BYD, Xpeng, and Li Auto have all entered what is called a "technical bull market" and Nio is close to it.

(Photo credit: Unsplash)

Without realizing it, investors have been in a bullish mood for leading Chinese electric vehicle (EV) stocks for half a month, driving their performance into what is called a "technical bull market".

Generally speaking, a stock or index is said to have entered a technical bull market when it has risen 20 percent or more from its recent lows.

BYD, Xpeng Motors, Li Auto have all achieved this, and Nio is close to achieving it.

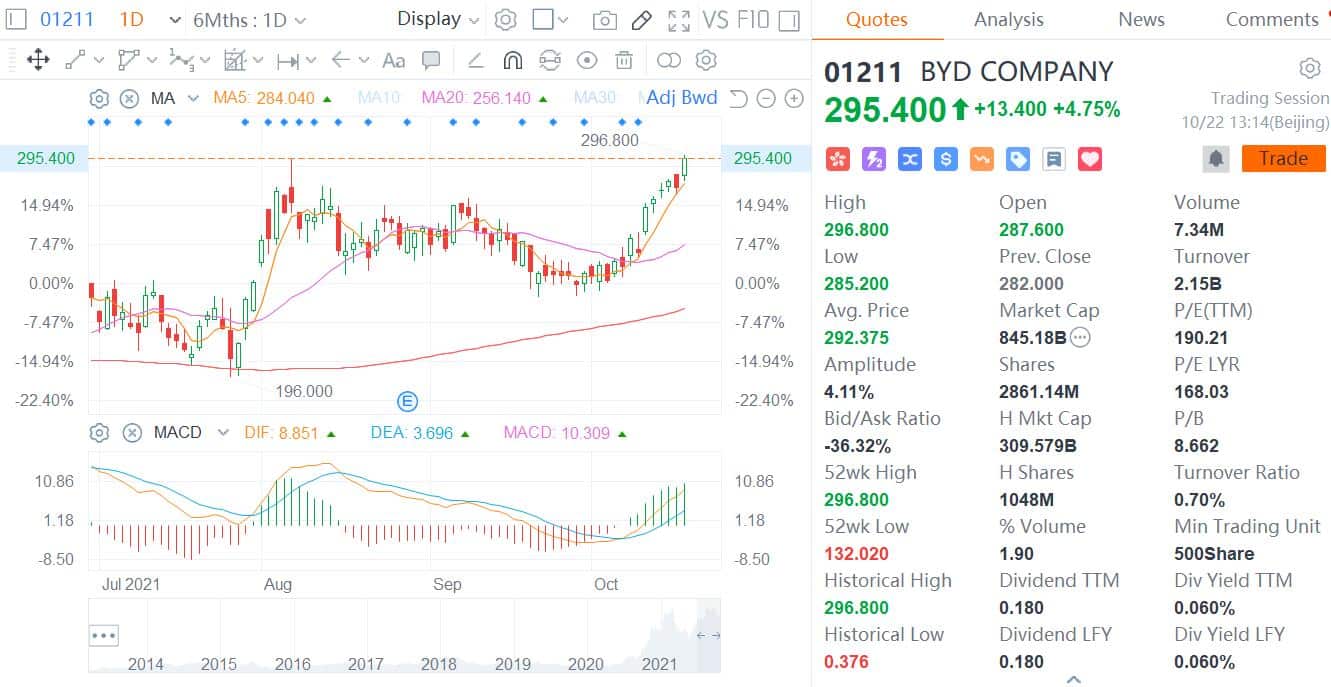

As of press time, Hong Kong-listed BYD is up 4.75 percent to HK$295.4, a new all-time high. The stock has accumulated a gain of about 23 percent since September 30.

