This is a full-text translation from CnEVPost of Nio's March 1 earnings call.

(Image credit: CnEVPost)

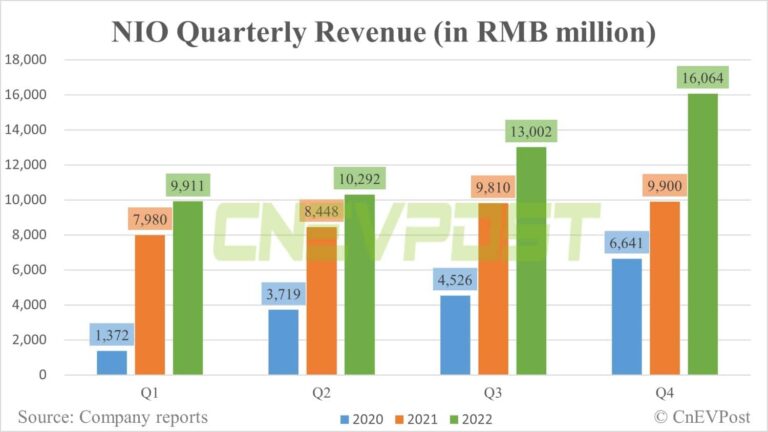

Nio (NYSE: NIO) announced its fourth-quarter earnings results on March 1, and its management held a conference call with analysts afterward.

Below is the full text of the conference call, translated from Chinese by CnEVPost.

Presentation by William Li

Hello everyone. Thank you very much for joining Nio's fourth-quarter and full-year 2022 earnings conference.

In the fourth quarter of 2022, Nio delivered 40,052 premium smart electric vehicles (EVs), up 60 percent year-on-year, achieving a new quarterly delivery high.

According to China Automotive Technology and Research Center (CATARC) retail data, Nio ranked No. 1 in China's premium electric vehicle market with a 54.8 percent market share at a transaction price of RMB 300,000 or more.

In the premium EV market with a transaction price of RMB 400,000 or more, Nio's market share reached 75.8 percent.

In 2022, Nio delivered a total of 122,486 premium smart EVs, up 34 percent year-on-year, despite the impact of the Covid epidemic and supply chain fluctuations.

In the first two months of 2023, Nio delivered 20,663 new vehicles, a 30.9 percent increase compared to the same period last year.

We expect deliveries of 31,000 to 33,000 units in the first quarter of 2023.

As EV penetration in the premium market continues to increase and more new Nio products are delivered in the second quarter of this year, we are confident about market demand throughout 2023.

Next, let me share with you the company's progress on the product, R&D and operational fronts.

ET5 has seen a steady climb in production and an overall uptick in deliveries since deliveries began in September 2022.

According to the CATARC's retail data, in January this year, in the RMB 300,000+ mid-size sedan market, ET5 outperformed many hot-selling fuel models in its class from traditional brands, and its deliveries ranked first in 19 cities including Beijing, Shanghai, Guangzhou and Shenzhen, and second in the national market.

On December 24, 2022, Nio held Nio Day 2022 in Hefei to launch the EC7, an intelligent electric flagship coupe SUV, and the new ES8, an all-scene intelligent electric flagship SUV.

The EC7 is a large five-seat coupe SUV that inherits Nio's high-performance genes and has the ultimate driving performance, with deliveries expected to begin in May this year.

As the flagship SUV model of Nio, the newly upgraded ES8 based on NT 2.0 platform has two six-seat layouts to meet the whole scenario of work, family, social and exploration needs, and the model is expected to start delivery in June this year.

These two new products have received widespread attention and praise after their launch.

In the first half of this year, Nio will launch more new products to accelerate the pace from product launch to customer delivery.

Nio's supply chain and manufacturing teams are actively working on preparations for new model switchover and mass production ramp-up to ensure capacity and supply to meet the increased demand for new products.

In terms of smart driving, Nio has pushed out NOP+ enhanced pilot assist beta to all users of NT 2.0 platform models in batches.

Based on the full-stack in-house developed smart driving technology and data closure loop, NOP+ Beta has significantly improved the dimensions of peace of mind, comfort and passing efficiency.

