Bridgewater reduced its holdings in Nio by 27.91 percent, Xpeng by 6.15 percent and Li Auto by 46.63 percent during the fourth quarter.

Bridgewater Associates, the world's largest hedge fund founded by renowned investor Ray Dalio, reduced its positions in the Chinese electric vehicle (EV) trio in the fourth quarter, after increasing or keeping them unchanged for several quarters.

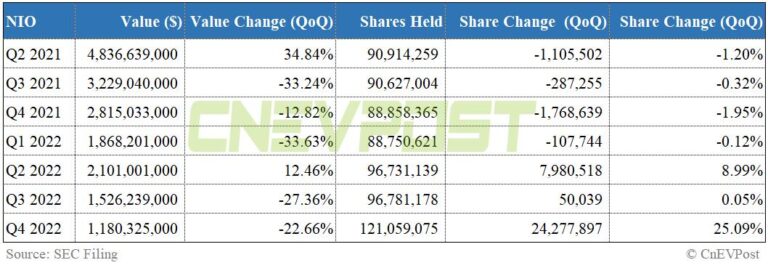

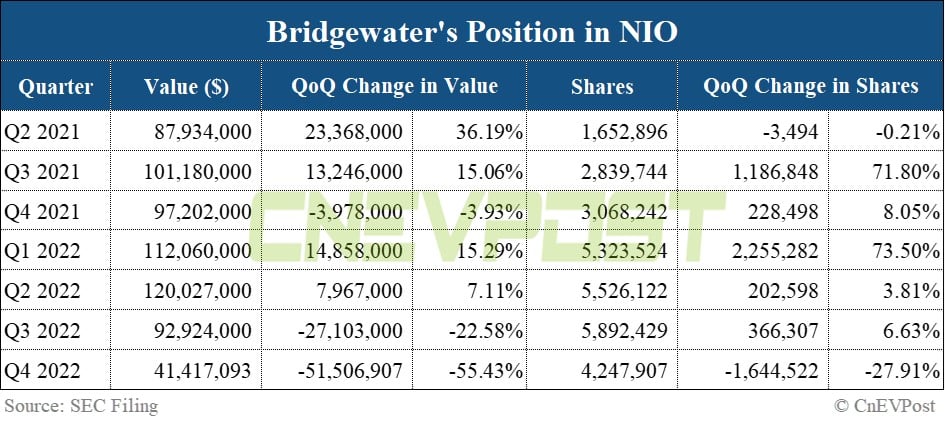

Bridgewater held 4,247,907 US-traded ADRs of Nio (NYSE: NIO) at the end of the fourth quarter, down 1,644,522 shares, or 27.91 percent, from 5,892,429 at the end of the third quarter, according to its Form 13F filing with the SEC on Monday.

Before that, Bridgewater increased its position in Nio for five consecutive quarters, including a 6.63 percent increase in the third quarter of last year, according to CnEVPost's tracking.

The value of Bridgewater's Nio holdings was $41.42 million at the end of the fourth quarter, down $51.5 million, or 55.43 percent, from $92.92 million at the end of the third quarter.

Nio declined 38 percent in the fourth quarter. The company fell 27 percent in the third quarter, rose 3 percent in the second quarter and fell 34 percent in the first quarter.

In addition to Nio, Bridgewater also reduced its holdings in Xpeng (NYSE: XPEV) and Li Auto (NASDAQ: LI) during the fourth quarter.

