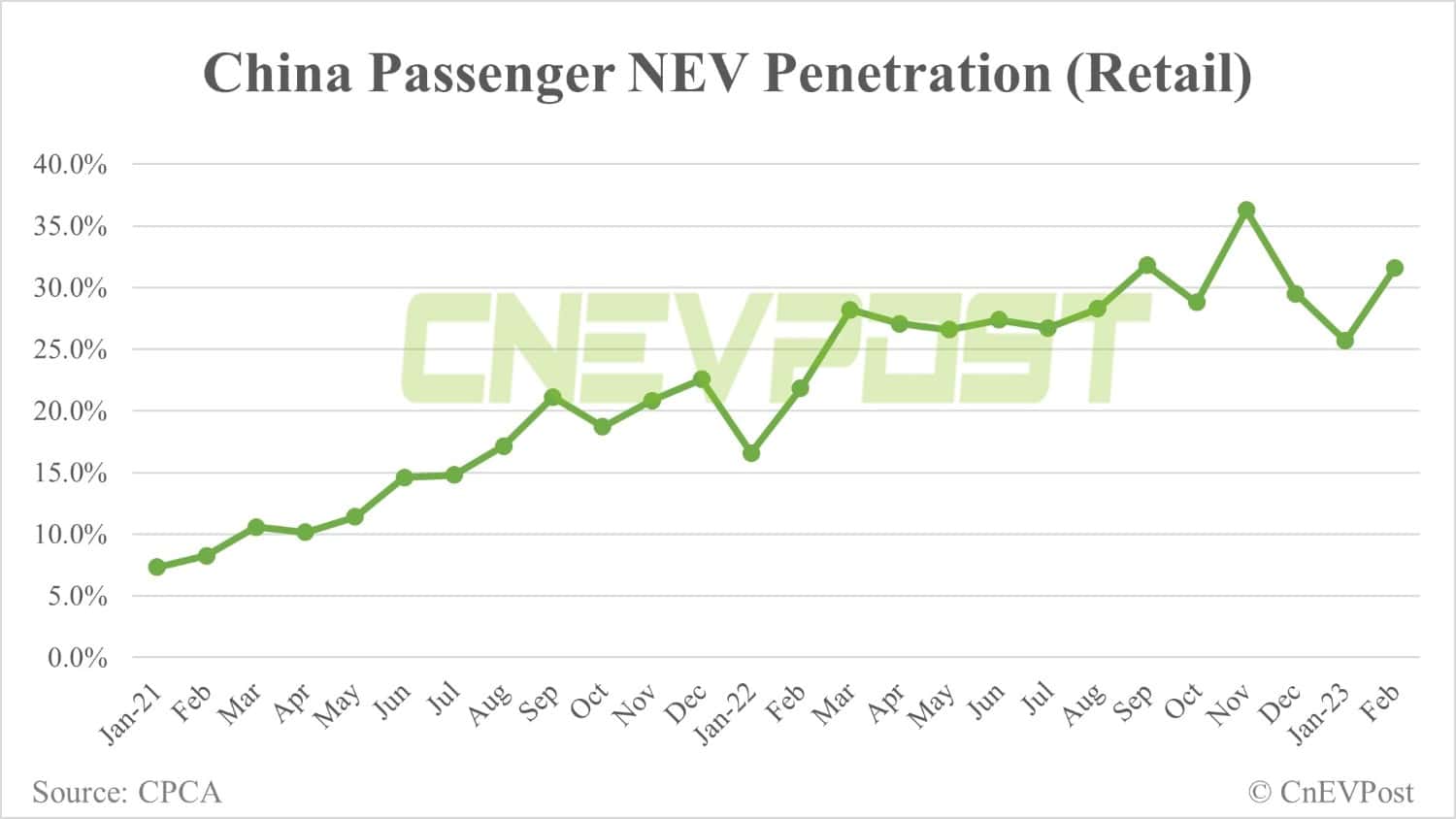

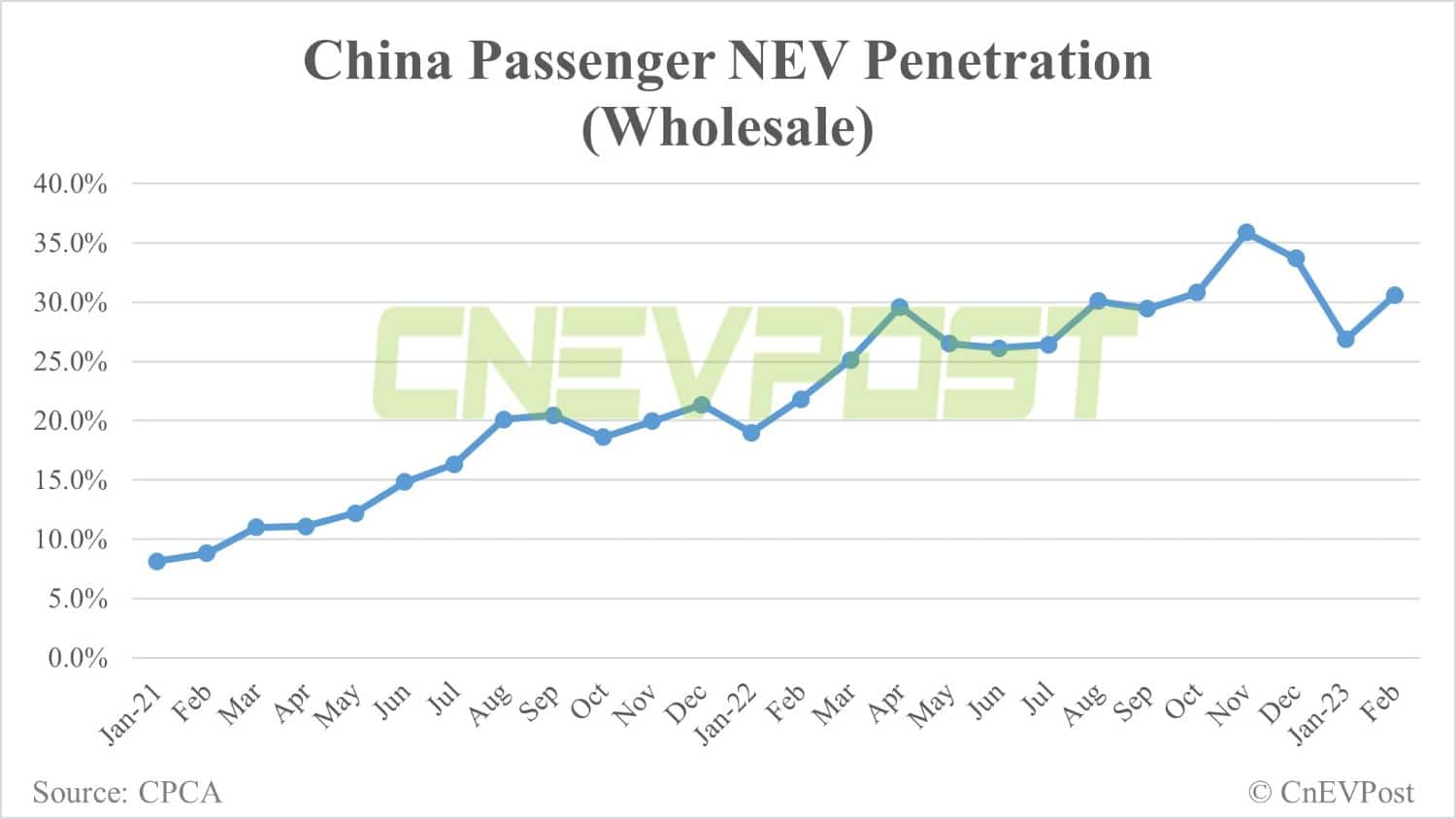

In terms of retail sales, China's NEV penetration rate was 31.6 percent in February, up nearly 10 percentage points from a year ago and up from 25.7 percent in January.

