Nio's guidance of 31,000-33,000 vehicle deliveries for the third quarter means it expects September deliveries of 10,271 to 12,271.

Nio reported second-quarter revenue that beat expectations, but its losses widened significantly, sending the stock to drop in pre-market trading.

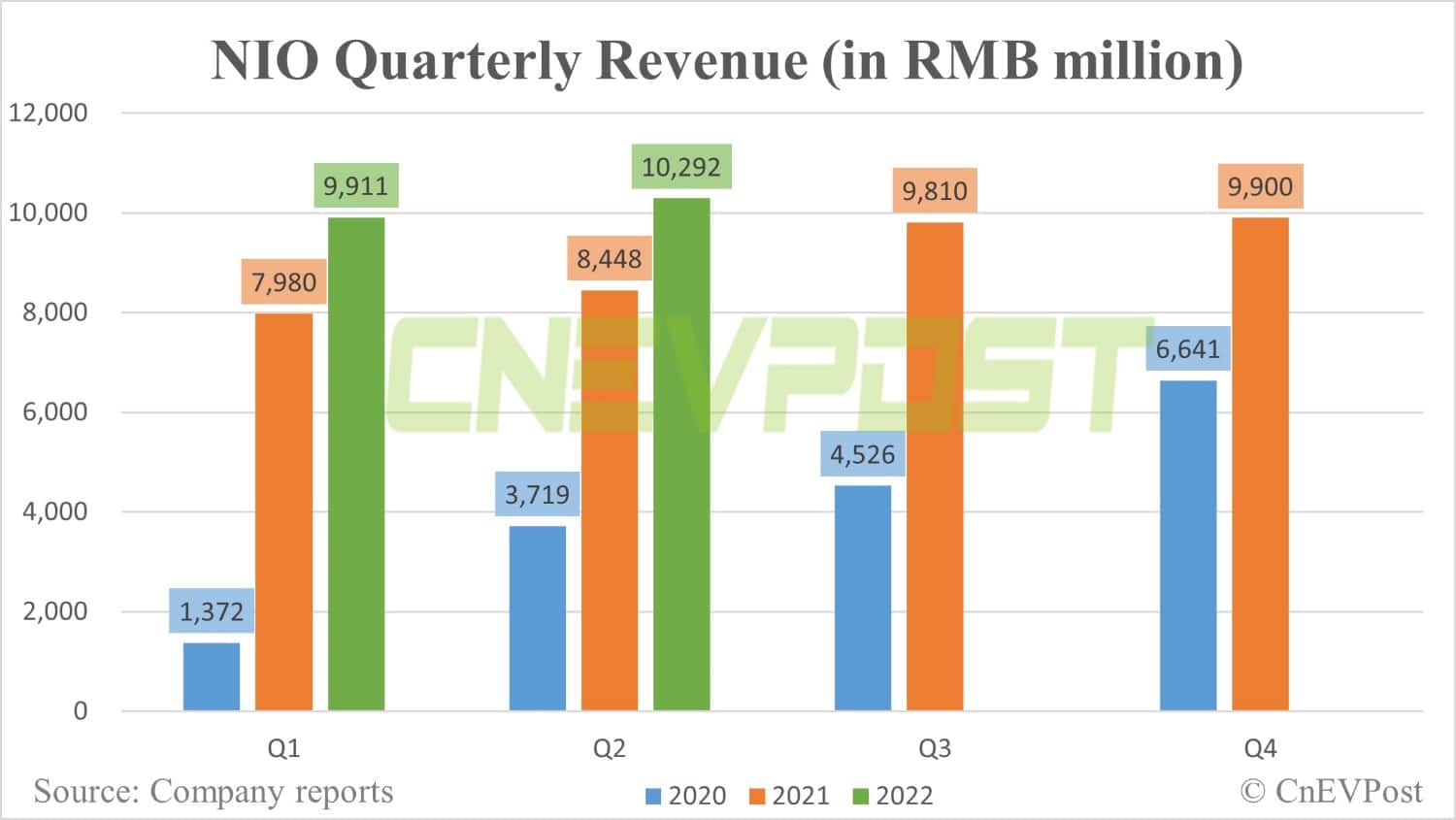

The company reported revenue of RMB 10.29 billion ($1.5 billion) in the second quarter, beating market expectations of RMB 9.8 billion.

