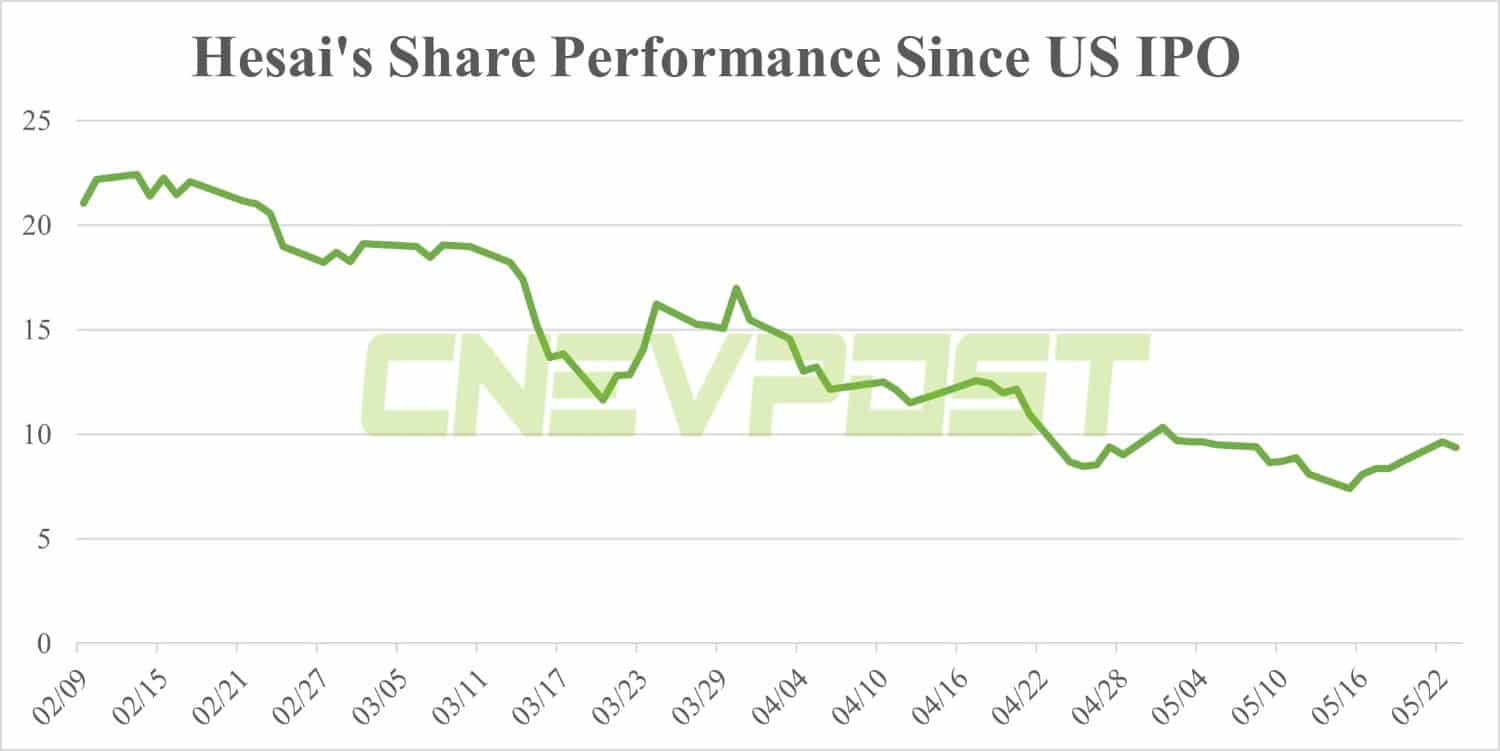

Hesai began trading on the Nasdaq on February 9 and has suffered a prolonged sell-off since then, with a cumulative decline of more than 60 percent to date.

Chinese LiDAR maker Hesai Group (NASDAQ: HSAI) posted record revenue in the first quarter and improved gross margins compared to the fourth quarter of last year.

