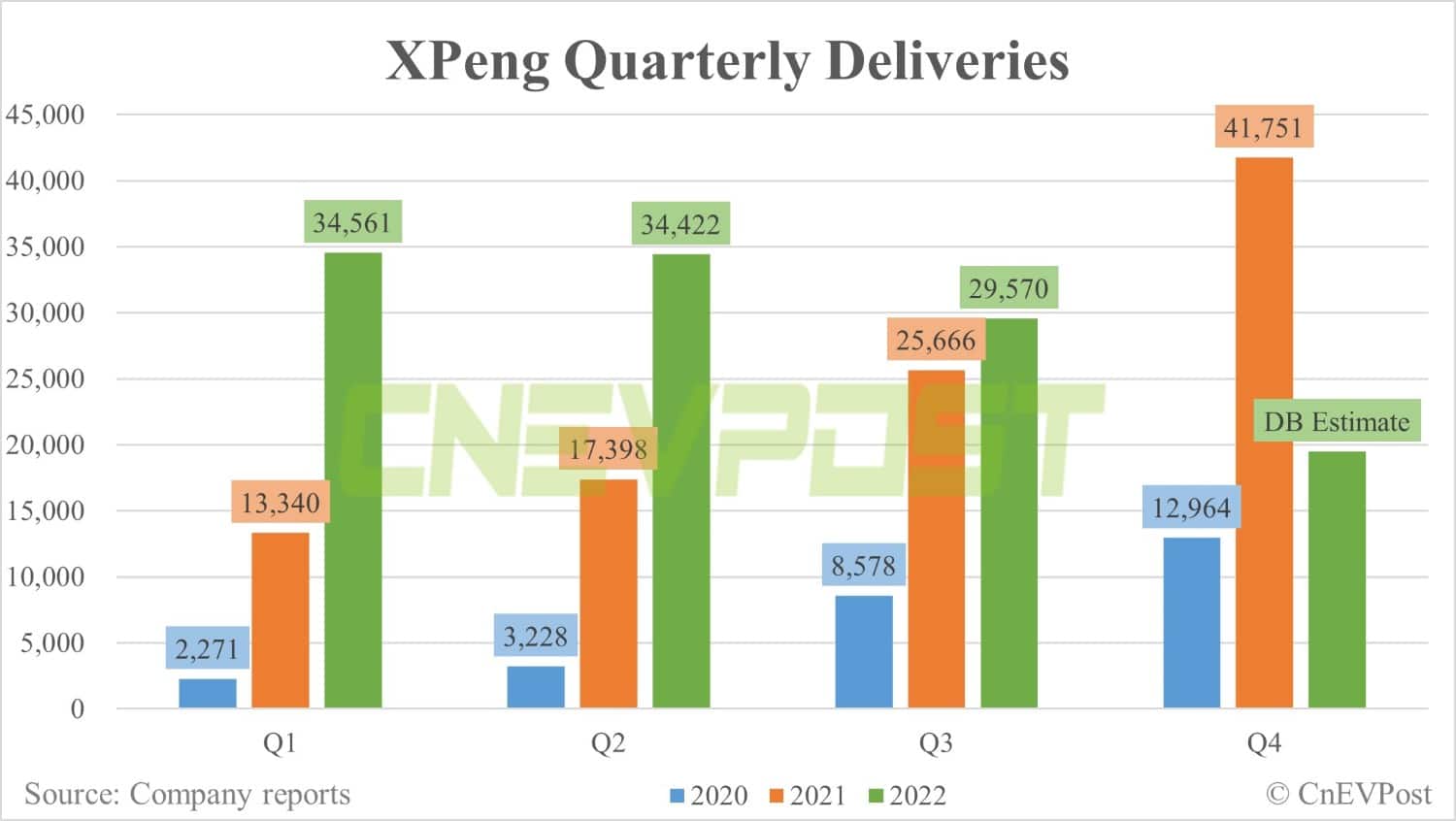

Xpeng expects fourth-quarter deliveries of 20,000 to 21,000 units, possibly suggesting that its December deliveries are expected to rebound to around 10,000 units.

Xpeng's revenue in the third quarter was down from the second quarter, but its guidance for the third quarter means it expects a significant rebound in December deliveries.

