As stocks in China's new energy vehicle industry chain continue to rise, some traditional value fund managers are starting to buy into them.

China Universal Asset Management star manager Hu Xinwei, known for his focus on the consumer sector, is a typical traditional value investor, but his holdings have started to include new energy industry chain stocks.

In the consumer sector fund Hu has been managing, the top 10 positions in the first quarter included liquor stocks such as Kweichow Moutai and Wuliangye, but in the second quarter EV battery maker CATL entered the fund's top 10 long positions for the first time, the Shanghai Securities News reported Monday.

The fund managed by Zou Xi, vice president and director of equity investments at Rongtong Fund, also added to its position in CATL, making the company a top 10 long position for one of his funds as of the second quarter.

To industry insiders, CATL becoming a top 10 long position in these funds is iconic, signaling that traditional value stock investors are starting to make a presence in the new energy sector, Shanghai Securities News reported.

"From their reasons for buying, one is that fund managers have finally realized that new energy is an important layout direction. Some fund managers are forced to join the new energy sector due to performance pressure," the insider said.

CATL is a leader in the lithium battery industry with strong performance certainty, the report quoted the Shanghai growth style fund manager as saying, adding that buying the industry leader is a relatively sound way for fund managers who know little about the new energy sector.

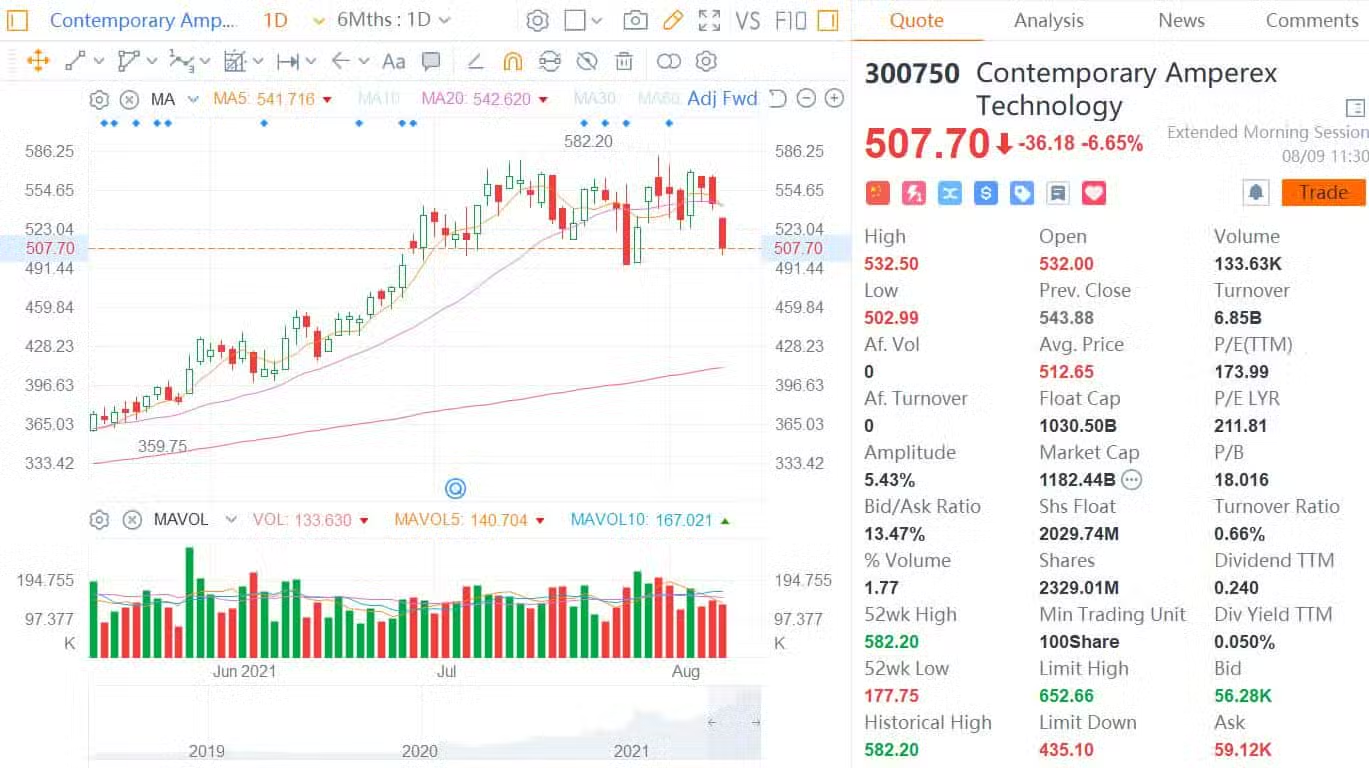

However, the strong trend in China's new energy sector has been going on for some time. CATL, for example, has seen its shares rise 88.42 percent from March 25 to Aug. 6, and the question of whether the new energy sector has a chance to make a comeback has become the focus of discussion.

According to Guo Xiaolin, head of Bosera Funds' new energy investment and research group and fund manager, the trend of new energy vehicles replacing fuel vehicles is relatively clear, and the industry will show sustained high growth in the next 2 to 3 years.

As there is several times of space for industry development, the related sector is likely to come out of a long-term shocking upward market, Guo said.

In the view of Juming Investment team, the electric vehicle and new energy sectors are likely to remain the main track for some time to come, with solid fundamentals and more manageable risks, although there is a certain bubble in valuation.

China's new energy sector generally retreated as of Monday's morning close, with CATL down 6.65 percent and BYD down 3.79 percent.