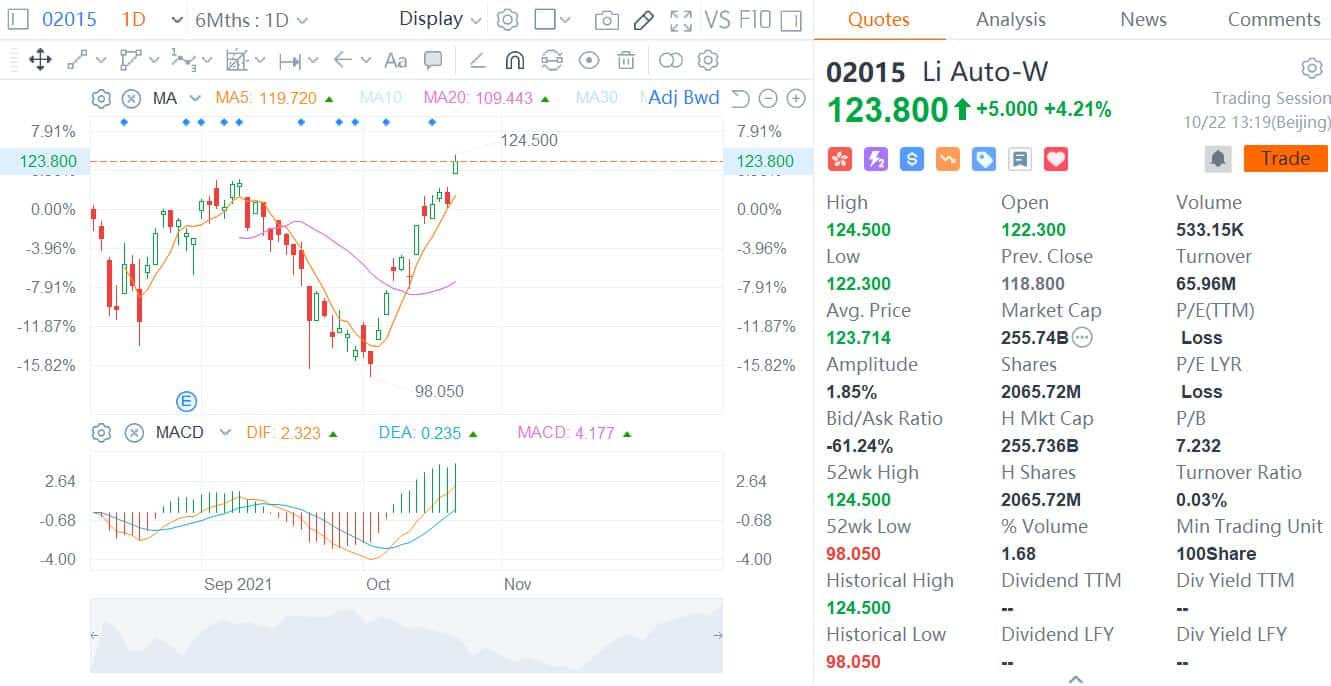

Li Auto's Hong Kong-listed shares are now up 4.21 percent to HK$123.8, a new high since the company went public in the city on August 12. Li Auto has gained a cumulative 22 percent since October 5.

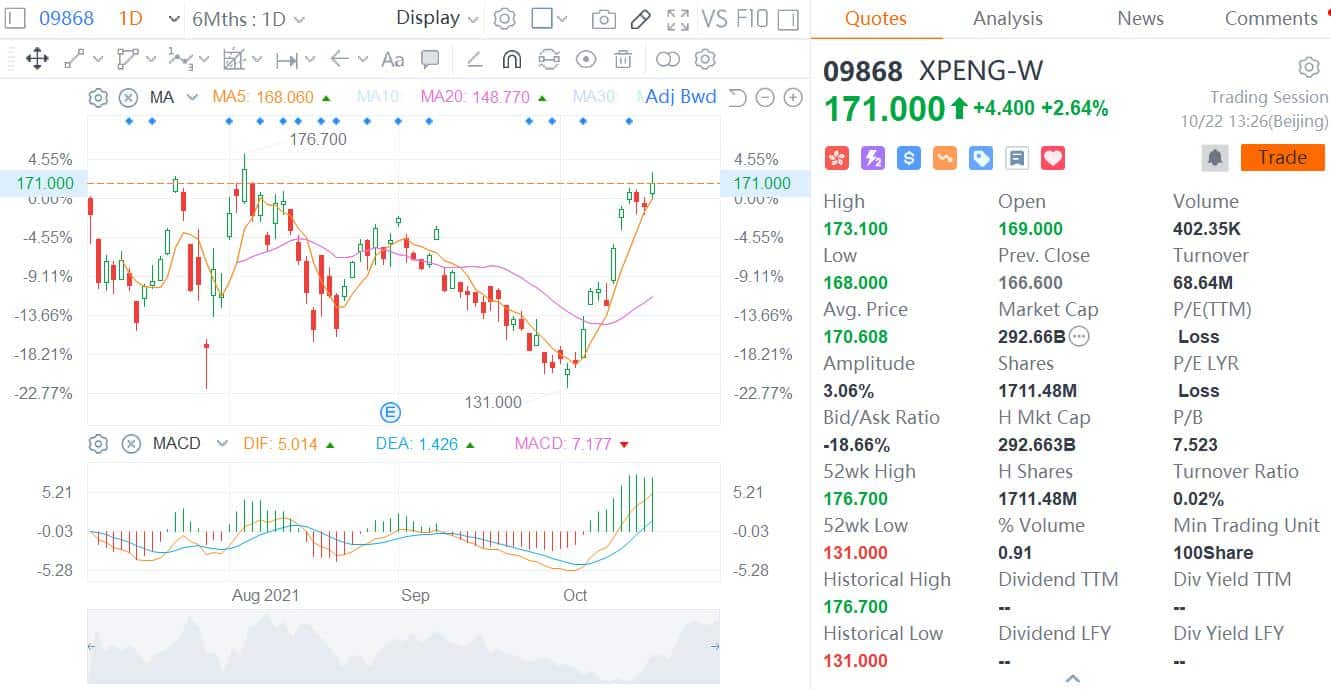

Xpeng's Hong Kong-listed stock is now up 2.64 percent to HK$171, near its all-time high. The stock is up about 26 percent since October 4.

Nio, which is not yet listed in Hong Kong, saw its US-traded ADR rise 0.48 percent to $39.97 on Thursday, bringing its cumulative gain since October 5 to 19.67 percent and putting it to the edge of a "technical bull market".

