Xpeng aims to reach 15,000 monthly deliveries in the third quarter and 20,000 monthly deliveries in the fourth quarter, its management said.

(Image credit: CnEVPost)

Xpeng (NYSE: XPEV) reported first-quarter earnings on May 24 and held a conference call with analysts afterward.

Below are the key points compiled by CnEVPost based on the call.

Xpeng management presentation

Over the past four months, Xpeng orders have grown in each month compared to the previous month, despite macroeconomic challenges and fiercer industry competition.

The high-end version of the P7i, the ternary lithium battery version, has exceeded expectations to the extent that the originally prepared capacity could not meet consumer demand.

Compared to previous versions, the P7i has a more streamlined SKU and a tighter rhythm of launch.

Starting in June, Xpeng will work with its supplier partners to increase the capacity of P7i components and accelerate its delivery.

Xpeng's first new model based on SEPA 2.0 architecture, the G6, is equipped with the industry's most advanced 800-volt high-voltage system and 3C fast-charging battery with a range of up to 755 km.

The G6 will be delivered with industry-leading XNGP technology, and media test drives of the model began last week, with feedback that the model is significantly different from other electric vehicles on the market in terms of smart driving and energy consumption with 800-volt high-voltage fast charging.

The G6 will be officially launched in June, with volume deliveries starting in July, and production capacity will climb rapidly.

The G6 will be a hot seller in the Chinese new energy SUV market in the price range of RMB 200,000 ($28,325) to 300,000.

Deliveries of the G6 will enable Xpeng's total deliveries to grow well above the industry's pace in the third quarter, and the company will see the first sales inflection point following its strategic and organizational realignment.

Xpeng will launch a 7-seat all-electric MPV, internally codenamed X9, in the fourth quarter of this year.

Xpeng will introduce more clearly defined and better equipped versions of its existing models this year, allowing sales to rise another notch.

Xpeng is confident that 2023 will be the inflection point for its smart technology, with the majority of potential customers recognizing its value in 2024 to 2025.

At the end of March, Xpeng pushed out City NGP and XNGP features to Max versions of several models in Guangzhou, Shenzhen and Shanghai.

Customer feedback on these assisted driving features has been positive, with mileage penetration exceeding 60 percent in the first month of rollout.

Following Xpeng's test drives of XNGP in Guangzhou, Shenzhen and Shanghai, orders for the Max versions of the P7i and G9 in those cities increased significantly in April, by more than 50 percent.

The company plans to officially launch Highway NGP 2.0 in June, and Xpeng has rewritten the system based on the XNGP framework with five times more code than the original.

Xpeng expects to make Highway NGP 2.0 a near-L4 autonomous driving experience, with virtually zero takeover.

This year, Xpeng expects to achieve less than 1 takeover per 1,000 km in highway scenarios.

By the end of the third quarter of this year, Xpeng will roll out XNGP without relying on high precision maps in cities in China that do not have high precision maps.

In terms of the difficulty of mass production, XNGP without relying on high precision maps is nearly 100 times more than highway NGP with high precision maps, which is an important watershed to test the team's technical and data capabilities.

The actual user experience will be greatly improved after this feature is implemented. Currently XNGP has reached the driving level of novice drivers.

Xpeng hopes to release an OTA update every quarter thereafter to improve the XNGP experience.

As the XNGP continues to break through in experience and cost, Xpeng's Max version vehicles with XNGP are expected to see a big increase in sales in the fourth quarter of this year.

Xpeng has recently brought in several new designers and will also bring in outside teams to compete creatively with in-house in the design process of new models.

These adjustments will bring Xpeng's future new models and facelifts to the top of the industry in terms of interior and exterior styling.

Since the first quarter, Xpeng's marketing and service system has changed significantly thanks to the efforts of new president Wang Fengying and the team. The user experience throughout the sales and service process has improved, speeding up the response time to user needs.

One of the core indicators Xpeng focuses on, NPS, has been steadily improving every month from the beginning of this year to April, and has returned to the top level in the industry in April.

In the coming quarters, Xpeng's primary goal will be to rapidly expand sales to capture a larger share of the electric vehicle market.

Xpeng has completed the flattening of the channel management and will optimize the current sales network to improve the overall capacity of the channel.

