Li Auto's guidance for first quarter deliveries is 30,000-32,000 vehicles, the same as its previous guidance for the fourth quarter of last year.

Li Auto today reported fourth-quarter revenue that beat market expectations and its quarterly net income rose sharply from a year ago.

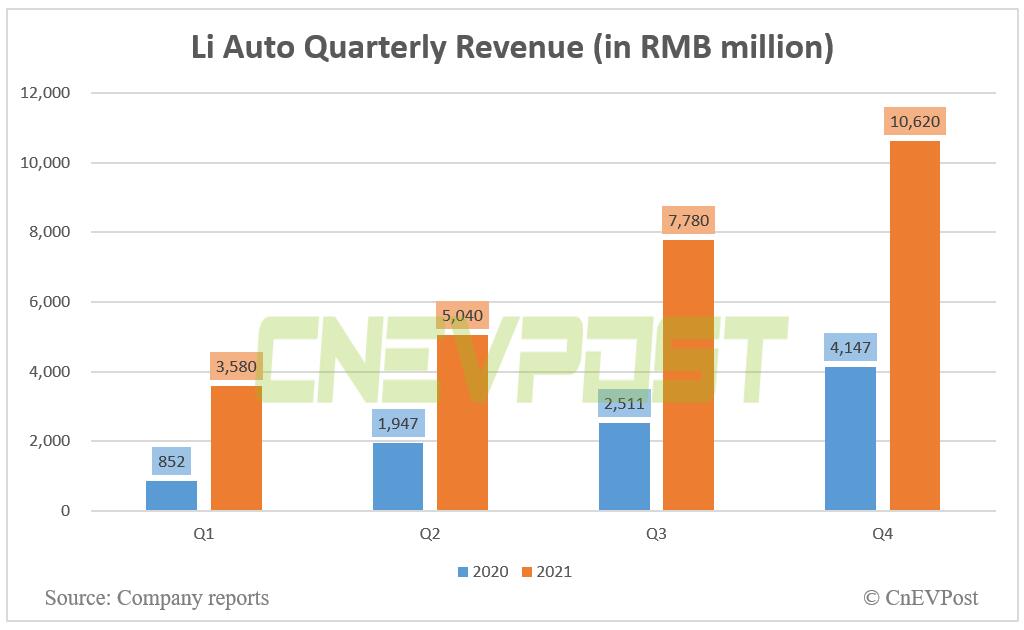

The company reported revenue of RMB 10.62 billion ($1.67 billion) in the fourth quarter of 2021, beating market expectations of RMB 10.29 billion, according to its unaudited earnings report, which was released before the US stock market opened Friday.

That was up 156.1 percent from RMB 4.15 billion a year ago and up 36.5 percent from $2.51 billion in the third quarter.

Li Auto reported vehicle sales revenue of RMB 10.38 billion in the fourth quarter, up 155.7 percent from a year ago and 40.5 percent from the second quarter.