Retail sales of passenger new energy vehicles (NEVs) in China were 439,000 units in February, up 61 percent year-on-year and up 32.8 percent from January, according to data released today by the China Passenger Car Association (CPCA).

This is higher than the CPCA's preliminary figure of 438,000 units announced yesterday and higher than the 400,000 units it had estimated in its February 22 report.

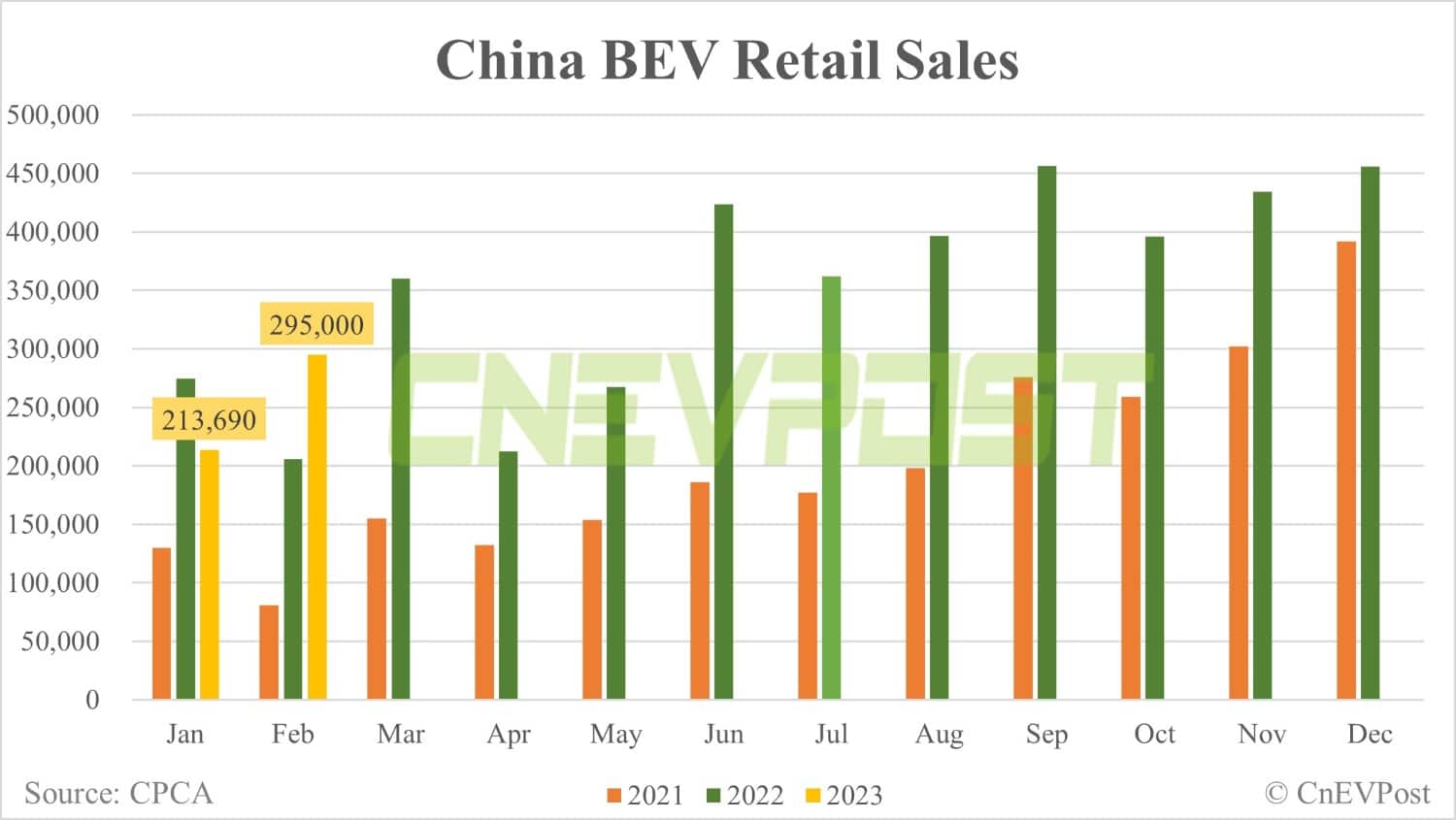

Battery electric vehicles (BEVs) continue to account for the vast majority of retail sales, with 295,000 units sold in February, accounting for 67.19 percent of all NEV retail sales. This represents a 43.19 percent year-on-year increase and a 38.05 percent increase from January.

Plug-in hybrid vehicles (PHEVs) accounted for 145,000 units of retail sales in February, contributing 33.02 percent of passenger NEV retail sales, an increase of 117.69 percent year-on-year and up 23.04 percent from January.