The usage rate of the software has doubled compared to NOP, and the total mileage used in the last week was 1.75 million km.

We will gradually realize the pilot battery swap on highways in the first half of this year.

In terms of sales and service network, we now have 375 Nio Houses and Nio Spaces, covering 141 cities.

We also have 305 service centers and delivery centers, covering 148 cities.

In terms of charging and battery swap network, we have accumulated 1,331 battery swap stations, providing more than 18 million battery swap services to our customers.

We have also built 6,385 supercharging stations and 7,558 destination charging stations.

At the same time, our charging map has access to more than 1.04 million third-party charging piles.

Battery swap has become the most convenient and reliable way for Nio customers to replenish energy.

In 2023, Nio will accelerate the construction of the battery swap network, with 1,000 new battery swap stations planned, and over 2,300 total battery swap stations by the end of 2023.

The mass production of Nio's third-generation battery swap stations is now well underway and is expected to begin in April.

The accelerated deployment of battery swap stations will not only provide existing customers with an experience that exceeds their expectations but will also provide strong support for the growth in demand.

In the fourth quarter of last year, Nio officially entered Germany, Netherlands, Denmark and Sweden to provide NT 2.0 models and full system services to European customers.

Nio products have been highly recognized by professional media in Europe, and user satisfaction has met our expectations.

After winning the Golden Steering Wheel Award in Germany, the ET7 has won other awards in Europe, including the Technological Frontrunner Award at the Auto Awards Denmark in Denmark, the "Car of the Year" and "Best Luxury Car" by the leading Swedish automotive magazine Auto Motor & Sport, and "Most Promising Car of the Year 2023" by the Dutch Business Owners Association.

On January 31, 2023, the first deliveries of the smart electric mid to large-size SUV EL7 to European customers began.

With the delivery of Nio's more diversified product portfolio, the gradual improvement of the sales and service and energy replenishment network, and the increasing brand recognition, we are confident of long-term development in Europe.

The overall progress in the development of strategic new businesses such as in-house developed batteries, AD chips, and mass market brands is progressing according to plan.

Nio's growth is dependent on the continued support of our customers. In 2022, a total of 4,447 customer volunteers participated in events such as car shows and Nio Day.

Nio users are also actively contributing to society, with 6,204 volunteers volunteering for charity activities.

On January 18, 2023, Nio was selected as one of the "Top 100 Most Sustainable Companies in the World 2023" by Corporate Knights.

Nio ranked first out of 233 companies in the "Automotive and Truck Manufacturing, including Parts" category by Corporate Knights.

At the same time, on January 31, 2023, Nio's second advanced manufacturing base officially became the first electric vehicle manufacturing base in China to receive the dual certification of Industrial Green Building 3 Star Design and LEED GOLD.

Nio attaches great importance to low-carbon development, environmental protection and ecological co-construction, and actively practices the concept of sustainable development to continuously improve ESG performance and practices.

In 2022, we have firmly invested in core technology and product development, charging network, battery swap network, sales and service network layout, and global market development around Nio's long-term competitiveness, and have made significant progress, laying a solid foundation for the company's long-term development.

In 2023, with the release and delivery of the full range of NT 2.0 platform products, we will be fully committed to providing users with an experience that exceeds expectations.

At the same time, we will be committed to an overall improvement in execution efficiency, working at an agile and efficient pace to compete in the global electric vehicle market in the long term.

Question and answer session

Nio management participating in the Q&A included William Li, Nio founder, chairman, and CEO; Steven Feng, Nio CFO; and Stanley Qu, Nio senior vice president of finance.

Question 1

Hello Nio management, thank you very much for taking my questions.

I have two questions, the first one is about the parts supply chain. The current supply still seems to have some bottlenecks. Can you share an update on the situation?

What is the maximum monthly and weekly output that the overall supply of components can support? What kind of improvement will we see in the second quarter?

That's my first question.

William Li:

Some of our vehicle deliveries did suffer in the fourth quarter of last year because of parts availability.

But the Covid outbreak basically ended in January of this year. As of now, our parts supply in general is not a bottleneck anymore.