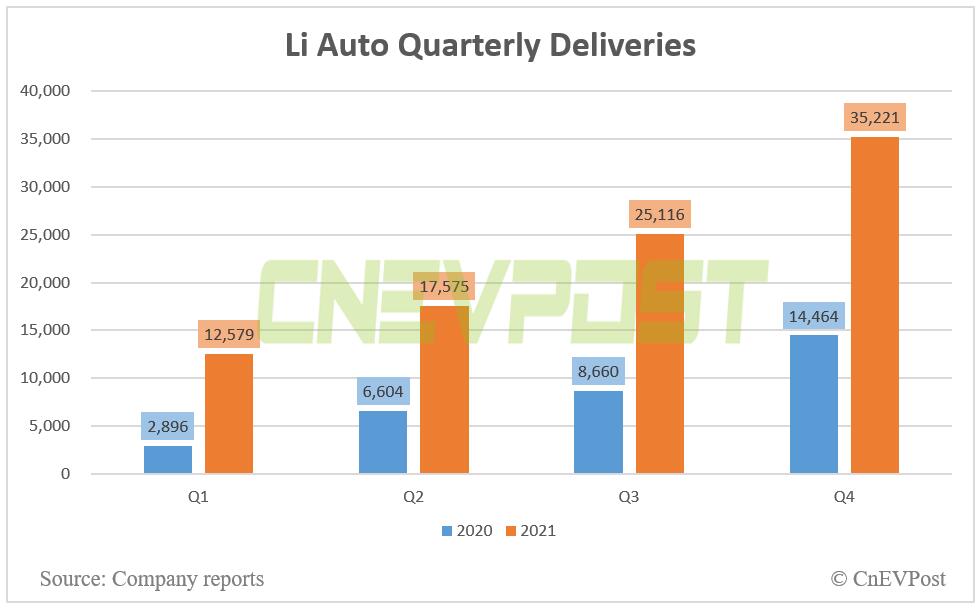

It delivered 35,221 vehicles in the fourth quarter, up 143.5 percent year-on-year and up 40 percent from the third quarter.

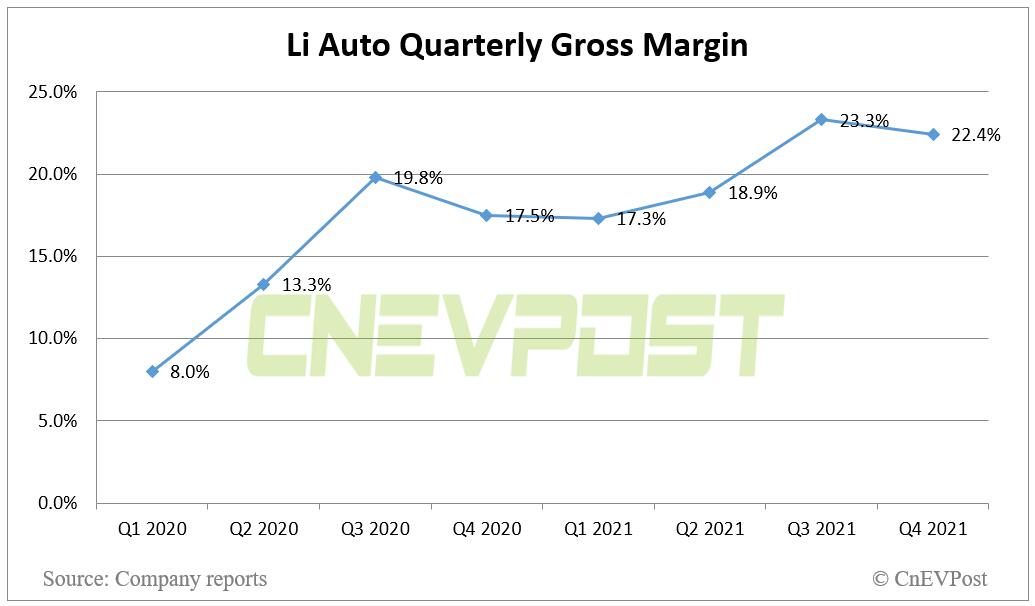

It reported a gross margin of 22.4 percent in the fourth quarter, down from 23.3 percent in the third quarter and up from 17.5 percent in the year-ago quarter.

