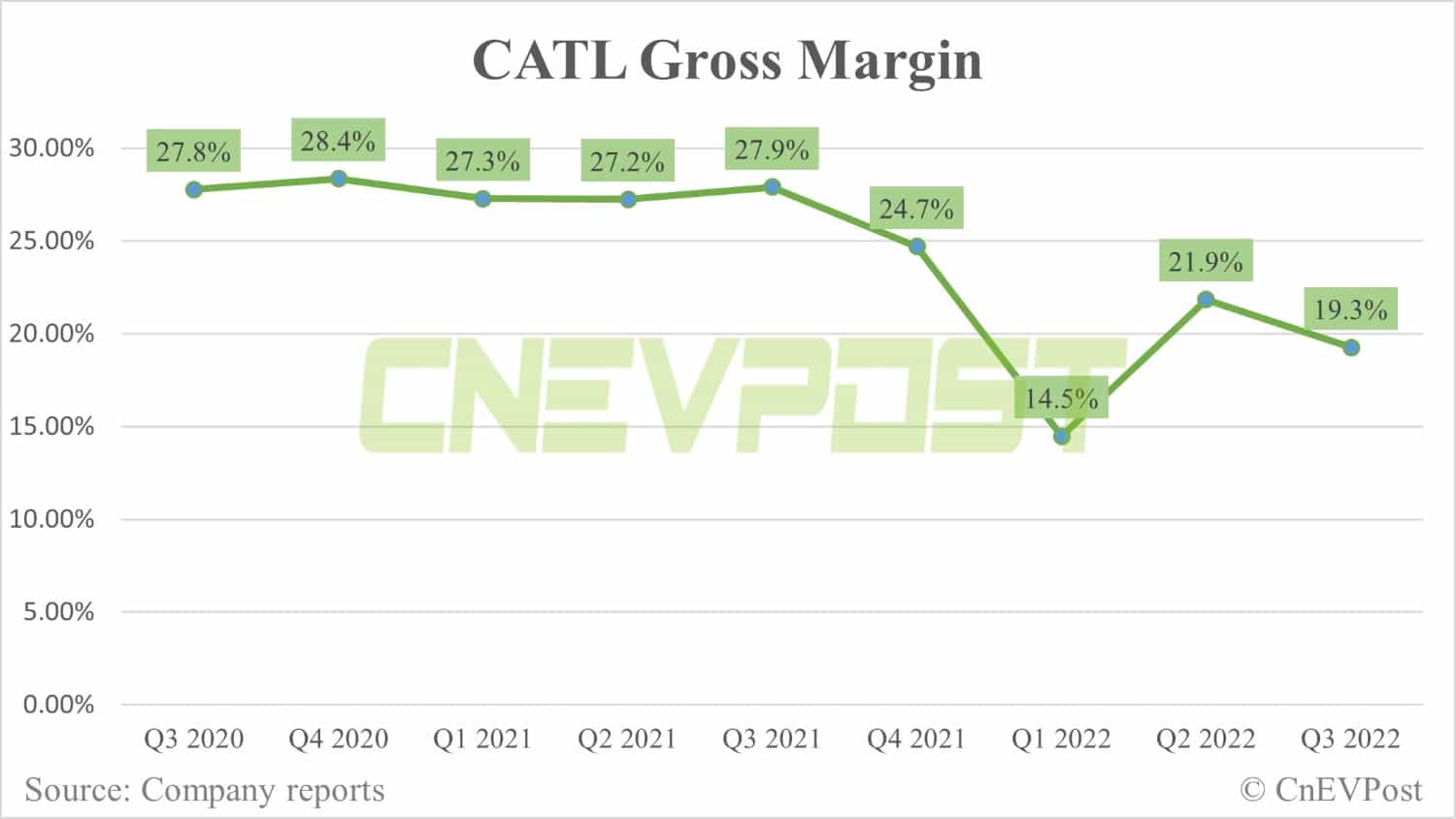

CATL reported a gross margin of 19.27 percent in the third quarter, which was significantly better than the 14.38 percent reported in the first quarter, although lower than the 21.85 percent in the second quarter.

CATL's net profit in the third quarter reached RMB 9.42 billion ($1.3 billion), up 188 percent year-on-year and 41 percent from the second quarter, according to the Chinese power battery giant's earnings report released today.

After excluding non-recurring gains and losses, CATL reported a net profit of RMB 8.99 billion in the third quarter, up 234.70 percent from the same period last year.

