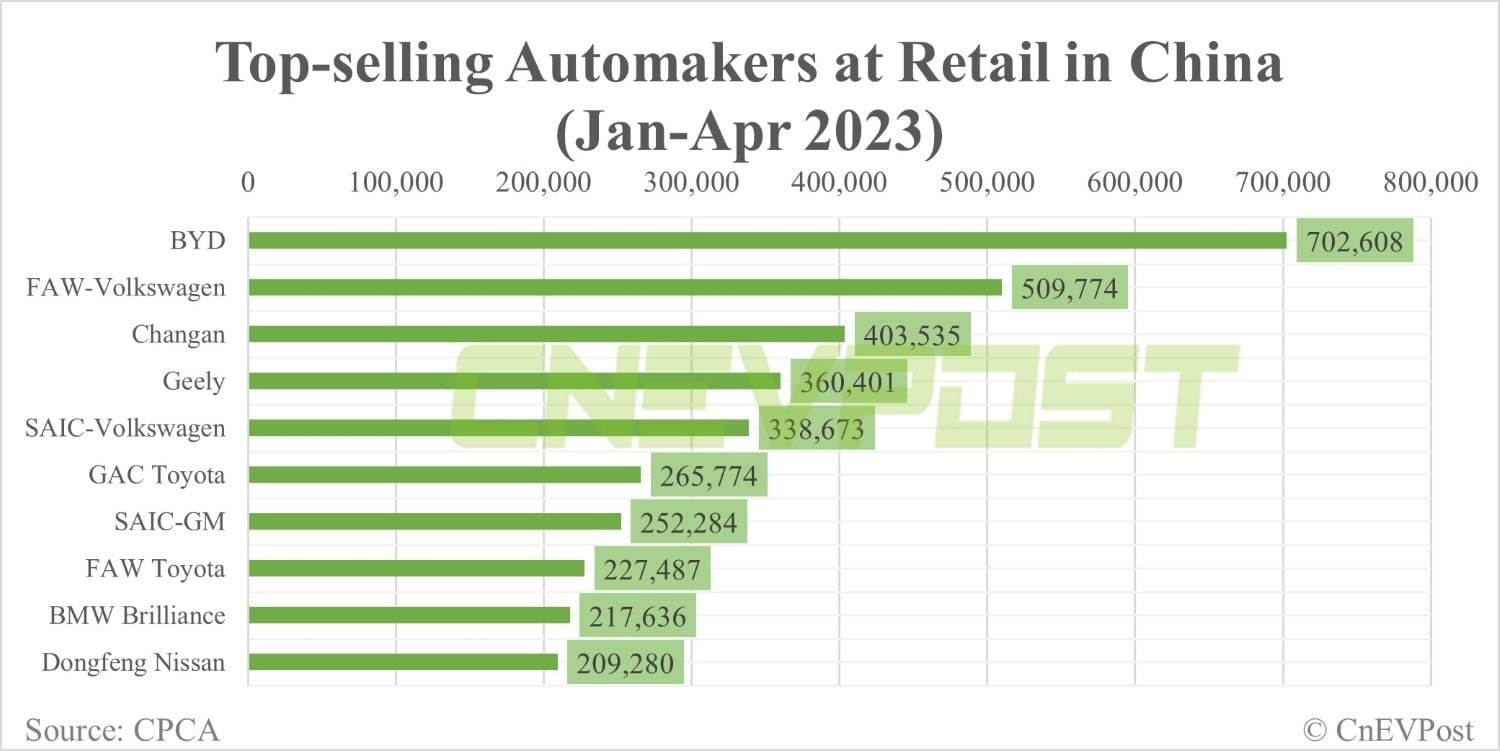

From January to April, BYD retail sales in China rose 79.2 percent to 702,608 units, taking the No. 1 spot with an 11.9 percent share, according to a ranking released last month by the China Passenger Car Association (CPCA).

FAW-Volkswagen sold 509,774 units at retail during the period, up 1.4 percent year-on-year, and ranked second with an 8.6 percent share, according to the ranking.

BYD sold 240,220 NEVs in May, up 108.99 percent from 114,943 units in the same month last year, according to data it released on June 1. The CPCA is expected to release its May sales rankings in the coming days.

On March 29, Wang said BYD aims to become the largest automaker in China by the end of this year.

The NEV industry is poised for big changes in the next 3-5 years, and the pace of change is now accelerating, Wang said today, adding that this is expected to accelerate further in the future and could exceed expectations.

For BYD, the toughest period is over and it will have a strategic opportunity period, Wang said.

BYD will leverage its existing industrial chain advantages, cost advantages, technology advantages and product advantages to further optimize its brand image and lead China's NEVs to the world, he said.

BYD has been vigorously expanding its production capacity in various regions since last year, and has now basically solved the problem of imbalance between supply and demand, Wang said.

The company's current production capacity and output of components can meet future market demand, he said, adding that BYD has made arrangements to meet the growing demand in overseas markets.

Wang believes that the NEV change is a technological revolution, and only companies with core technologies will survive.

If a company simply assembles, the probability of surviving is small, he said.

Companies that survive will also have a good strategic direction, because the industry's opportunity window is only 3-5 years, and the choice of models and technology lines is important, according to Wang.

He highlighted the importance of quick decision-making mechanisms, saying that auto companies tend to be large and have long decision-making mechanisms, but the NEV market is like a battlefield, requiring quick decisions.

Wang also mentioned his views on smart driving, saying that in the absence of changes in laws and regulations, smart driving technology is likely to be only an assist and difficult to commercialize.

In fully autonomous driving, any one safety accident will expose car companies to great responsibility and may drag down the sales of the whole model, he said.

Full CPCA rankings: Top-selling models and automakers in China in Apr