"We believe Nio is trading at an attractive discount relative to global peers such as Tesla and Lucid with the latter's premium likely being unwarranted," Edison Yu's team said.

Although Nio's shares have rallied about 10 percent in the past month, they have lagged far behind international peers including Tesla and Lucid Motors so far this year. In Deutsche Bank's view, that's not quite fair.

"We believe Nio is trading at an attractive discount relative to global peers such as Tesla and Lucid with the latter's premium likely being unwarranted given Nio's brand and ecosystem are far more developed," Deutsche Bank analyst Edison Yu's team said in a research note sent to investors today.

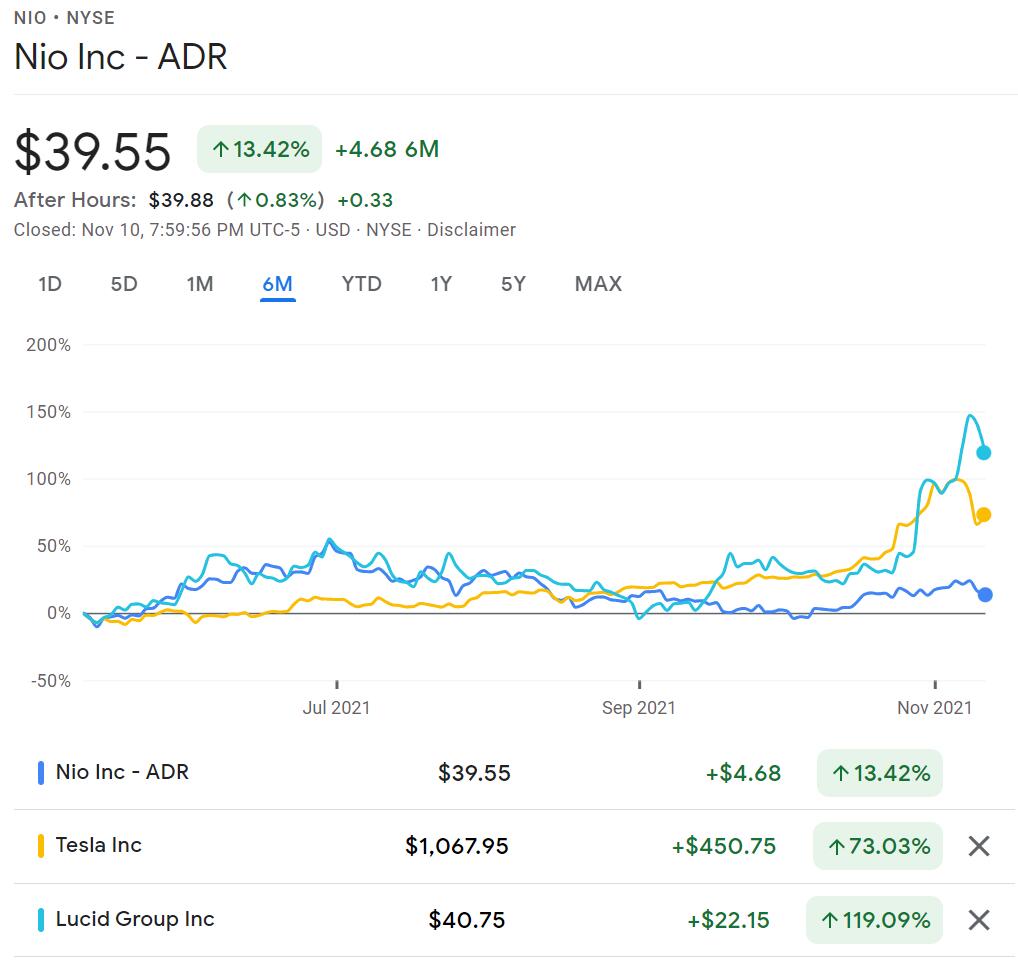

Although shares of these EV makers have pulled back this week, Lucid is up 119 percent and Tesla is up 73 percent over the past six months. Nio, by comparison, is up just 13 percent over the same period.

Yu's team believes that Nio's stock has been hurt by a lack of new products and a shortage of semiconductors, but these headwinds appear poised to reverse in the future. They reiterate Buy rating and $70 price target on Nio.

It's worth noting that deliveries appear to be the anchor for many investors valuing electric car companies. If Tesla's share price performance is justified based on this matrix, Lucid's share price performance is dubious.

Tesla delivered 241,391 vehicles in the third quarter, up about 73 percent from a year earlier. Nio delivered 24,439 vehicles in the third quarter, up 100 percent from a year earlier. Lucid, on the other hand, just started its first deliveries to customers on November 2.

Back to Nio, the company reported its third-quarter earnings yesterday, which Yu's team considers mostly uneventful and continues to expect investor attention to turn soon to Nio Day on December 18, when new products and technologies will be announced.

For the next two years, the team continues to maintain above-consensus delivery projections, believing that Nio will deliver 160,000 units in 2022 and 285,000 units in 2023, and that these should demonstrate the true scope of Nio's brand power.

The team wrote:

This will be first evident with the launch of flagship ET7 sedan in 1Q22; we expect an on-time SOP and the vehicle to easily sell out its entire first-year of production.

Moreover, we are also encouraged by the very positive initial customer reception seen by Nio in Norway where backlog and BaaS take-rate have exceeded management expectations (e.g., converted 25% of test drives into orders).