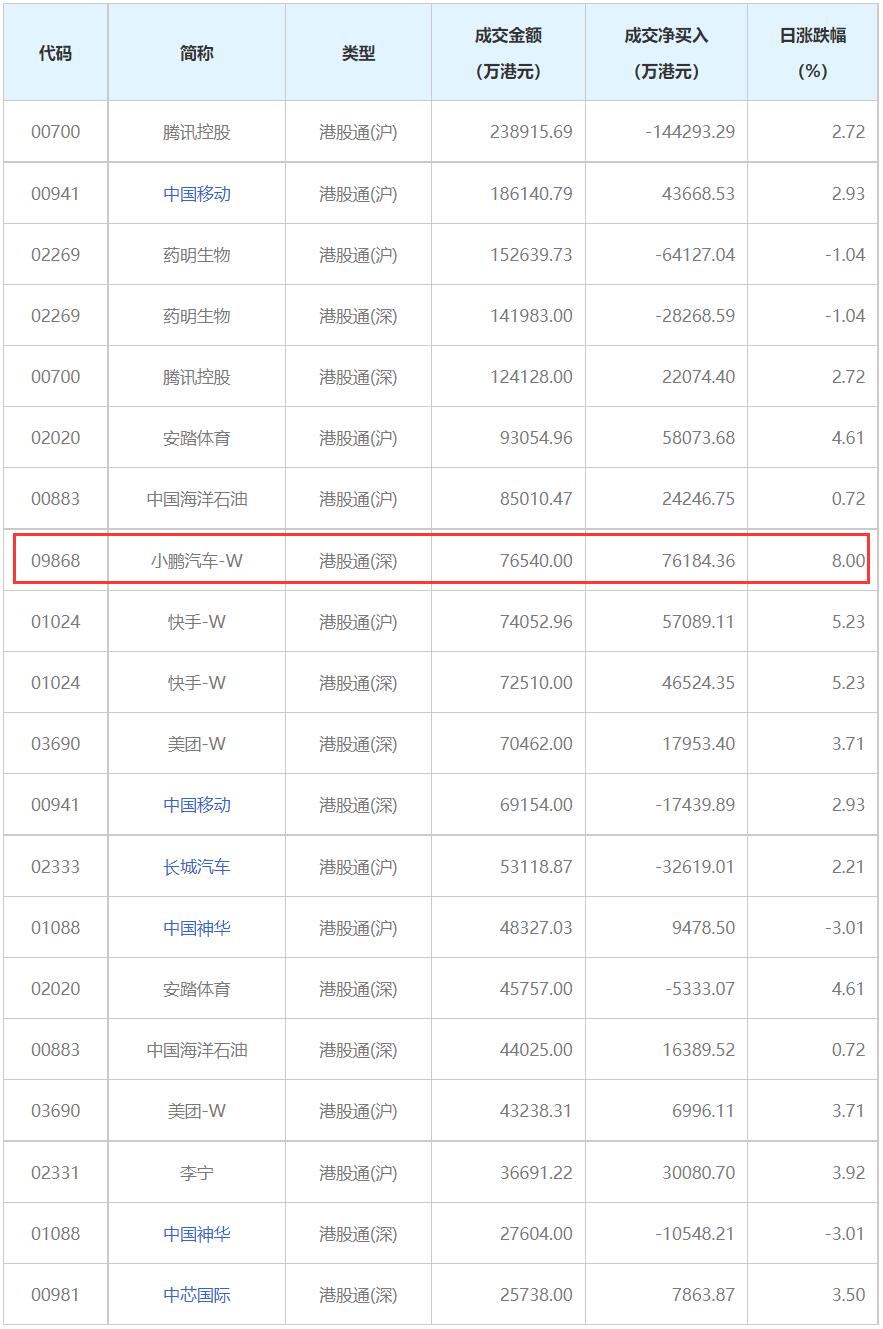

Mainland Chinese investors bought a net HK$762 million of Xpeng shares through the Hong Kong-Shenzhen Stock Connect today.

(Image credit: CnEVPost)

Xpeng Motors received significant inflows on its first day of inclusion in a mechanism linking the Hong Kong and the Chinese mainland stock markets.

Mainland investors traded HK$36.413 billion through the Hong Kong-Mainland Stock Connect today and saw a net buy of HK$2.740 billion in Hong Kong stocks, according to the Securities Times.

Of the amount, HK$19.965 billion was traded through the Hong Kong-Shanghai Stock Connect, with a net buy of HK$164 million. Investors traded HK$16.447 billion through the Hong Kong-Shenzhen Stock Connect, with a net buy of HK$2.576 billion.

Xpeng, which was included in the Hong Kong-Mainland Stock Connect starting today, saw HK$765 million of turnover by mainland Chinese investors through the mechanism, for a net buy of HK$762 million.

This makes Xpeng the eighth most traded stock in the Hong Kong-Mainland Stock Connect and makes it the most net bought stock by mainland investors in the Hong Kong-Shenzhen Stock Connect today.

(Source: Securities Times)

As of today's close, Hong Kong's Hang Seng Index rose 2.06 percent to 24,829.99, while Xpeng gained 8 percent to HK$152.50.

Before the stock market opened today, the Shenzhen Stock Exchange announced that it had adjusted the Hong Kong-Mainland Stock Connect list to include Xpeng Hong Kong shares with effect from today.

The stock linking mechanism was launched in November 2014 to facilitate investors from Hong Kong and the mainland to buy each other's stocks.

With access to the list, mainland Chinese investors will be able to trade Hong Kong stocks more easily, although investors will only be eligible to participate in the mechanism with securities account assets of more than RMB 500,000.

According to Edison Yu, an analyst at Deutsche Bank, Xpeng's inclusion in the mechanism comes about a week earlier than he had previously expected, which should act as a natural tailwind for the stock, allowing mainland investors to more easily buy shares.

"We continue to believe there is large appetite for EV exposure in the Mainland given accelerating penetration (>20% exiting 2021) and lack of high quality listed EV names (CATL is the de-facto standard with market cap of nearly 200bn USD). Xpeng also provides exposure to autonomous/mobility optionality," Yu wrote.