Hillhouse reduced its position in Nio by 59 percent in the fourth quarter and increased its positions in Xpeng and Li Auto by 455 percent and 363 percent, respectively.

Hillhouse Capital, one of China's best-known asset managers, trimmed its position in Nio in the fourth quarter, but increased its buys in Xpeng and Li Auto.

Hillhouse's HHLR Advisors, a fund manager that invests in overseas secondary markets, filed a 13F form with the SEC on Monday showing it held 350,000 shares of Nio at the end of the fourth quarter, down 59 percent from 859,200 at the end of the third quarter.

Hillhouse's holdings in Nio were valued at $11.0 million at the end of the fourth quarter, down about 64 percent from $30.6 million at the end of the third quarter.

While reducing its position in Nio, Hillhouse significantly increased its stake in the electric vehicle company's local peers Xpeng and Li Auto.

Hillhouse held 666,500 shares of Xpeng at the end of the fourth quarter, up 455 percent from 120,000 shares at the end of the third quarter.

Hillhouse's holdings in Xpeng were valued at $33.5 million at the end of the fourth quarter, up 687 percent from $4.27 million at the end of the third quarter.

The asset manager held 5,007,300 shares of Li Auto at the end of the fourth quarter, up 363 percent from 1,080,000 at the end of the third quarter.

The value of its holdings in Li Auto increased to $160 million from $28.4 million at the end of the third quarter.

This makes Li Auto one of Hillhouse's top 10 holdings for the first time.

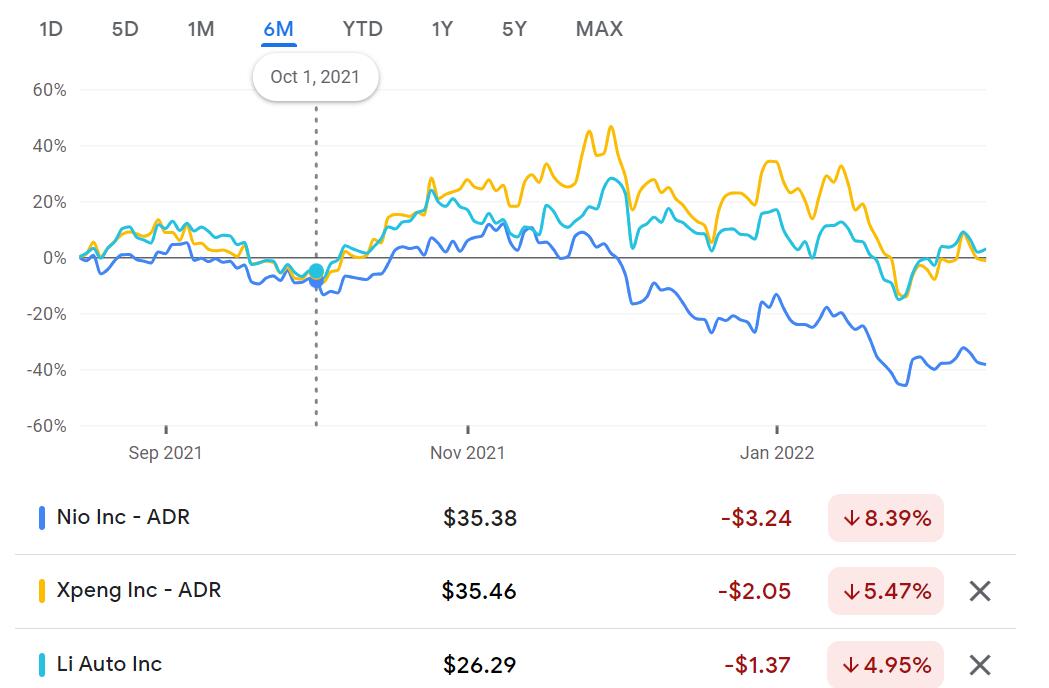

In the fourth quarter of last year, Nio was down 11 percent, Xpeng was up 41.6 percent and Li Auto was up 22 percent.