While improving the efficiency of the sales network in Tier 1 and Tier 2 cities, Xpeng will also bring in more dealer partners in Tier 3 and Tier 4 cities to support its product layout and sales targets in the RMB 150,000 to 350,000 price range in the coming years.

Technological changes and fierce competition will reshape the landscape of China's auto industry in the next three years. In addition to excellent product definition and technological innovation, extreme cost reduction and high efficiency will be the key to win.

Xpeng's SEPA 2.0 architecture is highly competitive in R&D efficiency innovation, and the mass production of G6 marks that the architecture and Xpeng's intense technology development over the past five years have allowed it to build up its technology platform capability.

This will keep Xpeng at the forefront of technology for the next three years, while the company is launching more new models based on the SEPA 2.0 architecture that are more cost competitive and have a consistent usage and operating experience.

Xpeng is working on several new models that will cover the RMB 150,000 to 350,000 price range, sharing power, electronics, smart cabin and smart driving platforms.

Xpeng expects to further reduce the development cycle of new models by 20 percent, and expects to achieve a component sharing rate of up to 80 percent for the architecture part, thus allowing the development cost and BOM cost of future models to be significantly reduced.

Xpeng is working on a clear and feasible technical solution to reduce the cost of the Max version by 25 percent by the end of next year.

Competition currently revolves around volume, but after 2025, the focus will be on a combination of innovation at scale, design cost, efficiency, quality, and globalization.

Xpeng had over RMB 34 billion in cash at the end of the first quarter, and will allow R&D investment to focus on customer-approved areas in the future.

Xpeng will optimize the organization and process management to further improve the efficiency of company-wide operations.

Starting in July, the delivery of G6 and other new products will allow Xpeng sales to grow rapidly, and monthly deliveries in the third quarter are expected to be substantially higher than in the second quarter.

Xpeng's target for monthly deliveries in the fourth quarter is above 20,000 units, at which time operating cash flow is expected to turn positive.

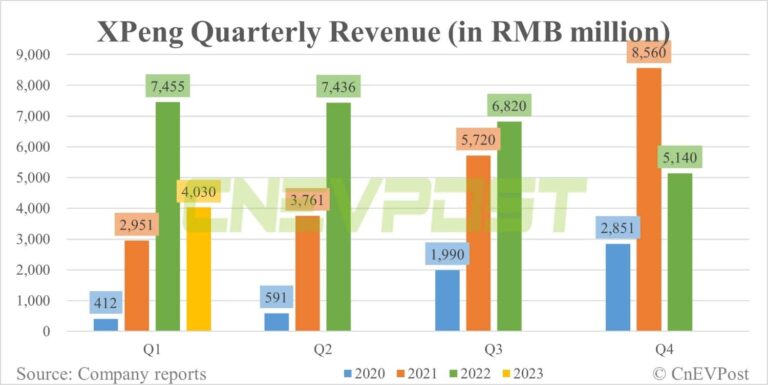

Xpeng expects total deliveries in the second quarter to be about 21,000 to 22,000 units, up 15 percent to 21 percent from the first quarter, and revenue is expected to be RMB 4.5 to 4.7 billion.

Below are the key points of the Q&A session.

Q1: What pricing strategy will Xpeng use for the G6 and future models?

A: Currently, Xpeng's overall strategy is a balanced pricing approach with scale first.

Pricing for the Xpeng G6 and subsequent models will take into account the cost fluctuations of raw materials, including lithium carbonate, and will allow for relatively manageable costs. Ultimately, we expect to achieve competitive pricing and maintain it over time, while prioritizing scale.

Q2: Has the supply chain bottleneck of P7i been solved and how long will the capacity creep time of G6 be?

A: The G6 has been set aside for about two months from SOP to delivery. The model will be released in June and deliveries will start in July. With a two-month cushion, monthly deliveries of the G6 are expected to climb much faster than the G9 and P7i in the third quarter.

Compared to the P7i, the G6 has a well-prepared supply chain and we expect the model to achieve a rapid sales creep.

For the problem of low yield rate of integrated die casting, we have been experimenting for more than a year and it is progressing smoothly and the yield rate is as expected, which will not be a problem for G6.

Q3: What impact do you think the drop in battery raw material prices will have on battery costs, and on gross profit in the second quarter?