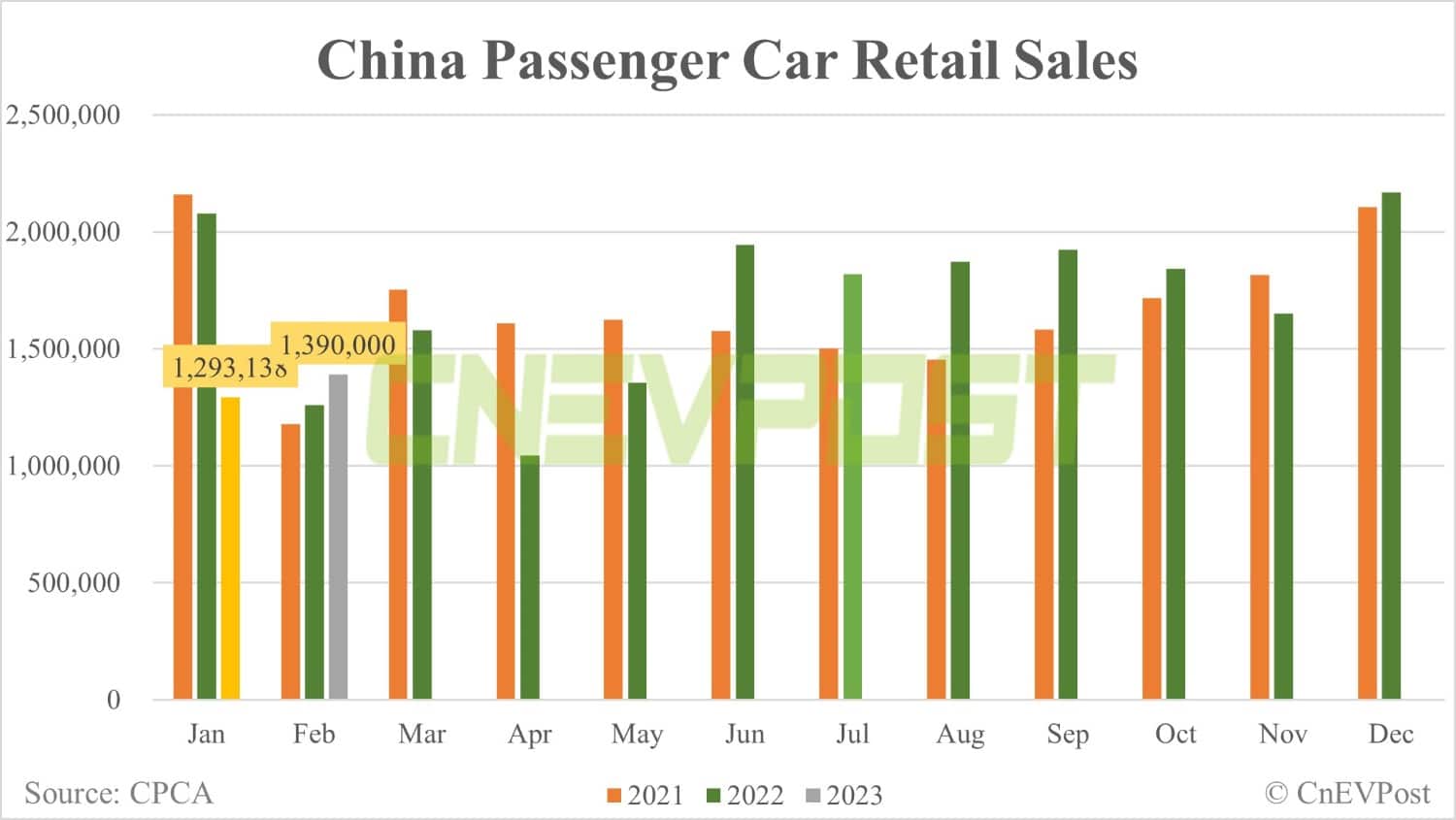

Retail sales of all passenger vehicles in China were 1.39 million units in February, up 10.4 percent year-on-year and 7.5 percent from January, according to the CPCA.

In terms of retail sales, China's NEV penetration rate was 31.6 percent in February, up nearly 10 percentage points from 21.7 percent in February 2021 and higher than January's 25.7 percent.

Among them, the penetration rate of NEVs was 52.9 percent for local brands, 22.6 percent for luxury brands and 4.2 percent for mainstream joint venture brands.