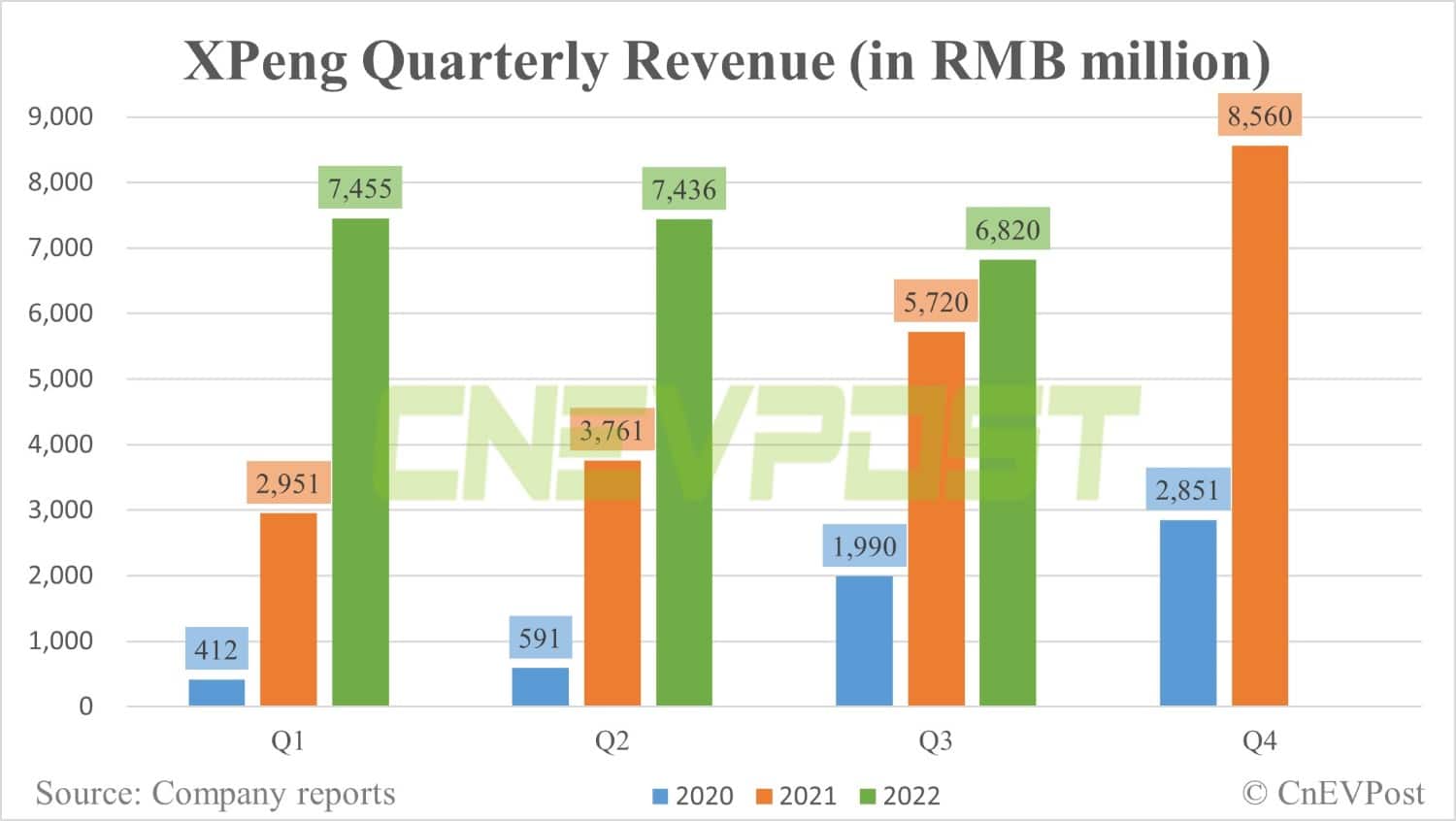

The company reported revenue of RMB 6.82 billion ($960 million) in the third quarter, up 19.3 percent from a year earlier and down 8.2 percent from the previous quarter, according to an earnings report released today.

That sits near the lower end of the RMB 6.8 billion to RMB 7.2 billion guidance range it previously provided, as the company faces reduced demand in the second half of the year.

Xpeng has previously released data showing it delivered 29,570 vehicles in the third quarter, near the low end of its guidance range of 29,000-31,000.

The company generated RMB 6.24 billion in car sales in the third quarter, up 14.3 percent from the same period in 2021 but down 10.1 percent from the second quarter.