This was above the upper end of its previous guidance range of RMB 9.34 billion to RMB 10.09 billion, representing a 21.83 percent year-on-year increase and a 3.85 percent increase from the first quarter.

The company reported vehicle sales revenue of RMB 9.57 billion in the second quarter, up 21 percent year-on-year and 3.5 percent from the first quarter.

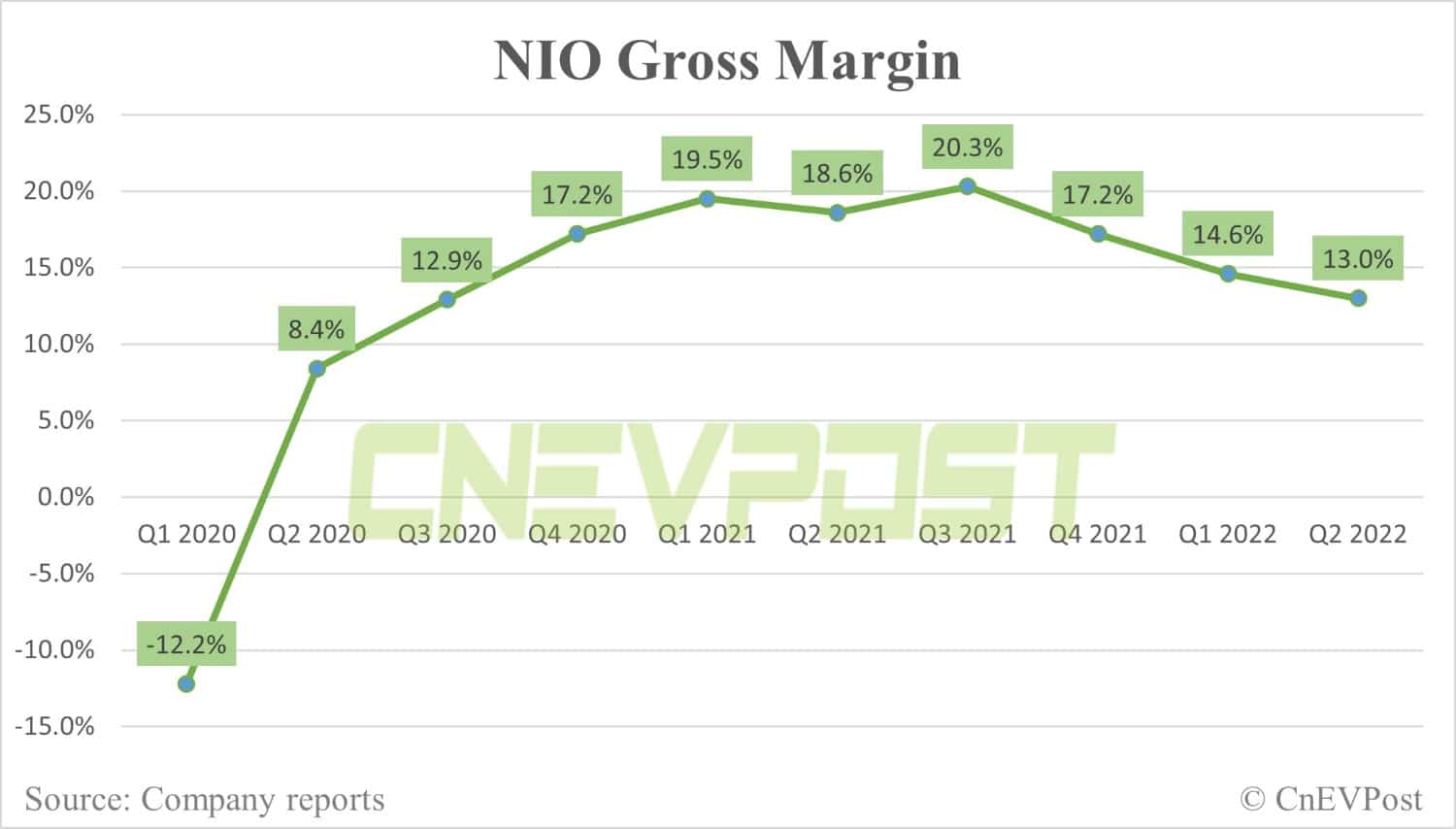

Nio's gross profit for the quarter was RMB 1.34 billion, a decrease of 14.8 percent year-on-year and a decrease of 7.4 percent from the first quarter.

It posted a gross margin of 13 percent in the second quarter, down from 14.6 percent in the first quarter and a new low since the third quarter of 2020.

The decrease in vehicle margin was mainly attributed to the increased battery cost per unit, which was partially offset by favorable changes in the sales mix of the ET7, Nio said.