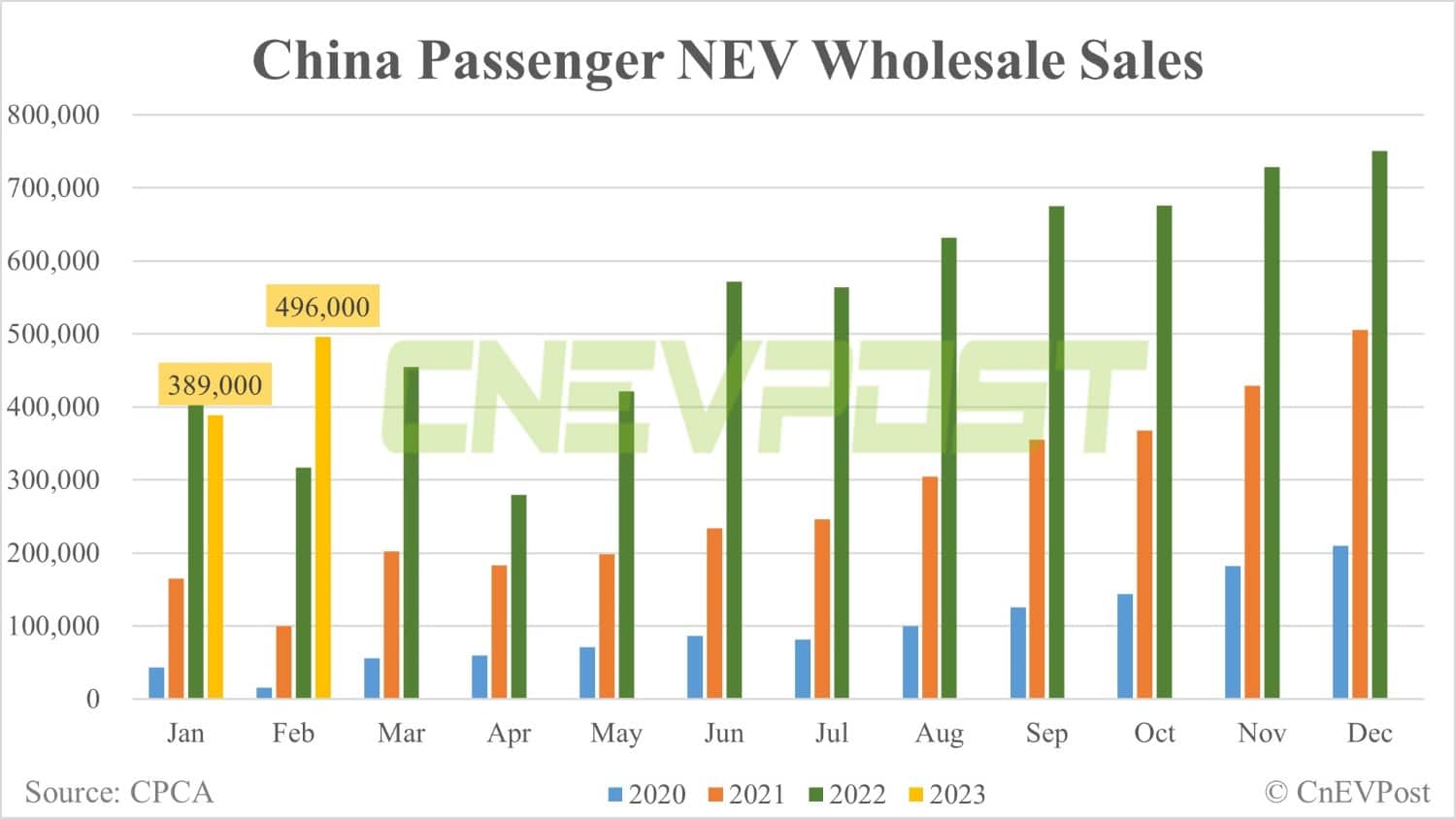

At wholesale, China's passenger NEV sales in February were 496,000 units, up 56.1 percent year-on-year and up 27.5 percent from January.

This represents a 30.6 percent penetration of NEVs at wholesale in February, up 9 percentage points from the 21.6 percent penetration in February 2022 and up from 26.8 percent in January.

NEVs from local Chinese brands had 45.7 percent penetration at wholesale in February, compared to 35 percent for luxury brands and 3.1 percent for mainstream joint venture brands.

Passenger NEVs exported from China in February were 79,000 units, with BEVs contributing 96 percent of the total.

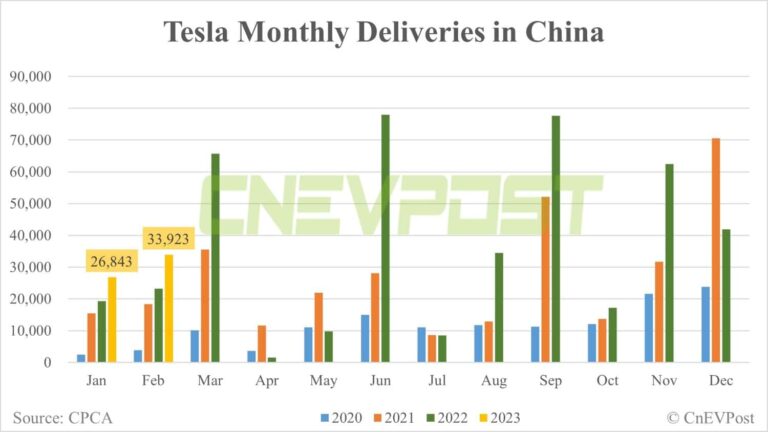

Tesla China exported 40,479 units, SAIC Passenger Vehicle 16,827 units, BYD 15,002 units and Geely 892 units in February, according to the CPCA.

March had 23 working days, a prime period for production and consumption after the Chinese New Year holiday, the CPCA said.

There was no second wave of Covid infection in China, so automakers had more ample production and sales time than last year, favoring production and sales growth, the CPCA said.

March is a month when many new products are launched, and the recent drop in lithium carbonate prices is also favorable for manufacturers to launch more cost-effective NEV models, the CPCA said.

Hubei province launched a month-long subsidy program for car purchases this month, demonstrating the province's policy commitment to boosting auto consumption, according to the CPCA.

From what have seen so far, consumer visits to dealership stores and order sizes are looking up, which could suck some of the sales away from other provinces in central China in the short term, the CPCA said.