The rapid growth of China's electric vehicle market has allowed power battery giant CATL to rapidly expand its market share.

Global electric vehicle battery sales were 65.9 GWh in January-April, up 146 percent from 26.8 GWh in the same period last year, market research firm SNE Research said on Tuesday.

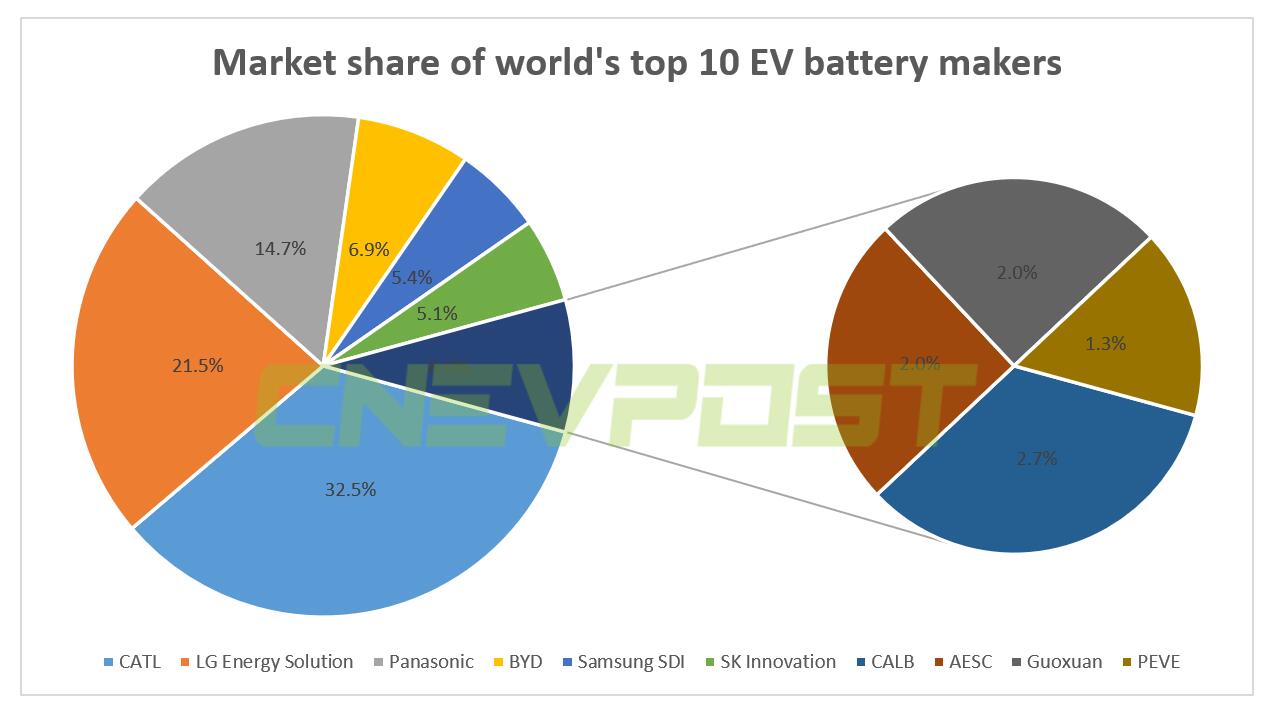

CATL's sales almost quadrupled to 21.4 GWh, further cementing the company's position as the world's largest maker of batteries for electric vehicles, giving it a 32.5 percent market share, 10 percentage points higher than second-place LG Energy Solution's 21.5 percent. LG Energy Solution sold 14.2 GWh from January to April.

Panasonic ranked third with 9.7 GWh and 14.7% market share in January-April, while BYD ranked fourth with 4.5 GWh and 6.9% market share in January-April.

(Data source: SNE Research. Graphic by CnEVPost)

SNE believes that CATL and BYD's growth is largely driven by the rise of Chinese EV companies, while at LG Energy Solution growth is driven by the China-made Tesla Model Y and Volkswagen ID.3.

Samsung SDI benefited from the Audi E-tron EV and Fiat 500. SK Innovation benefited from the Kia Niro EV and Hyundai Kona EV, SNE said.