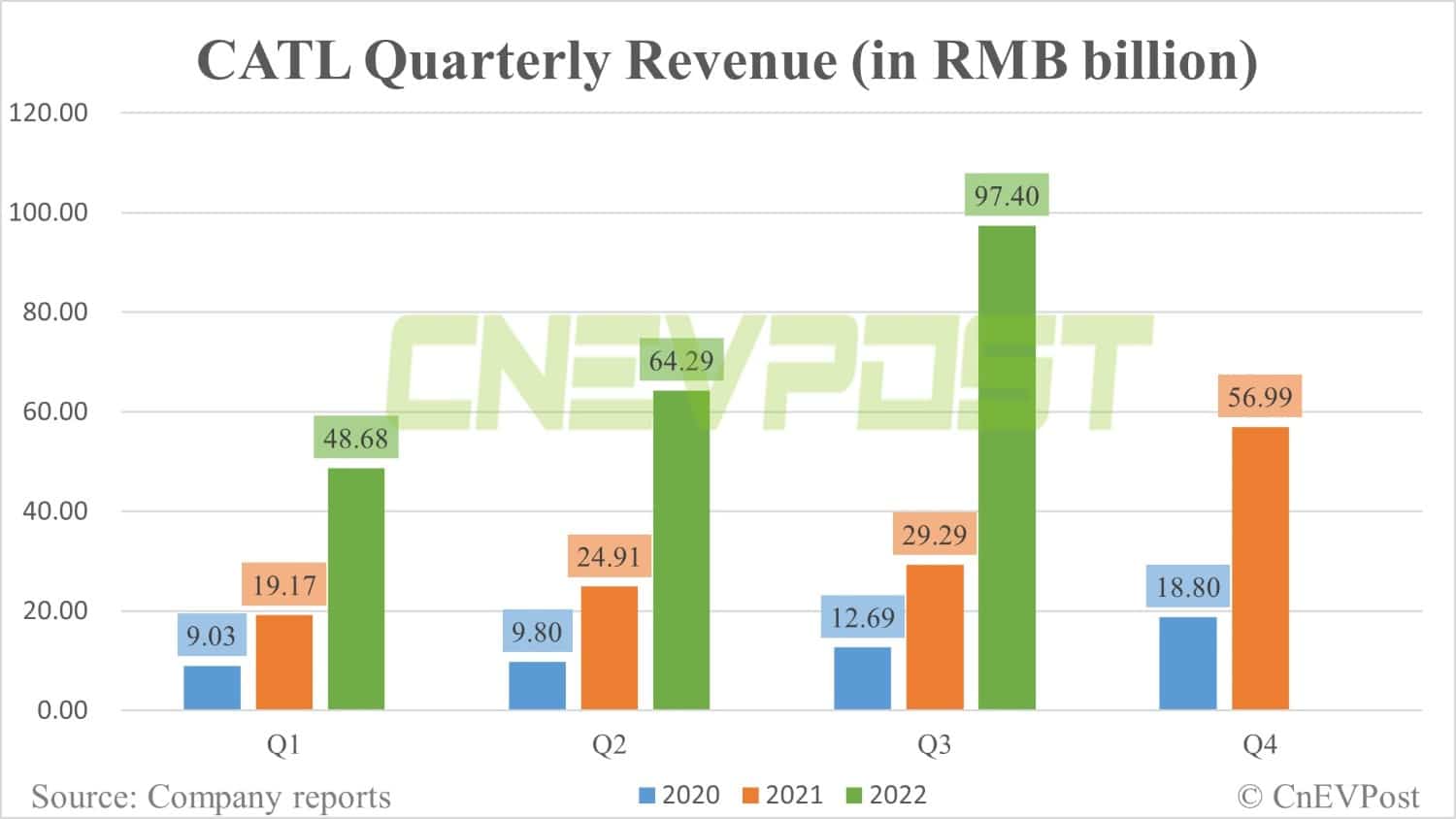

The company's revenue in the third quarter was RMB 97.37 billion, up 232 percent from the same period last year and up 52 percent from the second quarter.

In the first three quarters, CATL's revenue was RMB 210.3 billion, an increase of 187 percent from the same period last year.

Its net profit in the first three quarters was RMB 17.59 billion, up 127 percent from the same period last year.

After excluding non-recurring gains and losses, CATL's net profit in the first three quarters was RMB 16 billion, up 143 percent from the same period last year.

The company recorded government subsidies of RMB 1.61 billion in the first three quarters, of which RMB 599 million was recorded in the third quarter.

In the first quarter, CATL's earnings fell to RMB 1.49 billion at that time, a new low since the third quarter of 2020, due to higher upstream raw material prices and slow transmission of battery prices to vehicle makers.

The company's gross margin was around 27 percent in the first three quarters of 2021, but fell to 24.7 percent in the fourth quarter and further to 14.38 percent in the first quarter of this year.

The company's gross margin in the third quarter was 19.27 percent, which was significantly better than the first quarter, although lower than the 21.85 percent in the second quarter.

On the cost side, the price of lithium resources decreased in the second quarter, and CATL replenished its inventory during this period, with the value of inventory reaching RMB 75.51 billion at the end of the second quarter, an increase of RMB 13.93 billion compared to the first quarter.

The value of raw materials reached RMB 14.33 billion in the second quarter, an increase of RMB 6.2 billion compared to the beginning of the year.

During the third quarter, the price of battery-grade lithium carbonate rose back above RMB 500,000 per ton, but the rise in lithium price seems to have a limited impact on the company as it stockpiled raw materials at a lower cost.