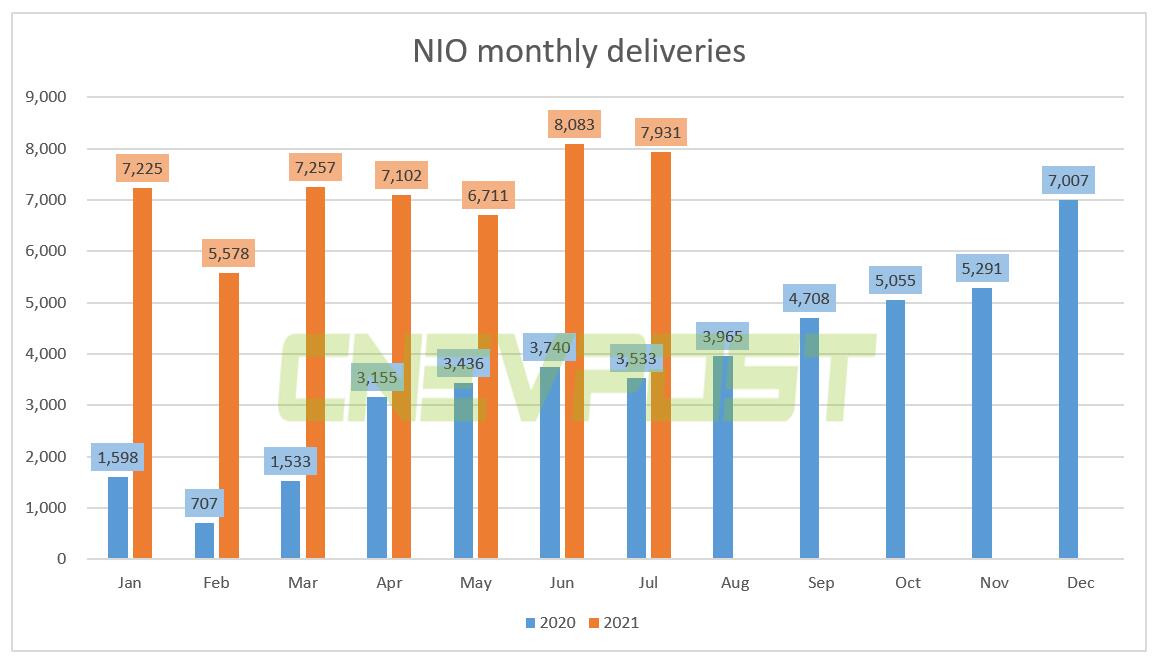

Nio delivered 7,931 vehicles in July, up 124.48 percent year-over-year and down about 2 percent from June.

The deliveries consisted of 1,702 ES8s, 3,669 ES6s, and 2,560 EC6s. Nio has completed the delivery of 49,887 units in 2021, exceeding last year's full-year delivery.

Nio's 100kWh battery pack is deploying to every battery swap station and the delivery of the 100kWh battery pack will significantly ramp up in the coming months, the company said.

At the same time, the first batch of ES8 for user delivery has been officially shipped to Norway and is expected to open for ordering and delivery in Norway in September this year, it said.

Nio's local counterpart, Xpeng Motors, delivered 8,040 vehicles in July, up 228 percent year-over-year. Li Auto delivered 8,589 vehicles in July, up 250 percent year-over-year.

Ahead of the July delivery data was released, a team at Hong Kong-based financial services firm CMB International raised its price target on Nio earlier today, citing marginal improvement in chip supply and the prospect of continued growth in deliveries in the second half of the year.

The team raised its price target for Nio by 13.6 percent to $52.60 per share, maintaining a buy rating. Nio closed up 4.83 percent to $44.68 on Friday and the price target implies an upside of about 18 percent.

CMB believes that in the short term, Nio expects to drive sales growth through increased density of battery swap stations. In the long term, Nio's unique business model of separating the vehicle from the battery will contribute to vehicle sales as it focuses on providing quality service to its customers.

Local tech media 36kr reported on Friday that Ai Tiecheng, former general manager of WeWork Greater China, has joined Nio to take charge of the company's mass-market-oriented sub-brand, and that a new model could be released in the first half of next year at the earliest.

Nio is the only local Chinese brand that has a firm foothold in the high-end market, with a minimum price of RMB 358,000 ($55,400). If customers choose its BaaS battery leasing service, the purchase threshold can be lowered by at least RMB 70,000, but they will need to pay a monthly battery rental fee.

The latest data from China Automotive Technology and Research Center shows that the average price of Nio vehicles in May was RMB 432,900, higher than BMW's RMB 391,000 and slightly lower than Mercedes' RMB 435,600.

The high-end positioning means that Nio's sales could hit the ceiling earlier than its local counterparts Xpeng Motor and Li Auto, and the launch of a mass-market-oriented brand is expected to make that ceiling higher.

The so-called sub-brand, a mid- to low-end brand independent of the Nio brand, is expected to be priced in the RMB 150,000 ($23,200) - 250,000 market, the 36kr report said.

"Li is also factoring in the positioning of the Wuling Hongguang Mini EV (priced at around RMB 30,000)," the report said, citing an unnamed source.

The Mini EV is the top-selling EV in China, with sales of 29,143 units in June, up 12.56 percent from May, according to the China Association of Automobile Manufacturers.

Nio's sub-brand will follow the battery swap technology, but will operate through a separate system that includes channels, communities and an app, the 36kr report said.