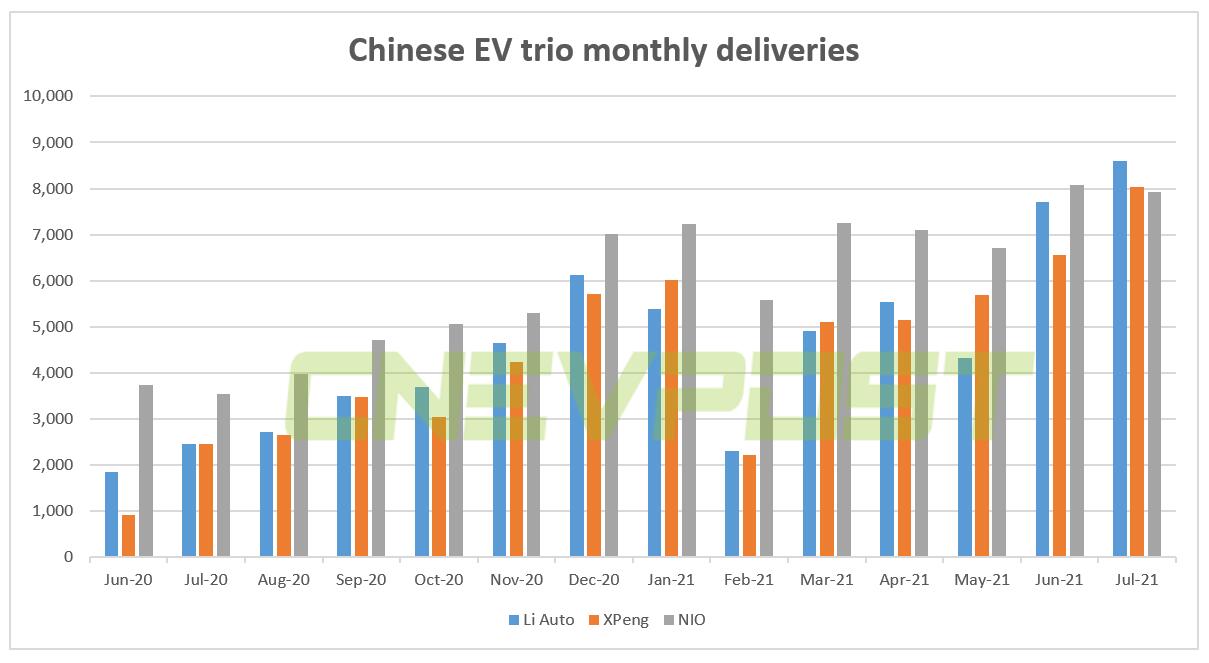

Nio's July deliveries were surpassed by Li Auto and Xpeng Motors and temporarily sits in third place for single-month deliveries by new car makers in China.

The company delivered a total of 7,931 vehicles in July, up 124.5 percent year-over-year, and down 1.9 percent from the previous month.

As of July, Nio's cumulative deliveries in 2021 have reached 49,887 units, exceeding last year's full-year deliveries.

It is worth noting that this is the first time Nio has lost the No. 1 spot for single-month deliveries by a new vehicle manufacturer since its deliveries began in 2018.

Li Auto, the top seller in July among the new carmakers, delivered 8,589 new vehicles, up 251.3 year-over-year and 11.4 percent from the previous month.

As of July, Li Auto's cumulative deliveries in 2021 have reached 38,743 units, and the historical cumulative deliveries came to 72,340 units.

It is worth mentioning that Li currently has only one model in its portfolio - Li ONE.

Xpeng deliveries exceeded 8,000 units for the first time in July, reaching 8,040 units, up 228 percent year-over-year and up 22 percent from June.

As of July, Xpeng has delivered a total of 38,778 new vehicles in 2021, 1.4 times more than last year's full year. Among them, 6,054 units of P7 were delivered in July, and the cumulative deliveries so far have exceeded 40,000 units.

(Graphic by CnEVPost)

If measured by insurance registrations, Nio has lost the number one position in June when the number of insurance registrations for Nio vehicles was 7,761, below Li Auto's 7,858.

Auto industry media cheyun.com quoted an unmade industry insider as saying that Nio had suffered complaints in July due to seat problems, and many owners expressed their dissatisfaction, which may be one of the influencing factors for its sales decline.

The drop in Nio sales may also be related to its impact from chip shortage or parts shortage, the industry insider said.

In addition to the three companies mentioned above, Neta and Leap Motor have also seen a rapid boost in deliveries, according to data already released.

Neta delivered 6,011 units in July, up 392 percent year-over-year.

Leap delivered 4,404 units in July, up 666 percent year-over-year and up 12 percent from the previous month.

While the rankings of these companies may change from month to month, the rapid growth of China's electric vehicle market means that they are all gaining new market share.

Sharing delivery figures for Xpeng, Nio, and Li Auto on Weibo Monday, Li Pengcheng, Xpeng's vice president and general manager of PR, said their combined deliveries exceeded 24,000 in record time, something one would not have dared to imagine three years ago.

It was only a matter of time before their monthly sales exceeded 10,000, and neither the Covid-19 nor the chip shortage could change that trend, Li said.

"The future is here because the minds of users are being changed, and even traditional car companies selling 200,000 a month can't ignore that," he said.

Li believes it's like the Chinese smartphone market of 2008-2010, where countless user habits were changed, and new demand was stimulated.

"Sales figures are not the most important thing, what matters most is that more and more people understand the product," he said.