The team expects Xpeng's sales to reach 190,000 units in 2022 and 550,000 units in 2025 with a 7 percent market share in China.

(Image credit: CnEVPost)

Chinese brokerage Guosheng Securities initiated coverage on Xpeng Motors, giving it a Buy rating and a HK$259, or $66.7, price target.

The valuation does not yet include potential realizations from businesses including smart cockpit, Robotaxi, robotics and flying vehicles, analysts Xia Jun, Xia Tian and Liu Lan said in a research note released on Friday, adding that Xpeng's future exploration in intelligence is expected to bring more value.

Xpeng closed down 6.28 percent to $41.81 on Friday on the US stock market, with Guosheng Securities' price target implying about 60 percent upside.

The team expects Xpeng to reach sales of 190,000 units and revenue of RMB 39.9 billion in 2022.

For reference, Xpeng delivered 98,155 vehicles in 2021, up 263 percent from 27,041 vehicles in 2020. The company's revenue in 2021 has not yet been announced.

Guosheng Securities expects Xpeng to reach full-year sales of 550,000 vehicles, a 7 percent share of the Chinese EV market and revenues of RMB 121.8 billion by 2025.

The team expects China's electric vehicle penetration, or the share of such vehicles in all new vehicle sales, to reach 40 percent, or 7.9 million units, in 2025.

The team notes that smart driving will not only be a technological advantage for Xpeng, but will also be a significant revenue and profit improvement engine. This will drive the company's growth in two ways: a higher percentage of software subscriptions and higher software fees.

The team expects the software business to generate RMB 6.6 billion in revenue for Xpeng in 2025, boosting its contribution to revenue to 23 percent from 5 percent in 2021.

"By then, Xpeng will have widened the gap with legacy car makers in terms of business model," the team wrote.

The team expects Xpeng to have a net margin of -17 percent in 2022 under non-GAAP, decreasing to -2 percent by 2024 and achieving a net margin of 6 percent by 2025.

The team has given Xpeng a target valuation of $56.6 billion, corresponding to 9x 2022 estimated P/S.

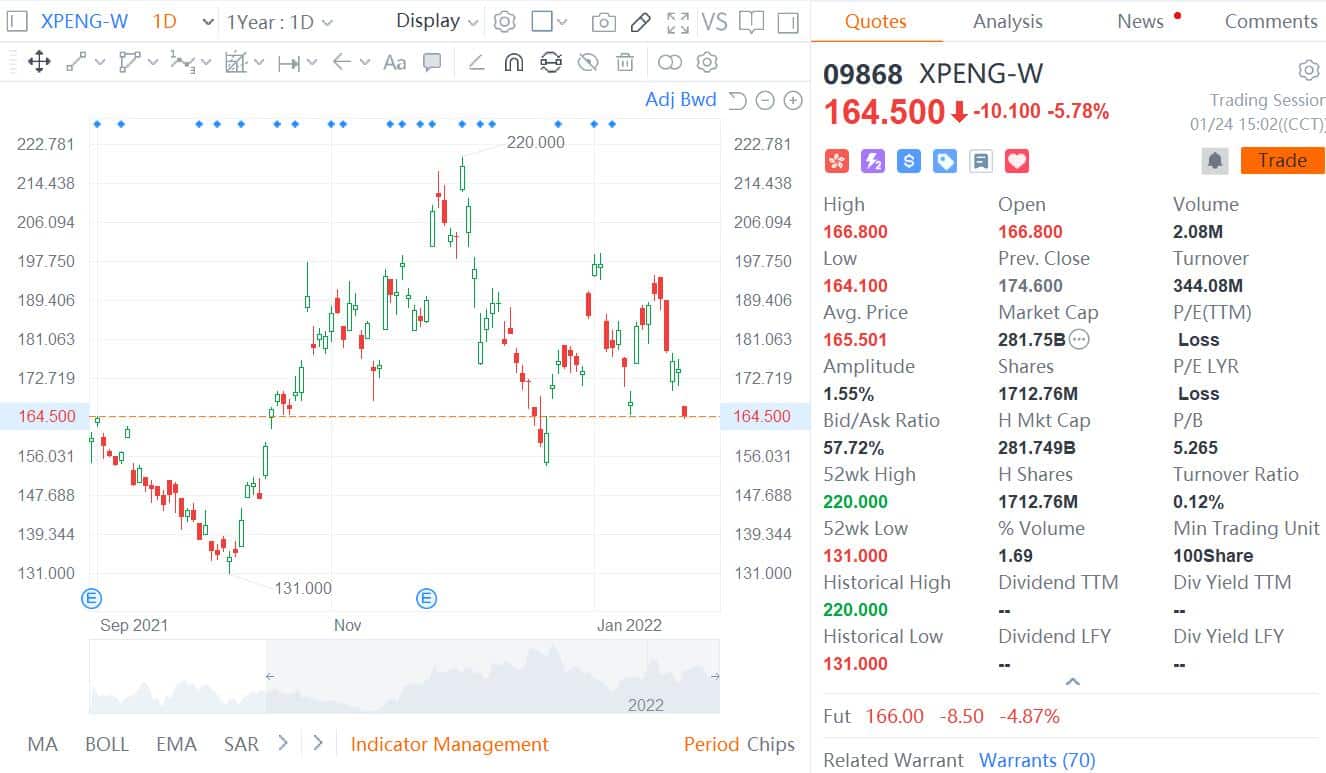

At press time, auto stocks trading in Hong Kong were generally lower, with Xpeng down 5.78 percent to HK$164.5.