If Li Auto maintains the current level of demand for the second half of the year, there would be upside to consensus estimates, according to Edison Yu's team.

Li Auto (NASDAQ: LI) yesterday reported first-quarter revenue that slightly beat expectations and gave strong first-quarter delivery guidance.

If Li Auto maintains this current level of demand for the second half of the year, there would be upside to consensus estimates, said Deutsche Bank analyst Edison Yu's team in their first impression of the earnings report yesterday.

Li Auto guided for first-quarter deliveries of 52,000 to 55,000 vehicles, meaning it expects to deliver a total of 36,859 to 39,859 vehicles in February and March.

The company's management said in a post-earnings call with analysts that it is targeting a 20 percent share of the luxury SUV market in the price range of RMB 300,000 to 500,000.

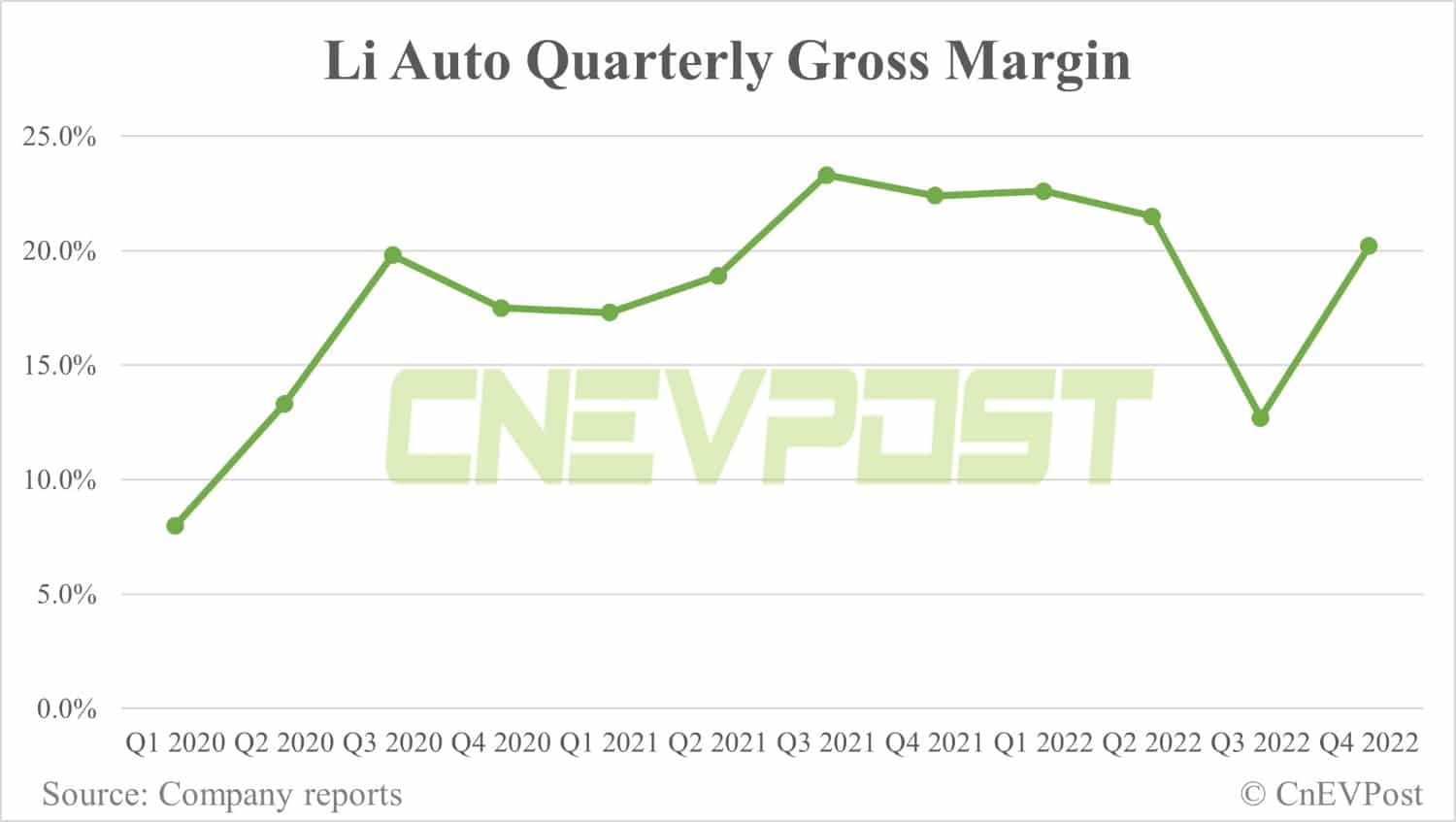

In terms of gross margin, Li Auto CFO conservatively targeted more than 20 percent, citing battery costs and a volatile macro backdrop. Yu's team believes that more than 22 percent is more realistic, with further upside dependent on the price of battery inputs.

Here is the team's first look at Li Auto's earnings report.

4Q22 Earnings First Look

Li Auto delivered mostly solid 4Q results along with a strong 1Q volume outlook as previewed.

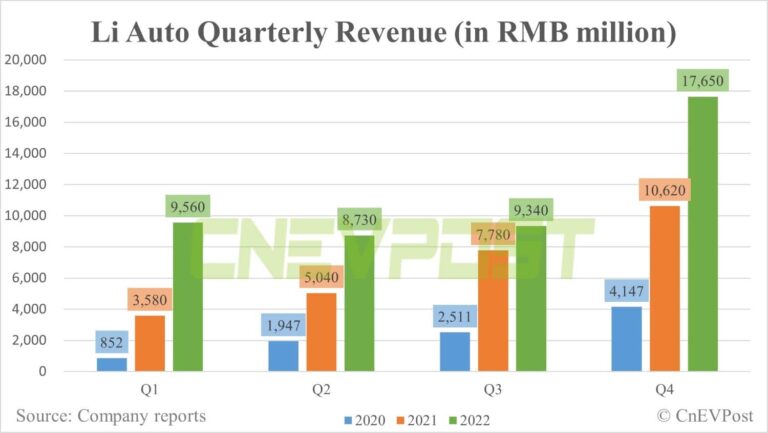

Deliveries were already reported for 4Q at 46,319 units, leading to revenue of 17.65bn RMB (vs. our 18bn forecast).

Total gross margin of 20.2% was below our 21.1% estimate on softer vehicle margin of 20.0% (vs. our 21.0%), likely due to higher-than-expected ramp-up costs for the new models.

