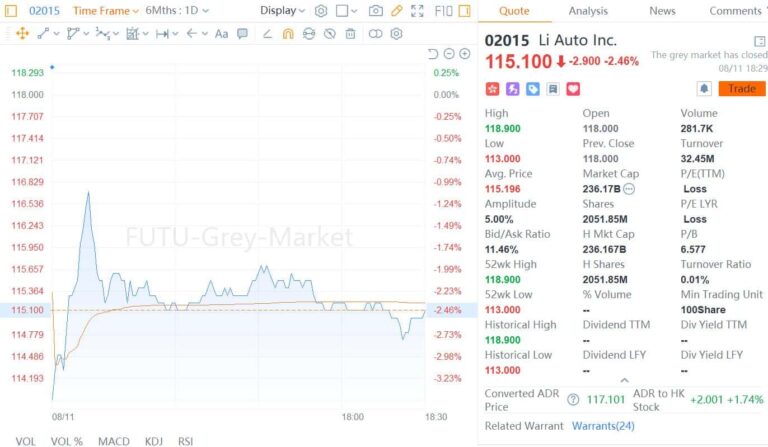

Li Auto will start official trading on the Hong Kong Stock Exchange on August 12 under the ticker symbol "2015". The stock has already started to trade on the grey market on August 11.

In accordance with the practice of listed companies in Hong Kong, investors can trade Li Auto's shares on the grey market from 16:15-18:30 Beijing time the day before the official trading starts.

This is very different from the US stock and A-share markets, so what exactly is the grey market?

Grey market trading refers to trading that is not in the open market but only by clients in the internal trading systems of certain large brokerage firms.

Trading hours are generally 16:15-18:30 in the afternoon after the close of business on a working day before the IPO.

There is no difference in operation between trading in the grey market and normal trading of IPOs, except that the volume of trading in the grey market is not as large as that of the official IPO.

The shares traded in the grey market are derived from the shares held by those who received the allotment. Simply put, investors can sell their shares in the grey market one day in advance, and other investors can buy these shares one day in advance.

The grey market reflects the sentiment of investors on that day. If a stock rises in the grey market, it will generally perform well when trading officially begins, and vice versa.

However, the grey market also has its limitations and cannot fully reflect the entire market. Therefore, the price of the grey market is not simply considered to be the price of the next day's official listing.

However, the price of the grey market is generally reflective of the stock price at the time of the official listing and can be used to predict the price the next day.

For investors, they can sell the shares they acquire in the grey market in advance to lock in gains or stop losses.

If one is very bullish on the stock and wants to enter after its IPO, one can also consider buying in the grey market. Of course, the grey market price can also provide a basis for your buying judgment.

For example, if you predict that the stock is supposed to rise sharply after its IPO, but the grey market is sluggish, you have to reconsider whether to give up.

If investors are financing the IPO, they liquidate them in the grey market, which is equivalent to returning the funds to the broker a day earlier to reduce interest costs.

Investors can also arbitrage in the grey market. Some stocks that have a greenshoe mechanism have a greater potential for profit on the official listing date if they are traded down in the grey market and the investor buys low.

(Photo source: Unsplash)