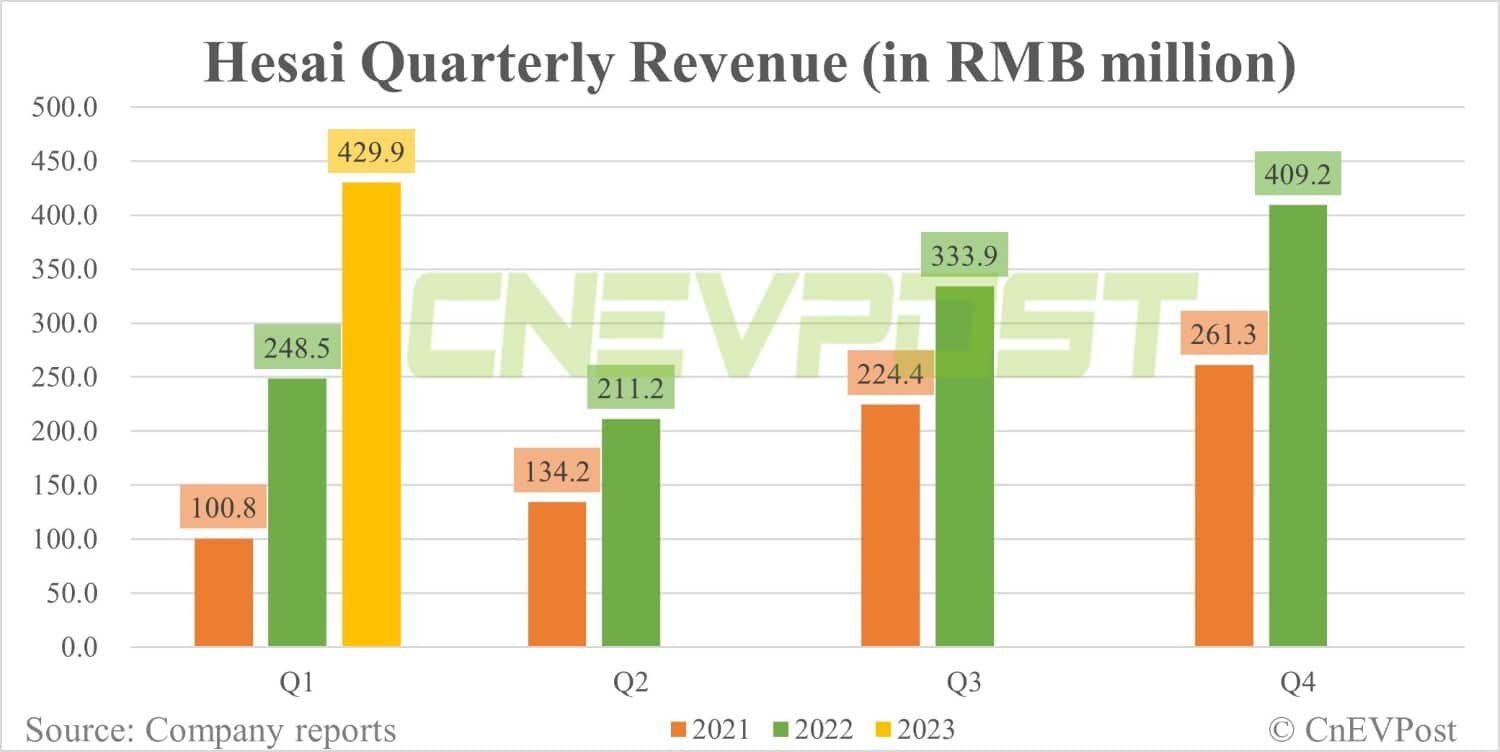

Hesai reported a net income of RMB 429.9 million ($62.6 million) in the first quarter, up 73.0 percent year-on-year, according to the company's earnings report, which was released after the US stock market closed on May 23.

The company reported product revenue of RMB 424.1 million in the first quarter, up 77.7 percent from RMB238.7 million in the first quarter of 2022.

This was due to increased demand for autonomous mobility and ADAS LiDAR products as volume production of the AT128 began in the third quarter of 2022, Hesai said.

Hesai shipped 28,195 ADAS LiDAR units in the first quarter, compared to 222 units in the same period in 2022.

It shipped a total of 34,834 LiDAR units in the first quarter, up 402.9 percent year-on-year.