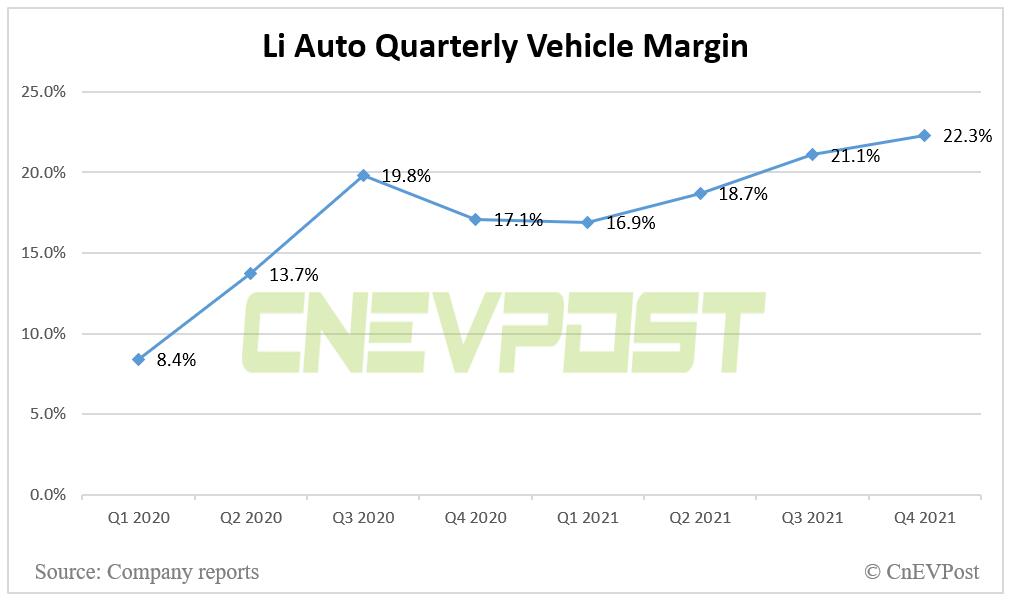

It reported a vehicle margin of 22.3 percent in the quarter, higher than the 21.1 percent in the third quarter and 17.1 percent in the year-ago quarter.

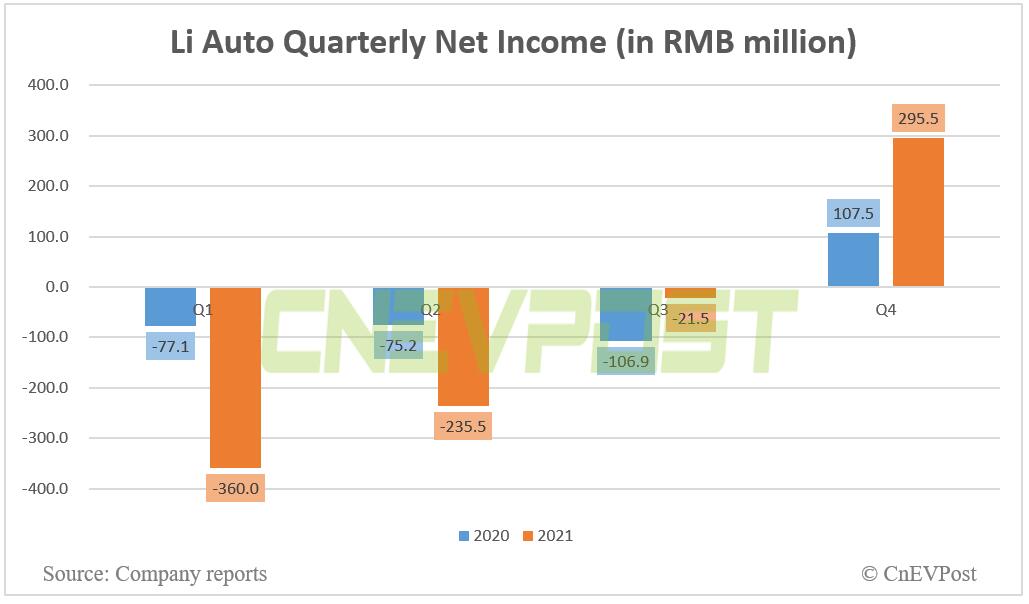

The company reported a net income of RMB 296 million in the fourth quarter, up 174.9 percent from RMB 108 million in the same quarter last year. The company reported a net loss of RMB 21.5 million in the third quarter.

In 2021, Li Auto's revenue was RMB 27 billion, up 185.6 percent from RMB 9.46 billion in 2020.

The company generated RMB 26.1 billion in vehicle sales last year, up 181.5 percent from RMB 9.28 billion in 2020.

Its gross profit in 2021 was RMB 5.8 billion, up 271.9 percent from RMB 1.6 billion in 2020.

Li Auto's net loss in 2021 was RMB 321.5 million, an increase of 111.9 percent from RMB 151.7 million in 2020. Under non-GAAP, it achieved a net profit of RMB 779.9 million in 2021, compared to a non-GAAP net loss of RMB281.2 million in 2020.

