Nio will begin deliveries of four new models in the second quarter, including the new ES6, with a fifth model to be delivered in July.

(Image credit: CnEVPost)

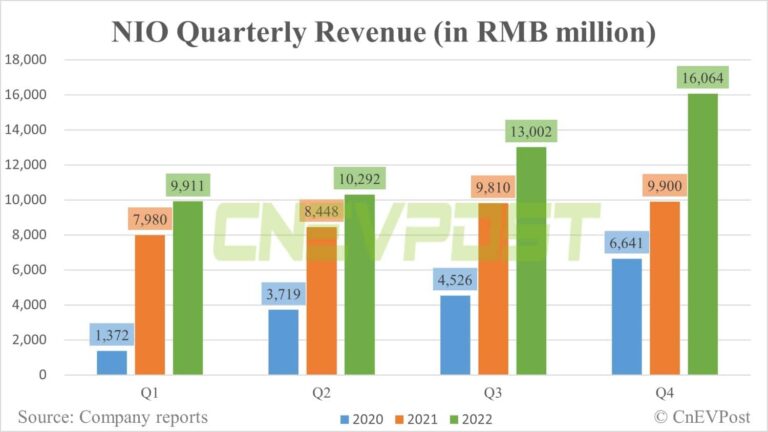

Nio (NYSE: NIO) today announced its fourth-quarter earnings results and its management held an analyst call afterward.

Below are the key highlights from the call, with the latest at the top.

Sales are not Nio's top priority in Europe this year, with internal expectations of less than 10,000 units. The priority is to improve consumer satisfaction.

European customers who have had their vehicles delivered are generally satisfied with Nio, but the build-out of local infrastructure, including battery swap stations, is lagging far behind expectations.

Nio hopes to have the 150-kWh semi-solid-state pack in service as soon as possible, but it may still be a few months away.

Nio is negotiating a new pricing mechanism with CATL and has not yet signed an agreement.

Nio's battery pack in collaboration with CALB will be operational in March.

Nio's product portfolio can support monthly sales of 30,000 units. The Nio ET5, ET5 Touring and ES6 can support 20,000 deliveries a month, while other Nio models can support 10,000 units per month.

If investment in innovative businesses is put aside, the main Nio brand still maintains its target of achieving break-even in its core business in the fourth quarter.

Nio's efforts to increase battery swap network construction this year will help the company's products reach a wider market.

Nio will begin deliveries of four new models in the second quarter, including the new ES6, with a fifth model to be delivered in July.

Nio's efforts to develop its own batteries, autonomous driving chips, and mass market brands are progressing on schedule.

At SG&A, Nio will take the investment in Europe into account, but Europe's contribution to sales is currently limited.

The F1 plant has to prepare for the production of new models, therefore the output in the first quarter will be low.

The ET5, which is priced lower, will be the main contributor to deliveries in the first quarter, which means Nio is still facing pressure on gross margins in the first quarter.

Nio is confident that gross margins will reach 18 percent to 20 percent in the fourth quarter, with new product deliveries ramp up and lower lithium prices.

From the current point of view, the availability of parts will not be a constraint to Nio delivery volume.

Nio's assisted driving software NOP+ Beta has significantly improved in comfort and passing efficiency, and the usage rate has doubled compared to NOP, with a total of 1.75 million kilometers used in the last week.

Nio will launch more features and gradually realize highway pilot navigation battery swap in the first half of this year.

Nio will accelerate the construction of its battery swap network this year, with plans to add 1,000 new battery swap stations. The mass production of the company's third-generation battery swap station is now well underway, and mass production is expected to begin in April.

In 2022, more than 50 percent of all power supplied by Nio's energy replenishment network was provided through battery swap stations.