"CATL, BYD, and other Chinese makers led the market growth," SNE said. "With the Chinese market is expected to continue expanding, growth for most of the Chinese makers is expected to exceed the market average."

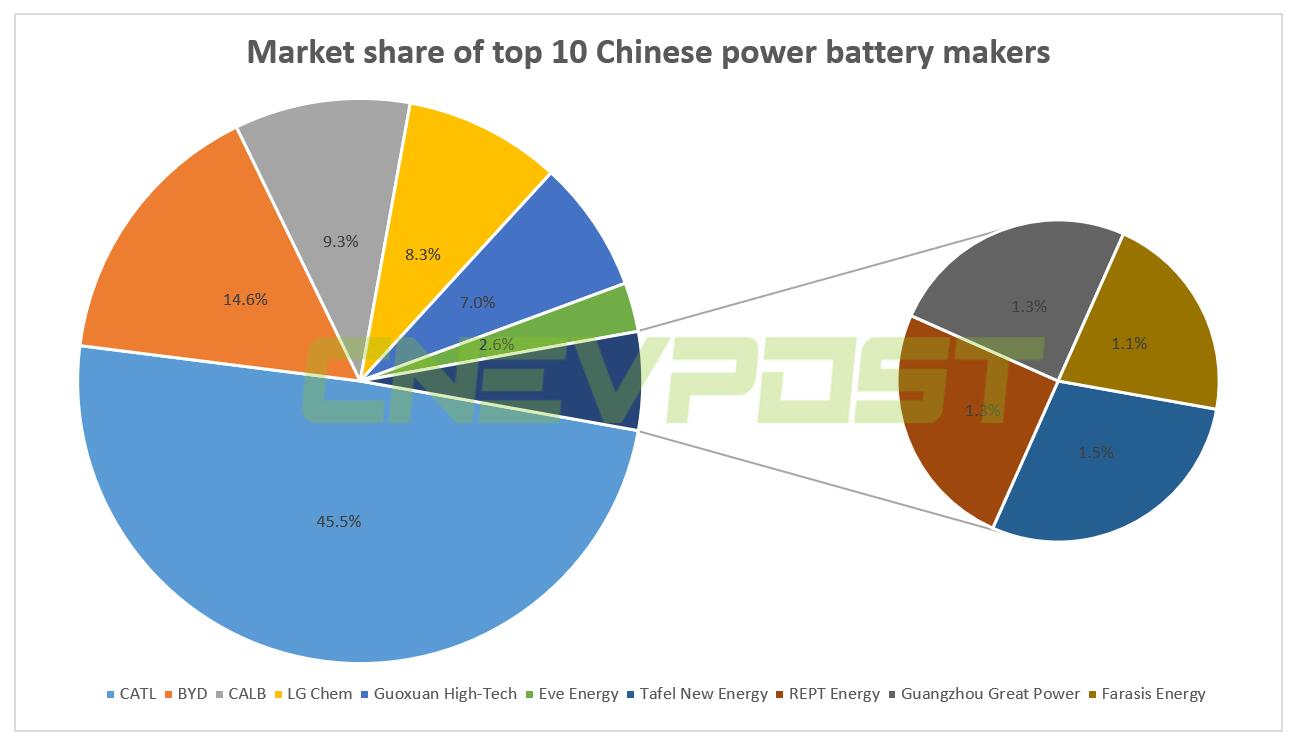

CATL, founded in 2011, is China's largest power battery supplier and has long held about half of the market share in China.

In April 2021, China's power battery installed base was 8.4 GWh, down about 7 percent from March and up 134 percent year-on-year, according to the China Automotive Battery Innovation Alliance.

CATL ranked first, with an installed base of 3.82 GWh in April and a market share of 45.5%.

Notably, this is the first time this year that CATL's market share has fallen below 50 percent, a new low since July last year.

On Monday, CATL's stock price jumped in Shenzhen trading, briefly putting its market capitalization at RMB 1 trillion for the first time, marking a significant moment in the development of China's new energy vehicle industry.

That made it the first company on the ChiNext Index, China's NASDAQ-style board of growth enterprises, to hit 1 trillion yuan in market value.