Point72 increased its bet on Nio in the fourth quarter, re-bought Li Auto, but liquidated its position in Xpeng.

Point72, the hedge fund led by legendary US investor Steven Cohen, increased its bet on Nio (NYSE: NIO) in the fourth quarter, resumed a position in Li Auto (NASDAQ: LI) but liquidated its holdings in Xpeng (NYSE: XPEV).

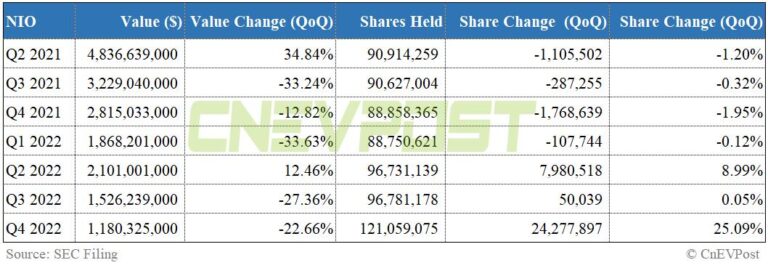

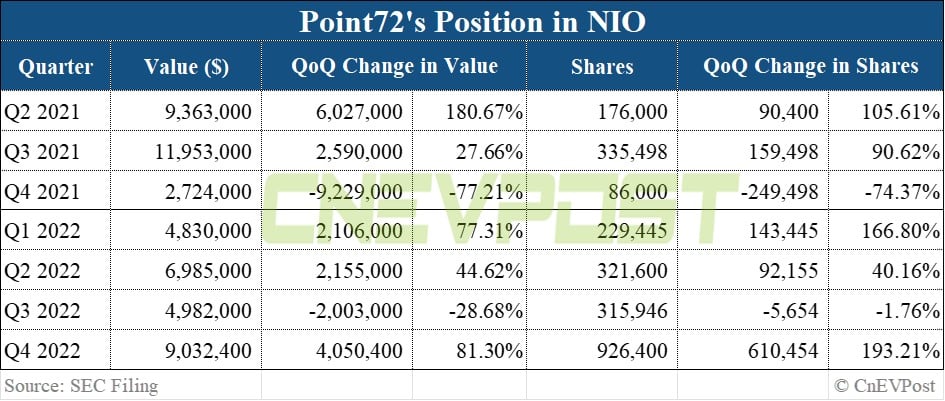

Point72 Hong Kong Ltd owned 926,400 shares of Nio's US-traded ADRs at the end of the fourth quarter, up 610,454 shares, or 193.21 percent, from 315,946 shares at the end of the third quarter, according to its Form 13F filing with the SEC on Tuesday.

Previously, Point72 continued to add to its position in Nio in the first and second quarters of last year, and trimmed 1.76 percent from its position in the third quarter.

Point72's holdings in Nio were worth about $9 million at the end of the fourth quarter, up $4 million, or 81.30 percent from $5 million at the end of the third quarter.

Nio declined 38 percent in the fourth quarter. The company fell 27 percent in the third quarter, rose 3 percent in the second quarter and fell 34 percent in the first quarter.

Point72 re-bought Li Auto in the fourth quarter, after not holding any shares in the company in the second and third quarters of last year.

The hedge fund liquidated its previous position in Li Auto in the fourth quarter of 2021 and re-purchased 545,000 shares in the first quarter of 2022. However, in the second quarter of last year, Point72 liquidated its position in Li Auto, and the position held in the company remained at zero as of the end of the third quarter.

Point72 owned 251,400 shares of Li Auto worth $5.13 million at the end of the fourth quarter.

Li Auto declined 11 percent in the fourth quarter. It was down 20 percent in the first quarter, up 41 percent in the second quarter and down 40 percent in the third quarter.

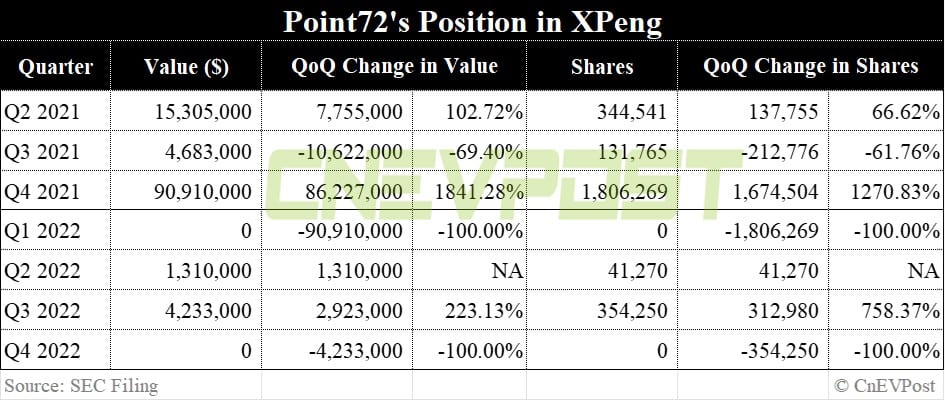

For Nio and Li Auto's local peer Xpeng, Point72 chose to liquidate its position in the fourth quarter.

At the end of the third quarter, Point72 held 354,250 shares of Xpeng, worth about $4.23 million.

On February 13, Bridgewater Associates, the world's largest hedge fund founded by Ray Dalio, filed a Form 13F showing that it had reduced its holdings in Nio by 27.91 percent, Xpeng by 6.15 percent and Li Auto by 46.63 percent during the fourth quarter.

Scottish investment firm Baillie Gifford & Co increased its position in Nio and liquidated its position in Li Auto during the fourth quarter, according to its 13F filing, which was released in late January. As of the end of the fourth quarter, Baillie Gifford did not hold any shares of Xpeng.