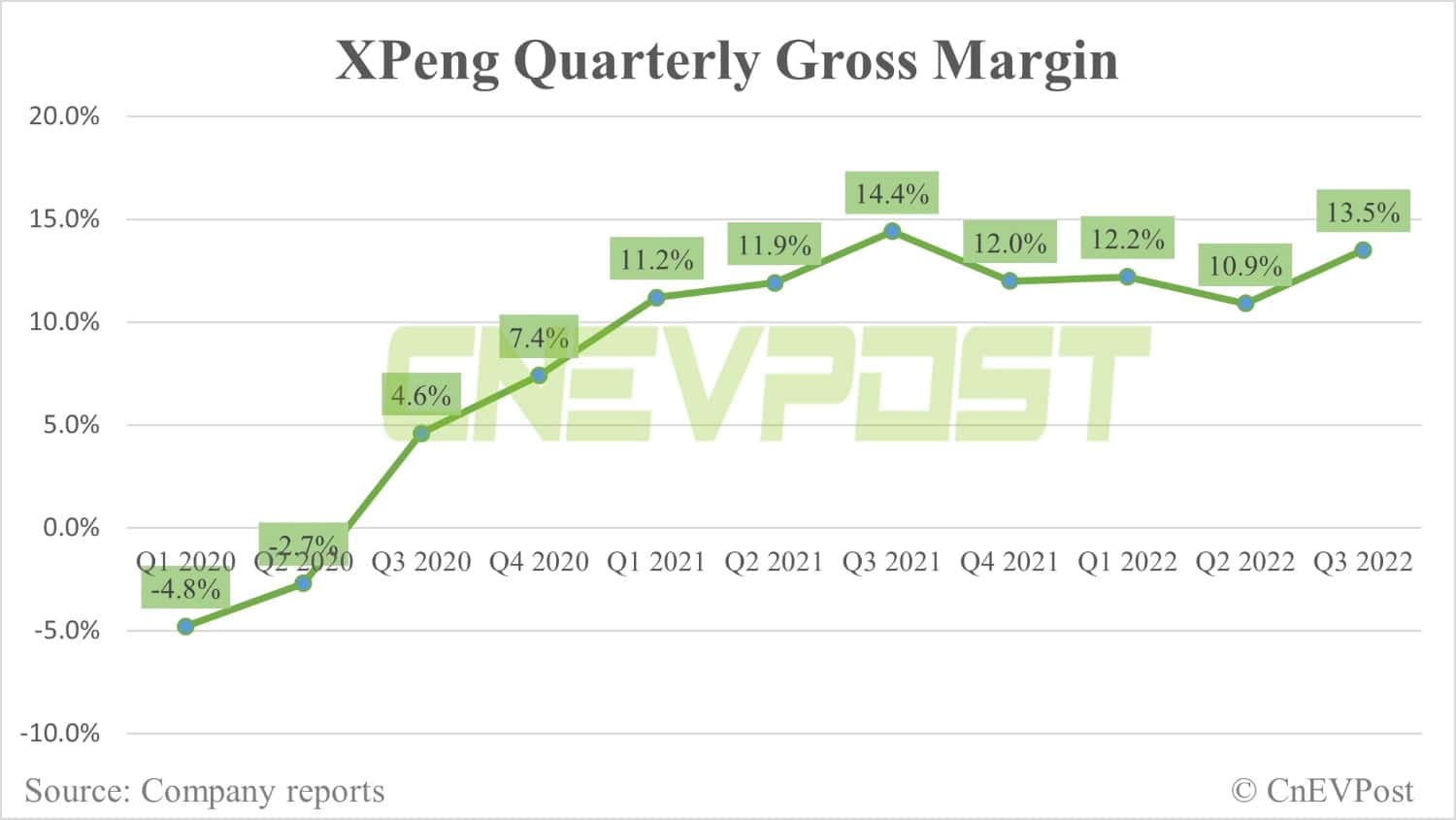

It reported a gross margin of 13.5 percent in the third quarter, a significant improvement from 10.9 percent in the second quarter. Vehicle gross margin was 11.6 percent, up from 9.1 percent in the second quarter.