How did all this happen?

In a research note sent to investors Thursday, Deutsche Bank analyst Edison Yu's team argued that the biggest overhang in Chinese EV stocks is the widespread investor caution on Chinese stocks since the Didi crackdown.

"The China EV cohort has certainly held up relatively better compared to education, e-commerce, and music streaming, but we have found many US-based investors are still hesitant to get involved even though fundamentals have improved meaningfully, likely awaiting more clarity about the government's intentions," the note reads.

However, the team believes that investor sentiment could bottom out heading into the end of the year.

Looking at the individual stocks themselves, there have been a number of catalysts contributing to their recent rally.

BYD

Rumors of BYD becoming a supplier to Tesla have resurfaced as the US EV maker said in its third-quarter earnings report that it is switching to lithium iron phosphate (LFP) batteries in standard-range vehicles worldwide.

BYD has received a 10 GWh order from Tesla for LFP batteries, local media cls.cn said Thursday after Tesla's earnings report, citing people close to the Warren Buffett-backed Chinese new energy vehicle company.

Previously, for many investors, the fact that BYD was far ahead of its peers in the Chinese new energy vehicle market in terms of deliveries was a key reason for optimism.

China Passenger Car Association (CPCA) data released on October 12 showed BYD's wholesale sales reached 70,432 units in September, topping Tesla China's 56,006 units, making it the top-selling brand in the country.

Other companies with more than 10,000 wholesale sales in September included SAIC-GM-Wuling with 38,850 units, SAIC Passenger Vehicle with 21,552 units, GAC Aion with 13,572 units, Great Wall Motor with 12,770 units, Nio with 10,628 units and Xpeng with 10,412 units, according to the CPCA.

Li Auto

For Li Auto, October 16 saw the official opening of its manufacturing base in Beijing's Shunyi District, which was previously Beijing Hyundai's No. 1 factory. This also makes the rumors that have been going on for months finally become true.

With a total area of 270,000 square meters and a total project investment of more than 6 billion yuan ($933 million), the plant's renovation and expansion are scheduled to be put into operation by the end of 2023. Upon reaching production, the plant will have an annual production capacity of 100,000 units of pure-play EVs.

Nomura initiated coverage on Li Auto in a research note sent to investors on October 14, with analyst Martin Heung giving the company a buy rating on its US-traded ADR and a $43.40 price target.

He believes that Li Auto has managed to differentiate itself from other brands with its unique extended-range technology for electric vehicles, allowing more skeptical car buyers to try to consider buying an electric car without worrying too much about battery charging.

Heung believes that Li Auto's solution not only reduces the common problems faced by pure EV users, such as mileage anxiety and long charging wait times but also allows OEMs like the company to unlock markets where charging infrastructure is scarce.

Xpeng

Deutsche Bank's Edison Yu reiterated a Buy rating on Xpeng and raised the price target to $57 from the previous $51 in a research note sent to investors on Thursday.

Yu's team believes that with the full ramping up of the P7, P5, and G3i models, growing consumer awareness, and higher EV penetration, Xpeng will exceed their previous expectations for deliveries next year.

The team is therefore raising its expectations for Xpeng deliveries in 2022 from 165,000 to 190,000 units, implying a 102 percent year-on-year growth rate.

The team still values Xpeng at 6.5 times 2022 sales and therefore raises its price target by $6.

Xpeng recently announced that the P5 sedan is rolling off the line in volume and will be delivered to its first customers at the end of this month.

HT Aero, a technology unit majority-owned by Xpeng Motors and CEO He Xiaopeng, recently closed more than $500 million in Series A funding at a pre-investment valuation of more than $1 billion.

The company will also be hosting its annual Technology Day on Sunday, October 24, starting at 10 a.m. Beijing Time to share its latest technological advances.

Nio

Nio entered the spotlight when a battery swap station in the central Chinese city of Kaifeng faced demolition, but the matter was quickly resolved with a decision to relocate the facility and a statement from the local government expressing its continued support.

Other developments at the company that has been highly visible to investors include Nio setting a date for its most important event of the year, Nio Day, on December 18, when it is expected to unveil, among other things, a model called the ET5, as well as another unknown model.

Some camouflage images of what is suspected to be the ET5 were subsequently released, and rumors suggest that the ET5 could be the most perfect Nio model, with its overall design continuing the design language of the ET7, while possibly being younger and sportier.

In addition, the ET7 sedan has completed tests at high altitudes to ensure the model has an excellent performance in all environments.

Local media reported that the second-generation electric drive system equipped in ET7 is expected to be equipped in the whole Nio models, including ES8, ES6, and EC6, in the future, thus giving them better performance.

Unisun Energy, a provider of distributed clean energy power plant solutions, recently announced that it has contracted with Nio to install rooftop distributed photovoltaic power plants for the EV maker's second-generation battery swap stations.

By the time Nio reaches its goal of having 3,000 battery swap stations in China by 2025, the total PV capacity on the roofs of these facilities will reach 300 MW.