Opex of 3,700m was below our expectation, mainly due to lower R&D spend. This led to a small net profit on a GAAP basis.

Adjusted EPS was 0.93, ahead of DBe/consensus, helped by higher proportion of stock comp (0.25 benefit).

Free cash flow came in at 3,257m, materially better than anticipated, supported by lower capex and working capital performance especially on payables.

Management provided strong 1Q guidance calling for 52,000-55,000 in deliveries, ahead of our 52,000 forecast, implying a big sequential step-up from January's 15,141 units. The CFO indicated "several thousand" units of the L7 are embedded into the quarterly outlook.

Revenue is expected to be 17.45-18.45bn RMB in 1Q, slightly below our forecast likely due to ASP/mix assumptions.

Looking ahead, the company believes it can reach 25,000-30,000 deliveries in May once the cheaper L7 and L8 "Air" trims garner a full month of availability.

Higher level, management is targeting 20% of the 300-500k RMB SUV price segment (1.4- 1.5m TAM) as a steady state level of volume for the current "L" series line-up.

Should LI maintain this level of demand for the 2H of the year, there would be upside to our/consensus estimates.

In respect to gross margin, the CFO is conservatively aiming for just >20% despite the new platform being structurally ~25%, citing battery costs and volatile macro backdrop.

We think >22% is more realistic with further upside depending on the price of battery inputs; the management team stayed away from providing details on the reported CATL rebate program on the earnings call.