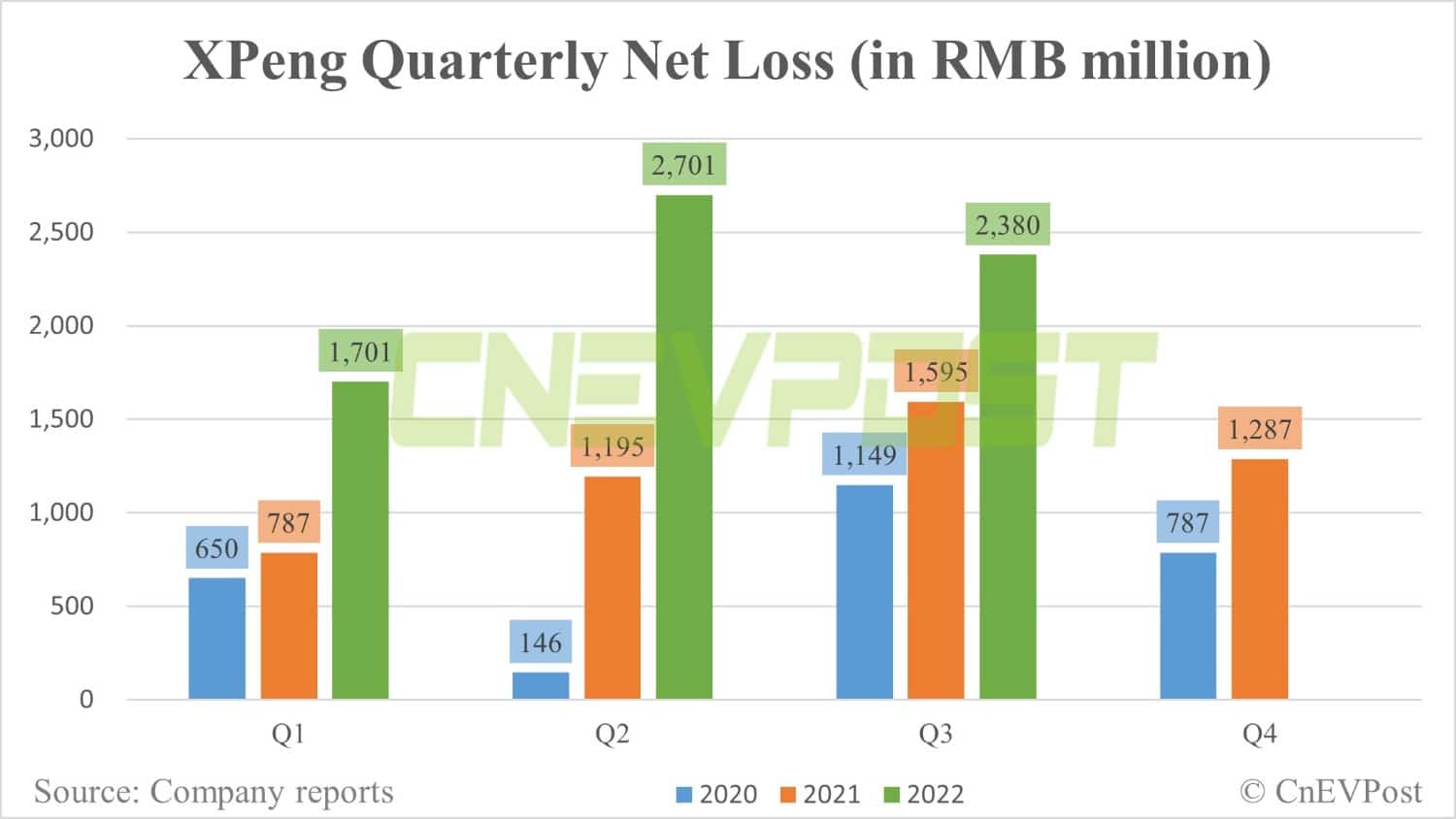

Xpeng reported a net loss of RMB 2.38 billion in the third quarter, compared to RMB 1.59 billion in the same period of 2021 and RMB 2.7 billion in the second quarter.

Excluding stock-based compensation expense, it reported a non-GAAP net loss of RMB 2.22 billion in the third quarter, compared to RMB 1.49 billion in the same period in 2021 and RMB 2.46 billion in the second quarter.

