Lithium miners in Yichun, nicknamed the "lithium capital of Asia," are being suspended for production violations that analysts expect will affect 13 percent of the global lithium supply if production is halted for a month.

The months-long decline in lithium prices may be interrupted as production at a lithium supply hub in China is being suspended amid regulatory investigations.

In Yichun, Jiangxi province in eastern China, nicknamed the "lithium capital of Asia," local lithium miners have now shut down production for an industry-wide rectification, Yicai reported Sunday.

China's central government has recently sent a working group to the city to investigate local lithium mining, which includes officials from several ministries, including China's Ministry of Natural Resources, Ministry of Industry and Information Technology and Ministry of Public Security, according to the report.

The working group will focus on Yifeng county in Yichun to conduct research, mainly to understand the situation and regulate the development of the local lithium battery industry chain, according to the report.

Yifeng county is rich in lithium mineral resources underground, but there are mining irregularities by producers, including mining without qualifications and continuing to mine after the qualifications have expired, the report said.

In addition to non-compliant mining, many transportation vehicles from lithium mining companies have affected normal local traffic, according to the report.

At present, lithium ore concentration producers in Yichun have completely stopped production, while lithium ore calcining companies did not stop production on a large scale, the report said, citing a number of local makers.

Notably, companies in Yichun Economic Development Zone's lithium battery chain are currently in normal production, including CATL's local subsidiary, as well as affiliates of Ganfeng Lithium and Gotion High-tech, according to the report.

In an optimistic scenario, lithium production in Yichun could be suspended for about a month, Yicai said, citing a lithium battery industry analyst who declined to be named.

Yichun currently produces between 10,000 and 12,000 tons of lithium carbonate each month, and a one-month shutdown would affect about 10 percent of global supply, according to the analyst.