A: In the first quarter, Xpeng's battery cost decreased by 5 percent compared with the fourth quarter of last year, benefiting from the decrease in the price of battery raw materials, and the battery cost in the second quarter is expected to decrease by 10 to 12 percent compared with the fourth quarter of last year.

Battery costs account for about 40 percent of total costs, so a 7 percent drop in battery costs in the second quarter would mean about a 3-4 percent improvement in gross margin.

This is just a judgment from the raw material perspective, the revenue side also has a very important impact on the gross margin.

Q4: Will you adjust your full-year delivery forecast?

A: G6 will start volume delivery in July, Xpeng delivery growth in the third and fourth quarters will be expected to be higher than the market growth rate.

Xpeng is expected to reach the target of 15,000 monthly deliveries in the third quarter and 20,000 monthly deliveries in the fourth quarter.

Q5: What is the order and capacity situation of P7i? How do you anticipate the demand for new models?

A: The supply chain bottleneck of P7i is mainly the lack of preparation of battery and battery-related parts. The production capacity of the ternary lithium battery will be improved in May and June, which will be able to meet the delivery demand of P7i ternary lithium battery version.

Regarding the estimation of industry demand and new model demand, the industry is not very stable recently, Xpeng's estimation of demand will remain robust and work with suppliers based on this.

Q6: What is the positioning of your MPV model? Does it differ more from the more youthful image of previous products, and how do you make the model relate to Xpeng's youthful and technological positioning?

A: Xpeng's current main user group is between 25 and 35 years old, and the unemployment rate of young people has no significant impact on sales.

Xpeng is thinking about how young people can be associated with MPV when defining 7-seater MPV, and will introduce the logic of young people buying MPV in detail at the end of the year launch.

Q7: What are your expectations for gross margin in 2023?

A: Xpeng still has some sales volume pressure in the second quarter, but continued cost reduction will have a positive impact.

In the second half of the year, gross margin levels will improve steadily throughout the year with the delivery of the G6, P7i and MPV.

Significant improvement in Xpeng gross margin will come after cost reduction measures start to be implemented and sales volumes improve, which will be reflected in 2024.

Q8: What are your expectations for lithium prices? What is the proportion of lithium iron phosphate and lithium ternary batteries used in the vehicle models? How does this affect costs?

The current short-term lithium price rebound is temporary, and prices will go down in the second half of the year and are expected to fall to within RMB 200,000.

Today Xpeng and its peers are pricing batteries flexibly based on market prices.

Xpeng's most important innovation goal is to achieve the longest range with the fewest batteries, so the use of lithium iron phosphate or lithium iron phosphate-like batteries will increase significantly in proportion.

This will bring down the cost of the vehicle, safety will be improved, and the range will satisfy the customer.

Q9: What is the contribution of XNGP to orders after its launch?

Xpeng launched XNGP in Shenzhen, Shanghai and Guangzhou in March, and customers in these three cities can experience the XNGP features. In April, there was a 50 percent increase in sales of P7i and G9 in these three cities.

Xpeng believes that as more cities see XNGP available in the second half of the year, and as the XNGP user experience continues to be optimized, it will help further improve orders.

XNGP will be free of its reliance on high-precision maps by the end of the third quarter when the launch of the feature will not require approval, and it will cover more cities this year and next.

Q10: How does Xpeng compare to its peers in terms of assisted driving? Will the short-term decline in sales affect data collection to the extent that it will limit the progress of assisted driving development?

Currently, no other company has reached Xpeng's level in cities without high-precision maps, and the company is 12 months ahead of its peers in terms of volume production for autonomous driving.

Current volumes are sufficient for the generalization of vision or language models. It needs to be seen in the future whether more vehicles on the road can improve the accuracy and reliability of assisted driving.

Q11: What are Xpeng's breakdown sales targets for different models for the second half of the year?

Xpeng wants the G6 to reach more than twice the sales of the P7i, and wants G9 sales to increase from current levels, but cannot provide a breakdown at this time.

Q12: What is Xpeng's product plan for 2023-2025? Will a lower-priced model be launched?

Xpeng will launch about 10 models on the same platform while controlling costs.

The company's main price range will remain RMB 200,000 to 300,000, while it will also offer products in the sub-RMB 200,000 and over RMB 300,000 price ranges, but not as a primary target.

($1 = RMB7.0609)