The dialogue and consultation between Chinese and US regulators on regulatory cooperation on auditing are progressing well, and both sides have demonstrated their sincerity in being willing to solve problems, local media said.

Dialogue and consultation between Chinese and US regulators on regulatory cooperation on auditing is progressing well, with both sides demonstrating a willingness to resolve issues in good faith, and a consensus is expected to be reached soon, local media Cailian said today, citing sources close to Chinese regulators.

The brief report did not provide much more than that. Shares of a large number of US-listed Chinese companies plunged overnight on a list released by the US Securities and Exchange Commission (SEC) that has sparked fresh delisting fears.

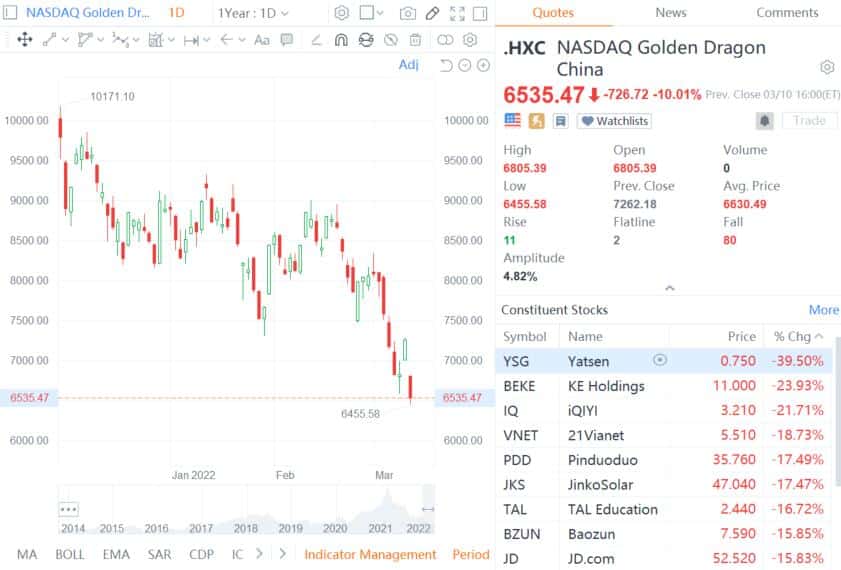

The Nasdaq Golden Dragon China Index (INDEXNASDAQ: HXC) plunged 10.01 percent by Thursday's close, the biggest one-day drop since October 2008.

US-listed Chinese electric vehicle makers' stocks all fell sharply, with Nio (NYSE: NIO, HKG: 9866) down 11.9 percent, Xpeng (NYSE: XPEV, HKG: 9868) down 9.01 percent and Li Auto (NASDAQ: LI, HKG: 2015) down 5.94 percent.

The SEC released a provisional list of issuers identified under the Holding Foreign Companies Accountable Act (HFCAA) on March 8, which included five Chinese companies: BeiGene, Yum China, Zai Lab Limited, ACM Research, and HUTCHMED.

According to the HFCAA, the SEC has the authority to delist a foreign company from the exchanges if it fails to file reports required by the Public Company Accounting Oversight Board (PCAOB) for three consecutive years.

By Thursday's close, BeiGene was down 5.87 percent, Yum China was down 10.94 percent, Zai Lab Limited was down 9.02 percent, ACM Research was down 22.05 percent and HUTCHMED was down 6.53 percent.

In a Q&A released at 00:30 am today, the China Securities Regulatory Commission (CSRC) said they had taken note of the situation, saying it was a normal step for US regulators to implement the HFCAA and related implementation rules.

"We respect the enhanced supervision of relevant accounting firms by overseas regulators to improve the quality of financial information of listed companies, but firmly oppose the wrong approach of some forces to politicize securities regulation," the CSRC said.

In recent times, the CSRC and the Ministry of Finance have continued their communication and dialogue with the PCAOB and have made positive progress, the Chinese securities regulator said.

Notably, this is not the first time the CSRC has said it is actively communicating with US regulators.

On December 5 last year, the CSRC said the US and China have been cooperating in the area of auditing and regulating China concept stocks and had also explored effective ways of cooperation through pilot examinations, laying a better foundation for cooperation between the two sides.

However, some US political forces have politicized capital market regulation in recent years and suppressed Chinese companies listed in the US for no apparent reason, which not only runs counter to the basic principles of a market economy and the rule of law, but also undermines the interests of global investors and the international status of the US capital market, the CSRC said in a statement at the time.

"It is a lose-lose approach that benefits no one," the statement said.

Fang Xinghai, the vice-chairman of the CSRC, held virtual meetings with executives from more than a dozen top Western banks and asset managers to reassure them about the country's economic prospects after a regulatory crackdown in 2021, Reuters said on January 28, citing people familiar with the matter.

China and the US were making progress in coordinating regulations governing Chinese companies listed in New York, and there could be a "positive surprise" by June or sooner, the report quoted Fang as saying.