Nio's management previously said they expect lithium carbonate prices to fall back to RMB 200,000 per ton this year, boosting gross margins.

The price of lithium, a key raw material for batteries, is accelerating its decline.

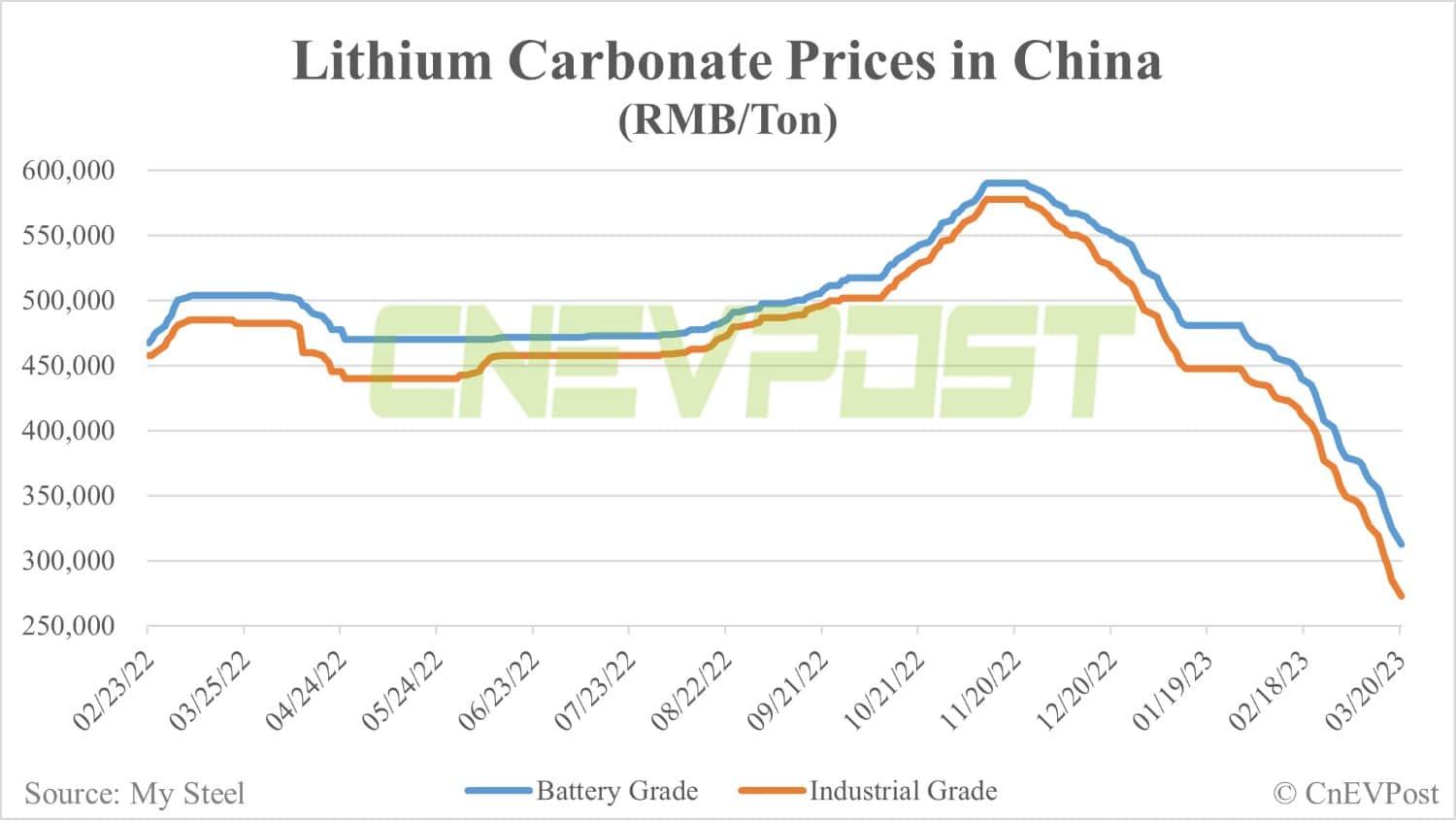

The price of battery-grade lithium carbonate in China today was down RMB 12,500 per ton ($1,814 per ton) from last Friday, with the latest average price quoted at RMB 312,500 per ton, according to My Steel.

That latest average price is down 3.85 percent from Friday, the biggest drop of the year, data monitored by CnEVPost show.

On Friday, the average price of battery-grade lithium carbonate in China fell RMB 8,000, or 2.4 percent, the previous biggest drop of the year.

Industrial-grade lithium carbonate also fell by RMB 12,500 per ton today, with the average price quoted at RMB 272,500 per ton. Its 4.39 percent drop was also the highest of the year.

The average price of industrial-grade lithium carbonate fell RMB 7,000 per ton to RMB 295,000 per ton on March 16, the first time it has fallen below RMB 300,000 per ton in this down cycle.

The average price of battery-grade lithium carbonate is now barely above RMB 300,000 and is at risk of falling below that mark in the next day or two.

In the two years prior to last November, lithium carbonate prices were soaring alongside the rapid growth of China's new energy vehicle (NEV) industry.

On November 23, 2022, the battery-grade lithium carbonate price rose to RMB 590,000 per ton in China, up about 14 times from RMB 41,000 per ton in June 2020.

Since then, however, lithium prices have continued to fall, with industrial-grade lithium carbonate prices falling below RMB 400,000 on February 22 and battery-grade lithium carbonate prices falling below that mark on February 28.

In late February, a local media report that lithium supplies could be disrupted by the production halt in a mining hub in China did not stop lithium carbonate prices from continuing to fall.

As of today, lithium carbonate prices are down about 47 percent from last November's highs and are down about 40 percent so far this year.

The drop in lithium carbonate prices is expected to ease the cost pressures faced by electric vehicle manufacturers.

Nio had previously mentioned that a drop in lithium carbonate price of RMB 100,000 per ton would increase its gross margin by 2 percentage points.

Nio's management said in a conference call with analysts after the March 1 earnings announcement that they expect lithium carbonate prices to fall to RMB 200,000 per ton this year, boosting gross margins.

($1 = RMB 6.8896)