From the second quarter onwards, as we deliver our new vehicles, we will face some volume production creep challenges in the early stages.

But for the full year, we think the pressure on the supply chain side will drop significantly for us.

Question 2

My second question is about gross margin and battery pricing.

We saw Nio's gross margin drop significantly in the fourth quarter.

At the same time, the good news this year may be that battery prices will come down. I would like to know the contribution of lower battery cost to Nio's profit.

You have mentioned before that the drop in lithium carbonate price will help the gross profit. How much will this help from a full-year perspective?

Stanley Qu:

First, let me clarify the gross margin for the fourth quarter of 2022.

In the second quarter of 2023, we will deliver the new ES8 and ES6 models, so we have lowered our sales forecast for the existing 866 models in the fourth quarter of 2022.

In the fourth quarter of 2022, the inventory provision and loss on purchase commitments related to these older models totaled RMB 985 million.

Excluding the impact of this, the gross vehicle margin for the fourth quarter was 13.5 percent.

There were some changes in the product mix compared to the previous quarter, such as increased sales of the ET5, a lower gross margin model, in the fourth quarter.

William will next present the gross profit outlook for 2023.

William Li:

On a full-year basis, we are confident that gross margin will improve to 18 percent to 20 percent in the fourth quarter of this year.

Of course, there are a couple of things to keep in mind, the first being our product mix. Our new products will be delivered gradually from the second quarter onwards.

The second aspect is the drop in lithium prices and raw material prices you mentioned, including the drop in chip costs. These had a relatively large impact on us.

In the past couple of days, we had very intensive communication with many upstream material manufacturers to understand the status of their production capacity and the status of production start-up.

We saw that the demand for lithium carbonate will definitely not be as strong as last year, which really exceeded everyone's expectations.

Overall, we think the price of lithium carbonate has a chance to drop to RMB 200,000 per ton in the fourth quarter of this year, and maybe even lower.

Third, we think our overall deliveries will rise significantly from the third quarter onwards.

Our new products will gradually start to be delivered from the second quarter onwards, and with the rise in new deliveries, we will be able to get a good improvement in a lot of our fixed cost sharing.

Overall, gross margin back to 18 percent to 20 percent is the goal we are pursuing and we are confident to achieve it.

In the first quarter, we will still be under more pressure because the first quarter is a transition period for us.

Our sales are also in a transition period as we switch our products to the second-generation technology platform.

On the other hand, we are clearing the existing show car inventory of 866 models and are offering benefits to consumers including subsidies and financial discounts, which have an impact on short-term gross profit.

One more thing, the JAC Nio advanced manufacturing site is going to prepare for the production of the new 866 models on the NT 2.0 platform.

Overall, Nio is still in the platform switching phase in the first quarter and output is relatively low, and this has some impact on our single amortization.

Nio's main model delivered in the first quarter will be the ET5, which is the lower gross margin model. So the pressure on our gross margin in the first quarter was relatively high.

Question 3

My first question is about your guidance on expenses.

I remember you mentioned in the last quarter that you hope to maintain R&D spending at around RMB 3 billion per quarter going forward.

Do you have any new guidance on that, given that you mentioned earlier that one of your goals for this year is to increase capital efficiency?

Stanley Qu:

We still maintain our previous guidance on R&D spending.

In 2023, we will spend on average around RMB 3 billion to RMB 3.5 billion per quarter on Non-GAAP R&D.

Regarding selling and administrative expenses, sales efficiency will gradually improve as new products on the NT 2.0 platform begin to be delivered in the second quarter. Sales and management expenses as a percentage of sales revenue are expected to decline significantly at that time.

William Li:

I would like to add that we also have investments in Europe.

Of course, it's still very early in our sales in Europe, and the investment there is in the early stages, and the investment will be relatively large.

So you may need to take our efforts to enter the global market into account when you look at our efficiency.

Question 4

My second question is about product launches.

Nio's new models for this year will be mainly the new 866 model, EC7 and ET5 shooting brake. I would like to know if the new EC6 and ES6 will start delivery around the same time as the ES8?

Also, I would like to know if the ES7 and ET7 will also have improved versions this year?