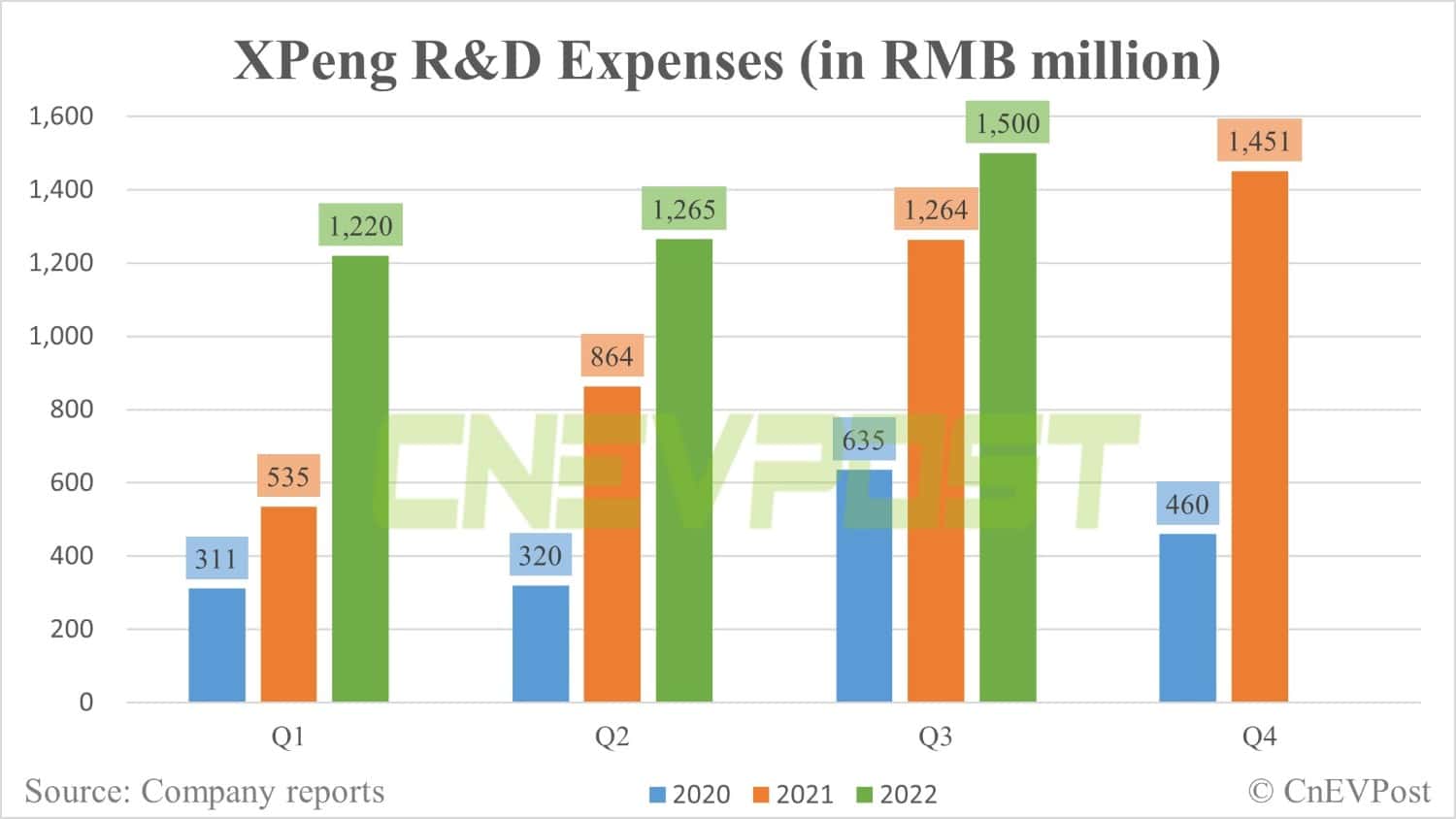

Xpeng's research and development expenses for the third quarter were RMB 1.5 billion, an increase of 18.5 percent from RMB 1.26 billion for the same period in 2021 and an increase of 18.5 percent from RMB 1.26 billion for the second quarter.

The year-on-year increase was primarily due to an increase in employee compensation due to the expansion of R&D staff, while the quarter-to-quarter increase was primarily related to higher new vehicle development to support future growth, the company said.

For the fourth quarter, Xpeng's guidance was:

Deliveries of vehicles to be between 20,000 and 21,000, representing a year-on-year decrease of about 49.7 percent to 52.1 percent.

Total revenues to be between RMB 4.8 billion and RMB 5.1 billion, representing a year-on-year decrease of about 40.4 percent to 43.9 percent.

The company delivered 5,101 vehicles in October, while insurance registration figures for the first four weeks of November were only 4,861. The latest guidance could mean that Xpeng management expects its December deliveries to rebound to near 10,000 units.

In a research note sent to investors on November 28, Deutsche Bank analyst Edison Yu's team said that Xpeng's management may provide a fairly grim fourth-quarter outlook with delivery guidance likely around 20,000 units as demand remains very weak.

The team forecasts Xpeng deliveries in the fourth quarter will be 19,500 units, the lowest quarterly sales since the second quarter of 2021, or about half of the peak in the fourth quarter of 2021.

Xpeng's cash and cash equivalents, restricted cash, short-term deposits, short-term investments and long-term deposits were RMB 40.1 billion at the end of the third quarter.