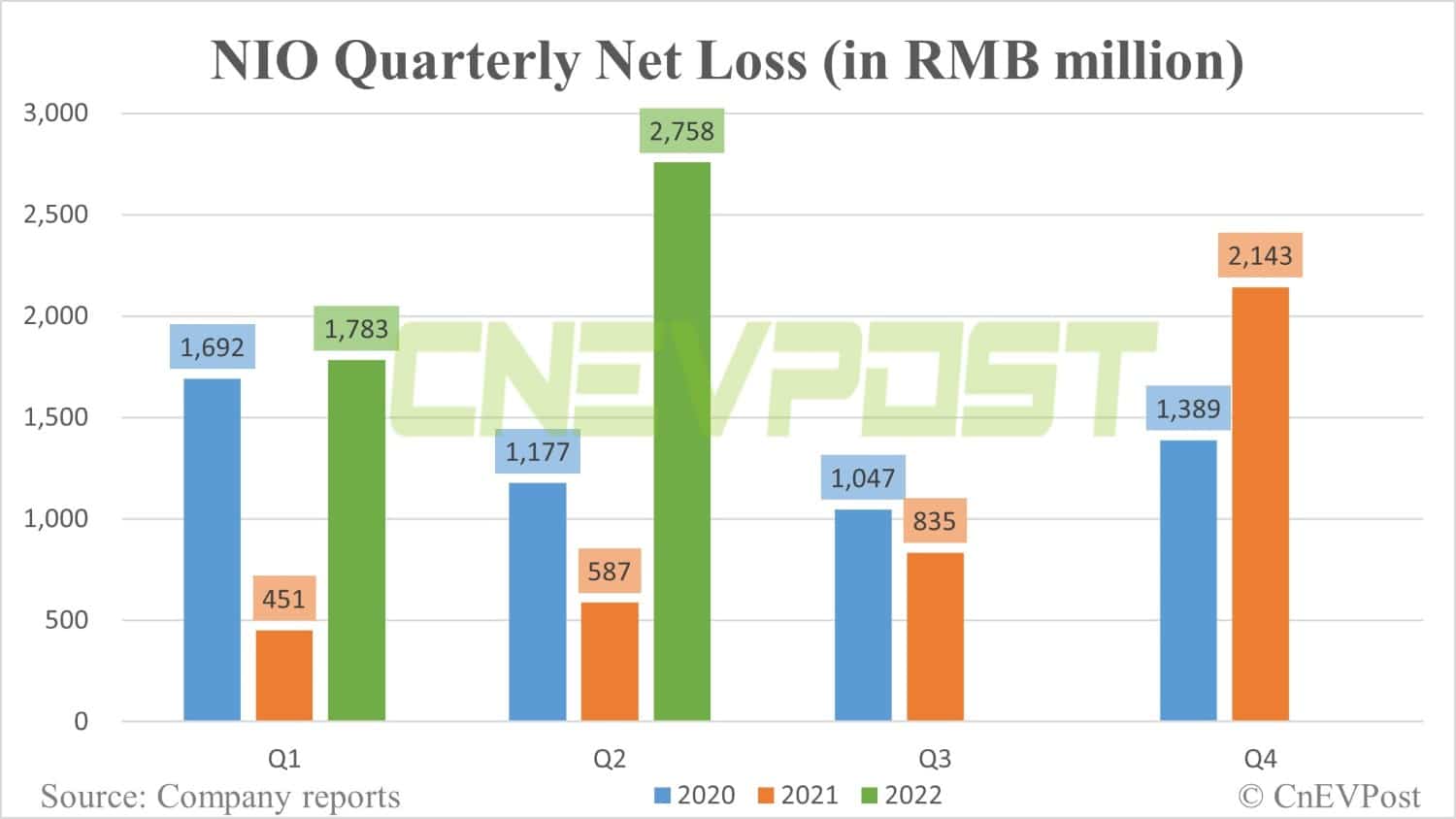

The company saw a net loss of RMB 2.76 billion in the second quarter, above analysts' expectations of RMB 2.029 billion and up 369.6 percent year-on-year and 54.7 percent from the first quarter.

Excluding stock-based compensation expenses, Nio reported an adjusted net loss (non-GAAP) of RMB 2.27 billion in the second quarter, up 575.1 percent year-on-year and 73.1 percent from the first quarter.

Nio's operating loss in the second quarter was RMB2.85 billion, an increase of 272.8 percent year-on-year and 30.0 percent from the first quarter.

Excluding share-based compensation expense, its adjusted operating loss (non-GAAP) for the second quarter was RMB 2.36 billion, an increase of 360.1 percent year-on-year and 37.3 percent from the first quarter.

Net loss attributable to Nio ordinary shareholders for the second quarter was RMB 2.75 billion, an increase of 316.4 percent year-on-year and 50.4 percent from the first quarter.

Nio's basic and diluted net loss per ordinary/American Depositary Share (ADS) was RMB 1.68 in the second quarter, compared to RMB 0.42 in the same quarter last year and RMB 1.12 in the first quarter.

The company's R&D expenses in the second quarter were RMB 2.15 billion, an increase of 143.2 percent year-on-year and 22.0 percent over the first quarter, primarily due to increased personnel costs in the R&D function and higher design and development costs for new products and technologies.