Can William briefly explain the pace of new car releases for next year and about the second brand? Thank you.

William Li:

In the second quarter of this year, we will start deliveries of four new models, including the new ES6, which is our most important model, according to our latest plan so far.

We will also start delivering the fifth new model of the year in July, which will probably a month later than we had planned.

Our original plan was to start deliveries of 5 new models in the second quarter.

But we have since realized that we need to give each vehicle slightly more time to ensure the quality at launch and the marketing cadence at launch.

With regard to the other products continuing to iterate and improve, it's all been something we've been doing and we'll communicate in a timely manner.

Regarding next year's product rhythm, it's too early to talk about it, we need to finish the start of deliveries of these five new models first.

Nio's product planning has always been very rigorous and in accordance with the plan, and from what we have seen so far, we are advancing according to the plan and rhythm for new brands and new products.

From a full-year perspective, we believe that we will be able to achieve our target this year.

After the new products start to be delivered, we are very confident about the demand, which is based on three main aspects.

Our first growth driver is the five new NT 2.0 platform-based products that will begin to be delivered in the first half of this year.

Our entire product line will switch to the new platform and enter a stronger product cycle.

It is important to avoid selling two generations of products at the same time, which will help our front-line sales force to be more efficient. We will be in a very different position then than we were in the fourth quarter of last year and the first quarter of this year.

After the product switchover is completed, our portfolio will be able to cover the markets that contribute 80 percent of the sales of BMW, Mercedes-Benz and Audi.

At the same time, we will have a commanding competitive edge in each market segment.

This is the first point.

Our second growth driver will come from the charging and battery swap system.

It is very important that we add 1,000 battery swap stations this year, which will support us to enter more markets, such as third and fourth-tier cities.

So far, we have more than 50 percent of our users from Shanghai, Jiangsu, and Zhejiang.

On the other hand, this shows that there is still a huge market space for us to expand.

We will add 1,000 battery swap stations this year, not only to enhance the experience of our current customers but also to support our entry into more markets.

Our third growth driver comes from the gradual release of some of the features of our NT 2.0-based software and the maturing of the experience.

As I mentioned earlier, our NOP+ feature has exceeded 1.75 million kilometers in the past week.

All of our new platform models are equipped with the same computing power and sensors as standard, and the advantages brought by the closed loop of data are huge.

Our NOP+ is already in first place in many third-party measurements.

In our NT 2.0 platform, the experience, including cockpit and audio, is being gradually improved.

We believe that this will be able to greatly increase the competitiveness of our products. Some of our peers have chosen the strategy of allowing consumers to option.

The release of more features will greatly increase the competitiveness of our products.

Collectively, our goal is to see sales double this year compared to last year. Our team is very confident about that.

As for profitability, our expenses are relatively fixed and are of course highly correlated with gross margin.

If raw material prices fall in line with the current trend, and putting aside the investment in innovative businesses, we could still achieve profitability in the fourth quarter of this year.

Question 5

I have two questions, the first one is about ET5.

We noticed that ET5, the main sales force, is facing a decrease in orders. Do you still maintain the expectation that ET5 sales will be stable at over 10,000 units per month?

Where is the main support for ET5 sales coming from? Is it consumer demand or service network expansion?

My second question is about lithium price. The lithium price is currently in the process of correction, and you have talked before that a drop in lithium carbonate price of RMB100,000 per ton would contribute 2 percentage points of gross margin.

Does this mean that a drop in lithium prices could bring 4-8 percentage points of gross margin upside this year?

Given the upward pressure on prices that the industry is currently facing, will Nio offer concessions to consumers? Will it lock in larger purchases with CATL?

William Li:

Overall, with all of our new models based on the NT 2.0 platform coming out this year, you can basically break our products into three categories.

The first category is the models that provide the main contribution to our sales, including the ET5, ES6, and ET5 shooting brake. Our goal is for these models to achieve 20,000 units of sales per month.

The second category includes the ET7, ES7, and ES8, each of which is expected to contribute almost 2,000 to 4,000 units of sales. Together, these models are expected to contribute about 10,000 units, or about 8,000 to 10,000 units.

