Tiger Global increased its stake in Xpeng by 120.33 percent and in Li Auto by 167.35 percent in the first quarter. The fund does not own any shares of Nio.

Tiger Global Management, a hedge fund focused on technology stocks, increased its bets on Xpeng Motors (NYSE: XPEV, HKG: 9868) and Li Auto (NASDAQ: LI, HKG: 2015) in the first quarter, but still does not hold any shares of Nio (NYSE: NIO, HKG: 9866).

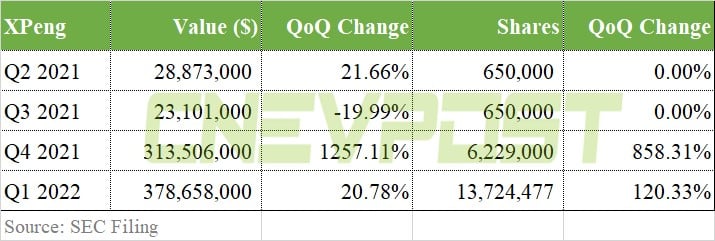

Tiger Global held 13,724,477 shares of Xpeng's ADRs at the end of the first quarter, up 120.33 percent from 6,229,000 shares at the end of the fourth quarter last year, according to its 13F filing with the SEC on Monday.

The fund's holdings in Xpeng were worth $378 million at the end of the first quarter, up 20.78 percent from $314 million at the end of the fourth quarter last year.

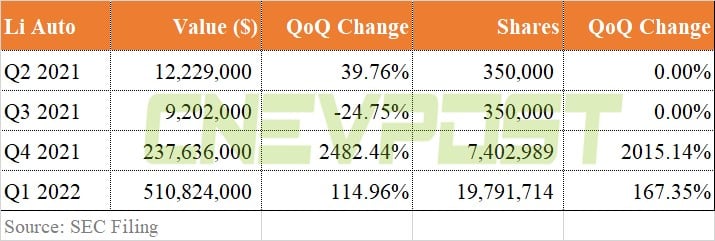

Tiger Global held 19,791,714 ADRs of Li Auto, up 167.35 percent from 7,402,989 at the end of last year's fourth quarter.

The value of its stake in Li Auto was $510 million, up 114.96 percent from $238 million at the end of the fourth quarter last year.

Tiger Global did not hold Nio (NYSE: NIO, HKG: 9866) at the end of the first quarter.

The fund bought Xpeng and Li Auto in the first quarter of 2021, buying 650,000 shares and 350,000 shares, respectively.

Tiger Global's position in Xpeng and Li Auto remained unchanged in the second and third quarters of 2021, but increased its bet significantly in the fourth quarter of last year, when it increased its stake in Xpeng by 858.31 percent and in Li Auto by 2015.14 percent.

During the first quarter, Nio fell 33.55 percent, Xpeng fell 45.18 percent and Li Auto fell 19.6 percent.