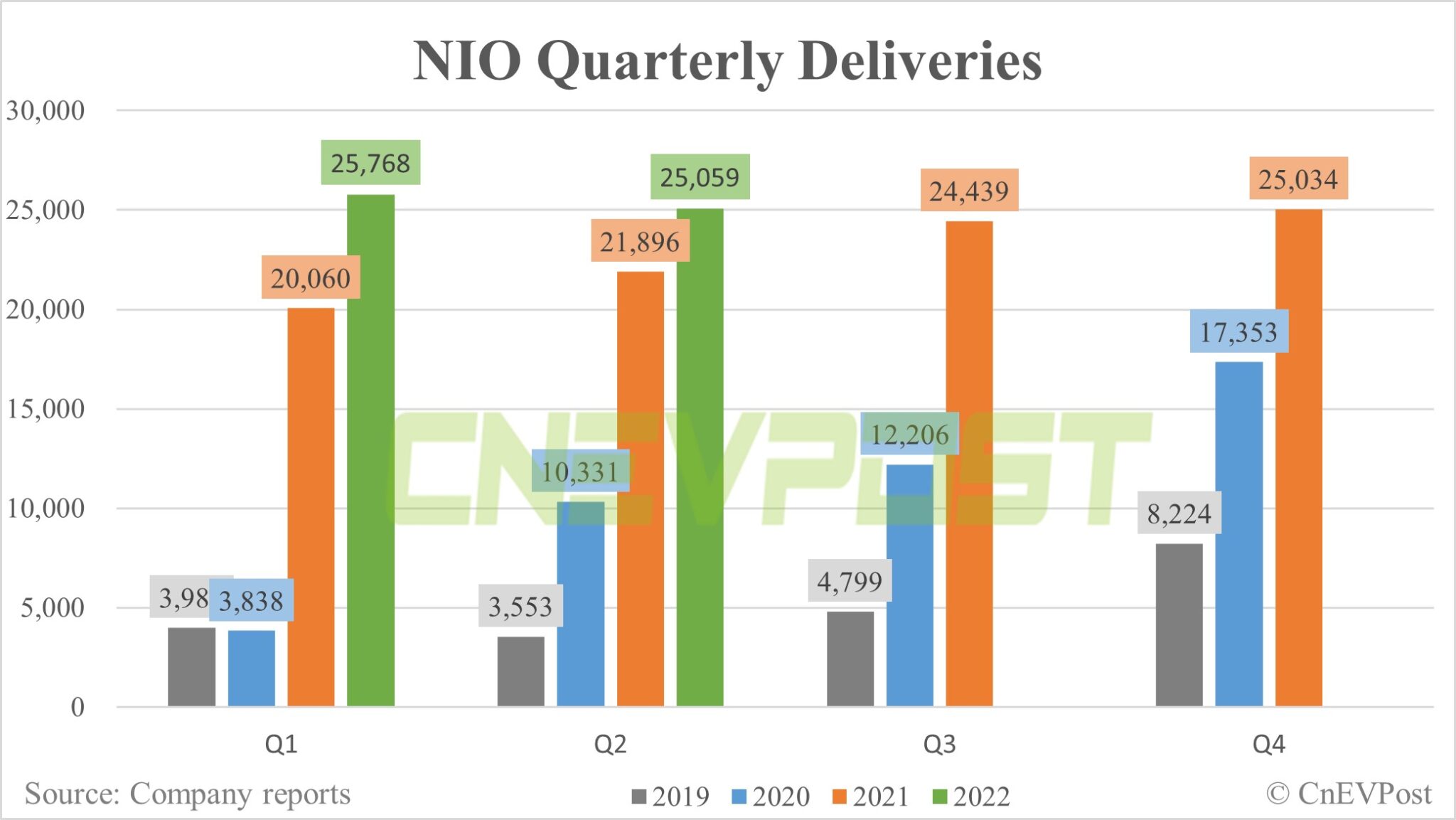

Nio's guidance for vehicle deliveries in the third quarter is 31,000-33,000 units, implying year-on-year growth of about 26.8 percent to 35.0 percent.

The company delivered 10,052 vehicles in July and 10,677 vehicles in August, and the guidance implies it expects September deliveries of 10,271 to 12,271 vehicles.

Its revenue guidance for the third quarter is between RMB 12.85 billion and RMB 13.6 billion, implying year-on-year growth of about 31.0 percent to 38.7 percent.

Previously published figures have shown that Nio delivered 25,059 vehicles in the second quarter, above the upper end of the guidance range of 23,000-25,000 vehicles.

The deliveries were 2.75 percent lower than the 25,768 vehicles delivered in the first quarter and 14.45 percent higher than the 21,896 vehicles delivered in the same period last year.

As of June 30, Nio's cash and cash equivalents, restricted cash and short-term investments were RMB 54.4 billion.

"The second half of 2022 is a critical period for Nio to scale up the production and delivery of multiple new products," said William Li, founder, chairman and CEO of Nio.

"We witnessed a robust order inflow for the ES7 and started its deliveries at scale in August. We also look forward to starting the mass production and delivery of the ET5 in late September. With the compelling product portfolio and well-established brand awareness, Nio will attract a broader user base and embrace robust growth in the coming quarters," Li added.

At press time, Nio was down about 4 percent in pre-market trading.