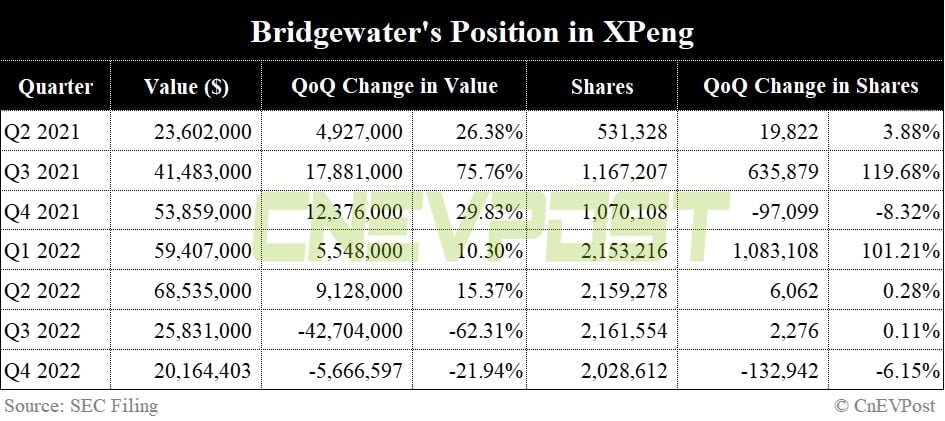

Bridgewater held 2,028,612 US-traded ADRs of Xpeng at the end of the fourth quarter, down 132,942 shares or 6.15 percent from 2,161,554 at the end of the third quarter.

The fund increased its position in Xpeng by 101.21 percent in the first quarter of 2022 and the holding remained essentially unchanged for the next two quarters.

The latest value of Bridgewater's holdings in Xpeng was $20.16 million, down $5.67 million, or 21.94 percent, from $25.83 million at the end of the third quarter.

Xpeng declined 15 percent in the fourth quarter. The company fell 62 percent in the third quarter, rose 15 percent in the second quarter and fell 45 percent in the first quarter.

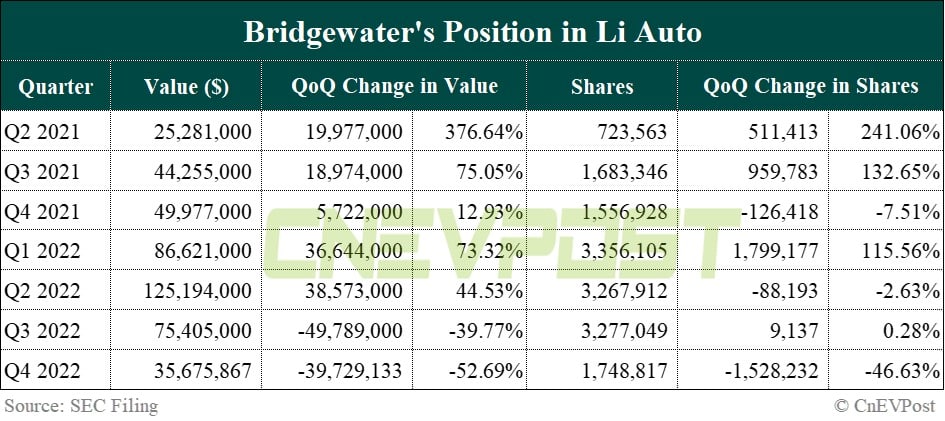

Bridgewater owned 1,748,817 shares of Li Auto at the end of the fourth quarter, down 1,528,232 shares or 46.63 percent from 3,277,049 shares at the end of the third quarter.

The fund increased its stake in Li Auto by 115.56 percent in the first quarter of last year, decreased it by 2.63 percent in the second quarter, and left it essentially unchanged in the third quarter.

The latest value of Bridgewater's holdings in Li Auto was $35.68 million, a decrease of $39.72 million, or 52.69 percent, from $75.40 million at the end of the third quarter.

Li Auto fell 11 percent in the fourth quarter. It was down 20 percent in the first quarter, up 41 percent in the second quarter and down 40 percent in the third quarter.

Before Bridgewater disclosed the position information, Scottish investment firm Baillie Gifford & Co released a 13F filing in late January showing that it increased its position in Nio and liquidated its position in Li Auto during the fourth quarter.

Baillie Gifford did not hold a stake in Xpeng as of December 31, 2022.