Li Auto's gross margin in 2021 was 21.3 percent, up from 16.4 percent in 2020, driven by vehicle margin growth.

The company's vehicle margin was 20.6 percent in 2021, up from 16.4 percent in 2020.

The increase in vehicle margin was primarily driven by improved cost control in supply chain management and higher average selling price attributable to the increase of vehicle deliveries in 2021, with the launch of the 2021 Li ONE in May 2021, it said.

Li Auto's balance of cash and cash equivalents, restricted cash, time deposits and short-term investments was RMB 50.16 billion as of December 31, 2021.

The company's delivery guidance for the first quarter of 2022 is 30,000-32,000 vehicles, the same as its previous guidance for the fourth quarter of last year, implying a 138.5 percent- 154.4 percent year-on-year increase.

Its revenue guidance for the first quarter is RMB 8.84 billion - RMB 9.43 billion, implying year-on-year growth of 147.2 percent - 163.7 percent.

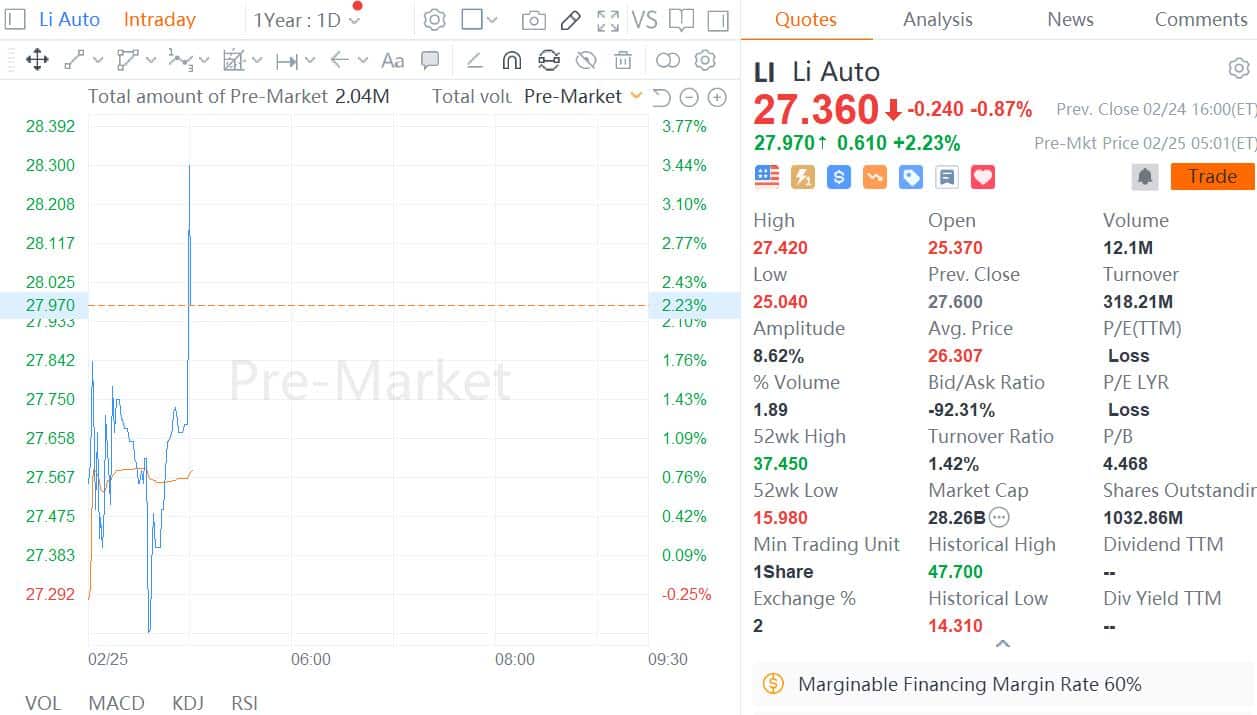

As of press time, Li Auto shares traded in the US were up more than 2 percent in pre-market trading.