We also have some models that are aimed at sharpening our brand, such as the EC7 and EC6. They can show our pursuit of design taste. There are some consumers who pursue individuality and prefer such cars.

We hope they can sell more, but of course, these models are relatively niche, potentially contributing almost 1,000-2,000 units of sales per month.

Overall, we think that our current product portfolio is able to support our sales of more than 30,000 units per month.

Steven Feng:

Let me answer your second question about the price of lithium carbonate.

First of all, I strongly agree with you that our gross margin is very much affected by the price of lithium.

If the price of lithium carbonate falls by RMB 100,000 per ton, our gross margin can increase by 2 percentage points.

We expect the lithium carbonate price to fall back to RMB 200,000 per ton this year, and our gross margin will pick up as a result.

Previously, the price of lithium carbonate was RMB 100,000 per ton, rising to a high of RMB 570,000 in November 2022, raising the cost of the entire electric vehicle industry.

At the beginning of this year, the price of lithium carbonate fell to RMB 400,000 per ton.

On the supply side, several battery suppliers have invested in upstream raw material manufacturers. From the second quarter of this year, these moves will benefit lithium carbonate supply, so we see a steady increase in lithium carbonate supply.

In terms of demand, electric vehicle sales in China almost doubled in 2022, but this year, growth is expected to be 30 percent.

As supply and demand improve, we expect lithium prices to fall significantly back to more reasonable levels, around RMB 200,000 per ton, which is good news for the industry as a whole.

Question 6

My first question is about the recent sales trend of ES7 and ET7.

Nio's older 866 models are facing replacement and you have a lot of expectations for the NT 2.0 platform.

My understanding is that this will have some impact on sales of the older products. So what is the reason for the recent lack of sales of the ES7 and ET7?

Is this due to the withdrawal of China's subsidies on NEVs? Due to supply chain bottlenecks? Or is it due to your allocation of capacity to the ET5 that has impacted the sales of the ES7 and ET7?

My second question is about improving efficiency.

At the beginning of this year, William mentioned in an internal communication the key initiatives to improve efficiency in 2023. Which area do you want to focus on to improve efficiency?

We can see that you are investing a lot in the future, including the plan to add 1,000 battery swap stations this year, as well as the expansion of your business in Europe and the construction of Nio House.

What are some of the specific efficiency improvements you are looking to make?

William Li:

In January and February, market demand, especially for pure electric vehicles, did suffer a bit.

Of course, our peers have also released their January delivery figures, and if you look at them, you'll see that they're all under some pressure.

One very important reason is that the state subsidies for NEVs were completely withdrawn at the end of last year.

This will have some short-term impact on every NEV maker.

For us, the impact will be relatively less because, after all, our average vehicle price is higher, but there will still be an impact.

We have been seeing increasing demand every week since February.

I think the ES7 and ET7 are still very competitive in the markets they are in. We are confident in the long-term demand for them.

In the short term, we do get a little bit of pressure.

This has to do with the seasonal factor of the Chinese New Year holiday, as well as the withdrawal of subsidies. And of course, the macro economy has had some impact.

But the good thing we see is that from February onwards, we can see that demand is a little bit better every week than the week before. Overall, we are confident.

In terms of efficiency improvements, that's really been a focus of our efforts this year. We had a very rapid expansion of staff last year, we had a lot of projects going on, a lot of projects starting to be put in place.

We're not going to cut back on projects or staff or shut down projects this year, we're going to focus more on making our people more efficient.

For the same number of employees, we want to have higher output and higher quality output, whether in R&D, sales or management.

On the other hand, we will rethink the priority of our projects, including R&D, and also some investments in fixed assets, and we will evaluate the priority of time.

Investment priorities are also a very important direction for us in terms of pacing.

In general, our efficiency improvement is more in terms of quality of output and prioritization of matters.

Question 7

I have two strategy-related questions, the first one is about batteries.

Will there be any more important changes in your contracting model with CATL in the medium to long term?

When will Nio's semi-solid-state batteries be in mass production?

In which year will Nio break even? Can you provide some directions for us?

William Li:

We will introduce new battery partners, and in March, our battery pack with CALB will be online.