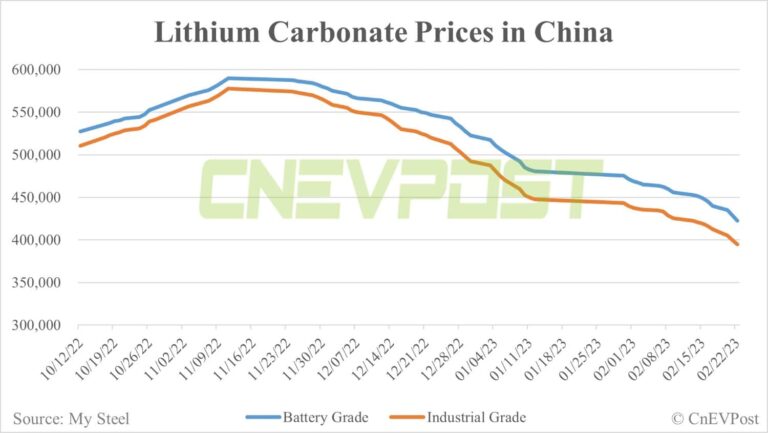

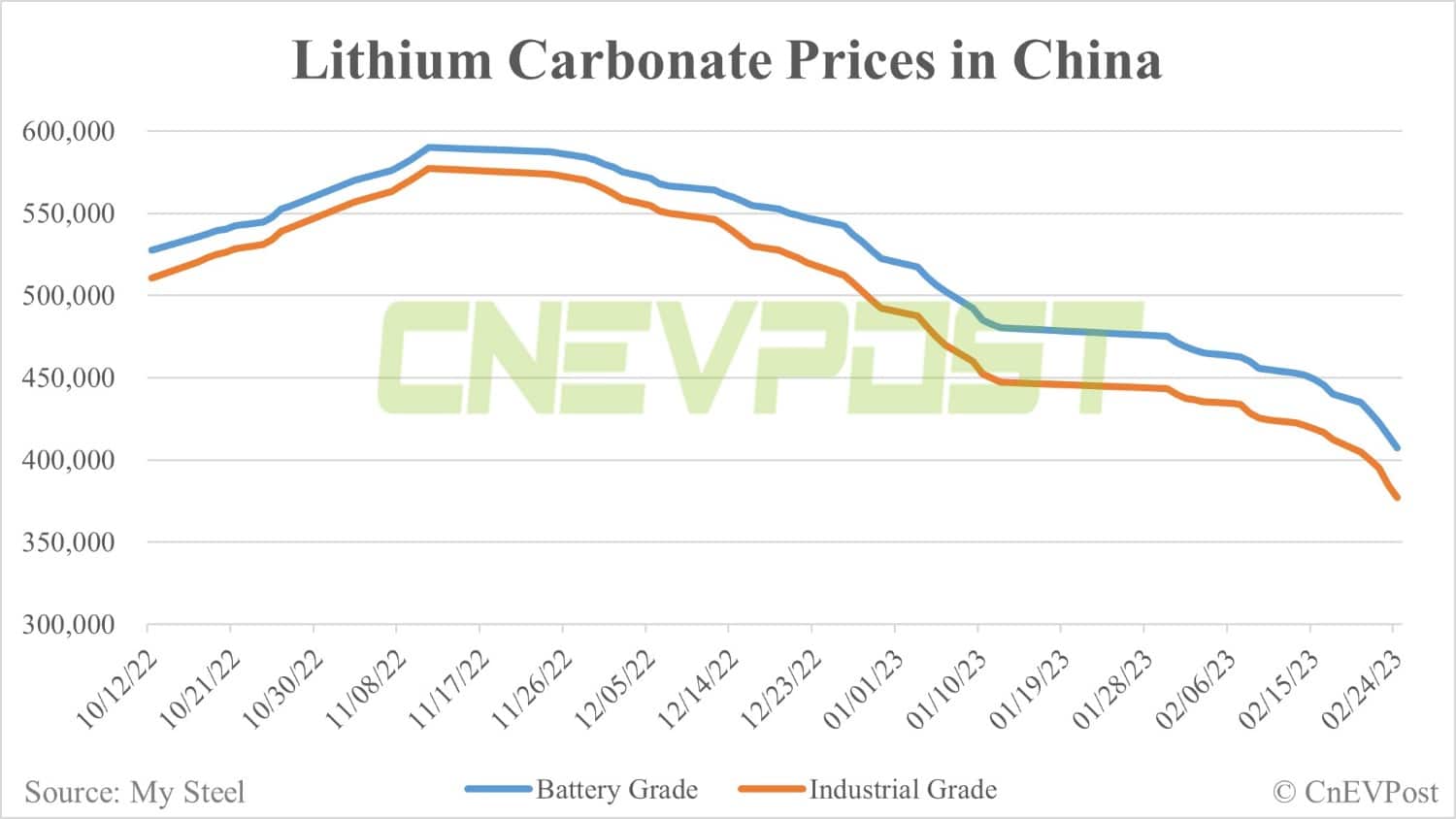

Since the end of last year, battery-grade lithium carbonate prices have fallen in China by RMB 5,000 ($720) to RMB 7,000 per ton per day, even plunging by RMB 15,000 in a single day at times.

However, on February 24, lithium carbonate prices began to show signs of stopping their decline, Yicai's report said. Some market participants believe that this may be related to this Yichun lithium mine rectification, the report said.

At one point in November 2022, the price of battery-grade lithium carbonate in China reached about RMB 600,000 per ton. That was about 14 times the June 2020 average price of RMB 41,000 per ton and up about 55 percent from RMB 364,000 per ton in early February 2022.

Since then, however, the price of lithium carbonate has continued to fall, as market concerns about slowing growth in the electric vehicle industry and discussions about sodium-ion batteries have begun to increase.

On February 22, quotes for industrial-grade lithium carbonate in China fell below RMB 400,000 per ton, a pullback of more than 30 percent from the November peak.

On February 24, battery-grade lithium carbonate fell RMB 7,500 per ton to an average price of RMB 407,500 per ton, while industrial-grade lithium carbonate fell RMB 8,000 per ton to an average price of RMB 377,000 per ton, according to data from My Steel.

The duration of Yichun's lithium mining industry rectification has not yet been determined, and assuming the lithium mines stop production for one month, it will reduce lithium ore production by about 13,000 tons of lithium carbonate equivalent, CITIC Securities wrote in a research note today.

Global lithium resource capacity in 2023 is about 1.2 million tons LCE/year, and a 1-month shutdown of lithium mines in Yichun is expected to reduce global lithium resource supply by 13 percent for that month, according to the note.

The city's lithium mica mining lines have been completely shut down, but the smelting lines have not been affected, CITIC Securities said, adding that lithium manufacturers in Yichun still have some concentrate in stock, which is expected to keep the smelting lines running for a short time.

($1 = RMB 6.9563)