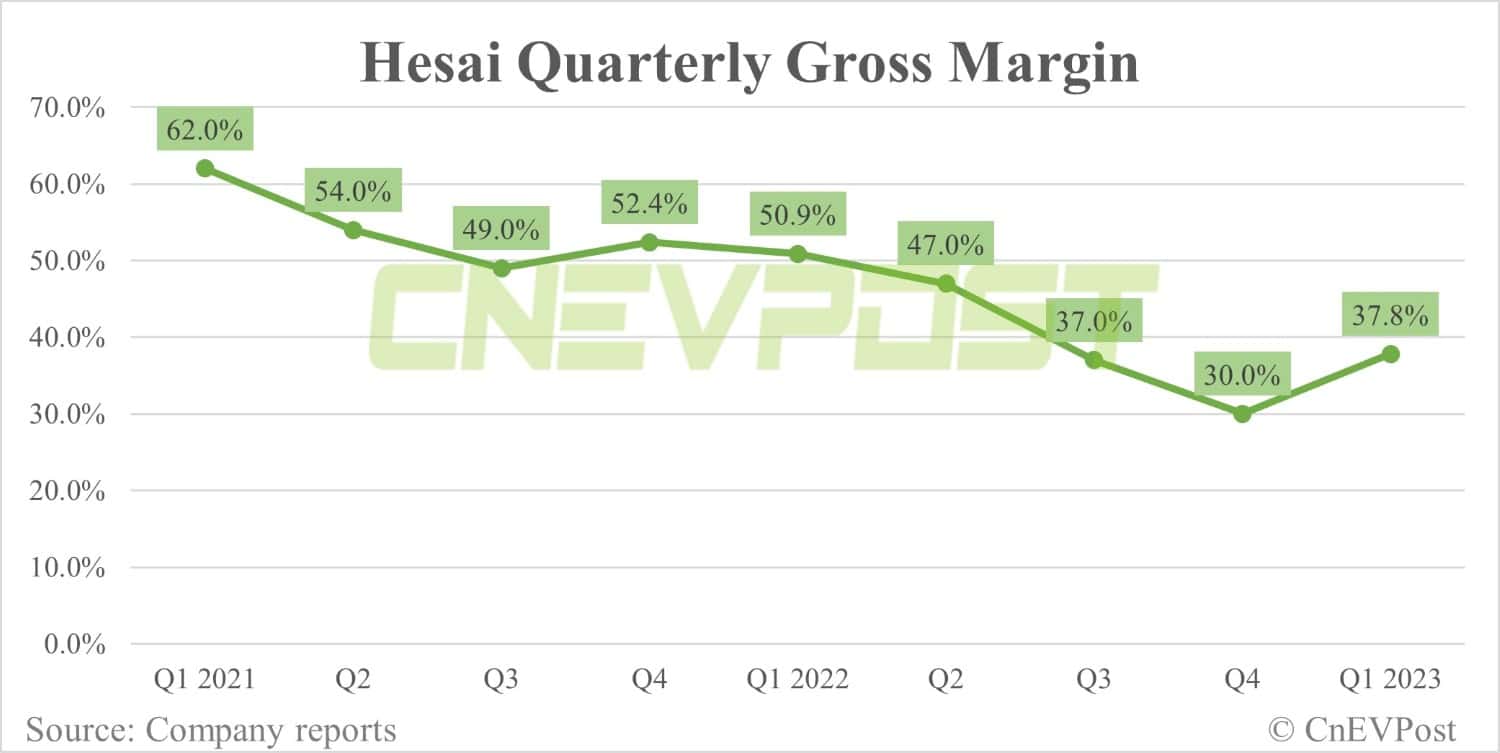

Hesai's gross margin for the first quarter was 37.8 percent, up from 30.0 percent in the fourth quarter, but down from 50.9 percent in the first quarter of last year.

The decline was due to increased shipments of lower-priced ADAS LiDAR products during the ramp-up stage with a lower in-house plant capacity utilization rate.

It reported a cost of revenue of RMB 267.3 million in the first quarter, up 119.2 percent year-on-year, caused by higher shipments of LiDAR products, partially offset by a decrease in unit costs.

Hesai's sales and marketing expenses for the first quarter were RMB 35.4 million, an 83.1 percent increase from RMB 9.3 million in the first quarter of last year.

The company's general and administrative expenses for the first quarter were RMB49.5 million, an increase of 10.8 percent from RMB 44.7 million for the same period in 2022.

Hesai's research and development expenses for the first quarter were RMB 208.5 million, an increase of 99.2 percent from RMB 104.7 million for the same period in 2022.

This year-on-year increase was primarily due to the recognition of one-time stock compensation expense of RMB 66.7 million related to stock options granted under the performance conditions of the IPO and increased payroll expenses of RMB 28.3 million due to an increase in R&D staff, Hesai said.

Hesai reported a net loss of RMB 118.9 million for the first quarter, compared with RMB 25.1 million for the same period in 2022.

Excluding stock-based compensation expense, it reported non-GAAP net income of RMB 1.6 million in the first quarter, compared with RMB 2.1 million in the same period in 2022.

It reported basic and diluted net loss per common share of RMB 0.98 for the first quarter, and non-GAAP basic net income per share and non-GAAP diluted net income per share of RMB 0.01.

Cash and cash equivalents and short-term investments were RMB 3,141.4 million as of March 31, 2023, compared to RMB 1,859.1 million as of December 31, 2022.

Hesai expects second-quarter net income to be in the range of RMB 410 million to RMB 430 million, an increase of about 94.3 percent to 103.8 percent year-on-year.

Hesai began trading on the Nasdaq on February 9 under the ticker HSAI and has suffered a prolonged sell-off since then, with a cumulative decline of more than 60 percent to date.

The company closed down 2.8 percent to $9.37 on Tuesday, with a total market capitalization of about $1.18 billion. It was down 1.28 percent in Tuesday's after-hours trading.