Of course, we will maintain a long-term strategic relationship with CATL, and we are also discussing with them some new pricing mechanisms.

In terms of direction, I think the battery manufacturers also recognize that they have to bear the price fluctuations of battery materials with automakers.

Of course, we are in the process of discussing this with them.

Regarding semi-solid-state batteries, we are still in the process of working on mass production. We have sent our own battery team to help our partners accelerate mass production.

I would also very much like to have that battery pack available to our customers as soon as possible, but it will take a few more months.

The second question concerns the size of our investment in the new business. Overall, it's almost RMB 4 billion to RMB 5 billion for the full year and over RMB 1 billion per quarter.

In terms of our overall goal, we still expect the whole company to reach break-even next year.

Question 8

My first question is about the feedback from users in Europe.

Nio has been in the Norwegian market for over a year and has recently entered several other markets in Europe. What is the feedback from users?

What are your expectations for sales in Europe in the next few years?

My second question is about other gross margins. Nio's other gross profit continues to be negative, when do you expect it to turn positive?

William Li:

In Europe, from the feedback of the users who have gotten deliveries, they rate our product very highly overall.

We look at user satisfaction on a weekly basis and overall it is meeting our expectations.

However, our infrastructure in Europe is lagging behind our expectations, such as battery swap stations, with only 11 so far, which is far behind our expectations.

Our colleagues are working hard, but this is far from our original plan.

Our Nio House opening is also slower than we expected, and our infrastructure in Europe is much slower than we had planned, which will also affect our delivery.

What we can see is that the feedback from users on test drives is very good in all aspects and our team is gradually getting on track.

But in general, we have to speed up the infrastructure.

This year we are still not looking at deliveries in Europe, but rather at customer satisfaction as the main goal.

In the long run, we are very confident about the competitiveness of our products and the satisfaction of our users.

Stanley Qu:

On the other gross profit issue, I would say that as we grow our sales and ownership in China, our losses in repairs and maintenance continue to narrow.

In 2022, we have continued to build battery swap stations, so that has resulted in increased other expenses.

We will continue to build battery swap stations and expand our energy service network.

We plan to add 1,000 battery swap stations in 2023, so other expenses are expected to continue to increase.

However, the continued deployment of energy infrastructure will not only benefit customer satisfaction, but will also contribute to sales growth.

Question 9

My first question is about the overall number of channels, which, if further grown, may cover more lower-tier cities.

In these markets, potential consumers have stronger recognition of traditional luxury brands.

For Nio, what adjustments will you make in terms of overall product marketing.

William Li:

In general, we think that in these markets, we don't necessarily have to invest in building stores.

Why we are building more battery swap stations this year is based on some of the feedback we have received from our practices.

For example, in Xingfu town, Boxing county, Binzhou, Shandong province, the population is less than 50,000, but there are more than 500 Nio users.

The main reason for the growth of local users is that the early owners worked together to set up a battery swap station, and then the number of local owners increased.

We then added a battery swap station here, bringing the total to two.

Getting more than 500 users at this location has given us a lot of inspiration.

For battery swap stations, we used to do more in Tier 1 cities.

We now realize that in Tier 3 and Tier 4 cities, and even in smaller places, battery swap stations can help increase the number of users. This will be a very efficient way.

So we are looking to move to lower-tier cities this year and will rely more on that approach, which is very efficient.

Question 10

My other question is about the overall pricing strategy, especially with the new products.

From the beginning of this year, I see that the overall market is very competitive in terms of pricing.

Although Nio may be targeting the higher end of the market, there will probably be bigger price cuts and promotions for both NEVs and fuel car competitors.

Will your new models, like the new 866 models and possibly other new models, come down in prices and become a little more aggressive? Or will you be considering more models with lower prices?

William Li:

Our strategy has always been to keep prices stable, and we have no plans to launch lower-trim models.

We believe that our pricing is valuable enough for our customers.

Each of our cars has the features, performance, intelligence, and service benefits to be worthwhile for the user.

Therefore, we have no plans about offering products with reduced configurations under the Nio brand, and the pricing strategy for Nio-branded models is not a low-price strategy.