Analysts believe the impact of the transition will not last long and will have less of an impact than the last switch in standards in 2019.

The recent price war in China's auto market has put a new emission standard that will come into effect in a few months' time in the spotlight.

CnEVPost obtained the views of several local analysts, which provide references on what impact that new emission standard will have on the auto industry.

As background, China released its final rule for stage 6 light-duty vehicle emission limits and measurement methods (China 6 standard) in December 2016, a new standard that combines best practices from European and US regulatory requirements.

The standard is being implemented in two phases, with the 6a standard already taking effect on July 1, 2020, and the 6b standard coming into effect on July 1, 2023.

CITIC Securities: Impact will not last long

From July 1, the China 6b standard will be fully implemented, which is more stringent in terms of emission standards and testing criteria compared with China 6a, especially the new RDE test that detects the actual driving emissions of the car, said Yin Xinchi, chief analyst of the auto industry at CITIC Securities, in a research note today.

There are still some old models on the market that do not meet China 6b emission regulations, and the de-stocking of these models may have an impact on the production, sales and prices of the auto industry, according to the note.

However, CITIC Securities also pointed out that the duration of the impact of the transition will not be too long, and the degree of impact will be significantly smaller than the switch of China's auto industry emission standard from China 5 to China 6a in 2019.

China Securities: Essence is the weakening competitiveness of JV brands

China's passenger car market will begin implementing the stricter China 6b emissions standard on July 1, which could exacerbate the pressure to de-stock older models, China Securities automotive industry chief analyst Cheng Siqi's team said in a research report today.

This may intensify the profitability pressure among car companies in the short term, but behind it reflects the further erosion of the competitiveness of second- and third-tier joint venture brands, according to the team.

Against the backdrop of rising market share of local Chinese brands and the ongoing electrification transformation of China's auto market, these joint venture brands have been forced to start cutting prices and de-stocking, the team said.

Huaxi Securities: Several regions have already completed the standard switch

The China 6b emissions standard will go into effect on July 1, and overall, this will have limited material impact on the auto industry, Huaxi Securities analyst Cui Yan's team said in a research note today.

The window for that transition is long, and several regions have already completed the transition ahead of schedule, such as Beijing, Shanghai, Guangzhou and Tianjin, according to the team.

Car companies previously experienced the pain of the transition from China 5 to the China 6a standard and this time are expected to prepare beforehand, the team said.

Inventories in the Chinese auto industry are currently at an above-average level, but the vast majority of inventories have been accrued since April 2022, according to the team.

The team believes the recent wave of price cuts in the Chinese auto industry is largely due to the penetration of new energy vehicles (NEVs) reaching about 30 percent and the willingness and ability of some leading car companies to grab market share.

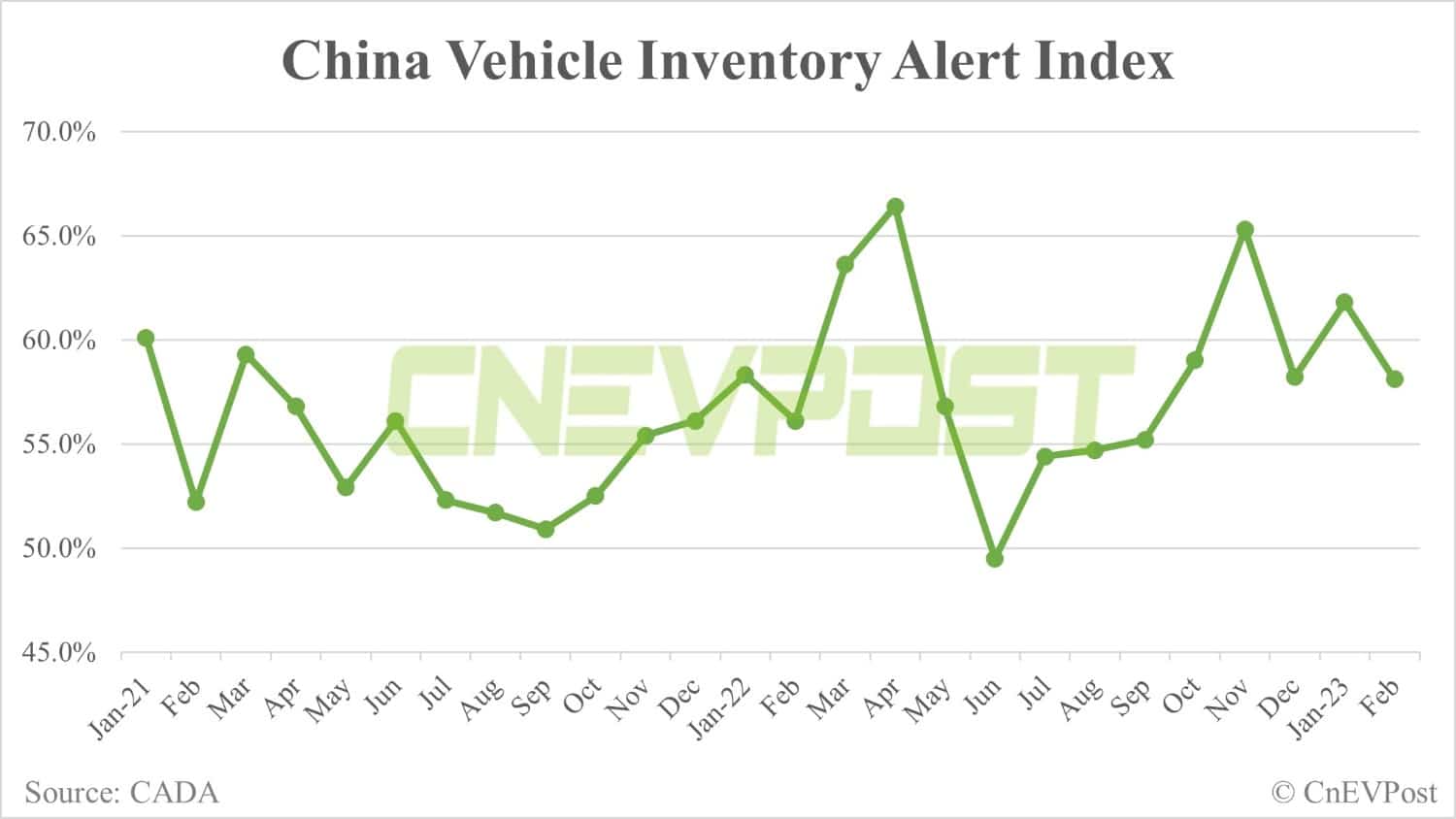

The China automobile dealers VIA (Vehicle Inventory Alert Index) stood at 58.1 percent in February, up 2.0 percentage points from a year ago but down 3.7 percentage points from January, still sitting above the 50 percent mark, according to China Automobile Dealers Association data released earlier this month The data.

For the VIA, a value below 50 percent is a reasonable range, and a higher reading means lower market demand and greater inventory pressure, according to the index's description.

If you'd like to learn more about the China 6 standard, here's a report from the International Council on Clean Transportation, a nonprofit organization.